Subscribe

Sign up for timely perspectives delivered to your inbox.

Wealth Strategist Ben Rizzuto discusses key considerations for advisors seeking to leverage artificial intelligence (AI) in their practices – chief among them, understanding clients’ comfort level with the technology.

My colleague Mike McNurney and I were recently reminiscing about some of our favorite artificial intelligence (AI) stories and movies from the past.

From books like “I, Robot” and “Do Androids dream of Electric Sheep?” to movies like “2001: A Space Odyssey” with HAL 9000 or “Tron” and the Master Control Program, humans as well as sci-fi nerds like me and Mike have thought about the promise and possibilities AI could offer for decades. In fact, Mike has written about AI quite a bit this year and created a great presentation on the subject to help advisors and clients better understand the implications of these technologies.

Many of these works of fiction have a decidedly doomsday perspective, but in the real world, I think we have reached a point where advisors need to consider how they want to use AI in their practices and, more importantly, understand how clients will be affected by it.

One reason this is worth considering is the level of personalization clients are seeking in their interactions with financial advisors (FAs). In a recent survey, 96% of FAs acknowledged that personalization is important, if not very important, to the success of their practice.1

We all seek personalization with any service provider or business we interact with. The question is, how much personalization can businesses or FAs provide while keeping it scalable? Ideally, every interaction would be personalized to each individual, but that’s clearly not sustainable. Heck, I’ve been guilty of trying to do this in my own interactions, and I must admit it can be very difficult and time consuming.

And the research bears this out: In the same study, 54% of FAs also said they found it challenging to spend as much time with each client as they would like, which led to 68% saying they found personalization difficult to scale within their practice.2

This is where AI may be able to provide some assistance. Advisors are using AI more and more, and firms are spending more time, effort, and money working to test and provide tools that can be easily used by FAs.

In fact, Orion recently found the following regarding AI usage by advisors or their firms:

– 46% plan to leverage AI for the strategic direction of the firm in the next three years

– 42% are currently evaluating/testing AI

– 32% are already using AI3

While AI is clearly making inroads in the financial services industry, I think it’s important to consider how clients or potential clients might feel about their advisor using AI.

We addressed this question in our most recent Investor Survey, where we asked 1,000 participants several questions around how they would feel if they learned their advisor was using AI to complete certain tasks.

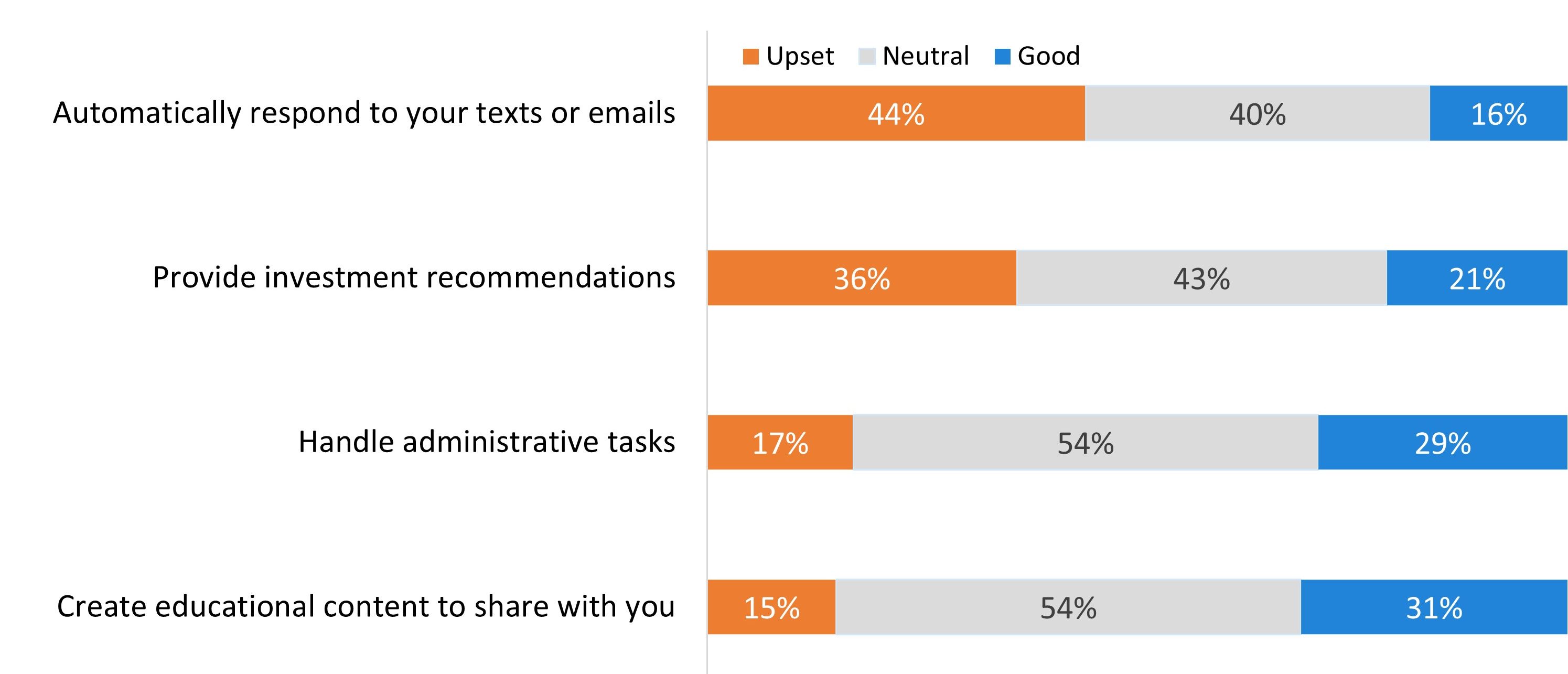

Those tasks included:

– Automatically responding to texts or emails

– Providing investment recommendations

– Handling administrative tasks

– Creating educational content

For each of these tasks, participants could gauge their comfort level as Upset, Neutral, or Good. The responses we received provide insight into what investors want from advisors, how they view relationships and communication, and what they believe is included in an advisor’s value proposition.

Source: Janus Henderson Investor Survey, 2024.

These results show us that, in many cases, clients feel neutral about their advisor using AI. But I think it’s more important to focus on the areas where respondents said they would be upset or feel good about AI usage.

Clearly, most investors seem to agree that communication with their advisor should be handled by a person, not a machine. Many also feel it is important for their advisor to personally provide investment recommendations.

The latter finding presents a bit of a Catch-22, as more and more advisors are utilizing managed accounts or off-the-shelf models that utilize technology and/or AI to create allocations, but which also give them more time in their day to provide personalized, one-on-one guidance to clients.

On the more positive side, clients do seem to acknowledge how AI could help their advisor create educational content or deal with tasks that may not be as personal as sending an email or text message.

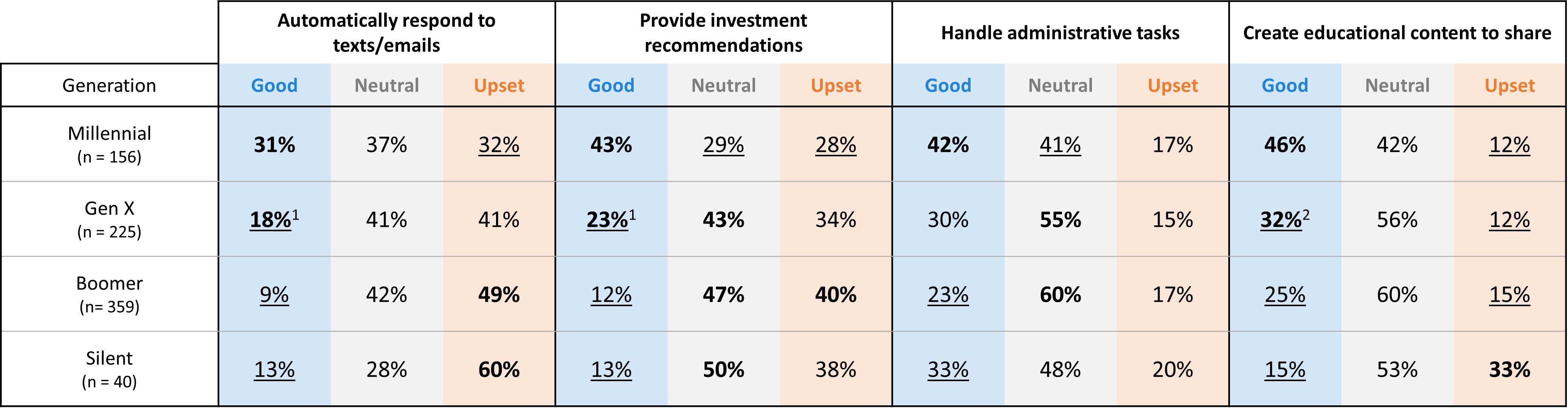

Digging into the data further, we find differences in sentiment around AI based on investors’ age and investable assets.

Note: Numbers in bold are significantly higher than underlined numbers. Totals may not add to 100% due to rounding. Millennials: born 1980-1995; Generation X: born 1964-1979; Baby Boomers: born 1945-1963; Silent Generation: born 1925-1944.

1Only significantly higher than Boomer.

2Only significantly higher than Silent.

From a generational standpoint, we can see that younger investors are more open to the use of AI, while older investors have stronger feelings about how an advisor should communicate with them and what an advisor’s value proposition is regarding investment management and even education.

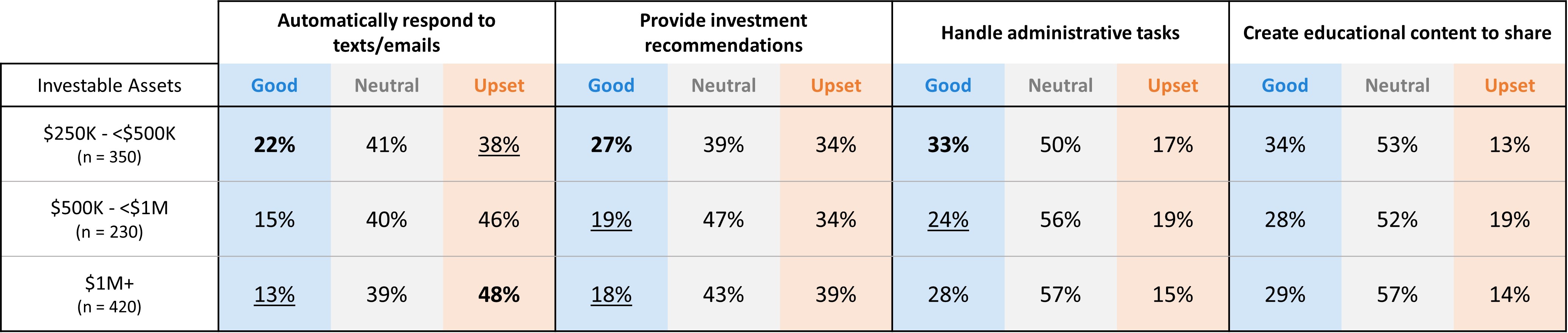

How investors would feel if they learned their advisor used AI to:

Note: Numbers in bold are significantly higher than underlined numbers. Totals may not add to 100% due to rounding.

When it comes to investable assets, the differences are less significant, although it is important to note that average investable assets increase with age. Millennials had the lowest assets on average, while the Silent generation had the highest, and this may explain some of the differences we see.

All of this should lead advisors to consider not only how they want to use AI in their practices, but also – and I think more importantly – how they want to communicate with clients and prospective clients about its usage.

By focusing on the value AI provides, the time it frees up and the ways it facilitates better service, FAs can help clients feel more comfortable about how they’re using the technology. It’s also important for FAs to remind clients that their use of AI does not mean they have been replaced by HAL 9000 or some other program that lacks the feelings, emotions, and ability to form meaningful relationships with clients.

Technology has become and will continue to be a major part of our lives. The programs that can talk to us, guide us, and teach us are no longer the stuff of fiction. The question is how to best integrate these technologies into our value propositions and client interactions. For those who deploy it thoughtfully and strategically, AI has the potential to not only preserve the personalized touch clients are seeking, but even elevate it.

1 Enhancing Personalization in Financial Services, AI to the Rescue? 8 Acre Perspective and Totumai, February 2024.

2 Ibid.

3 Quarterly Financial Advisor Pulse Survey, Orion, September 2024.