Shifting demographics: How post-pandemic working patterns are changing

People are choosing to live their lives differently since the pandemic and ‘Shifting Demographics’ is one of our three macro drivers for the next decade. Here, the Economist Intelligence Unit (EIU) explores the shift back to in-office working and the uptake of AI while Janus Henderson CEO Ali Dibadj looks at what it means for investors.

7 minute read

Key takeaways:

- After recent years of remote and hybrid working, employers are now pushing employees to be in the office more often.

- While increasing costs for employees, this should revive investment into office property, consumer transport, and food chains, while corporate culture should also benefit.

- Despite the shift back to the office, the commercial property sector remains under pressure but selectivity in allocations still present attractive investment opportunities.

Since 2023 employers have pushed back against the global experiment with remote working that started during the pandemic (2020-22). From tech companies such as Google (US) and Tata (India) to banks such as HSBC (UK), employers are pushing workers to get back to the office. We, at the Economist Intelligence Unit (EIU), believe the shift is likely to revive investment into businesses such as office property, commuter transport or food chains that have been badly affected by the decline in office working. However, the need to commute will also deplete employees’ savings, already strained by the recent cost-of-living crisis. This could depress demand for online retail and home renovations, as well as consumer technology needed to work from home.

The balance of power has shifted away from employees

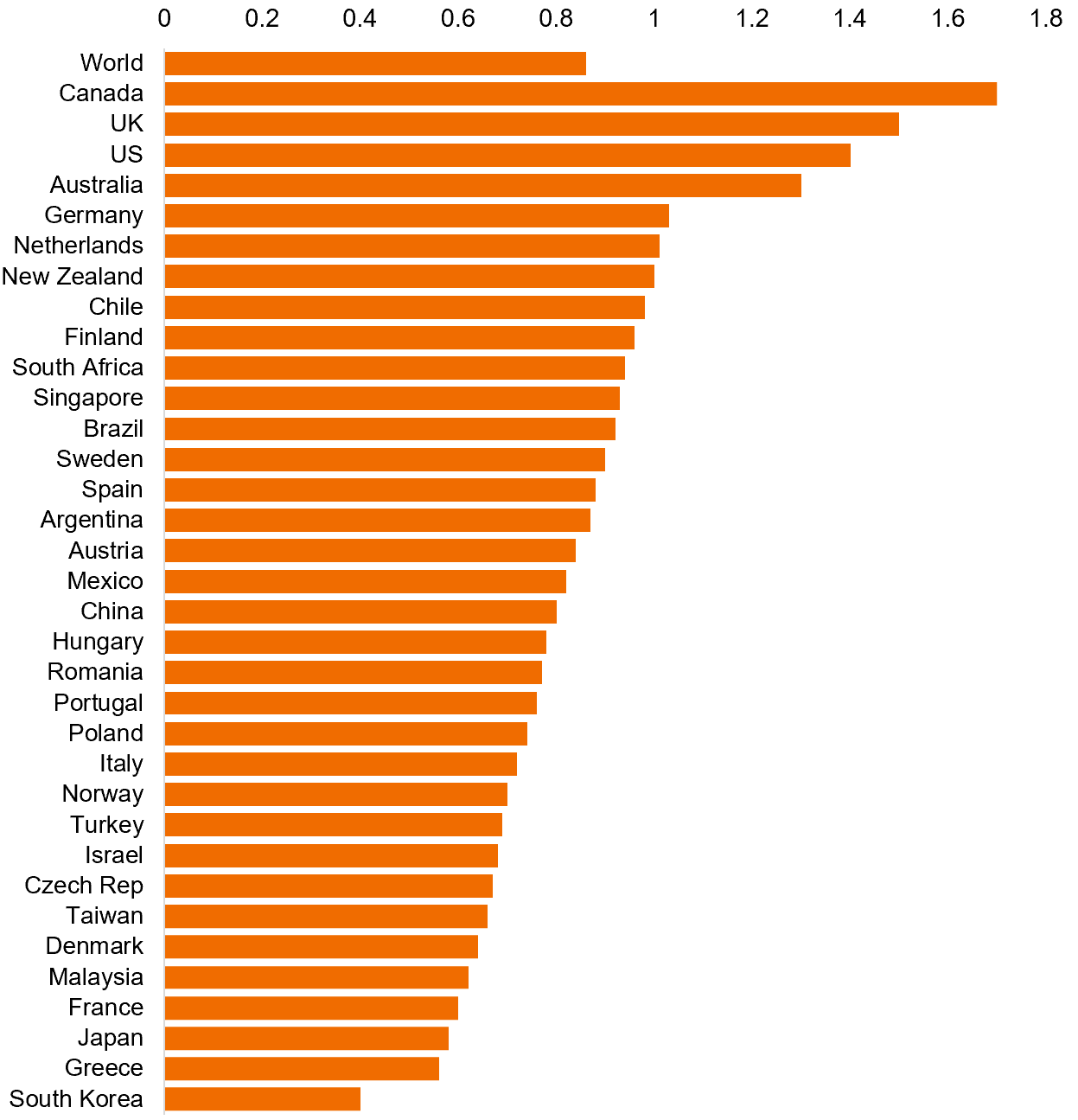

According to WFH Research, a US-based survey, the average number of days that employees work from home across 34 countries worldwide has fallen from 1.5 days at the start of 2022 to 0.9 days in April-June 2023. Rates differ widely by region, with Asia least likely to work remotely and English-speaking countries the most likely, but the downward trend is visible nearly everywhere. In the US, the survey suggests that the proportion of people working from home during the previous week has fallen from 61% amid the covid-19 lockdowns of 2020 to around 30% in mid-2023.

The office beckons

Average work-from-home days

Source: WFH Research, April to June 2023.

This shift back to the office points to a shift in the balance of power between employees and employers since late 2022 due to the combination of an economic slowdown and high inflation. In general employers are keener on in-office work than employees. However, the productivity surge seen during the early days of the pandemic, combined with the scare of the Great Resignation period of late 2021, persuaded many companies that they should bow to employees’ desire for hybrid or remote work. While some employees miss office culture, they liked saving time and money on commuting, as well as the flexibility to care for family or even to move homes. Women, who still cope with most childcare needs, have been particularly reluctant to head back to the office.

Now, however, the balance of power has shifted back towards employers, who tend to want employees on site in order to revive company culture and reassert management control. With wage growth struggling to match inflation, recruiters and employers are seizing an opportunity to set firmer ground rules around flexible and remote working. Workers are also less assertive: while unemployment has fallen from its pandemic peak, there is less long-term job security in some sectors, especially those being disrupted by the energy transition, automation or the adoption of technologies such as artificial intelligence. With employees agreeing to shift back to commuting, transport usage is now back to normal in most major cities across the world.

Yet hybrid or remote working remains a powerful incentive for employers to offer, particularly for higher-skilled employees. The 30% of US workers who reported that they sometimes work from home in mid-2023 is still well above the 7% reported before the pandemic. Indeed HR consultancy MBO reports that 17.3m Americans still describe themselves as digital nomads. A full return to pre-pandemic working patterns seems unlikely, and a whole host of business sectors will continue to be affected by the relative emptiness of city centres.

Hybrid working will still benefit some sectors and depress others

The biggest struggle will be in the commercial property sector, which is also coping with higher interest rates. As leases come up for renewal in city centres, many companies are still scaling back the space they occupy. CBRE, a property consultancy, predicts that one-fifth of US offices will stand empty in 2024 — a new peak. Office vacancy rates are expected to rise to 15% in Canada but just 8% in the EU in 2024, while Asia will see a fitful rebound despite China’s property woes. Canary Wharf, in eastern London, is one victim of the trend: as financial companies have exited, its owner recently raised £400m (US$450m) to pivot away towards life sciences and the residential sector.

However, while residential property is in demand, not all offices can easily be converted. Office service companies, including cleaning, maintenance and security, are also affected by the downturn in commercial property. Many other services that rely on office workers, such as gyms and food retailers, have already closed during lockdowns, so the trend here is now upwards, but high costs remain a barrier to expansion. Moreover, with workers now facing additional commuting costs on top of inflationary pressures, consumer spending will be subdued in the US and EU, with brighter prospects in Asia.

Meanwhile, the shift away from home working is also affecting the online retail market, where EIU predicts that growth will slow sharply in developed markets and accelerate in developing ones. Online margins and jobs are under pressure from still-high inflation, while regulatory scrutiny of the sector and its use of customer data is increasing. Demand for household goods and services such as furniture or renovations will also be dampened, as will demand for laptops and consumer electronics, which soared during the pandemic. Last but not least, demand for childminders and even pet-minders will rise as workers head back into offices.

Disruptive forces and AI

How these shifts will affect employment is an open question – particularly given that bigger threats are afoot. One effect of the remote working trends is that some employers have shied away from taking on employees at all, preferring instead to use remote workers. Others have taken the opportunity to hire even more remotely: why pay for off-site California IT staff if similar skills are available in Asia? The rapid adoption of AI is likely to supercharge these trends: while EIU does not predict widespread job losses, there will be more churn and greater training needs as companies use AI to boost productivity. Workers who are not on-site may lose out, yet demand for remote working will not go away.

Artificial use cases across industries

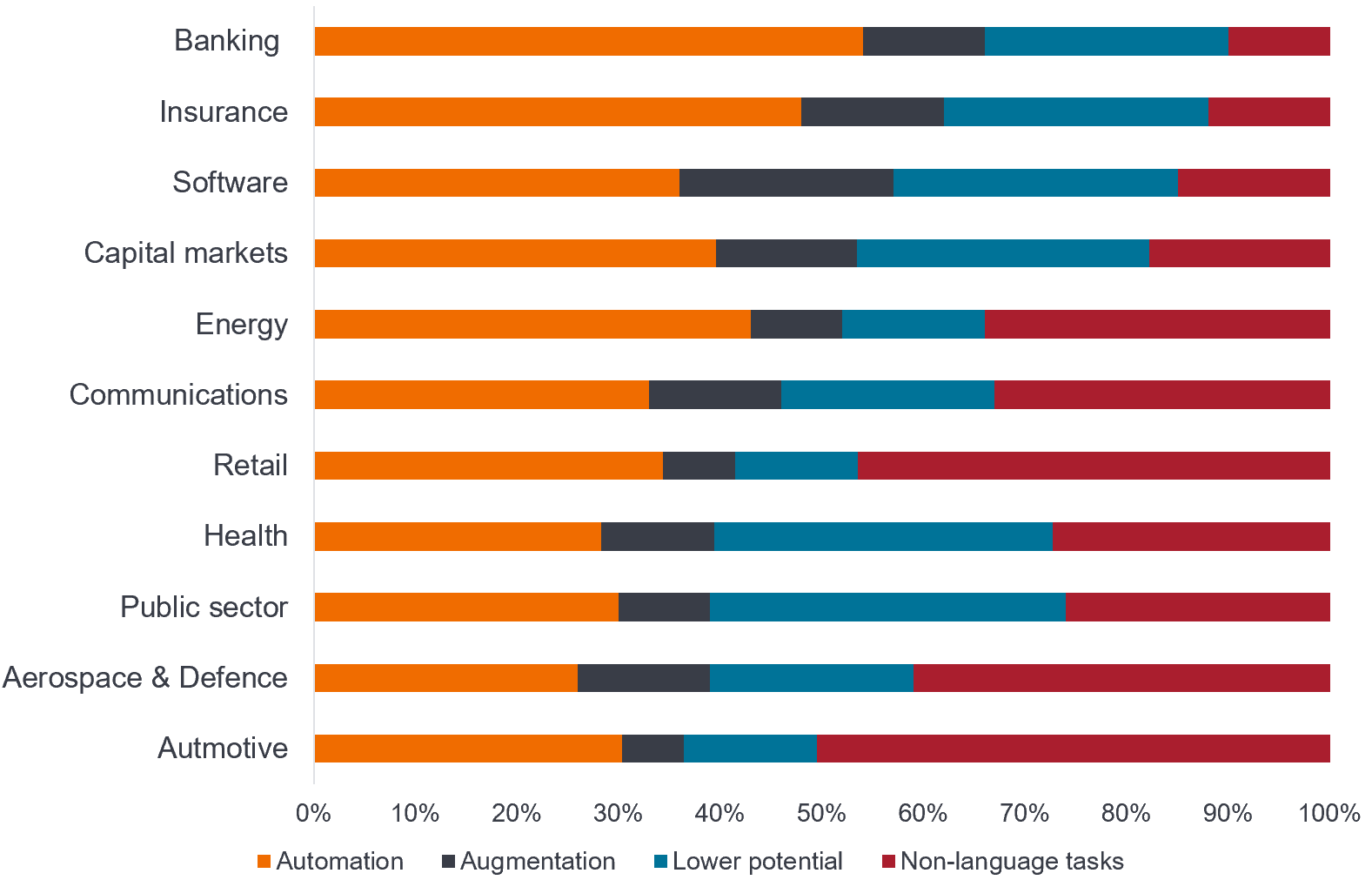

Potential generative AI impact by sector

Source: Accenture, calculated as % of tasks.

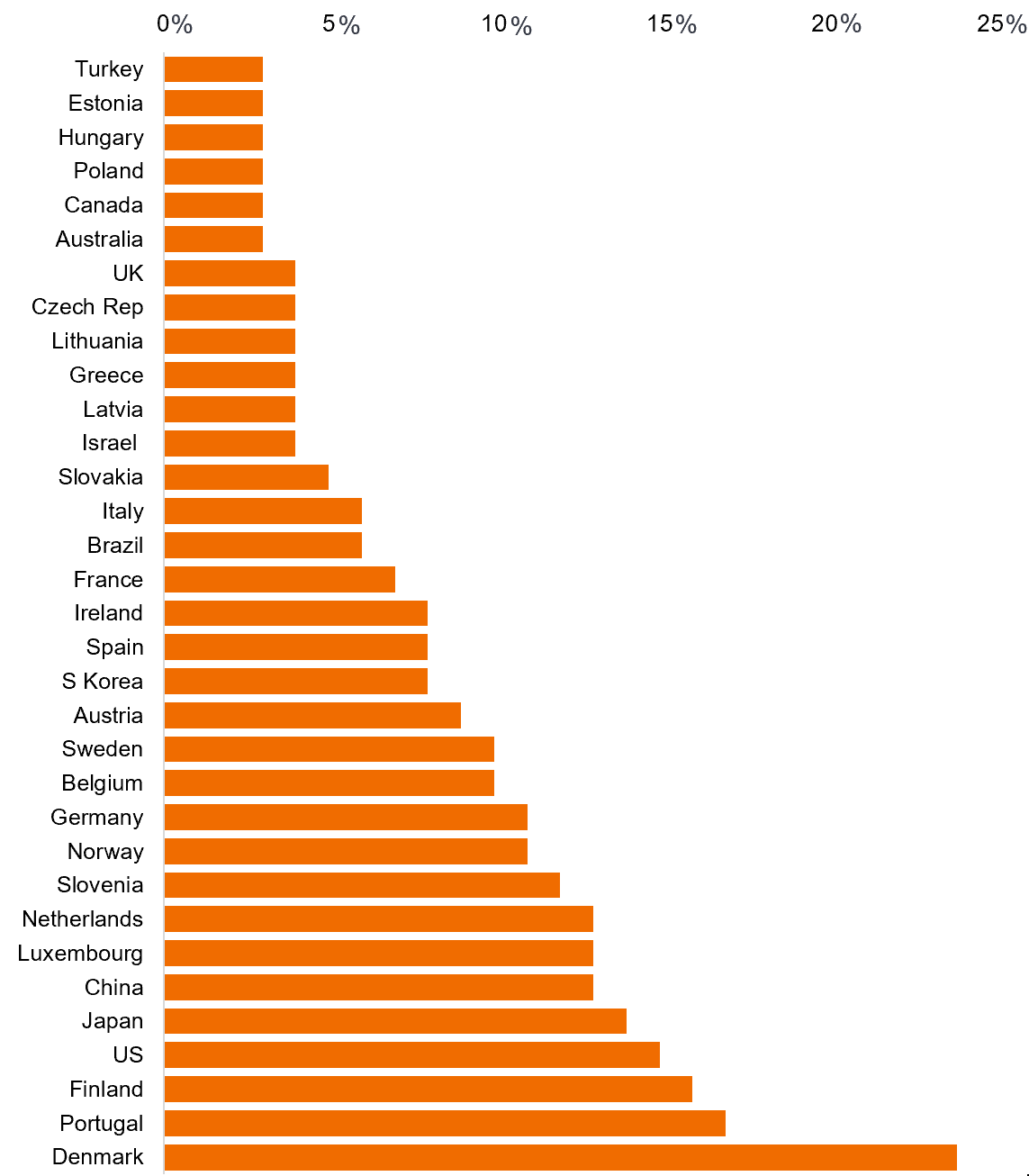

AI adoption rates by companies

Source: Economist Impact; Lenovo.

At Janus Henderson, we view shifting demographics as one of three important investment drivers for the coming decade (Navigating change: Three drivers for long-term investment positioning). The changing dynamics of hybrid working and the adoption of AI are both good examples of why a proactive approach to investing is more important than ever in navigating risks and opportunities.

At a firm level, we follow a hybrid working model, with the majority of time spent in the office for most roles. We believe this is the most effective way to maximise the expertise of our employees, maintain our strong people-based culture, and deliver the best service we can to clients. We are also exploring how to maximise AI and other technology enablers in line with our value of putting clients first – always.

From an investment perspective, the move back to in-office working demonstrates the need for selectivity and a focus on quality. Our experienced global real estate team believes the office sector is evolving fast, with leases getting shorter and landlords needing to become operators rather than just rent collectors. Demand for environmental credentials is high as well as top-end features, connectivity, and mixed-use supporting amenities. Office space is an important drawcard to encourage workers back and retain talent, and tenants are prepared to relocate to secure quality.

Of course, offices are just one of 16 types of commercial property, and a small (less than 10%) part of the public Real Estate Investment Trust (REIT) universe in which we invest. The Janus Henderson real estate team is currently underweight offices with other areas of the property market, such as industrials/logistics, technology real estate, and healthcare, currently considered to offer more attractive opportunities.

Demographic shifts will impact many areas of the investment landscape in the coming decade. In addition to real estate, we also see particularly interesting opportunities within healthcare and technology. For example, with aging populations around the world there is growing demand for healthcare, and small and mid-cap companies are providing the innovation to tackle the challenges. As demographic shifts continue to evolve our 340+ investment professionals will continue to share insights and seek to position clients for a brighter future.

Ali Dibadj, Chief Executive Officer

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.