Policy matters: The importance of sound macroeconomic management in EM investments

In the second of a two-part series on emerging market (EM) equities, Portfolio Manager Daniel Graña explains why assessing macro drivers such as government debt, national savings, monetary policy, ease of doing business, and geopolitical risks are key to investing in the space.

9 minute read

Key takeaways:

- Sound macroeconomic management is inextricably linked to a country’s long-term growth prospects – particularly for EMs, whose legislative bodies and central banks may lack the experience to maintain a steady fiscal or monetary course.

- Some of the most relevant indicators for gauging fiscal stability include government debt, budget balances, and the current account. Perhaps less quantifiable, but also important, are ease of doing business and geopolitical risk.

- In our view, concentrating exposure in countries that prioritize sound macroeconomic and pro-growth policies increases the odds of finding companies capable of compounding earnings over a longer horizon.

Emerging markets (EM) investors must simultaneously wear two hats: that of a bottom-up equities analyst seeking to identify the innovative private-sector companies that will likely drive these regions’ future economic growth, and that of a keen observer of a country’s macro policy, as this realm considerably affects the business environment and, thus, investment returns.

In the second installment of a two-part series, we explore macroeconomic drivers of EM countries and identify which members stack up well in these criteria as well as those that have yet to learn the hard lessons experienced over the preceding decades.

Macroeconomic management

The 1970s through the 1990s was a challenging period for EMs, with several examples of “own goals” such as poorly regulated banking systems or outrageously funded government spending sprees. More recently, these regions have had to contend with collateral damage from a Global Financial Crisis (originating in the developed world), Brexit, and a global pandemic followed by an unprecedented U.S. tightening cycle. In general, EMs have navigated these challenges well with few – if any – sovereign or banking crises. However, there are clear differences in macroeconomic management that have the potential to undermine the growth outlook of certain countries.

Sound fiscal management is inextricably linked to a country’s long-term economic prospects. This is especially true for EMs. Yet macroeconomic stability can prove to be a daunting task. Institutions such as legislative bodies and central banks often lack the experience – or spine – to maintain a steady fiscal or monetary course. Adding to the challenge is the need for these countries to invest heavily during early stages of economic development, which can lead to imbalances.

Some of the most relevant indicators for gauging fiscal stability include government debt, budget balances, and the current account. Other – related – factors worth monitoring include currency volatility, national savings, and money supply. Perhaps less quantifiable, but also important, are metrics on the ease of doing business and a country’s exposure to geopolitical risk.

Government accounts

Exhibit 1 presents several EM countries’ government debt, the budget balance, and revenues as a share of gross domestic product (GDP). Taiwan, Saudi Arabia, Vietnam, Turkey, and Indonesia have all struck the right balance. Government debt in these countries is at reasonable levels, and the burden of government revenues is not too great. China, Brazil, and South Africa, on the other hand, are in troubled waters. If one includes local government obligations and off-balance-sheet items, China’s position is likely even more worrisome than it initially appears. Brazil merits close attention as the country’s fiscal framework may become more diluted under President Luiz Inácio Lula da Silva. Aggravating matters is the country’s already high tax burden.

Exhibit 1: Fiscal management sorted by IMF’s expected 2028E govt debt/GDP

| Govt debt/GDP | Budget Balance/GDP | Govt Revenues/GDP | ||

| 2023E | 2028E | 2023E | 2023E | |

| China | 83.0% | 104.3% | -3.8%* | 26.5% |

| Brazil | 88.1% | 96.0% | -7.9% | 41.1% |

| South Africa | 73.7% | 86.7% | -4.9% | 26.8% |

| India | 81.9% | 80.5% | -5.9% | 19.4% |

| Argentina | 89.5% | 69.5% | -4.0% | 33.8% |

| Thailand | 61.4% | 60.7% | -2.9% | 20.0% |

| Korea | 54.3% | 57.9% | 0.6% | 24.1% |

| Mexico | 52.7% | 56.3% | -3.3% | 23.8% |

| Philippines | 57.6% | 52.9% | -4.8% | 20.0% |

| Indonesia | 39.0% | 37.2% | -1.7% | 15.1% |

| Turkey | 34.4% | 32.2% | -5.4% | 29.1% |

| Vietnam | 34.0% | 29.7% | -4.0% | 18.4% |

| Saudi Arabia | 24.1% | 16.9% | -2.0% | 29.2% |

| Taiwan | 26.6% | 12.5% | -0.2% | 16.6% |

Sources: IMF for govt debt/GDP and govt revenues/GDP; various govt ministries of finance via Bloomberg and Statista for budget balance/GDP. *NOTE: Goldman Sachs believes the augmented budget deficit/GDP for China is closer to -11 to -12% of GDP.

External accounts

External accounts represent both opportunities and vulnerabilities for EMs. Considerable investment is required when countries seek to expand economic capacity. In many instances, investment exceeds national savings. Consequently, EMs in this phase often run sizeable current account deficits as they must import excess savings from other regions. The relationship between fixed asset investment and the external account is an iron law of macroeconomics. The price of rising capacity and productivity, however, is vulnerability to currency adjustments and capital flows.

How a country finances a current account deficit is important. Stickier long-term foreign direct investment (FDI) is preferred to capricious portfolio flows from foreign bond and equity investors. Typically, a deficit persistently above the 3% to 4% range is problematic, especially in periods where bond investors are enticed to relatively attractive rates in developed markets. Furthermore, a large current account deficit can be a sign that an economy is overheating as investment outpaces economic potential.

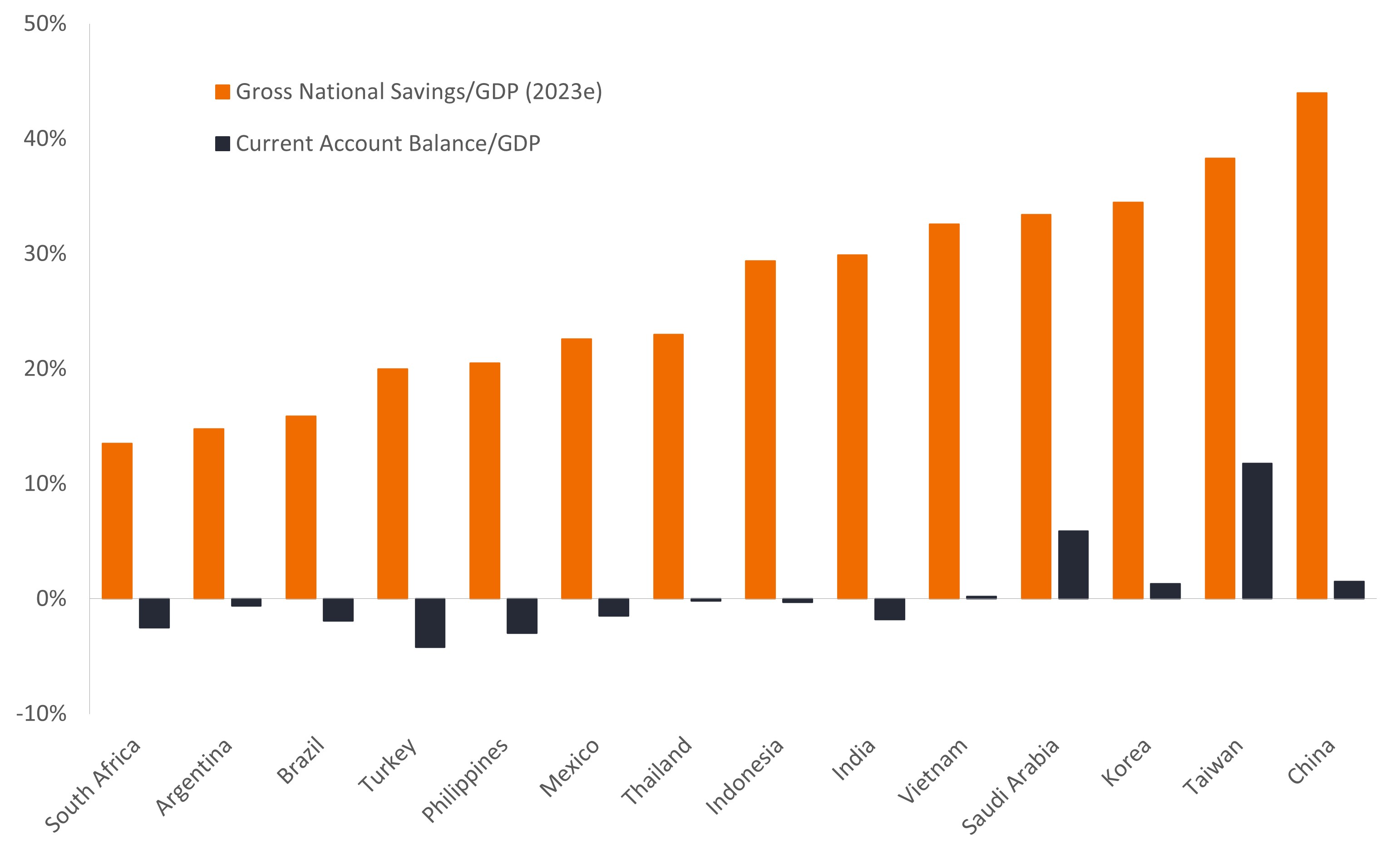

As illustrated in Exhibit 2, Brazil, Argentina, Turkey, and South Africa appear vulnerable in this area, given their modest national savings. Export-led growth masks problems that Brazil could face once borderline recessionary domestic consumption is revived. All things equal, we would expect its current account deficit to increase.

Exhibit 2: Savings, current account and growth sorted by national savings

Sources: IMF, Bloomberg for GDP growth.

Also worth noting is the role played by remittances from citizens living abroad. These inward flows reduce both Mexico’s and the Philippine’s external account vulnerability. Countries with healthy national savings rates, such as those in North Asia and Saudi Arabia, are also less exposed to the risks posed by account imbalances.

Monetary discipline

Prudently containing inflationary pressures through appropriate monetary policies is another feature of responsible macro management. History demonstrates the importance of central bank independence as governments may be tempted to tilt the policy scales when facing elections. Argentina and Turkey fail on this metric. By contrast, North Asia has hard-earned, inflation-fighting credibility. Mexico, the Philippines, and Indonesia are respectable in this category as well.

Exhibit 3: Monetary management sorted by 2020 monthly peak money supply growth

Even when accounting for the surge in money supply during the peak of the COVID-19 pandemic, some countries were loose with monetary discipline, which often resulted in bouts of very elevated inflation.

| M2 Money Supply Growth | |||

| Trend growth before COVID* |

2020 monthly peak | Post-COVID CPI Peak |

|

| Argentina | 26.6% | 101.4% | 138.3%* |

| Turkey | 18.5% | 48.0% | 85.5% |

| Brazil | 7.1% | 31.2% | 12.1% |

| Philippines | 10.4% | 16.3% | 8.7% |

| South Africa | 6.6% | 15.7% | 7.8% |

| Mexico | 8.1% | 15.2% | 8.7% |

| Vietnam | 15.4% | 14.5% | 4.9% |

| Indonesia | 8.9% | 13.4% | 6.0% |

| India** | 9.6% | 12.8% | 7.8% |

| Saudi Arabia | 3.3% | 12.4% | 6.2% |

| Thailand | 4.6% | 11.4% | 7.9% |

| China | 10.1% | 11.1% | 2.8% |

| Korea | 7.0% | 10.0% | 6.3% |

| Taiwan | 4.3% | 8.5% | 3.6% |

Source: Bloomberg.

*Prior 5-year average through the end of 2019

**M3 supply growth used for India

Currency volatility

Another measure of assessing macro management is currency volatility. All EM countries manipulate their currencies to varying degrees. And while the market eventually wins out, the process can create headaches for investors. A country with high currency volatility saps growth by encouraging domestic capital flight and discouraging foreign portfolio and FDI inflows. On this metric, it should come as little surprise that Argentina, South Africa, and Brazil score poorly, whereas Vietnam, China, and Taiwan impress.

Exhibit 4: Annual FX volatility sorted by annualized volatility over 15 years

Source: Bloomberg.

Source: Bloomberg.

*Based on annualized weekly returns since January 9, 2009.

**Based on annualized weekly returns since January 9, 2016.

Ease of doing business

Good governance could also be defined as a government’s ability to create a welcoming business environment. Complicated tax and tariff regimes, difficult permitting processes, and challenging contract enforcement are all examples of poor governance that can undermine risk taking and, thus, an economy’s ability to grow.

Exhibit 5 illustrates that Korea and Taiwan are far ahead of the pack in the World Bank’s 2020 rankings. Methodological considerations cause us to question China’s favorable position. Bringing up the rear are Argentina, Brazil, and South Africa. Brazil’s plight, however, imparts an important lesson: While fiscal reform represents the bare minimum, more durable stabilization would come in the form of improved infrastructure, education, and tax regime. Alas, neither side of the political aisle appears up to the task of delivering these.

Exhibit 5: World Bank’s Ease of Doing Business global rankings

| Ease of Doing Business ranking |

|

| Korea | 5 |

| Taiwan | 15 |

| Thailand | 21 |

| China | 31 |

| Turkey | 33 |

| Mexico | 60 |

| Saudi Arabia | 62 |

| India | 63 |

| Vietnam | 70 |

| Indonesia | 73 |

| South Africa | 84 |

| Philippines | 95 |

| Brazil | 124 |

| Argentina | 126 |

| USA | 6 |

*World Bank 2020 report, the latest available year.

Geopolitics: The end of an era

The era of globalization has reversed, and the global economy is instead heading toward a multi-polar future, governed more by geopolitical considerations and industrial policy than by pure market dynamics. The most telling example is the dying dream of engaging with – and potentially reforming – China. Consequently, the Asian giant will find it more difficult to make the leap from middle income to high income as it loses access to the most advanced Western technology, especially in the semiconductor space.

In many instances, EM policymakers will have to decide in which trading sphere they plan to operate. Some will have to find ways to mitigate the breakdown of existing relationships. And while replacing a global commercial architecture with several regional ones represents a step backward in efficiencies, there will be beneficiaries. Vietnam, India, Indonesia, and Mexico all appear to be well positioned to capitalize on the move away from dependence on China.

Summing it up

Based on key macroeconomic indicators, which themselves are a reflection of governmental policies and priorities, Vietnam, Taiwan, and India stand above their EM peers. Honorable mentions go to Mexico, Thailand, South Korea, and Chile. Turkey and South Africa score unfavorably. Despite their material abundance, Brazil and Argentina continue to face self-made challenges. For obvious reasons, Russia has removed itself from consideration. Perhaps most important – given its size within the EM benchmark – China’s many positives are becoming increasingly negated by a deteriorating fiscal position as it navigates a sizeable debt overhang, weakening productivity potential, and worrisome governance challenges as it prioritizes national service over maximizing shareholder value.

As referenced in the first part of this series, innovative companies capable of growing earnings faster than broader GDP growth can be found in any EM country. But policy does matter, as do the ingredients delineated in the growth equation. Concentrating security selection in the countries that prioritize sound macroeconomic and pro-growth policies increases the odds of finding companies capable of compounding earnings over a longer horizon, while at the same time lowering potential exposure to the unfavorable outcomes that have dotted the history of EM investing.

IMPORTANT INFORMATION

Emerging market investments have historically been subject to significant gains and/or losses. As such, returns may be subject to volatility.

Volatility measures risk using the dispersion of returns for a given investment.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Quantitative Tightening (QT) is a government monetary policy occasionally used to decrease the money supply by either selling government securities or letting them mature and removing them from its cash balances.

The information contained herein is for educational purposes only and should not be construed as financial, legal or tax advice. Circumstances may change over time so it may be appropriate to evaluate strategy with the assistance of a financial professional. Federal and state laws and regulations are complex and subject to change. Laws of a particular state or laws that may be applicable to a particular situation may have an impact on the applicability, accuracy, or completeness of the information provided. Janus Henderson does not have information related to and does not review or verify particular financial or tax situations, and is not liable for use of, or any position taken in reliance on, such information.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.