Why global property equities?

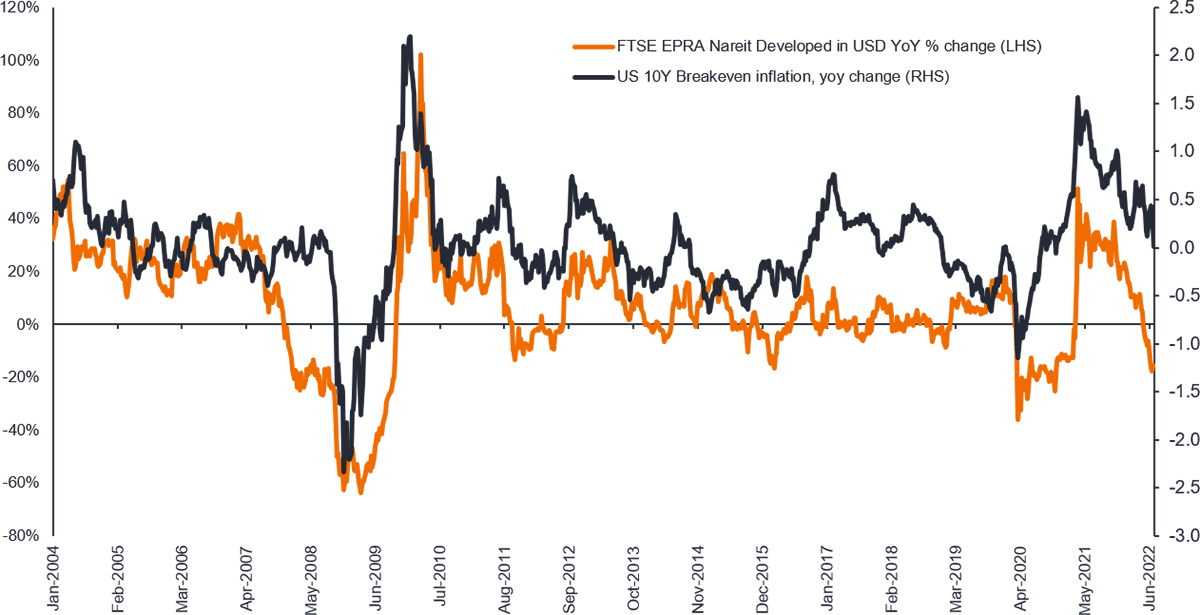

1. Real estate offers inflation protection

A recovering economy typically leads to rising rental income and increases the value of underlying real estate assets. Rental contracts are often linked to inflation through annual uplifts or are reset when they expire.

Rental contracts often have fixed or inflation linked annual uplifts

US 10-year Breakeven Inflation vs FTSE EPRA NAREIT Developed Index

Source: Janus Henderson Investors, FactSet, as at 30 June 2022.

Note: Chart shows YoY change from 2004 using weekly data, index performance in USD.

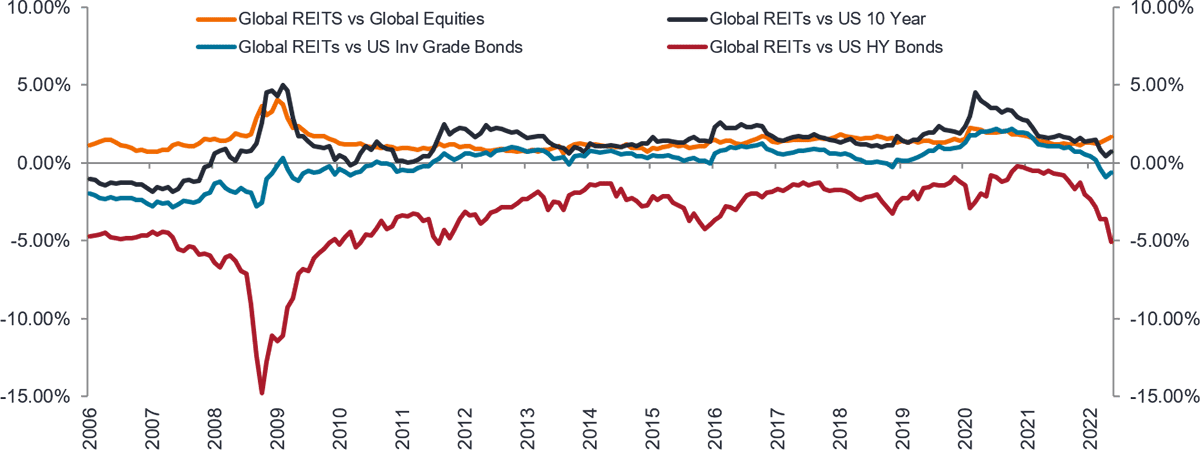

2. REIT income remains attractive

Attractive and sustainable yields at a premium to those of general equities and bonds. Reinvested dividends have comprised ~60% of long-term total return in the listed real estate sector.

Dividend yield spread elevated vs history, especially relative to corportate and high yield bonds

REIT Dividend Yield Spreads vs Equities

Source: Janus Henderson Investors, as at 30 June 2022.

Note: Benchmark: FTSE EPRA NAREIT Global Developed Index, MSCI World Index, Bloomberg US Corporate Total Return Value Unhedged USD, Bloomberg US High Yield ex Energy Total Return Index Value Unhedged USD. Past performance is not a guide to future performance.

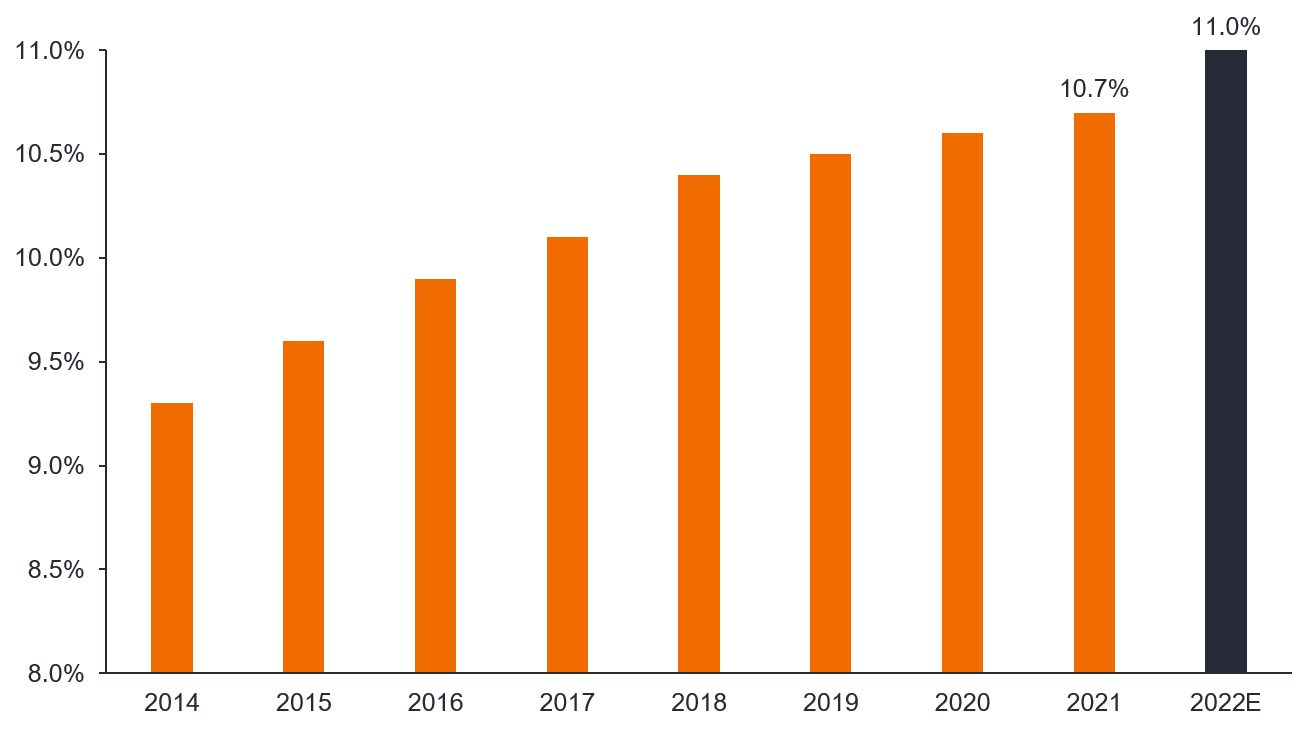

3. Real estate allocations continue to grow

Whilst REITs are still a relatively young asset class, they have evolved into one which is very much relevant today and beyond. Institutional allocations to real estate continue to grow, supporting underlying real estate asset pricing, particularly in the more structurally supported sectors. These sectors offer highly visible long-term compounding return potential, driven by permanent and powerful secular tailwinds such as e-commerce, mobile data, cloud computing, 5G, changing demographics and sustainability.

Investment market volumes recovered sharply in 2021

Source: Hodes Weill, Janus Henderson Investors Analysis, as at 31 December 2021.

Note: Data after December 2021 are forecasted. Forecasts are subject to change without notice.

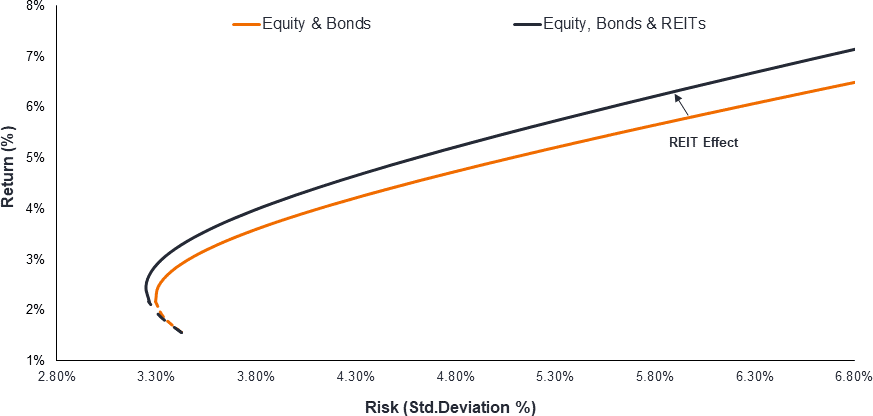

4. Portfolio diversification and liquidity

Global property equities offer a low cost, liquid and transparent way to gain exposure to a wide range of property sectors across geographies. Historically, REITs have shown a low correlation to bonds and equities, making them an efficient way to diversify portfolios and potentially help enhance risk-adjusted returns.1

Adding Property Equities may potentially increase returns and decrease risk

Source: Janus Henderson Investors, EPRA, as at 30 June 2022.

Note: The efficient frontier shows the minimum variance portfolio (or least risky portfolio) for a given rate of return. The resulting line shows the most efficient portfolio for any given combination of risk and return. Rational investors will construct portfolios that have risk-return profiles that are located on this frontier. The efficient frontiers are calculated using data from a rolling 10-year period.

"Property equities offer investors a liquid, diversified and low-cost way of accessing the global property market."

- Tim Gibson,

Co-Head of Global Property Equities

Why Janus Henderson for property equities?

5-star Morningstar rating 2 and numerous fund awards won by our property equities funds in the past five years. 3

Morningstar 2

Capture powerful secular themes

Focus on areas of structural growth such as industrial/logistics, rental residential, technology focused real estate assets with little exposure to more challenged sectors.

Actively managed by experienced experts with local expertise

Janus Henderson has managed listed real estate assets since 1997, with strong expertise and regional “on-the ground” teams in Asia, Europe and North America.

Various distribution options to suit your needs

Our property equities funds offer monthly and quarterly distribution share classes and a wide range of currencies. Aims to pay dividend* on monthly basis (A4m USD) / quarterly basis (A3q USD).4

*Dividend amount or dividend rate is not guaranteed. Positive dividend does not mean positive return. Distributions may be paid out of capital.

A time-tested, integrated approach to ESG

Our active management approach allows the integration of ESG into portfolio construction that can lead to meaningfully better performance.

Explore our suite of property equities funds

Global

Pan European

Asia-Pacific

Meet our team

Janus Henderson has managed listed real estate assets since 1997 and manages a total of US$3.6bn in global portfolios.

Our global property teams are based in the Europe, Asia and North America.

Europe

Guy Barnard, CFA

Co-Head of Property Equities

19 years' industry experience

Nicolas Scherf

Portfolio Manager

15 years' industry experience

Tom Foster, CFA

Investment Analyst

7 years’ industry experience

North America

Greg Kuhl, CFA

Portfolio Manager

17 years' industry experience

Danny Greenberger

Portfolio Manager

16 years' industry experience

Asia

Tim Gibson

Co-Head of Property Equities

21 years' industry experience

Xin Yan Low

Portfolio Manager

15 years' industry experience

Alex Koslover, CFA

Investment Analyst

9 years' industry experience

David Segall

Research Analyst

10 years' industry experience

Source: Janus Henderson Investors, as at 30 June 2022

Meet our team

Europe

Guy Barnard, CFA

Co-Head of Property Equities

18 years' industry experience

Nicolas Scherf

Portfolio Manager

14 years' industry experience

Tom Foster, CFA

Investment Analyst

6 years’ industry experience

North America

Greg Kuhl, CFA Portfolio Manager

16 years' industry experience

Danny Greenberger Portfolio Manager

15 years' industry experience

Alex Koslover, CFA Investment Analyst

8 years' industry experience

David Segall, Research Analyst

10 years' industry experience

Asia-Pacific

Tim Gibson

Co-Head of Property Equities

20 years' industry experience

Xin Yan Low

Portfolio Manager

14 years' industry experience

Source: Janus Henderson Investors, as at 31 December 2021.

Related insights

Connect with our Sales team

Footnotes:

- Nareit, FactSet as of 31/3/21, 10- and 30-year correlation data to 31/3/21, for FTSE Nareit All Equity REITs Index versus bond and equity indices.

- 5-star Morningstar rating for Janus Henderson Global Real Estate Equity Income Fund and Janus Henderson Horizon Pan European Property Equities Fund as at 30 June 2022.

- For more fund awards information, please visit the Janus Henderson Investors Awards page. Fund Selector Asia Awards 2022 Singapore, reflecting fund performance from 13 November 2020 to 12 November 2021, Equity Sector for Janus Henderson Horizon Global Property Equities Fund. Refinitiv Lipper Fund Awards Singapore 2022, reflecting fund performance based on Janus Henderson Horizon Global Property Equities Fund, class A2 USD share, Equity Sector Real Estate Global, 3 and 5 years as of 31 December 2021. Refinitiv Lipper Fund Awards Singapore 2021, reflecting fund performance based on Janus Henderson Horizon Global Property Equities Fund, class A2 USD share, Equity Sector Real Estate Global, 5 years as of 31 December 2020. For more information, see lipperfundawards.com. Refinitiv Lipper Fund Awards, ©2022 Refinitiv. All rights reserved. Used under license.

- For dividend distribution frequency and details, please see the Janus Henderson Horizon Fund - Dividend Table PDF

- Morningstar, as at 30 June 2022. Europe OE Property - Indirect Global

- Morningstar, as at 30 June 2022. Europe OE Property - Indirect Europe

- Morningstar, as at 30 June 2022. Europe OE Property - Indirect Asia