Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Brian Demain sees an attractive backdrop for mid-cap stocks in 2025. In his annual outlook, he identifies key macro themes and sector opportunities, while also emphasizing the need for a selective approach due to significant valuation differences across the asset class.

Mid-cap equities enter 2025 from a position of strength, supported by resilient economic growth, solid fundamentals, and exposure to powerful secular growth themes. While 2024 saw declining inflation and stable economic growth, the transition to a new administration creates both opportunities and challenges that require careful navigation.

The changing political landscape under the Trump administration is one theme that could reshape market dynamics, particularly regarding industrial policy. While both administrations supported bringing manufacturing back to the U.S., we expect a shift from Biden-era green energy subsidies to an approach emphasizing deregulation and targeted initiatives. This transition will likely impact which industries benefit from government support.

The intersection of monetary policy and inflation also bears monitoring. The Federal Reserve (Fed) has begun its easing with inflation still hovering in the mid-2% range – notably higher than during the pre-pandemic era, when reaching 2% was a persistent challenge. If new administration policies trigger faster economic growth while the Fed is cutting rates, inflation could reaccelerate. While not our base case, this scenario could significantly impact markets if it triggers a more hawkish Fed stance.

Market broadening is a third key theme that could emerge. After another year of large-cap growth outperformance led by mega-cap technology and communication services stocks, two developments could catalyze broader market leadership in 2025. First, the earnings growth gap between technology and other sectors is expected to narrow based on consensus estimates. Second, shifting sentiment around AI’s return on investment could influence the market’s direction.

AI remains pivotal in shaping industries and market sentiment. Throughout 2024, AI enthusiasm overshadowed other sectors, sometimes leading to concentrated market leadership. Looking ahead, sentiment shifts will likely continue until we gain clarity on both the pace of AI-driven capital investment and its returns.

We view AI as being in the early chapters of an investment story with wide-ranging outcomes. If AI proves to be a valuable productivity enhancer and delivers strong gains, the AI-spending boom will likely continue. We may even find current spending is too low. Conversely, subpar gains could significantly slow the pace of investment.

Given this uncertainty, we are carefully monitoring the commercial success of various AI applications, from Microsoft Copilot to emerging startups, to better understand potential returns. Additionally, we are focusing on businesses with strong fundamentals and differentiated offerings to help mitigate risks associated with potential AI spending slowdowns.

We’re positive on industrials heading into 2025. After two years of Purchasing Managers’ Index (PMI) ratings below 50 indicating contraction, we anticipate recovery potential. This, combined with expected favorable policy changes for U.S. industrial production, creates an attractive backdrop. Transport companies, especially in the less-than-truckload and intermodal segments, typically benefit early in such cycles.

The electrification of the economy continues to be attractive as a long-term theme. Electricity demand, which has been flat for a long time, is poised for persistent growth over the next few decades. The utilities sector benefits from increasing power demands, particularly from AI data centers, which consume six times more power than traditional facilities. Combined with broader electrification trends, this creates a favorable backdrop for select utilities trading at attractive valuations.

In our view the insurance sector remains favorable due to persistent pricing strength and recent catastrophic events. The extended pricing cycle is creating above-average growth opportunities in a traditionally stable sector that also offers dividend income and portfolio diversification benefits. We believe firms with sustainable advantages – such as those with scale benefits or specialty line expertise – are well positioned to outgrow competitors.

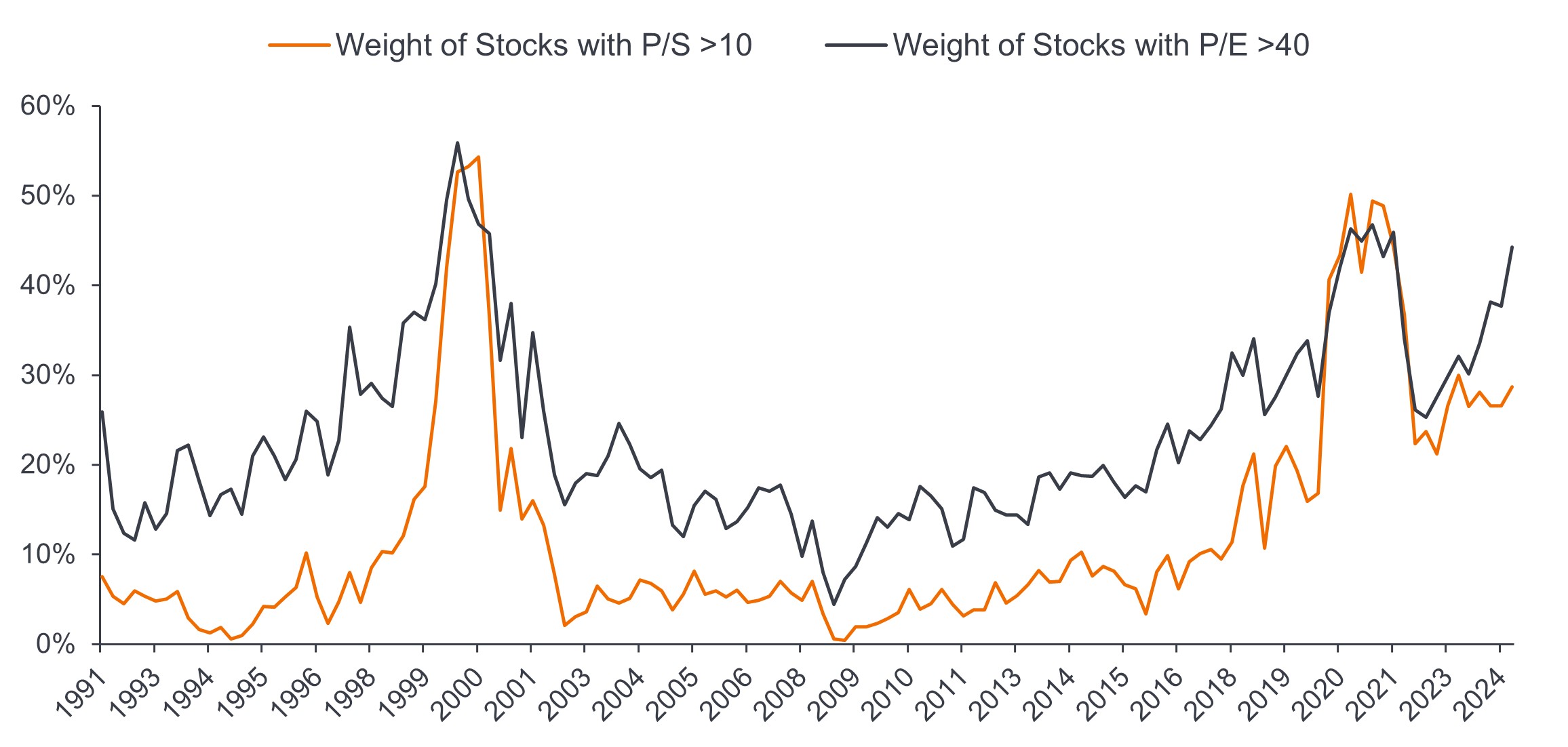

Mid-cap equities offer potential diversification benefits and exposure to a broad range of industries and business models. However, it is essential to exercise caution, as the mid-cap growth benchmark index includes highly valued and speculative names. Over 40% of the Russell Midcap Growth Index trades above 40 times earnings – well above the historical range of 10%-20% (Figure 1).

Source: Janus Henderson Investors, FactSet, as 30 September 2024.

In our view, success in 2025 will require focusing on quality companies with sustainable business models and reasonable valuations. While challenges exist, particularly around evolving policies and valuation extremes, we continue to find attractive, reasonably valued growth opportunities across the mid-cap universe. The key is maintaining discipline by staying invested while carefully navigating pockets of excess speculation.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Quantitative Easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market

Purchasing Managers’ Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors, based on a survey of private sector companies.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

Price-to-Sales (P/S) Ratio measures share price compared to revenues per share for a stock or stocks in a portfolio.

Russell Midcap® Value Index reflects the performance of U.S. mid-cap equities with lower price-to-book ratios and lower forecasted growth values.

IMPORTANT INFORMATION

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.