| Market GPS blends the thinking of our investment teams and our Portfolio Construction and Strategy (PCS) Team. The PCS Team performs customized analyses on client portfolios, providing differentiated, data-driven diagnostics. By combining the insight of our investment teams with the client focus of PCS, our goal is to help you position your portfolio for the route ahead. |

Investors entered 2023 anticipating calmer markets after last year’s historic inflation, rise in interest rates, and the expectation that a higher cost of capital would weigh on economic growth. Recently added to the list was turmoil within the banking sector. While regulators’ actions have likely stemmed the risk of contagion, enough assumptions were undone to beg the question of whether markets have entered an even more challenging environment.

Investors entered 2023 anticipating calmer markets after last year’s historic inflation, rise in interest rates, and the expectation that a higher cost of capital would weigh on economic growth. Recently added to the list was turmoil within the banking sector. While regulators’ actions have likely stemmed the risk of contagion, enough assumptions were undone to beg the question of whether markets have entered an even more challenging environment.

We believe they have. The global economy is clearly late cycle, with central banks coming to the end of rate hikes. Many investors adopt a defensive posture when facing an economic downturn. Yet, with a probable soft patch so well telegraphed – and potentially somewhat priced in – we think investors, while acknowledging further downside risk, could soon go on offense, especially as this stage of the cycle may present opportunities for active security selection that can benefit from idiosyncratic risk.

Equities: Quality matters – even more

At the beginning of the year, we stated that, as the global economy faced a mid-cycle adjustment, equity investors should prioritize quality, which we define as companies with sound balance sheets and stable cash flows. That message is truer than ever. As customers’ access to credit weighs on revenues and higher input costs squeeze margins, 2023 earnings may drift toward the lower end of consensus range.

The current breadth of risks heightens our concern about how those risks may impact stocks. Yet, rather than seeking to avoid risk, investors could use volatility to take advantage of the dislocations that can occur between a stock’s price and a company’s underlying fundamentals. For example, higher rates and volatility have created opportunities within the technology sector. We expect to see a greater dispersion of returns over the mid-term based on companies’ ability to execute operationally and maintain profitability in a slowing economy. With headwinds apparent, healthcare also merits consideration. Biotechnology, in our view, holds particular promise as do profitable small- and mid-cap companies that could outperform early in a recovery.

Leaning into Europe

A similar dynamic is at play geographically. With many global indices tilted toward the U.S., benchmark-tracking investors could be exposed to a notable economic slowdown as tighter credit conditions potentially magnify the impact that the Federal Reserve’s (Fed’s) rate-hiking campaign will have on growth. We believe the potential for attractive returns exists in the U.S., but investors should be afforded the opportunity to determine for themselves their level of exposure by country.

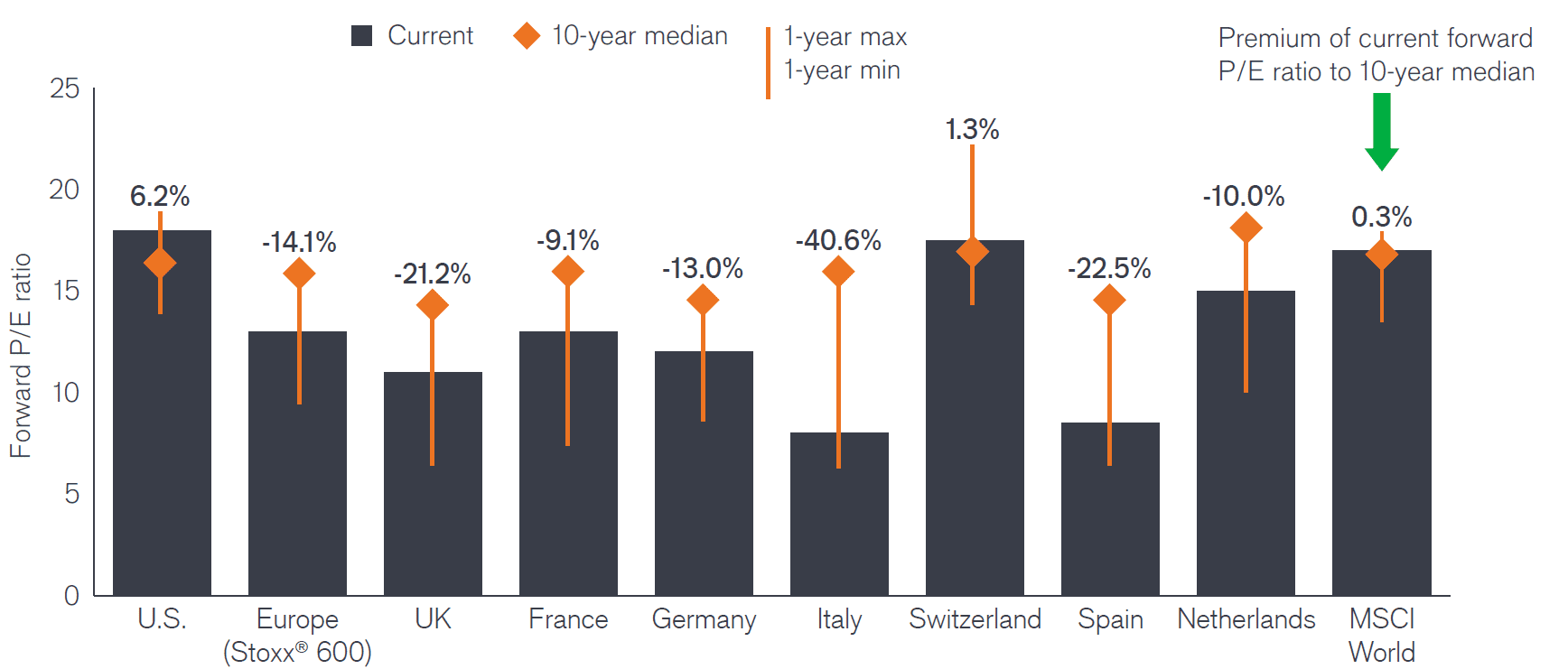

Historical and current price-earnings ratios in select markets

While P/E ratios are at above-average levels in the U.S., many European countries still trade at significant discounts.

Source: Bloomberg, as of 30 April 2023. P/E ratio = price-to-earnings ratio. Past performance is no guarantee of future results.

While focusing on quality during the downturn, investors should also think ahead by considering attractively priced cyclical exposure in markets that are most likely to lead the way out of recession. We believe Europe could fit this criterion. There are risks, but if the current trajectory continues, the cyclical nature of European stocks means they could be well positioned to outperform as the economy moves toward recovery.

Fixed income: Take what the market is giving

Higher rates mean that a bond allocation again can offer attractive income generation, the potential for capital appreciation, and the accompanying benefit of diversification against riskier asset classes. Consequently, we expect to see increased allocations to bonds as investors seek defensive strategies for the downturn.

After a long absence, shorter-dated bonds are now offering mid-single-digit returns. And with the global economy likely slowing, longer-duration intermediate bonds hold the potential for capital appreciation. Within credit, we believe resilient investment-grade businesses are likely to weather a downturn better than more cyclically exposed issuers.

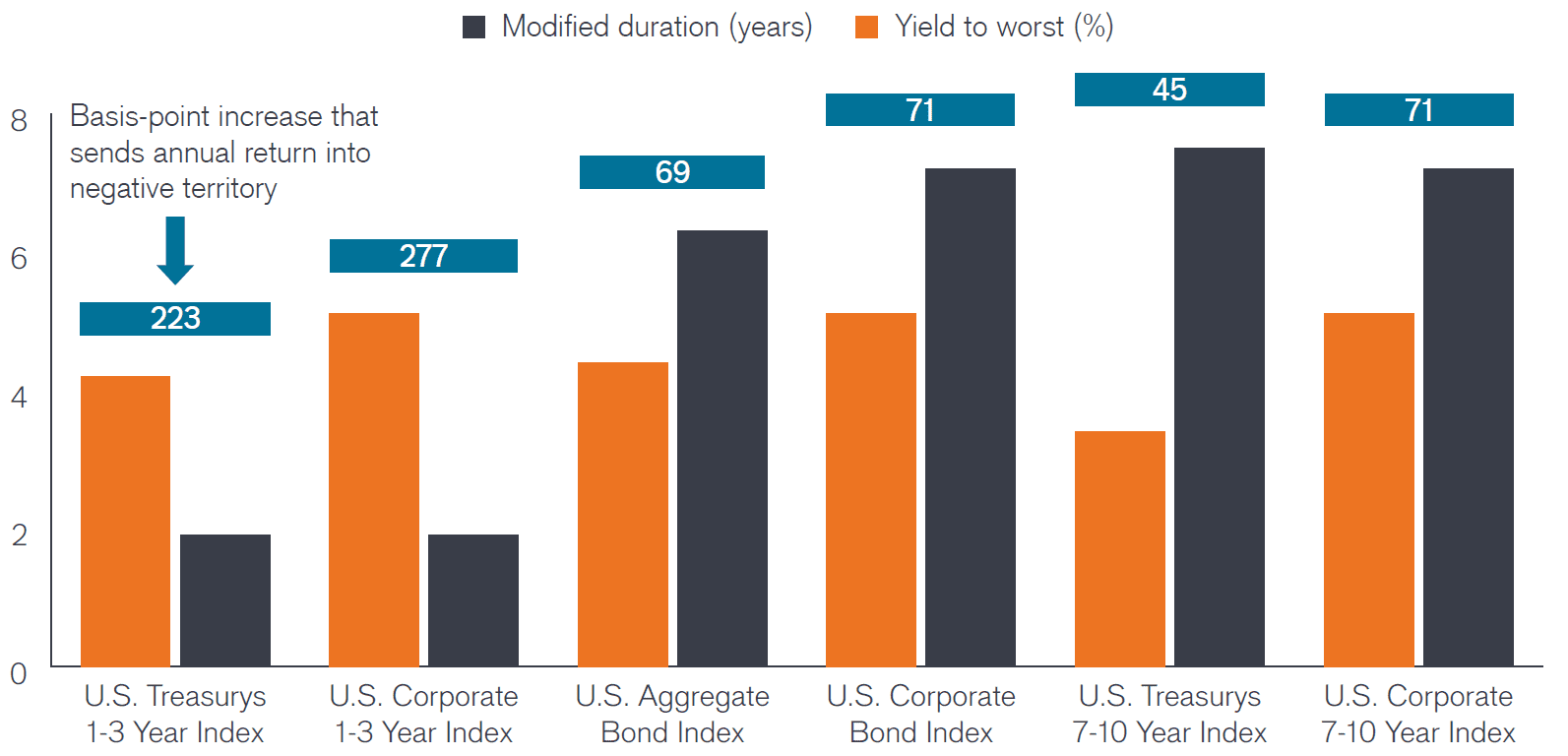

Rise in interest rates required to wipe out a bond’s annual income

Shorter-duration bonds have significantly higher yield cushions than those with longer-dated maturities.

Source: Bloomberg indices, Janus Henderson, as of 30 April 2023.

An environment for alternatives

Alternative strategies aimed at lowering the downside risk of a broad allocation were conceived for volatile periods like this. We believe the current environment is set up well for a multi-strategy approach that seeks to capitalize on the dispersion we expect to see between securities of resilient companies and those of more vulnerable firms as the global economy slows.

Staying nimble

As the global economy resets to a higher-inflation, higher-rate regime – and one fraught with geopolitical risk and a trend toward deglobalization – we expect price dislocations to emerge across asset classes and sectors. We believe nimble investors, including those willing to deviate from their benchmark, will make the most of the opportunity to pivot their portfolios from defense to offense.

Basis point (bp) = 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Bloomberg U.S. Aggregate Bond Index: A broad-based measure of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market.

Bloomberg U.S. Corporate Bond Index: Measures the investment grade, fixed-rate, taxable corporate bond market.

Bloomberg U.S. Treasury 1-3 Year Index: A measure of nominal U.S. Treasury securities with maturities ranging from 1 to 2.999 years.

Bloomberg U.S. Corporate 1-3 Year Index: A measure of U.S. dollar denominated, investment-grade, fixed rate, taxable corporate bonds with maturities between 1 and 3 years.

Bloomberg U.S. Treasury 7-10 Year Index: Measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury with maturities of 7 to 9.9999 years to maturity.

Bloomberg U.S. Corporate 7-10 Year Index: A measure of U.S. dollar denominated, investment-grade, fixed rate, taxable corporate bonds with maturities between 7 and 9.999 years.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Idiosyncratic risks: factors that are specific to a particular company and have little or no correlation with market risk.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

U.S. Treasury securities are direct debt obligations issued by the U.S. Government. The investor is a creditor of the government. Treasury Bills and U.S. Government Bonds are guaranteed by the full faith and credit of the U.S. government, are generally considered to be free of credit risk and typically carry lower yields than other securities.

Volatility measures risk using the dispersion of returns for a given investment.