What’s next for weight-loss medicines?

Research Analyst Luyi Guo provides an update on GLP-1 weight loss drugs, including whether today’s leading companies can maintain their market share and the outlook for pricing and reimbursement.

5 minute read

Key takeaways:

- The market for new GLP-1 weight-loss medicines is expected to top $100 billion by the end of the decade, led by Eli Lilly and Novo Nordisk.

- Given the market potential, several other biopharma companies are developing competing drugs, with the earliest launch expected in 2027. Eli Lilly and Novo Nordisk are also investing in new variants that could expand their respective weight loss franchises.

- Over time, a growing supply of GLP-1s, including new versions that improve efficacy or ease of use, could help to lower prices and expand reimbursement.

Ever since coming to market in 2021, incretin-based drugs — which deliver dramatic weight loss by mimicking hormones in the gut to control insulin and blood glucose levels and promote feelings of satiety — have exploded in sales. As of the second quarter of this year, the drugs, also known as GLP-1 agonists, were annualizing more than $50 billion. With an annual growth rate of roughly 50%, the market could easily exceed $100 billion by the end of the decade, making GLP-1s the largest therapeutic category on record in terms of revenue.

Given the market potential, biopharma companies are investing heavily to compete, striving to improve mode of delivery (e.g., oral pills vs. weekly injections), efficacy, duration, and unwanted side effects. In addition, the industry is exploring the drugs’ potential to treat other conditions, including cardiovascular disease, sleep apnea, fatty liver disease, and diabetes.

The challenge for investors will be to determine which firms and products come out ahead, especially as valuations for some biopharma companies have already climbed significantly. There are also questions around pricing and the willingness of health plans globally to cover costs for patients given enormous demand for the medications.

Luyi Guo, who worked in the pharmaceutical industry for several years before becoming a Research Analyst on the Healthcare Team in 2019, has covered the GLP-1 market since its inception. She provided these insights for some of the biggest questions now surrounding GLP-1s.

Eli Lilly and Novo Nordisk are the only companies with incretin weight-loss drugs on the market today (Zepbound and Wegovy, respectively). How soon could another company launch a competing drug?

While many companies have incretins for weight loss under development, it will be several years before any of the drugs complete late-stage clinical trials and come to market. It could then take a while longer for drugmakers to develop the manufacturing capability to meet demand — all factors that give a significant advantage to Eli Lilly and Novo Nordisk.

Even so, Eli Lilly and Novo Nordisk will eventually face more competition. One of the first big challenges could come from Amgen. The company is developing MariTide, a bispecific molecule that activates the GLP-1 receptor and antagonizes another receptor known as GIP. In clinical trials, this dual mechanism of action has shown to deliver weight loss levels similar to Zepbound and Wegovy but with fewer required injections — once monthly vs. once weekly. Amgen is also testing the drug for weight-related conditions such as heart, liver, and kidney diseases, with the aim of expanding MariTide’s potential patient population. The drug is expected to move into phase 3 trials in the coming months, with a potential launch in 2027.

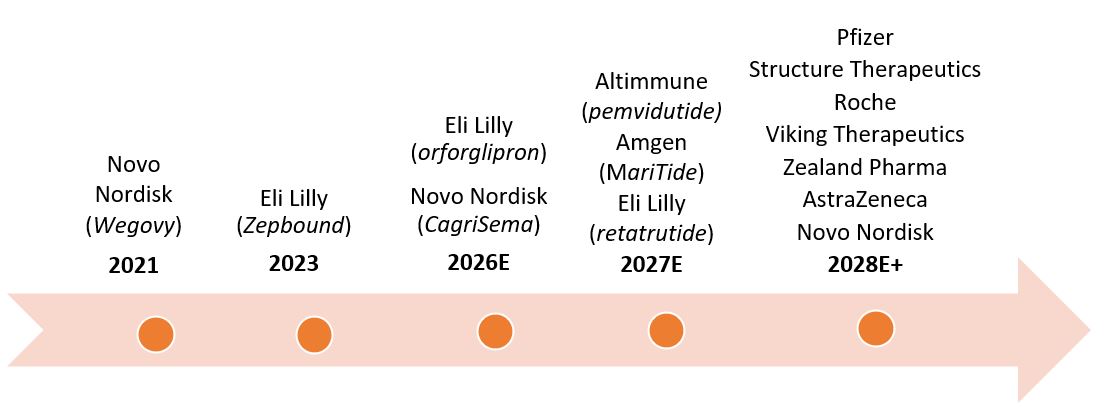

Figure 1: Timeline of market launches for GLP-1s

Source: Janus Henderson Investors, Morningstar, company reports. As of 30 September 2024. E=estimated.

What are Eli Lilly and Novo Nordisk doing to maintain their market leadership?

Both companies are investing aggressively to fortify and evolve their GLP-1 pipelines. Eli Lilly is developing orforglipron, which could be the first oral version of a GLP-1 to come to market, possibly in 2026. The option of a daily oral pill should help alleviate global supply shortages and give patients more choice. The company is also developing a triple-hormone-receptor agonist called retatrutide, which could launch in 2027. Retatrutide has shown potential to deliver substantial weight loss (high 20% range) and to reduce liver fat in patients with metabolic dysfunction-associated steatohepatitis (MASH).

Meanwhile, Novo is developing CagriSema. The drug combines Wegovy with cagrilintide, a long-acting amylin analogue that delays gastric emptying and lowers blood glucose levels. In early stage clinical trials, the dual approach has led to higher levels of weight loss more quickly (as much as 25% vs. ~17% for Wegovy) and without plateauing. The drug has also shown better efficacy in patients with type 2 diabetes, who’ve traditionally experienced smaller weight-loss benefits from incretins. CagriSema is expected to deliver phase 3 trial results before the end of the year and could launch as soon as 2026.

What is the outlook for pricing for GLP-1s, as well as reimbursement?

Most investors expect GLP-1 prices to come down as supply increases (drug prices typically move down as volumes rise). In addition, in 2027, semaglutide (the peptide used in Wegovy) will be subject to price negotiation in Medicare, the federal health program for the elderly in the U.S., per the Inflation Reduction Act. However, these factors are well known by the market and could be offset by growing sales volumes as drugmakers improve weight loss offerings and if more insurers agree to add the drugs to plan formularies.

GLP-1s that can prove health benefits beyond weight loss may stand the best chance of qualifying for reimbursement. For example, by law Medicare is prohibited from providing coverage for drugs used for weight loss but will reimburse when the therapies are prescribed for other medical indications, such as diabetes and cardiovascular disease. A similar trend could play out in health systems globally should GLP-1s continue to show efficacy against these and other co-morbidities.

IMPORTANT INFORMATION

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.