This article is part of the latest Trends and Opportunities report, which outlines key themes for the next stage of this market cycle and their nuanced implications across global asset classes.

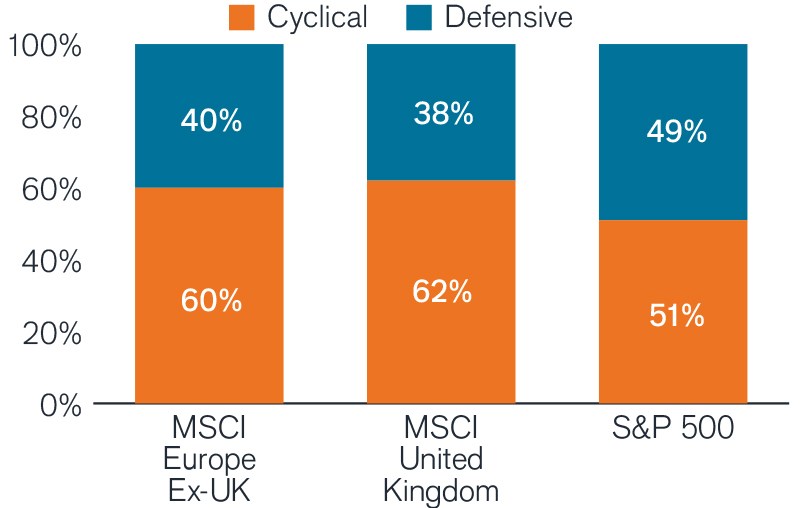

The more cyclical nature of European equities and their lower relative valuations than U.S. equities present strong upside potential.

2022 Recap

- Inflation, rising bond yields, and the conflict in Ukraine drove the decline in valuation multiples and subsequent drawdown of European equities from January through September, which fell 22% before rallying in the fourth quarter to close out 2022 U.S. equities.

- The increase in energy prices has been the biggest driver of Euro area inflation, which reached a staggering 10.7% in October 2022 and has urged the European Central Bank (ECB) to hike rates.

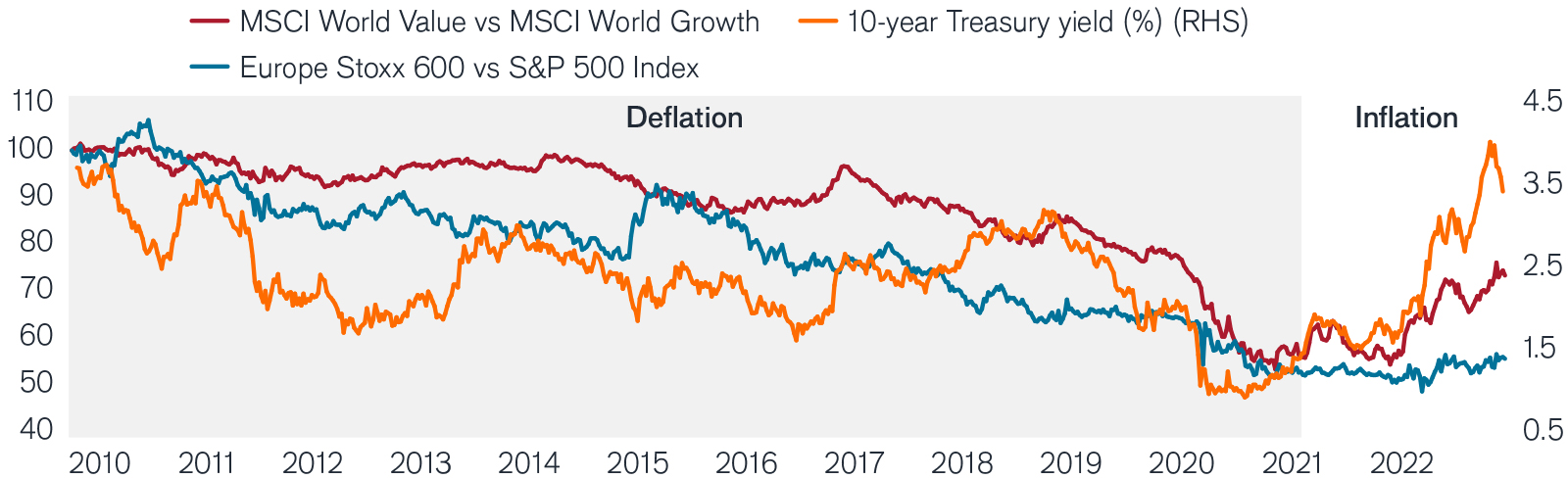

- German 10-year bund yields reaching an 11-year high in 2022 marked a new era of rising rates in developed markets, which took a toll on growth-oriented stocks.

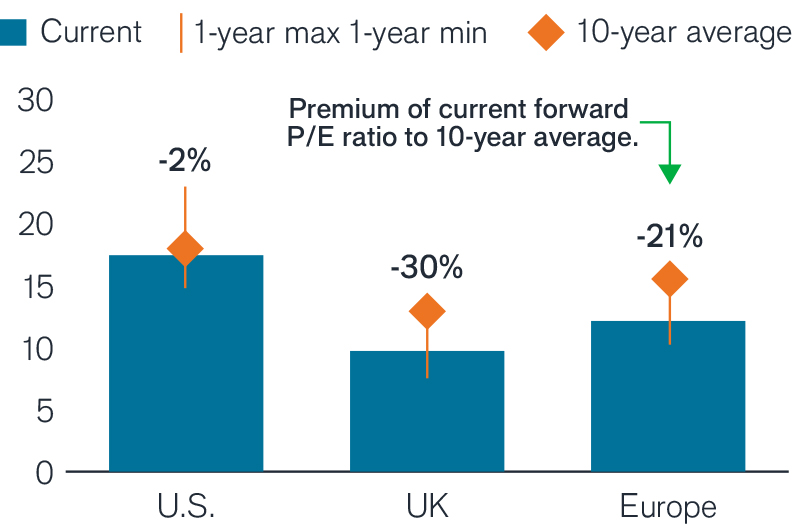

European equities contain more cyclical stocks – typically outperforming during rate rises – and trade at a discount vs. the U.S.

Source: (LHS) Janus Henderson Portfolio Construction and Strategy, Morningstar. Cyclical sectors include energy, financials, industrials and materials. Defensive includes communication services, consumer discretionary, consumer staples, healthcare, technology, real estate and utilities. As at 31 December 2022. (RHS) Janus Henderson Portfolio Construction and Strategy, Bloomberg. Forward P/E Ratio as at December 2022.

Outlook

- With a potential recession on the horizon, the ECB must delicately navigate rate increases to bring down core inflation in 2023. This will create an environment that should benefit more value-oriented sectors, as well as companies that are an inflation hedge and are less sensitive to rising rates (vs. future earnings for growth stocks).

- The generally cyclical European market structure, combined with historic valuation discounts, implies that a little bit of good news can go a long way. Europe is potentially well-positioned for any relief that might stem from a weaker U.S. dollar, geopolitical resolutions, and/or a continued pickup in post-pandemic demand recovery.

U.S. vs. Europe returns: European cyclicality and value potentially poised to outperform in an era of higher interest rates

Source: Janus Henderson Portfolio Construction and Strategy, Morningstar, as at December 2022. Stoxx 600, S&P 500 Index, MSCI World Value, MSCI World Growth, total return indices. 10-Year U.S. Treasury yield (%). Past performance does not predict future returns.

PCS Perspective

- Europe is likely to enter a recession earlier than other developed markets – a scenario that appears to be increasingly factored into relative market valuations.

- While impossible to predict the point of recovery, there are strong indications that suggest a recession in the region should be relatively shallow compared to previous experiences. Therefore, we believe it makes sense to look for opportunities to position portfolios for the eventual economic recovery.

- Irrespective of the timing of a recovery, European equities are paying dividends that are nearly double that of the U.S.1, thus providing an attractive income opportunity, in our view.

- In our view, the more cyclical nature (i.e., greater exposure to consumers, energy, financials, and materials) of European equities versus the U.S. and their lower relative valuations present strong upside potential.

Footnote

1 Source: Morningstar as at 31 December 2022

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

MSCI Europe ex UK IndexSM reflects the equity market performance of developed markets in Europe, excluding the United Kingdom.

MSCI United Kingdom IndexSM reflects the equity market performance of developed markets in the United Kingdom.

MSCI World Growth IndexSM reflects the performance of growth stocks from global developed markets.

MSCI World Value IndexSM reflects the performance of large and mid cap equity securities exhibiting value style characteristics across global developed markets.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

STOXX® Europe 600 Index represents large, mid and small capitalization companies across 17 countries in the European region.

IMPORTANT INFORMATION

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Growth stocks are subject to increased risk of loss and price volatility and may not realize their perceived growth potential.

Value stocks can continue to be undervalued by the market for long periods of time and may not appreciate to the extent expected.