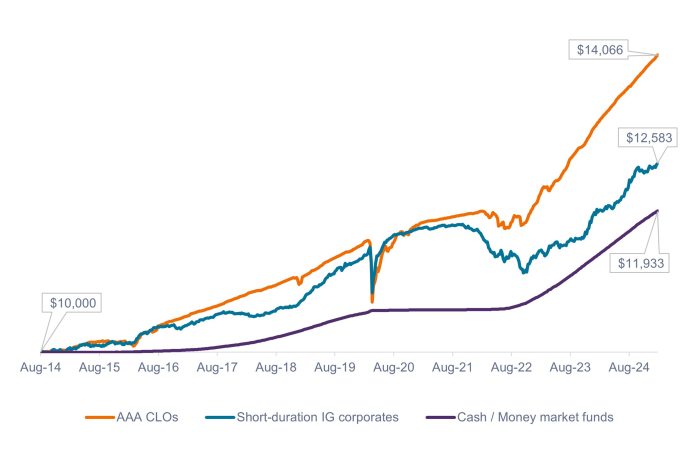

Source: Bloomberg, J.P. Morgan, as of 24 January 2025. Indices used to represent asset classes: AAA CLOs = J.P. Morgan AAA CLO Index, Short-duration IG corporates = Bloomberg U.S. Corporate 1-3 Year Index, Cash / Money market funds = Bloomberg U.S. 1-3 Month Treasury Bills Index. Past performance does not predict future returns.

Some investors who are hesitant to put their short-term cash reserves at risk may feel uneasy with any volatility in their short-duration holdings. We believe this approach may be overly cautious, as many investors could handle an incremental amount of volatility in exchange for potentially higher returns. Historically, despite occasional drawdowns, AAA CLOs and short-duration IG corporates have ended up comfortably ahead of cash over the long term.

– John Kerschner, Head of U.S. Securitized Products

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

For promotional purposes.

Anything non-factual in nature is an opinion of the author(s), and opinions are meant as an illustration of broader themes, are not an indication of trading intent, and are subject to change at any time due to changes in market or economic conditions. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. No forecasts can be guaranteed and there is no guarantee that the information supplied is complete or timely, nor are there any warranties with regard to the results obtained from its us.