Subscribe

Sign up for timely perspectives delivered to your inbox.

Research Analyst Tim McCarty, from the Healthcare and Global Research Teams, explains how investors should think about advances in artificial intelligence-driven drug research, including the latest version of AlphaFold, a protein-structure prediction tool.

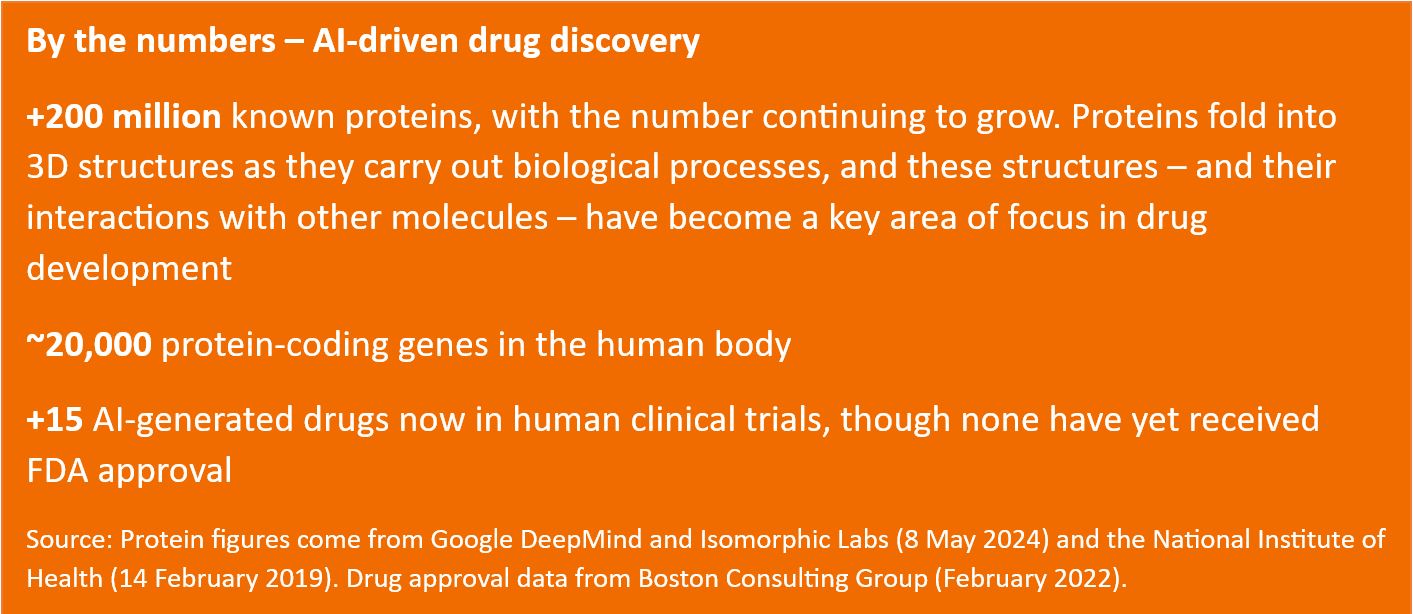

This month, the promise that artificial intelligence (AI) might speed the pace of drug discovery took another step forward with the launch of AlphaFold 3. The tool, the third iteration of the protein-structure prediction model that first debuted in 2018, models not only the 3D structures of proteins – the building blocks of life – but how those structures interact with other biomolecules, including DNA,1 RNA,2 and small molecules known as ligands. Such level of complexity has never been accessible through a single tool and could deepen scientists’ understanding of the biology of disease and their ability to develop novel treatments.

AlphaFold 3 is one of many AI algorithms now being developed throughout the biopharma industry with the aim of speeding up the pace of drug discovery. The big question for investors is, will these tools succeed?

So far, the track record is mixed. To date, no fully AI-generated medicines have come to market, and some AI drugs that have entered human clinical trials have either been shelved or deprioritized due to lackluster results.

The problem may come down to the fact that as powerful as AI is, drug development suffers from long odds of success: on average, 90% of therapies that enter human clinical trials never make it to market – a big margin of error for the technology to overcome and indicative of the complexity of drug development.

In addition, AlphaFold 3 can still make mistakes, and like other AI tools may not be predictive of what will be a best-in-class medicine. Moderna, for example, has spent more than a decade building and analyzing a database of synthetic messenger RNA (mNRA) with the help of AI, which the company relied on to quickly develop its COVID-19 vaccine. Its second mRNA vaccine – this time targeting respiratory syncytial virus (RSV) – is expected to get Food and Drug Administrative approval in the coming weeks. But this shot will be third to market, and in clinical trials demonstrated shorter duration of efficacy than its competitors, both of which launched last year.

AlphaFold 3 is pushing the envelope: Developers say the algorithm can model the structure and interactions of biomolecules with at least 50% greater accuracy than existing methods. But predictions still have to be confirmed through traditional clinical research. And so far, AlphaFold 3 is only available for non-commercial use, which could limit the availability of data inputs and learnings going forward.

As such, we continue to believe investors should approach AI’s role in drug discovery and development with a level head – thinking of AI not as the solution, but more a part of it. To that end, we think it is important to identify firms showing proof of concept through clinical trials and for investors to remain mindful of valuations. In addition, as AI tools grow in prevalence, demand for high-quality molecular data will also rise, which could benefit companies that provide services such as next-generation genomic sequencing and interpretation, as we noted in another article that looked at a broader set of AI-related investment opportunities in healthcare. These firms’ supporting role could carry less risk than pure AI biotech but still provide exposure to the benefits of AI-aided drug research.

IMPORTANT INFORMATION

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Concentrated investments in a single sector, industry or region will be more susceptible to factors affecting that group and may be more volatile than less concentrated investments or the market as a whole.