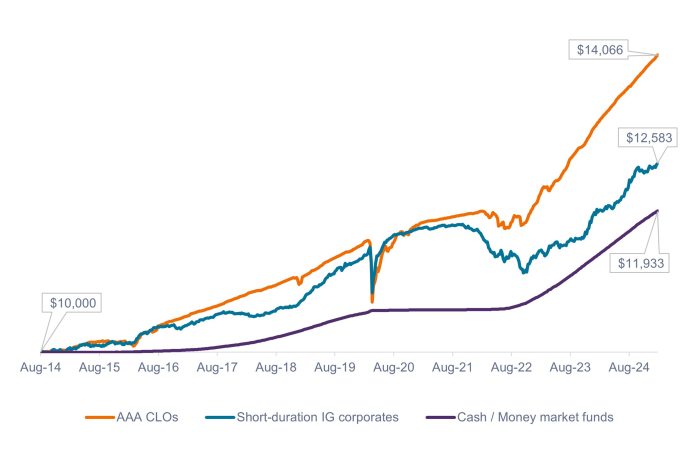

Source: Bloomberg, J.P. Morgan, as of 24 January 2025. Indices used to represent asset classes: AAA CLOs = J.P. Morgan AAA CLO Index, Short-duration IG corporates = Bloomberg U.S. Corporate 1-3 Year Index, Cash / Money market funds = Bloomberg U.S. 1-3 Month Treasury Bills Index. Past performance does not predict future returns.

Some investors who are hesitant to put their short-term cash reserves at risk may feel uneasy with any volatility in their short-duration holdings. We believe this approach may be overly cautious, as many investors could handle an incremental amount of volatility in exchange for potentially higher returns. Historically, despite occasional drawdowns, AAA CLOs and short-duration IG corporates have ended up comfortably ahead of cash over the long term.

– John Kerschner, Head of U.S. Securitized Products