The 2016 election of Donald Trump brought a wave of optimism for U.S. small-cap stocks as investors anticipated lower corporate taxes, deregulation, and a focus on domestic economic growth. Fast forward to the 2024 election and the first few months of 2025, and the parallels between the first and second Trump administration are striking.

Once again, small-cap stocks have rallied following the election, driven by similar policy expectations. But as the initial euphoria fades, investors are left wondering: What’s next, and how can we navigate the evolving small-cap landscape?

The three phases of the Trump trade

The market’s reaction to Trump’s policies so far follows a familiar pattern to what occurred during his first term, which can be broken into three phases:

Initial euphoria: About 4-6 weeks post-election

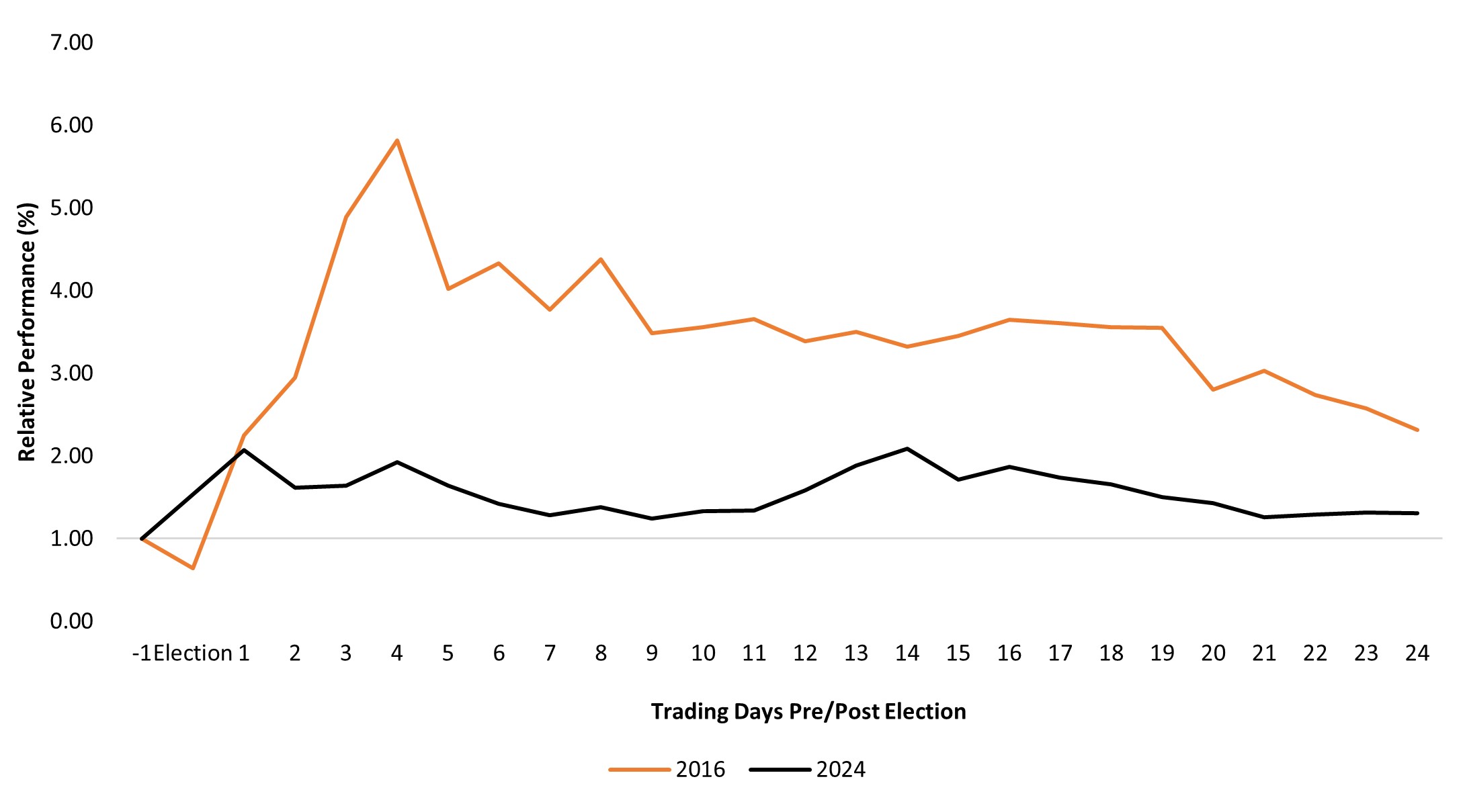

In both 2016 and 2024, Trump’s victories triggered enthusiasm for smaller U.S. companies. Investors rushed into small cap indices, creating a “rising tide lifts all boats” scenario – essentially a broad-based rally that benefited even lower-quality companies.

During this phase, markets focused on potential tailwinds from deglobalization, tax cuts, and deregulation. There was also an expectation that tariffs could help domestic firms fill gaps created by overseas competitors becoming less cost competitive. This period was more defined by perception and sentiment than by fundamental analysis.

Figure 1: Positive small cap initial reaction to Trump victories in 2016 and 2024

Relative Performance, Russell 2000 Index, S&P 500® Index

Source: Bloomberg. Russell 2000 Index and S&P 500 Index price returns from 7 November 2016 to 13 December 2016, and 4 November 2024 to 10 December 2024.

Policy evaluation: 12-month period following first phase

The second phase, roughly the next calendar year post-election, is where markets begin parsing winners and losers as policy proposals come into clearer focus. In this period, investors weigh real-world impacts of tariffs, tax cuts, immigration reform, and deregulation. This is where active management typically adds value – distinguishing actual beneficiaries from lower-quality companies that initially rose with the tide.

In 2017, this period revealed performance gaps between high- and low-quality companies. Now in 2025, investors must assess how specific policies affect inflation, monetary policy, and individual sectors and companies.

Economic reality: Beyond 13 months

The third phase reveals actual economic impacts. In 2018, small caps faced headwinds from rising interest rates and inflation concerns. However, companies with prudent valuations and strong fundamentals weathered the storm better than their overvalued peers.

Today, inflation remains elevated, and the Federal Reserve has signaled that rates may stay higher for longer. This could benefit small-cap companies with high returns on invested capital (ROIC) and profitability, as they are better positioned to navigate a higher cost of capital. Conversely, unprofitable companies with cash flows far out in the future may struggle.

Comparing market conditions

The policy backdrop in 2025 echoes that of 2017, with a focus on tariffs, tax cuts, and deregulation. Tariffs, in particular, are a key area of overlap. In both administrations, Trump has used tariffs as a tool to advance policy priorities, creating both challenges and opportunities for small-cap companies.

Another parallel is the focus on domestic economic growth. Small-cap stocks, which have greater exposure to the U.S. economy than their larger-cap counterparts, stand to benefit from policies that favor domestic producers. Lower corporate taxes and a more lenient regulatory environment could further boost small-cap performance, as seen in 2017 and 2018. A moderation of regulatory oversight could lead to more M&A activity with large cap companies looking to scoop up well positioned small caps.

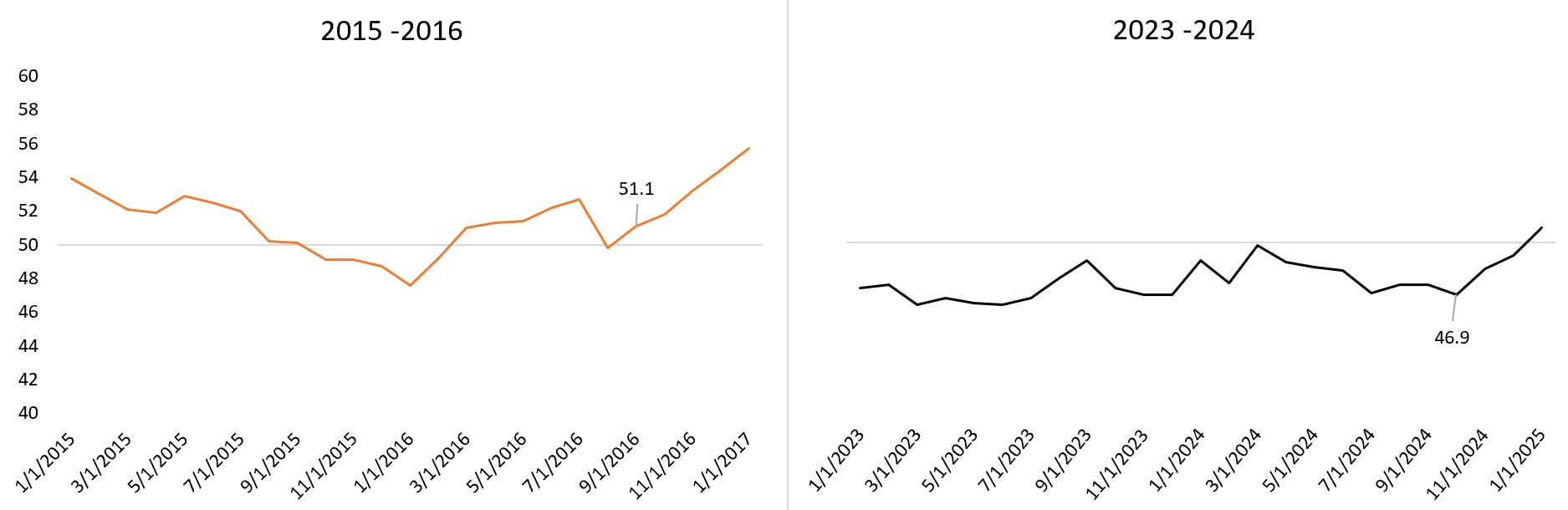

Notably, both periods featured industrial slowdowns, though of different magnitudes. The ISM Manufacturing Index indicates the U.S. has been in an industrial contraction period since November 2022, similar to 2016’s weakness (see Figure 2). There is optimism that business-friendly policies could spark a rebound, as seen previously.

Key differences exist, however. High interest rates in 2025 may temper the “animal spirits” that drove the previous small-cap rally in Trump’s first term. Additionally, the market is more focused on supply chain resilience and inflation risks than in 2016.

Figure 2: ISM Manufacturing Index – Transitioning from contraction to expansion

Source: Bloomberg. ISM Manufacturing Index.

Lessons learned

The 2016 experience highlights the importance of focusing on companies with sound valuations and strong fundamentals. The Russell 2000’s post-election valuation spikes in both periods were short-term distortions that eventually normalized. As we move from policy speculation to policy implementation, we believe companies with strong balance sheets, high ROIC, and domestic market exposure will emerge as winners.

Another lesson is the value of patience. While initial rallies can be exhilarating, the real opportunities often surface during later phases as markets stabilize. History has shown that when enthusiasm fades, companies with competitive advantages can best navigate changing conditions. By emphasizing fundamentals and avoiding overvalued stocks, we believe investors will be better positioned to capitalize on policy shifts.

Return On Invested Capital (ROIC) is a measure of how effectively a company used the money invested in its operations.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Smaller capitalization securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalization securities.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.