In this year’s Wealth Planning Trends, we uncovered several gaps that exist for clients that represent planning-related opportunities for financial advisors. They include taxes, education about financial exploitation, and retirement withdrawal strategy.

Even though we in financial services may spend significant time thinking about these issues and how they may impact clients’ financial plans, it appears many investors have overlooked them.

For example, regarding withdrawal strategy, a 2024 survey of 2,521 Americans found that only 41% had “thought about how much money to withdraw from [their] retirement savings and investments in retirement.”1

These gaps provide us with opportunities to have conversations with clients, and the withdrawal issue specifically allows us to revisit a topic that’s been a thorn in the side of many advisors over the past several years. I’m referring to the 10-year rule and required minimum distribution (RMD) rules for inherited IRAs, which were only finalized last summer.

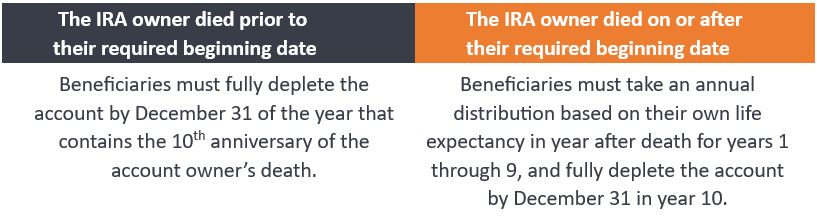

As a reminder, SECURE 1.0 of 2019 ended the stretch IRA and introduced the 10-year rule. From there, the IRS declared that non-spouse beneficiaries would need to take RMDs from IRAs. Advisors around the country spent the next four years wondering how these rules should be implemented as they waited for the IRS to provide final regulations. Clarity finally came in July 2024, when final regulations (TD 10001) set out the following rules for non-spouse beneficiaries.

This clarity, and the survey finding showing that clients haven’t thought about how to withdraw assets from their retirement accounts, provides a great opportunity to discuss clients’ retirement plans and how they can deal with this rule, whether it be through an account they might inherit or accounts they own that may be inherited by others.

These conversations could include discussing how clients could withdraw assets from traditional IRA accounts. For instance, does it make sense to withdraw assets prior to the new RMD age of 73 to help manage taxable income now and in the future?

This conversation could also inform a client’s Social Security claiming strategy. While 59% of people in that same survey had thought about how the age at which they claim Social Security could impact the amount they receive, that still leaves a large chunk of Americans who may not have considered this nor created a plan to claim benefits at the best time for their financial situation.

Along with that, I think all the complexity surrounding the 10-year rule and RMDs for inherited IRAs should prompt clients to consider a full or partial Roth conversion. Not only might this provide additional tax diversification for IRA owners, but it may spare future beneficiaries from having to deal with the complexity and tax issues they’ll inherit with that traditional IRA.

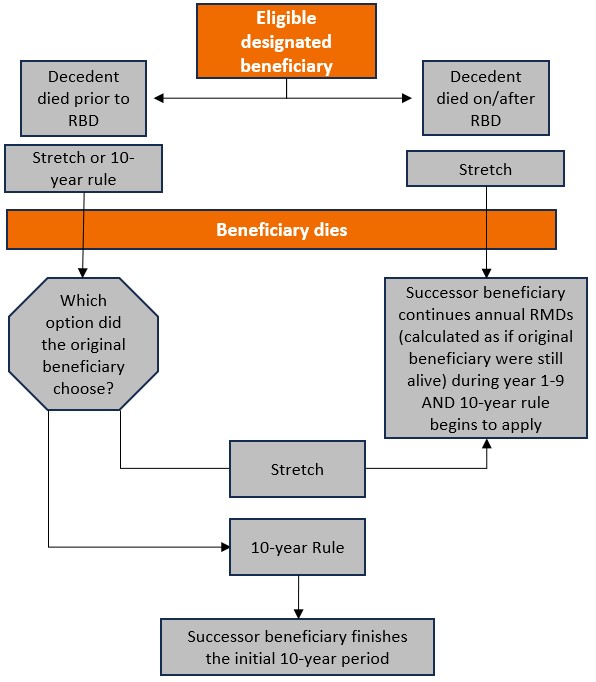

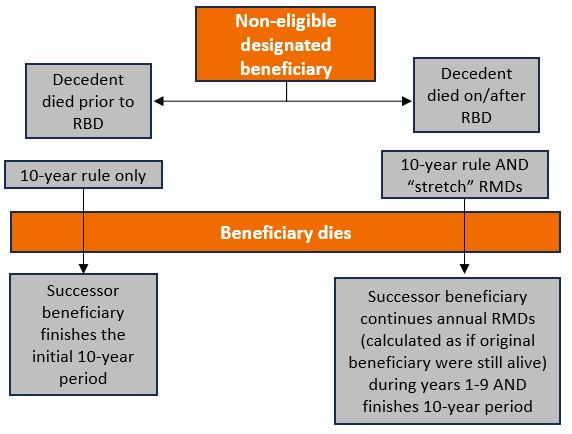

One final topic I’d like to cover is based on questions I’ve received from advisors: What happens after a beneficiary dies, and that IRA is inherited by a successor beneficiary? What rules must we follow in these cases? The flowcharts below illustrate how to navigate these questions for eligible designated beneficiaries and non-eligible beneficiaries.

Figure 1: Eligible designation beneficiary

Figure 2: Non-eligible designated beneficiary

I wish I could say it were easy, but these are the rules. While the flow chart looks complex, my hope is that it provides advisors with the information they’ll need to have productive inherited IRA conversations with not only beneficiaries but successor beneficiaries.

The information contained herein is for educational purposes only and should not be construed as financial, legal or tax advice. Circumstances may change over time so it may be appropriate to evaluate strategy with the assistance of a financial professional. Federal and state laws and regulations are complex and subject to change. Laws of a particular state or laws that may be applicable to a particular situation may have an impact on the applicability, accuracy, or completeness of the information provided. Janus Henderson does not have information related to and does not review or verify particular financial or tax situations, and is not liable for use of, or any position taken in reliance on, such information.

1 2024 Retirement Confidence Survey, EBRI, Greenwald Research.