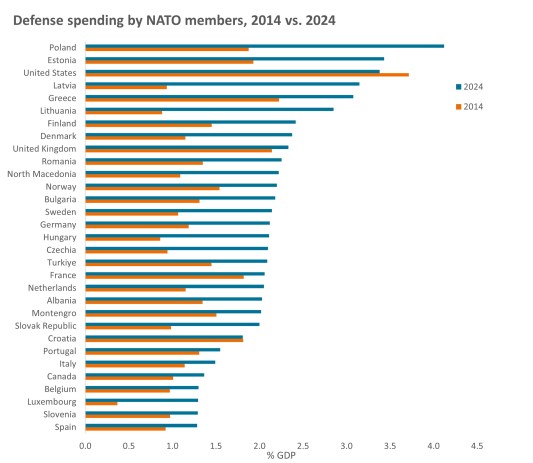

Source: NATO, Defence Expenditure of NATO Countries (2014-2024), 17 June 2024. GDP=gross domestic product. NATO=The North Atlantic Treaty Organization, an intergovernmental transnational military alliance of 32 member states (30 European and two North American). Data excludes Iceland, which has no armed forces.

For decades, defense budgets in Europe experienced little to no growth. But amid new geopolitical tensions and a change in White House leadership, defense spending in the region is poised to accelerate.

Already, countries located near Russia have dramatically increased defense expenditures as a percentage of their gross domestic product (GDP), with Poland committing more than 4% of its GDP in 2024, up from less than 2% a decade ago. More recently, Ursula von der Leyen, president of the European Commission, said the EU plans to activate a mechanism that allows member states to substantially increase defense expenditures without having to make cuts elsewhere. She also proposed lending up to 150 billion euros (US$158 billion) to EU governments to rearm amid worries about faltering U.S. support for Ukraine.

Some countries have already taken action. This year, the UK pledged to increase its defense spending from an estimated 2.3% of GDP in 2024 to 2.5% by 2027 (and target a 3% level in subsequent years) and Denmark announced it would boost its defense spending to more than 3% of GDP in 2025 and 2026. In addition, Germany’s incoming government recently said it will launch a 500 billion euro ($528 billion) fund to invest in infrastructure projects and that it will amend the constitution to exclude defense outlays from fiscal spending limits.

The shift in policy has helped to lift non-U.S. defense stocks. Until recently, though, many of the shares traded at valuations that reflected much lower rates of growth. One possible reason: After more than a decade of U.S. outperformance, market participants have seemingly written off foreign stocks. But amid a changing geopolitical backdrop, investors may want to reconsider.

We’re standing at a turning point for fiscal, trade, and defense policy, and believe the resulting volatility is creating disconnects investors can take advantage of. Defense is one example. Outside the U.S., the industry has historically been very slow growing. But as geopolitical alliances shift, we expect non-U.S. defense revenues to accelerate, and we think markets are only beginning to catch up to this potential for faster growth. – Julian McManus

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Volatility measures risk using the dispersion of returns for a given investment.