Research in Focus: Finding smoother air in the aerospace industry

Director of Research Chris Benway explains how one aerospace supplier has managed to overcome industry volatility, providing a compelling example of why fundamental research matters in investing.

3 minute read

Key takeaways:

- Despite rising costs and production hurdles in the aerospace industry, one aerospace company is among the best-performing stocks in the S&P 500® Index this year.

- A combination of long-term industry trends, smart innovation, and an effective management team have helped to drive earnings growth.

- In our view, it is a compelling example of how fundamental research can potentially lead to strong investment opportunities.

The aerospace industry has run into turbulence for much of 2024 — from quality control concerns in commercial aircraft manufacturing to supply chain challenges, labor strikes, and inflationary cost pressures. The turmoil has weighed on profit margins and, in turn, aerospace stocks, with many underperforming year-to-date.

Which might make it all the more remarkable to learn that Howmet Aerospace, which manufactures precision metal components and fasteners primarily for aircraft, is one of this year’s top-10 performing stocks in the S&P 500® Index.1 While other aerospace firms have revised earnings lower this year, Howmet has experienced double-digit growth: The firm surpassed profit expectations in both the first and second quarters and raised its earnings forecast for fiscal year 2024. What’s more, these results come despite a sharp slowdown in aircraft production.

Investor takeaway

Howmet’s story is a reminder for investors that even when times are tumultuous, potentially good investment opportunities can be uncovered through deep research of business models and longer-term market trends.

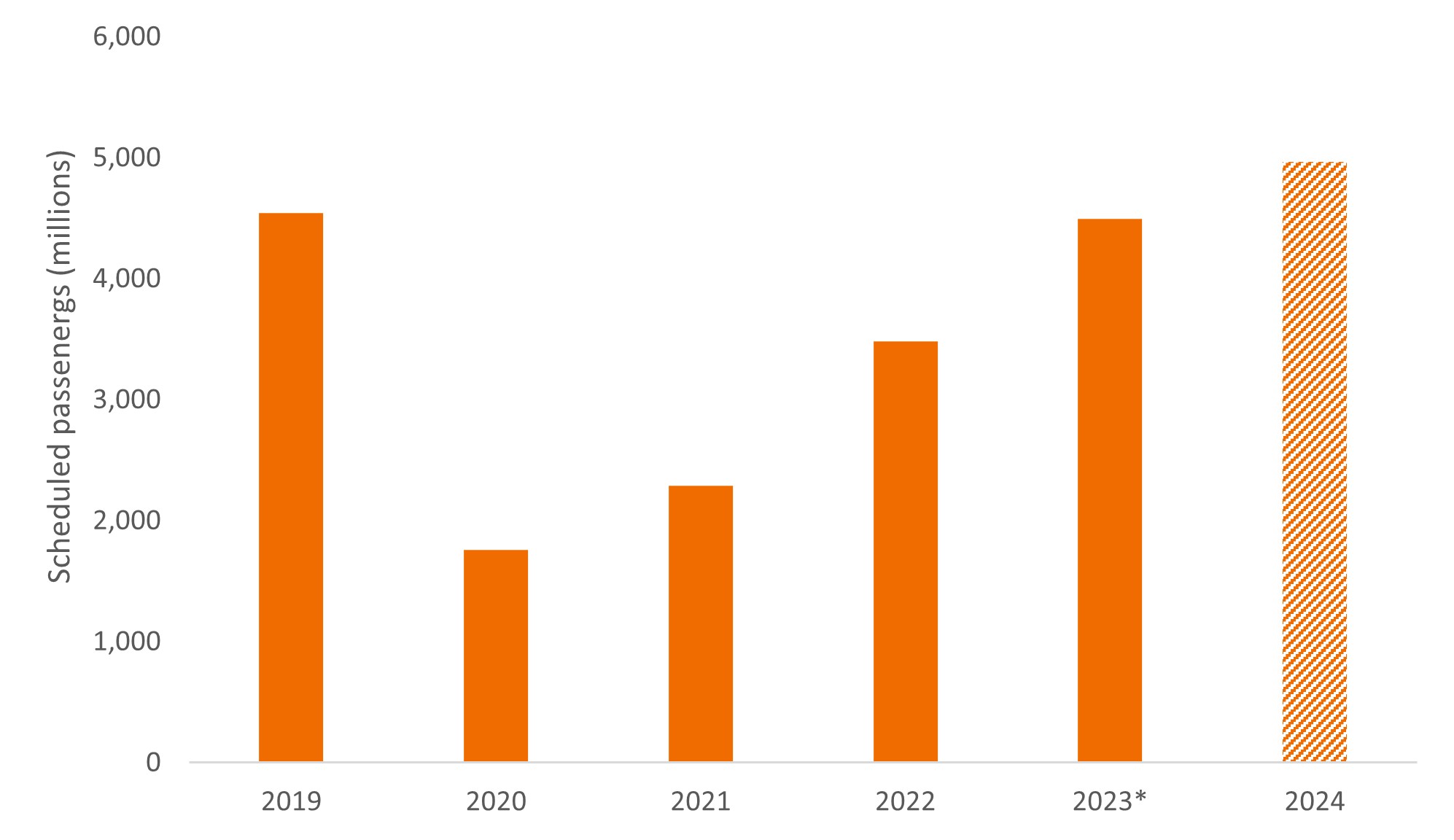

The outlook for Howmet began to improve in the wake of Covid-19. Historically, aircraft manufacturing has been cyclical in duration. But with passenger traffic still recovering from the pandemic — today, sitting at only 2019 levels — the industry now looks set up for nearly a decade of solid growth. Production hurdles at Boeing and Airbus have only added to order backlogs, which currently extend well beyond 2030. In the meantime, as airlines await delivery of new fleets, existing aircraft are being forced into service for longer, increasing demand for spare parts.

Howmet has benefited from these trends thanks, in part, to its wide competitive moat. The company operates in a virtual duopoly, including in key areas such as jet engine parts. In addition, there are significant barriers to entry because of the growing complexity of jet components and the rigorous certification required by regulators. Plus, the downside risk of faulty parts is enormous, all but eliminating any incentive for aerospace manufacturers to switch suppliers.

Innovation is another tailwind. Howmet has spent the last few years investing in airfoil technology that can cope with the extreme temperatures and centrifugal force of the latest class of jet engines. (Airfoils are turbine blades that help create thrust.) The innovation has resulted in market share gains and pricing power for Howmet. It has also driven sales volumes given the strain placed on airfoils in modern engines, increasing the cycle of replacement.

Revenues are not the only metric on the rise. Operating leverage has also improved thanks to factory automation that is driving efficiencies. During the second quarter, Howmet reported operating income margin of 21.2%, up nearly 4 percentage points from the same period the year prior. At the same time, the company has boosted staffing in anticipation of a recovery in aircraft production, which should allow it to meet increased demand down the road at or near current cost levels.

Some of these trends, particularly growth in air travel and production fixes, could eventually support the aerospace industry more broadly. But as Howmet makes the case, individual companies can sometimes thrive even in a tough environment — and reward the investors who seek them out.

By the numbers – Global air traffic

Source: International Air Transport Association, as of June 2024. *2023 figures are estimated. 2024 data are a forecast.

1 Bloomberg, as of 25 September 2024.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.