How will China’s commitment to growth fare amid tariff headwinds in 2025?

In her outlook for the year ahead, Head of Greater China Equities, Victoria Mio, discusses the significance of the recent policy pivot for sustainable growth, aiming to boost the Chinese market’s resilience.

4 minute read

Key takeaways:

- China’s comprehensive RMB 12 trillion restructuring package aims to revitalise the economy by targeting structural inefficiencies and boosting investor confidence.

- Although the stimulus measures were initially met with disappointment by foreign investors, and higher US tariffs will add to uncertainty, we believe China’s ability to adapt and the commitment to revitalise its economy should underpin the market’s resilience.

- Current market volatility presents opportunities as the market shifts from broad-based beta gains to alpha-generating opportunities. Patience, foresight, and a focus on company fundamentals are key to achieve attractive long-term returns.

The Chinese government’s various initiatives to revive its lacklustre economy this year have been received with both disappointment and optimism in equal measures. In April, the issuance of long-term special government bonds failed to create lasting momentum, while in September, a pledge to ease monetary policy lacked detail, but later in the month, markets rallied hard when coordinated policy effort from China’s top regulators marked a decisive shift from debt control to growth support.

More recently, in our view, China has made pivotal announcements to address long-standing structural challenges in its economy. In early November, The National People’s Congress (NPC) Standing Committee approved a comprehensive RMB 12 trillion (approximately USD 1.65 trillion) debt restructuring package, reflecting a shift from cautious debt management to proactive measures aimed at stabilising growth and rebuilding confidence. However, these efforts are now intersecting with the emerging challenge of US President-elect Donald Trump’s proposed tariff hikes, which threaten to reshape the global trade landscape. For foreign investors, the recent policy announcements might not immediately appear transformative.

Domestic investors, however, have reacted positively, viewing them as a genuine policy pivot with long-term implications. Despite looming US tariffs and market volatility, China remains committed to addressing systemic risks such as excessive local government debt and its weak property sector. We believe the groundwork is being laid for an economic recovery that could extend into 2025 and beyond.

The narrative of a resilient China is a critical reason why we believe investors should remain invested in the long-term potential of the second largest economy in the world.

Comprehensive stimulus package underscores policy pivot

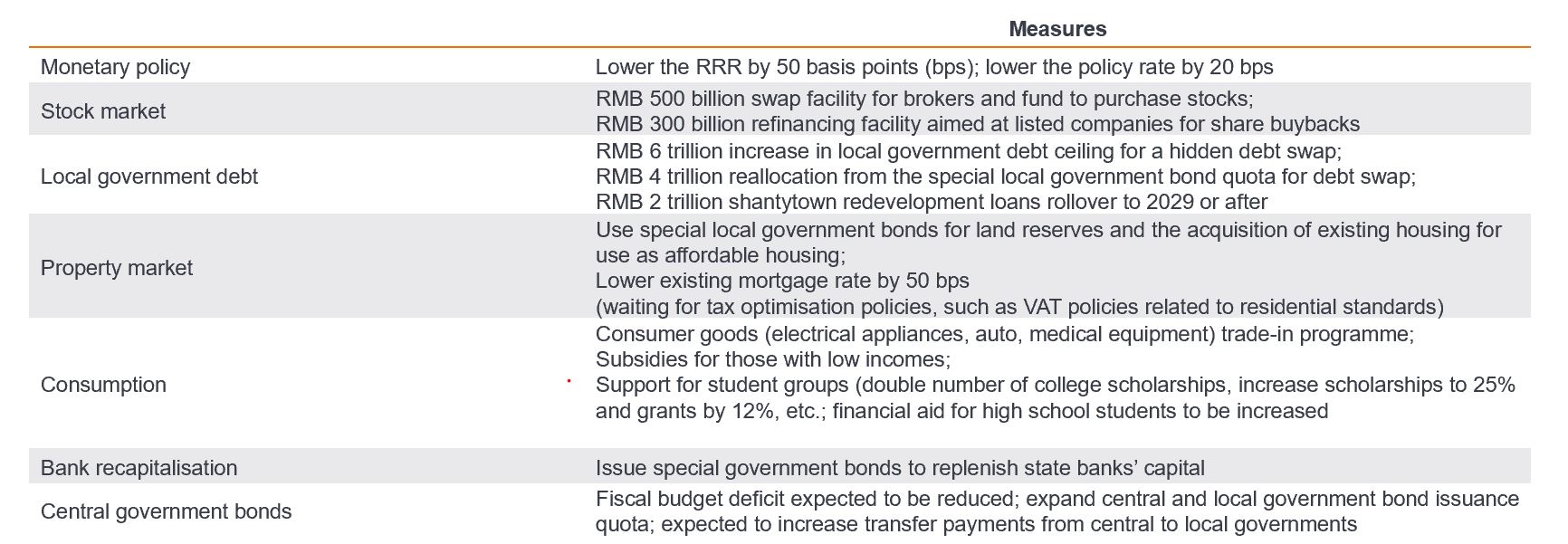

Looking into the details of the RMB 12 trillion restructuring package at the core of China’s recovery strategy, it is a range of comprehensive incremental stimulus to address the key areas of concern for investors in recent years.

The below table summarises the Chinese authorities’ measures announced from September to November 2024, which aim to reduce local government debt, stabilise the property market, and stimulate the economy.

Figure 1: A package of incremental stimulus measures

Source: gov.cn, Janus Henderson Investors as at November 2024.

Commitment to long-term growth should help to navigate tariff headwinds

Nonetheless, the optimism surrounding China’s policy pivot is tempered by the potential escalation in US-China trade tensions. President-elect Trump’s proposed tariff increases of up to 60% on Chinese goods and a doubling of tariffs on the rest of the world have raised significant concerns about the global trade environment. These concerns have already prompted ‘panic stockpiling’ of Chinese goods by foreign companies. While this is boosting export growth temporarily, it creates further uncertainty for 2025.

Market shift from beta-driven to alpha-seeking

China’s equity markets have reflected the dual narratives of policy optimism and geopolitical uncertainty. While Hong Kong-listed H-shares have experienced sell-offs due to concerns over global growth and geopolitical risks, the domestic A-share market has shown resilience, supported by retail investors’ confidence in the government’s ability to manage these challenges.

Meanwhile, foreign investor flows into Chinese equities have remained cautious to-date. However, with the MSCI China Index trading at a steep discount to global equities,1 there is growing recognition of the market’s long-term value proposition. Exchange-traded funds (ETFs) invested in Chinese equities have seen renewed inflows this year, signaling that international investors are beginning to recalibrate their strategies amidst the uncertainty.

However, now with the market shifting from beta-driven rallies to alpha-seeking opportunities, both foreign and domestic investors should place greater emphasis on company and sector fundamentals and long-term growth potential, in addition to macro factors.

Investors positioned in sectors aligned with China’s policy priorities—such as financials, consumer goods, and technology— are more likely to benefit significantly. These sectors look poised to take advantage of targeted government initiatives, from trade-in subsidies for consumer goods, to investments in innovation and infrastructure.

Look beyond today’s headlines for long-term opportunities

As we move into 2025, the outlook for Chinese equities is underpinned by the potential cumulative impact of the government’s policy measures and the rebuilding of investor confidence. Should these policies bear fruit, local government spending, enhanced credit growth, and reduced deflationary risks will contribute to a more conducive environment for economic recovery. Although higher US tariffs will add to uncertainty, China’s ability to adapt and implement countermeasures should not be underestimated.

For investors, we believe market volatility can present many opportunities to identify alpha-generating investments in China’s evolving market. Successful investors will require patience, foresight, and a focus on company fundamentals to achieve attractive long-term returns. In our view a long-term investment in Chinese equities can be rewarding for those investors who are willing to look beyond current news flow.

1 Source: Bloomberg, MSCI China Index versus MSCI World Index, 12-month forward price-to-earnings ratio as at 30 November 2024. Past performance does not predict future returns.

Beta-driven to alpha-seeking: refers to a shift from stock returns being dictated by the market to a more active approach of identifying stocks based on their capability to outperform the market.

Fiscal budget deficit: refers to a country having a shortfall in revenue compared to its spending during a certain period.

Fiscal stimulus/policy: government policy aiming to improving economic growth by setting tax rates and government spending levels. Fiscal expansion (or stimulus) refers to an increase in government spending and/or a reduction in taxes.

Monetary stimulus/policy: monetary stimulus refers to measures by a central bank to increase the supply of money and lowering borrowing costs with the aim of improving economic growth.

Reserve requirement ratio: a regulatory requirement typically imposed by a central bank that sets the minimum amount of cash reserves that a bank must hold relative to the amount that it lends. It is a monetary policy tool used to increase or decrease the money supply, as well as to ensure that banks retain sufficient money on hand to meet the needs of depositors.

Volatility: the rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

MSCI China Index: the index captures large and mid-cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs).