Subscribe

Sign up for timely perspectives delivered to your inbox.

In his U.S. growth equities outlook, Portfolio Manager Doug Rao explains why it is important to find companies with durable revenue growth drivers, particularly those gaining market share by growing unit sales – not hiking prices.

U.S. large-cap equities continue to face a number of macro uncertainties heading into 2024. Will geopolitical tensions continue to rise and affect trade policy and commodity prices? Can the Federal Reserve (Fed) architect a soft landing? Will the U.S. election create policy uncertainty and dampen consumer confidence? How resilient is the U.S. consumer?

These questions only frame part of the picture for the year ahead. As long-term, bottom-up investors, we remain vigilant about the impacts of macroeconomic developments, but our primary focus continues to be evaluating companies’ business models and fundamentals. We believe competitively advantaged companies in healthy, growing end-markets have the potential to thrive regardless of the economic backdrop.

In 2024, there are two company attributes that we think will be especially important: market share growth and innovation. But first, let’s consider some of the broader trends that will likely impact earnings growth for U.S. companies next year.

The maxim “as the U.S. consumer goes, so goes the U.S. economy” feels more apropos than ever. In 2023, the economy realized economic growth ahead of expectations as consumers continued to spend robustly. Unemployment remained low and a tight labor market provided income gains for households.

However, heading into 2024 we are more cautious on consumers as the core U.S. growth engine. High inflation and interest rates will likely curb spending, especially on big-ticket items. Savings built during the pandemic are largely depleted, reducing purchasing power. Therefore, slowing wage growth will likely limit discretionary spending.

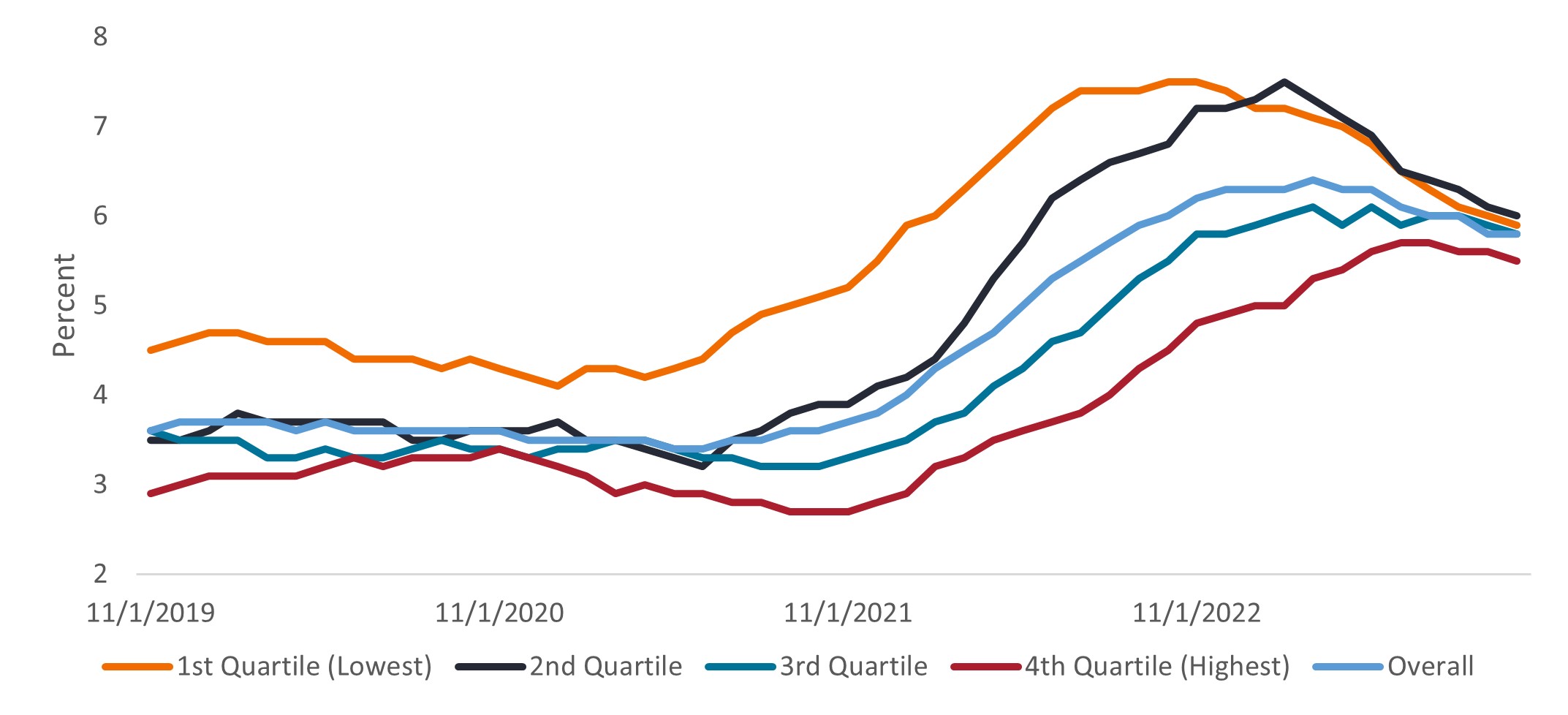

Source: Federal Reserve Bank of Atlanta, Current Population Survey, Bureau of Labor Statistics. 12-month moving average of median wage growth for each category, hourly data; trailing 4 years ending 1 October 2023.

Source: Federal Reserve Bank of Atlanta, Current Population Survey, Bureau of Labor Statistics. 12-month moving average of median wage growth for each category, hourly data; trailing 4 years ending 1 October 2023.

An additional challenge for companies is the prospect of higher structural inflation. For now, the Fed appears to be finished hiking rates. Many of the “transitory” elements of inflation will continue to abate, providing a fairly clear path for the Consumer Price Index (CPI) to continue normalizing, but we expect structural inflation issues will persist. This structural inflation is largely driven by a reversal of the prior three decades of globalization – a phenomenon that kicked off en masse with China joining the World Trade Organization (WTO) in 2001.

And not all stocks perform equally during inflationary environments, which is why we favor companies that can perform well, regardless of the economic backdrop: those with strong fundamentals, wide competitive moats, expanding margin structures and pricing power.

Conversely, a bright spot for 2023 earnings growth has been the massive uptick in technology spending as advancements in semiconductor processing speed coupled with the development of large language models (LLMs) helped companies unlock a new market opportunity in generative artificial intelligence (GenAI).

The materiality of this spend should not be overlooked. As an example, Amazon’s cloud unit Amazon Web Services (AWS) will spend more on capital expenditures this year than Exxon and Chevron combined. We expect AI-driven spending to carry over into 2024 and offset economic weakness in other areas of the market. Enterprise AI spending is forecasted to reach $143 billion by 2027, with a 73% compound annual growth rate, according to recent International Data Corp (IDC) research report.[1]

That said, we will continue to monitor GenAI’s progress through the adoption curve. The level of technology spending for 2024 partly depends on whether companies find enough near-term use cases.

Amid an uncertain backdrop, the path to growth may become more challenging for U.S. equities as a whole; however, growth drivers remain at an individual stock level. We believe profitably compounding revenue growth is the biggest driver of multi-year equity outperformance. Further, companies growing unit sales to drive revenue is more durable in our view than those relying on price increases.

Over the last three years in this highly inflationary environment, many companies have realized growth through price hikes. For example, Coca-Cola’s price has increased by 30% over the last three years, which exceeds the cumulative 24% increase that was realized over the prior decade![2] To offset inflation impacts, many companies had to push price and are bumping up against a consumer affordability ceiling. It will be difficult for companies to maintain pricing-driven growth next year and, as a result, maintaining margin growth now hinges on their input costs decreasing. If economic growth dips and labor costs continue to rise, it could pressure margins for companies lacking pricing power.

We believe companies driving market share gains by growing quantity sold – not price – are best positioned in the current environment. Wide-moat companies earning a larger consumer wallet share in a recurring manner, such as through subscriptions, are especially attractive. Even with the potential for slower consumer spending, companies growing ahead of market rate should be recognized.

Innovation remains key to company growth. While major breakthroughs make the headlines, most innovation is both more subtle and incremental.

Evolution, and with it growth, often comes in the form of companies that are solving problems for their customers through consistent, incremental improvements. For instance, e-commerce companies leverage transaction data and AI to understand customers better and create enhancements. Similarly, medical technology firms refine products through tight doctor feedback loops.

In 2024, GenAI is expected to drive innovation and permeate companies across economic sectors. The use cases are rapidly expanding, and we’ll likely learn more about who is adopting GenAI and how they plan to reap productivity gains. There will likely be a period of initial transition before companies gain confidence in GenAI models and realize productivity gains. That said, we believe innovative companies will invest in this transformative technology while others risk being left behind over the long term.

We believe companies that create innovative solutions should grow earnings faster than peers who fail to grasp the magnitude of this paradigm shift. The same holds true for organizations that integrate these services into their businesses. While valuations can get stretched and markets can sometimes overestimate the near-term value, we believe the market also tends to underestimate the long-term power of such shifts.

A widening range of possible economic outcomes places greater importance on deeply understanding a business’s fundamentals and its potential for future cash flows. In our view, investors will be well suited to focus on companies taking market share and investing in innovation. Though volatility may persist, high-quality growth firms with competitive advantages have the potential to compound earnings over time, even in a slower-growth economic environment.

1 “GenAI Implementation Market Outlook: Worldwide Core IT Spending for GenAI Forecast, 2023–2027” International Data Corporation (IDC), October 2023.

2 Source: Coca-Cola reported financials. Based on price/mix of North American portfolio.

The Consumer Price Index (CPI) is a measure that examines the price change of a basket of consumer goods and services over time. It is used to estimate inflation. ‘Headline’ CPI inflation is a calculation of total inflation in an economy, and includes items such as food and energy, where prices tend to be more volatile. ‘Core’ CPI inflation is a measure of inflation that excludes transitory/volatile items such as food and energy.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Volatility measures risk using the dispersion of returns for a given investment.

IMPORTANT INFORMATION

Growth stocks are subject to increased risk of loss and price volatility and may not realize their perceived growth potential.