Quick view: Europe’s first-mover advantage?

The European Central Bank has moved ahead of the US Federal Reserve in its first move to cut interest rates. Portfolio Manager Tim Winstone tackles five questions for investors in Europe.

6 minute read

Key takeaways:

- As Europe moves first to cut rates, the divergence in central bank approaches could create opportunities for active managers.

- The eventual interest rate settled on in Europe could be lower than in the US, which has implications for the ECB in policy headroom and tools, as well as for investors.

- The ‘higher for longer’ narrative has not lost its steam and the path to easing in Europe, as well as other developed markets, appears to be gradual. Security selection for investors will remain key.

While the European Central Bank (ECB) was arguably behind the curve in hiking interest rates, it has been wary to be the same on the way down in cutting rates. Not only in its first move to cut, but in guiding towards the start of the rate cutting cycle. This is the first time that Europe has moved ahead of the US Federal Reserve in cutting rates since November 2011 and April 1999. So it has ignited a vis à vis narrative and debate for global asset allocators.

What are the implications of Europe’s move to cut rates ahead of other developed markets?

While this was the first ECB rate cut since 2019, we believe it was one of the most widely expected cuts on record. So much has already been priced into markets. A move away from the synchronisation of central banks is not a cause for concern, in our view, but more of a function of differing economic situations.

We began to see a divergence in central bank communication since earlier this year. Compared to Europe, US demand-driven inflation has been stickier; growth/employment better; and the consumer exceptionally strong. The Eurozone economy is experiencing less sticky inflation as largely driven by energy prices. This divergence creates opportunity for us as active managers.

As the path down to target inflation has been a bumpy one, markets are pricing a shallower cutting cycle across the globe versus what was priced at the start of 2024. Just because the ECB cut first though, it doesn’t mean it will cut at a faster pace versus other central banks. However, if policy rates are perceived as too slow to fall, bond yields could rise.

Some forecasts suggest that Europe may land at a lower neutral interest rate or r* – the rate at which monetary policy is neither stimulating nor restricting economic growth – than the US. This could be a positive for European corporates, but also influences policy headroom for the ECB. A lower long-term neutral rate in the Eurozone compared to other developed markets could:

– mean the ECB has less room to lower rates during economic downturns before hitting the effective lower bound. This could constrain the ECB’s ability to stimulate the economy through traditional monetary policy tools during recessions.

– mean the ECB could rely more on unconventional monetary policies such as quantitative easing, negative interest rates, forward guidance, etc.

– encourage corporate borrowers to invest and expand. Lower interest rates can reduce the cost of borrowing, but it can also push investors towards riskier assets as they chase higher yields and possibly inflate asset price bubbles.

What should investors be watching for in Europe’s outlook?

After better-than-expected wage growth and inflation figures, the ECB are buying themselves some optionality in “not pre-committing to particular rate path.” Forward guidance has now been scaled back in favour of “data dependency” and a “meeting by meeting’” approach. Upward revisions to both headline and core inflation from the March figures underline this more cautious approach. However, for Europe, there is little to suggest economic activity is going to suddenly substantially pick-up from here.

This caution extends to the ECB doesn’t want to undershoot their 2% target either. While the disinflation theme appears to have stalled, its revival is another risk perhaps more so than for other global markets.

What are the implications for credit investors?

Credit tends to perform best during ‘not too hot not too cold’ growth environment, where excess returns from investment grade (IG) credit are better when real GDP growth is between 1% and 3% (Figure 1). A relatively contained economic backdrop as well as continued strong demand for credit with investors far from overextended, it seems like an environment where carry – or yield – is important. Duration – the sensitivity of a bond to a change in interest rates – will also be important in an environment of falling rates.

Figure 1: Credit tends to perform best during ‘not too hot not too cold’ growth environment

Investment grade credit performance vs. GDP: 1948-2024

Quarterly excess returns vs. quarterly real GDP cohorts

Source: Janus Henderson Investors, Bloomberg, ICE BofA, Ibbotson, Morgan Stanley Research as at 30 April 2024.

Note: Past performance does not predict future returns.

The Governing Council of the ECB also confirmed the reduction of Eurosystem’s holdings of securities under the pandemic emergency purchase programme (PEPP) by around EUR€7.5 billion per month over the second half of the year. According to Deutsche Bank supply forecasts factoring in the ECB’s quantitative tightening until year end, investors would have to absorb almost twice the amount of non-financial senior debt compared to financial seniors.1 This means an improving (relative) technical backdrop in senior financial supply.

How does European credit look compared to other markets?

Higher yields – at around 4% for Euro IG credit2 – act as a buffer against any market volatility and are an attractive entry level to the asset class. Nevertheless, we believe volatility is likely to remain muted and spread sell-offs relatively short-lived. Our focus is therefore to try to remain nimble and use weakness to buy at attractive levels. As discussed in our Q1 Credit Risk Monitor, dispersion is set to increase as rates stay higher for longer with the path gradual to the neutral interest rate, which means adding value through security selection will become more important.

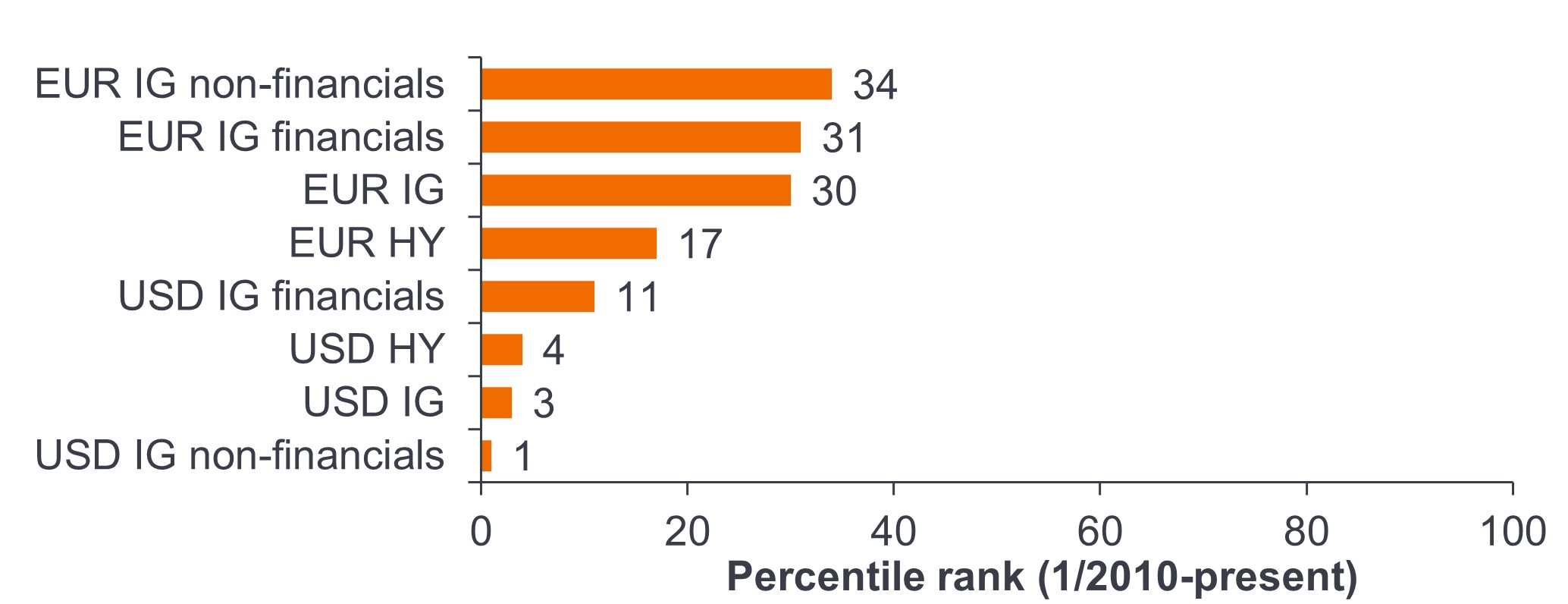

Spreads have tightened on the anticipation of easing as yields have repriced, which leaves less scope for outperformance from further tightening. However, euro credit spreads look much more attractive than US credit spreads. For example, EUR IG non-financials are at the 34th percentile versus US IG non-financials at the 1st percentile.

Figure 2: Euro spreads look the best value

Source: Goldman Sachs, as at 30 April 2024. Note: The above are the Team’s views and should not be construed as advice and may not reflect other opinions in the organisation. The views are subject to change without notice.

What difference to companies could this progression along the path to lower rates make?

Lower interest rates could open up access to capital for all companies – good and bad – but similarly, it could lead markets to be more discerning and spreads to show more dispersion than there has been in the IG space.

It’s important to expect this path to lower rates as gradual though with the absence of guidance towards a cut in the July meeting and a cut only needed every other meeting to get down to the neutral rate by the end of next year.

Higher rates for longer have two main implications for companies. First, this could flag inappropriate capital structures and their unsustainability. We are beginning to see this play out in lower-rated credit where the much higher cost of funding is really biting. Second, higher rates for longer encourages corporates to pay down their debt, i.e. we could see deleveraging, which should be positive for credit. This also indicates there could be higher dispersion in performance which we as active managers can exploit the market dislocations and inefficiencies to capture opportunities.

1 Source: Deutsche Bank, Bloomberg Finance, ECB, 6th June 2024.

2 Source: Bloomberg, Janus Henderson Investors as at, 30 April 2024. ICE Bofa Euro Corporate Bond Index.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Quantitative Easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market.

Quantitative Tightening (QT) is a government monetary policy occasionally used to decrease the money supply by either selling government securities or letting them mature and removing them from its cash balances.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.