Subscribe

Sign up for timely perspectives delivered to your inbox.

In his 2025 investment outlook, Head of U.S. Fixed Income Greg Wilensky outlines the most likely scenarios for the U.S. economy and which asset classes he believes will be best positioned under each scenario.

As 2025 beckons, investors may be contemplating how to best allocate their portfolios for the monetary, economic, and geopolitical landscape that the new year may bring. With over $7 trillion sitting in cash and money markets globally, it seems many investors remain in a “wait-and-see” mindset.

In our view, investors should position their portfolios to benefit under the majority of economic outcomes. Below we outline four potential scenarios for the U.S. economy and the prospective outlook for the three major asset classes under each scenario.

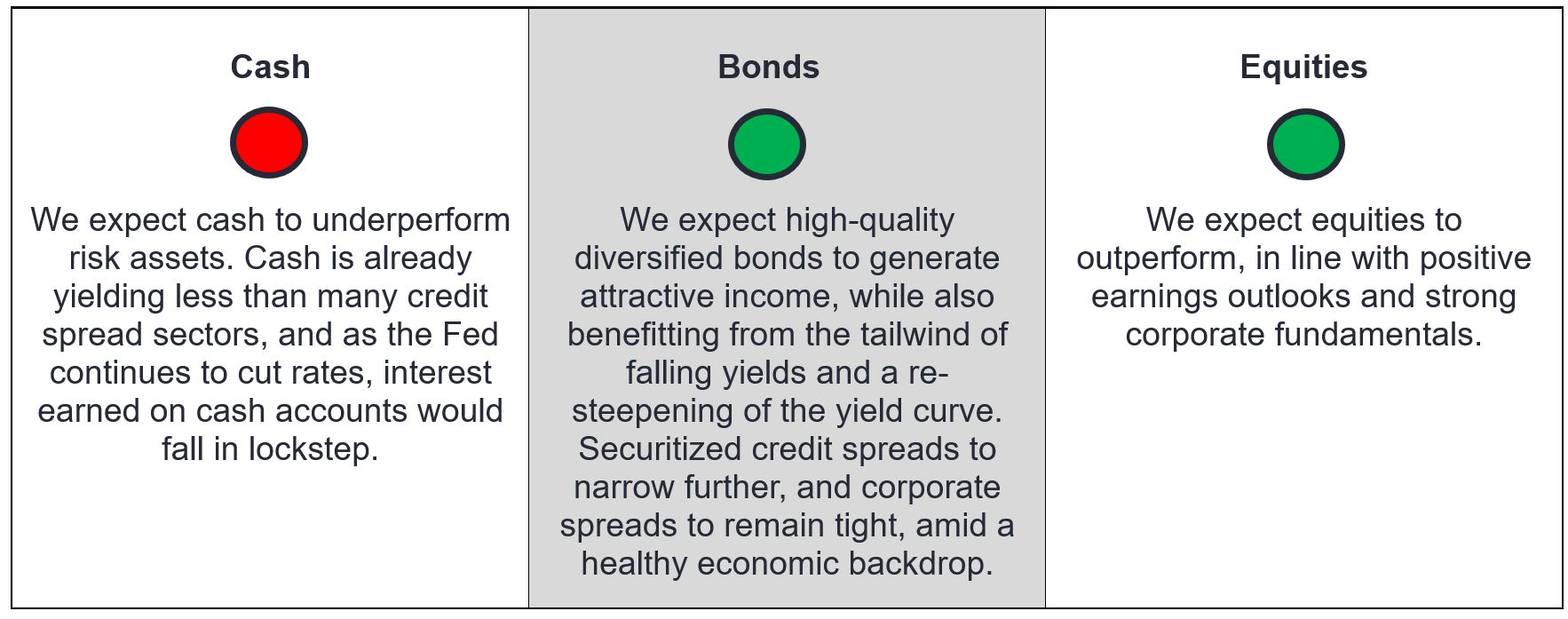

Key characteristics: Inflation continues its downward trend back to the Federal Reserve’s (Fed) 2% target, labor market tightness eases without a dramatic rise in the unemployment rate, and while economic growth begins to taper, the U.S. economy continues its growth trajectory.

Anticipated Fed response: We would expect the Fed to cut interest rates gradually as the economy and inflation continue to cool and the labor market comes back into balance. Expect the federal funds rate would be close to the Fed’s terminal – or neutral – rate within 18-24 months. (The terminal rate is a subjective rate the Fed considers to be neither restrictive nor accommodative for the economy, currently estimated to be around, or slightly above, 3%.)

Likelihood: We consider the soft landing our base case for the U.S. economy over the next twelve months.

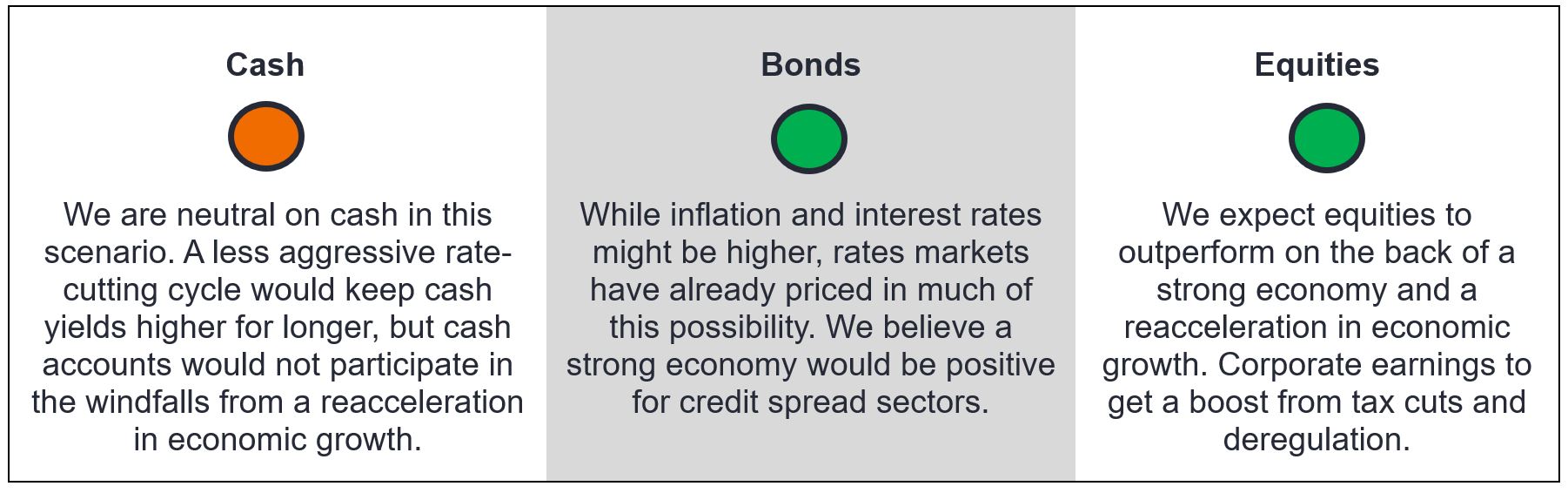

Key characteristics: The U.S. experiences no deceleration in economic growth, and the labor market stays tight. Inflation remains sticky above the Fed’s target and possibly begins to rise again.

Anticipated Fed response: Higher growth coupled with potentially higher inflation would hamstring the Fed from cutting rates as much as currently projected, thereby precipitating a higher-for-longer interest rate environment.

Likelihood: The incoming administration’s stated policies of lower taxes, deregulation, and tariffs on imported goods may lead to higher growth but also higher inflation. As a result, the likelihood of a no-landing scenario has increased.

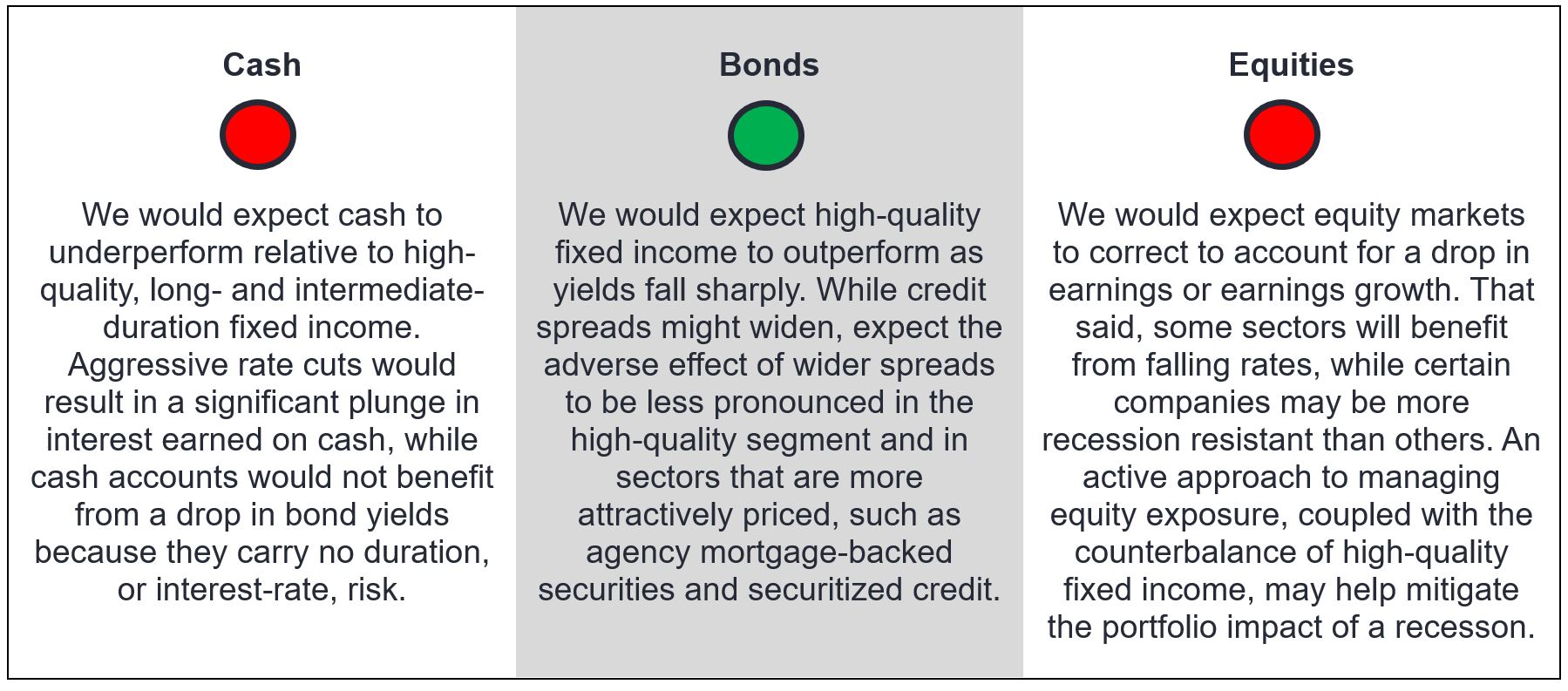

Key characteristics: Economic growth and consumer spending slow dramatically. Corporates are forced to cut jobs, leading to a rise in unemployment and an exacerbation of the recessionary cycle.

Anticipated Fed response: Inflation is already close to the Fed’s target, and if the U.S. does enter a recession, we would expect inflation to fall further. Consequently, the central bank has the flexibility to focus on the full employment side of its dual mandate. Expect the Fed to cut rates aggressively to boost economic growth and employment.

Likelihood: In our view, a hard landing is unlikely. By most measures, U.S. corporates and households are in good shape. We do not see anything in the present data that suggest a recession is a highly probable outcome in 2025.

Key characteristics: Immigration reform squeezes labor supply and the labor market tightens up again, with a resultant increase in wage inflation. Rising prices and the lagged effects of higher interest rates slow consumer spending, while trade wars, tariffs, and geopolitical tensions further increase inflationary pressures. Economic growth stalls while inflation accelerates.

Anticipated Fed response: This scenario would be the trickiest situation for the Fed. The central bank would have to choose whether to tolerate higher unemployment or higher inflation. Expect the Fed to tiptoe through the political and monetary minefield, trying to strike a balance on rates.

Likelihood: Low. The U.S. economy is showing few signs of stress, and it is unlikely that the incoming administration’s policies would be implemented in a manner – or to the extent – that they result in stagflation. Markets and the Fed would conceivably look through a one-time upward price adjustment due to tariffs, while the scope and pace of implementation of new immigration policy would probably be lower than was touted on the campaign trail.

In our view, in the three scenarios we consider most likely for the U.S. economy (soft landing, hard landing, no landing) an actively managed portfolio of high-quality diversified fixed income and equities would outperform cash.

While a cash allocation might be beneficial in the unlikely scenario of stagflation, we think the diversification benefit of an allocation to high-quality fixed income outweighs any potential benefits of cash. In our view, investors should remain invested and implement a strategy that is poised to outperform in the majority of outcomes.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Risk assets: Financial securities that may be subject to significant price movements (ie. carrying a greater degree of risk). Examples include equities, commodities, property lower-quality bonds or some currencies.

Volatility measures risk using the dispersion of returns for a given investment.

IMPORTANT INFORMATION

Actively managed investment portfolios are subject to the risk that the investment strategies and research process employed may fail to produce the intended results. Accordingly, a portfolio may underperform its benchmark index or other investment products with similar investment objectives.

Derivatives can be more volatile and sensitive to economic or market changes than other investments, which could result in losses exceeding the original investment and magnified by leverage.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Mortgage-backed security (MBS): A security which is secured (or ‘backed’) by a collection of mortgages. Investors receive periodic payments derived from the underlying mortgages, similar to the coupon on bonds. Mortgage-backed securities may be more sensitive to interest rate changes. They are subject to ‘extension risk’, where borrowers extend the duration of their mortgages as interest rates rise, and ‘prepayment risk’, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.