Going global: Short-duration bonds well positioned for economic divergence

Head of Global Short Duration Daniel Siluk believes that an extension of the economic cycle in the U.S. and suspect growth elsewhere create an opportunity for bond investors to capture attractive yields and preserve capital by diversifying globally.

5 minute read

Key takeaways:

- While pro-growth components of the incoming U.S. administration may extend the country’s economic cycle, the risks of stalling progress on inflation and a higher terminal rate cannot be ignored by bond investors.

- As some major economies face headwinds, we expect global interest rate trajectories to diverge, enabling investors to seek opportunities for capital appreciation in certain jurisdictions while gaining exposure to attractive yields in others.

- An extension of the cycle should improve the fortunes of economically sensitive corporate issuance. But with valuations elevated and yield curves relatively flat, we believe investors should focus on high-quality, shorter-dated credits in regions exhibiting relative value.

In assessing the prospects for global bonds in 2025, investors must consider the inextricable links between the shifting macro and policy environments. In the U.S., even prior to November’s election, markets were calibrating expectations for the Federal Reserve’s (Fed) easing cycle. The combination of a resilient labor market and inflation falling perhaps not as rapidly as hoped lessened the urgency to cut rates as an extension of the economic cycle was priced in.

In many respects, the election of former President Donald Trump increased the likelihood of sustained economic growth, but it also introduced new uncertainties that bond investors cannot ignore. While pro-growth initiatives such as deregulation and tax reform could spur investment and consumption, tariffs and trade barriers could be inflationary at the very least and – at worst – present potential hindrances to global growth should these measures be reciprocated.

Already interest rates have taken notice. The U.S. Treasuries yield curve has risen across all tenors. Shorter-dated yields reflect a more subdued rate cut trajectory, and longer-dated yields have risen as investors account for greater volatility, potentially higher growth, and the possibility that the battle to fully tame inflation isn’t over.

Facing acute headwinds, other regions – much of Europe, for example – may have to be more deliberate in easing policy. It will be the responsibility of investors digging into the details to determine which regions, sectors, and securities will be net beneficiaries of the incoming administration’s policies and which may face new headwinds.

Exhibit 1: Market-based expectations for policy rate paths

Expectations for an extension of the economic cycle could benefit certain corporate bonds, but they also indicate that, in many regions, more rate-sensitive issuance will receive less of a tailwind from rate cuts in 2025.

Source: Bloomberg, Janus Henderson Investors, as of 29 November 2024.

From an investment perspective, diverging economic and policy prospects create both opportunities and risks for bond investors. Across jurisdictions, the battle against inflation has sent yields to levels that can again provide investors with attractive income streams.

The outlook for rates is evolving, however. With Europe facing floundering growth, bond yields may continue to fall farther, representing an opportunity for capital appreciation along the front end of sovereign curves. In the U.S., any pro-growth initiatives or barriers to trade may alter the pace of inflation’s downward trajectory. This could lead to additional volatility in mid- to longer-dated Treasuries.

As different regions travel their own economic and policy paths, investors with a global view have the opportunity to increase diversification within fixed income allocations by incorporating issuance with attractive yields and securities in regions where rates may fall.

Exhibit 2: U.S. Treasuries curve

The U.S. Treasuries curve remains relatively flat, meaning longer-dated notes could be subject to volatility should economic growth or inflation surprise to the upside – scenarios that must be accounted for given the transition of power in Washington.

Source: Bloomberg, Janus Henderson Investors, as of 29 November 2024.

One must also consider what’s already been price into markets. In the U.S., for example, the nominal yield on the 10-year note has risen by as much as 80 basis points (bps) since mid-September, with rising expectations for inflation over the next decade accounting for a considerable portion of the increase.

We believe a similar global approach should be applied when seeking opportunities within corporate credits. Diverging economic prospects have implications for corporate issuers’ credit profiles. And with valuations elevated across the asset class, investors have the opportunity to seek out regions where stabilizing – or improving – economic conditions should fortify an issuer’s ability to meet its obligations. In contrast, where growth is more tenuous, richly valued and more cyclically exposed issuance is best avoided.

Furthermore, valuations in some regions appear more favorable than others, often for the same credit rating – or even specific issuer. With volatile currency exposure hedged away, global investors can maximize the potential for excess return with little or no incremental increase in risk.

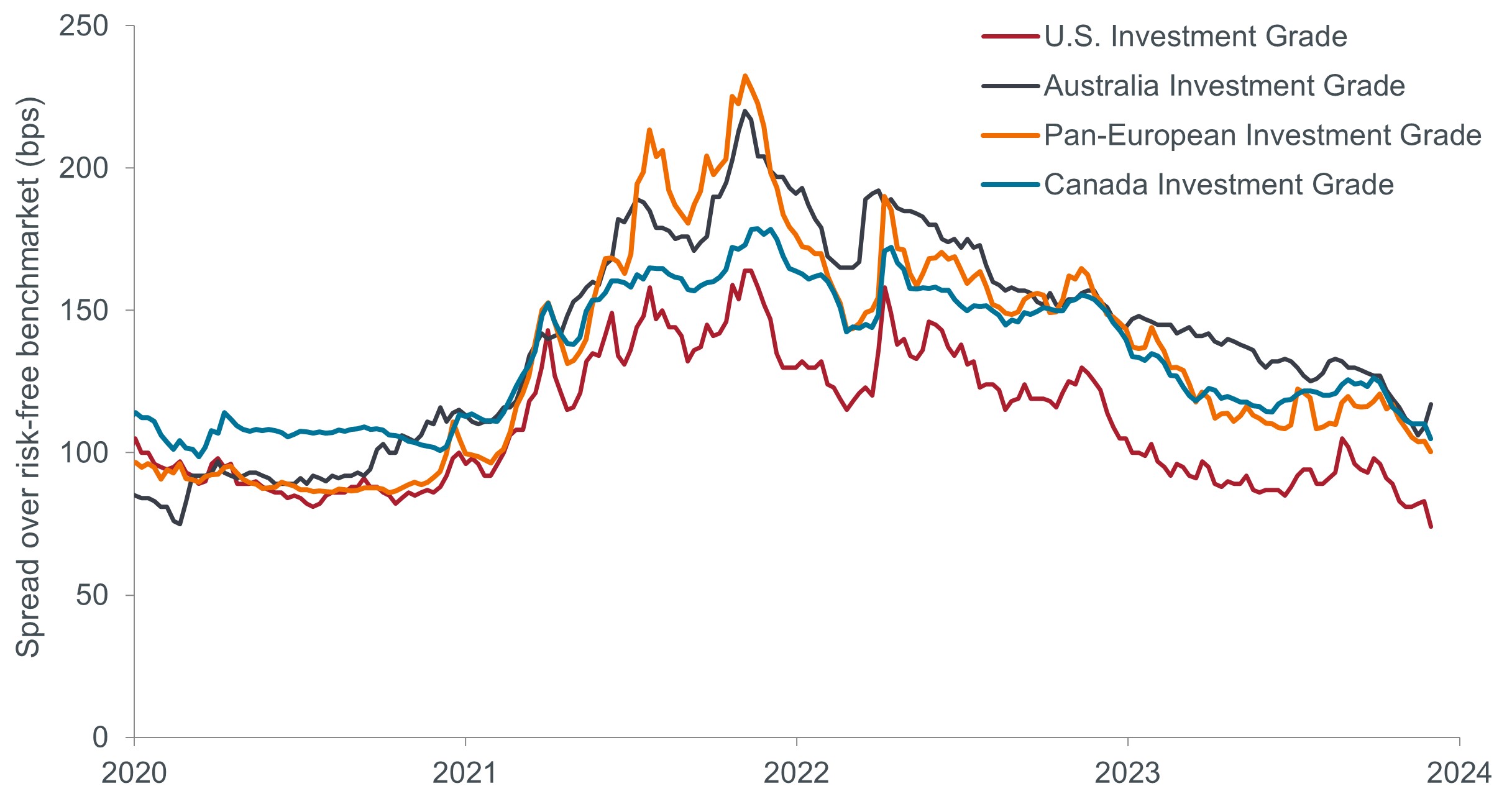

Exhibit 3: Global credit spreads

With valuations of corporate credits – as measured by the difference between their yields and those of their risk-free benchmarks – relatively rich, investors may seek out regions that offer more attractive relative value for the same level of risk.

Source: Bloomberg, Janus Henderson Investors, as of 29 November 2024. Note: Data based on following indices: Bloomberg US Aggregate Corporate Index, Bloomberg Australian Corporate Index, Bloomberg Pan-European Aggregate Corporate Index, Bloomberg Canada Aggregate Corporate Index.

One way to navigate the still-uncertain economic environment is to focus on shorter-dated corporate issuance. Higher yields relative to much of the past 15 years have resulted in the potential to generate attractive returns due to the steeper roll down of these securities as they near maturity. Over these shorter time horizons, investors tend to have better visibility into an issuer’s ability to service its debts. The rationale for a focus on the front end is reinforced by still-low term premiums, meaning investors are potentially exposing themselves to considerably more volatility for only marginally higher returns.

Policy matters

We expect to gain greater insight into President-elect Trump’s economic priorities during the early months of his administration. His team’s approach to trade, deficits, and the economic aspects of his national security agenda will reverberate globally. Pro-growth initiatives would likely keep Treasury yields high relative to global peers. The accompanying dollar strength would come at the expense of other currencies and also funnel a greater share of global investment toward the U.S. This could aggravate the economic positions of regions like Europe. And to the degree this agenda would alter expected growth trajectories, it would inevitably influence the decisions of the Fed and other central banks.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Quantitative Easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market.

Roll down is the tendency of a fixed income security’s market price to approach its par value as it nears maturity.

Volatility measures risk using the dispersion of returns for a given investment.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.