The climate-nature nexus underscores the intrinsic link between climate change and the health of our planet’s ecosystems and biodiversity. Globally consistent responsibility reporting standards are a foundational element in understanding the climate and nature crises as investors by enabling better measurement and management of environmental risks.

What is the TCFD?

Launched by the Financial Stability Board (FSB) in December 2015, the Task Force on Climate-related Financial Disclosures (TCFD) stands as a pioneering initiative with a mission to forge a set of voluntary, yet consistent, recommendations for climate-related financial risk disclosures. These are aimed at empowering corporations to effectively communicate their climate-related financial risks to investors, lenders, insurers, and other pivotal stakeholders. The TCFD set a new benchmark in transparency with the release of its recommendations in June 2017.

At the heart of the framework are four fundamental themes that mirror the crucial dimensions of organisational operations:

- Governance: The necessity for organisations to disclose their governance structures and processes around climate-related risks and opportunities.

- Strategy: The importance of disclosing how climate-related risks and opportunities could affect the organisation’s business, strategy, and financial planning over the short, medium, and long term.

- Risk management: The imperative to disclose the processes a company uses to identify, assess, and manage climate-related risks.

- Metrics and targets: The requirement to disclose the metrics and targets used to gauge and manage significant climate-related risks and opportunities.

The recommendations set forth by the TCFD are crafted to be universally applicable across various sectors and regions, encouraging entities to contemplate the financial impacts of climate change. This initiative significantly contributed towards enhanced transparency in responsibility reporting. By providing a structured approach for companies to disclose climate-related information, the TCFD fostered more informed capital allocation decisions and became a benchmark for other responsibility-related reporting best-practice frameworks.

ISSB absorbs the TCFD

In June 2023, the IFRS Foundation, responsible for guiding the creation of the IFRS Sustainability Disclosure Standards via the International Sustainability Standards Board (ISSB), achieved notable progress in the realm of climate-related disclosures with the roll-out of IFRS S1 (sustainability-related financial disclosures) and S2 (climate-related disclosures). In July 2023, the Foundation successfully merged the TCFD’s 11 recommendations into the ISSB’s standards, representing a major leap forward in the journey towards a cohesive global reporting standards on these risks and opportunities.

Exhibit 1: Which countries have adopted, or plan to adopt, ISSB-based standards?

Source: S&P Global, Janus Henderson Investors.

The adoption and integration of ISSB standards into the legal and regulatory frameworks of jurisdictions worldwide are gaining momentum. As of September 2024, 30 jurisdictions, representing 57% of the global gross GDP, over 40% of global market capitalisation, and more than half of the world’s greenhouse gas (GHG) emissions, have either adopted or are planning to adopt these standards.1 This widespread acceptance underscores the global commitment to enhancing transparency and accountability in climate-related financial disclosures, as well as the practicality of the reporting framework.

Further, the impact of the ISSB standards is already visible, with over 1,000 companies referencing the ISSB in their reports between October 2023 and March 2024.1 This marks a significant milestone in the global journey towards enhanced responsibility reporting, indicating a growing recognition of the importance of standardised climate-related financial disclosures in addressing the financially material risks and opportunities associated with climate change.

What is TNFD?

Launched in June 2021, the Taskforce on Nature-related Financial Disclosures (TNFD) was created to develop recommendations for nature-related disclosures to promote more informed investment decision-making.

In September 2023, the TNFD announced 14 recommendations designed to be consistent with the four pillars of the TCFD, as well as the ISSB and Global Reporting Initiative (GRI) standards. The recommendations also aim to serve as a tool to operationalise the achievement of Target 15 of the Kunming-Montreal Global Biodiversity Framework (GBF).

The TNFD recommendations share similarities with the TCFD guidelines that are already mandatory in countries like the UK, Switzerland, Hong Kong, Singapore, and New Zealand:

- Governance: This involves the board’s oversight and management’s handling of nature-related dependencies, impacts, risks, and opportunities.

- Strategy: These covers identifying dependencies, impacts, risks, and opportunities across different time frames, understanding how nature-related issues affect the business model, strategy, and financial planning, and evaluating the resilience of the company’s strategy to nature-based risks.

- Risk and impact management: This focuses on the company’s approach to identifying, assessing, and prioritising nature-related issues within its operations and supply chain, along with managing these factors.

- Metrics and targets: This section details the metrics for assessing and managing nature-related risks and opportunities, including specific metrics for dependencies and impacts. Feedback on metrics for financial institutions is sought at the time of writing.

Additionally, recommendations extend beyond the current TCFD requirements in three of these four categories:

- Governance (Extended): This includes board engagement and policies on human rights, particularly concerning indigenous peoples and local communities.

- Strategy (Extended): This addresses the consideration of sensitive locations in direct operations and supply chains.

- Risk and impact management (Extended): This pertains to integrating nature-related processes into overall risk management.

TNFD – LEAP framework

Implementing the TNFD guidelines poses challenges due to the complexity of evaluating factors beyond greenhouse gas emissions, adding significant complexity to the implementation process.

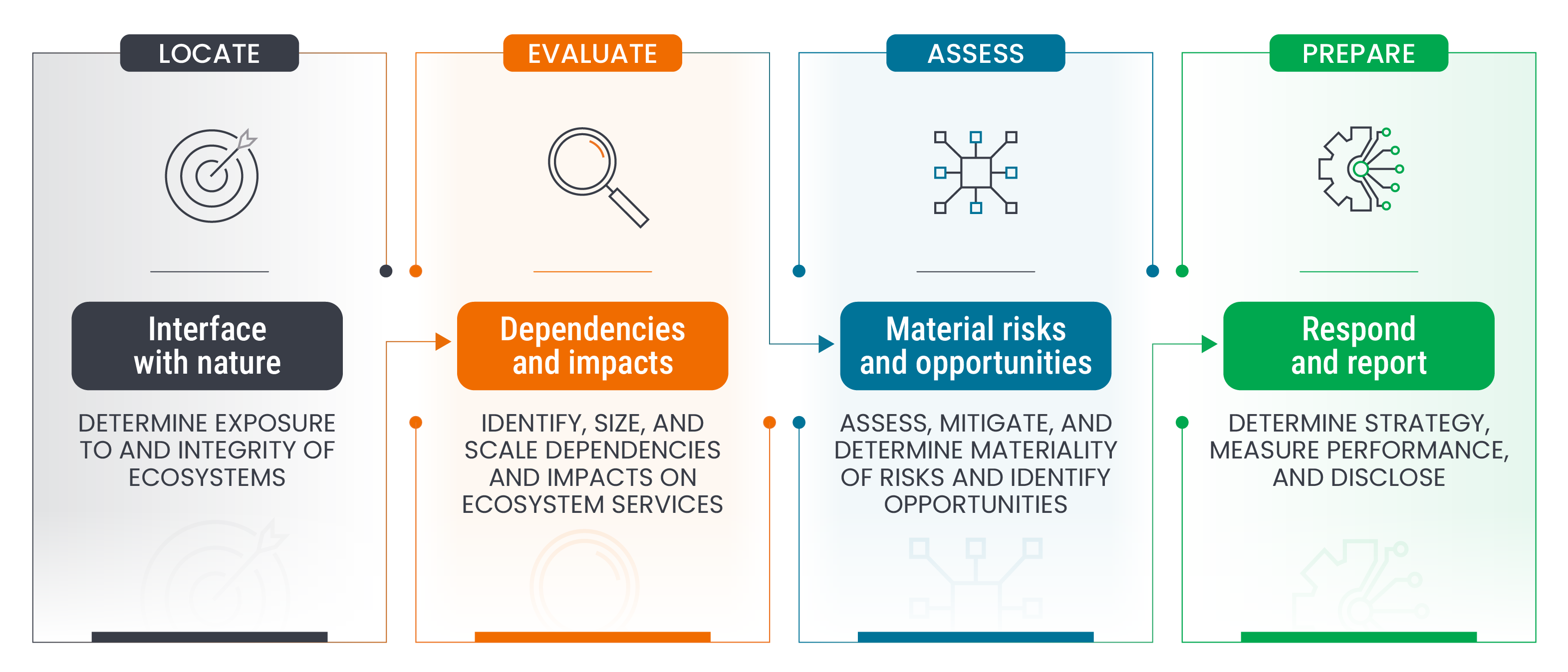

To that end, as well as its disclosure recommendations, the TNFD has also released an optional due diligence assessment as guidance to corporates and investors, including its LEAP – Locate, Evaluate, Assess and Prepare – approach to identifying and assessing nature-related issues.

Exhibit 2: LEAP framework

Source: The Taskforce on Nature-related Financial Disclosures, Janus Henderson Investors.

Tackling the climate-nature crisis

The growing adoption of these responsibility reporting standards across numerous jurisdictions and a growing number of corporates underscores a collective commitment to better understanding the financially material risks and opportunities associated with climate change and nature loss through enhanced transparency and accountability in financial disclosures.

Together, the ISSB, TCFD and TNFD initiatives reflect a growing recognition of the critical need to incorporate environmental risks into financial reporting and decision-making processes. By fostering a more transparent and informed financial system, these efforts contribute to the resilience and sustainability of the global economy in the face of environmental challenges.

Kunming-Montreal Global Biodiversity Framework (GBF): The conclusion of the 15th Conference of Parties to the UN Convention on Biological Diversity saw the adoption of the Kunming-Montreal Global Biodiversity Framework (GBF). Amidst a dangerous decline in nature threatening the survival of one million species and impacting the lives of billions of people, the GBF aims to halt and reverse nature loss. The framework consists of global targets to be achieved by 2030 and beyond to safeguard and sustainably use biodiversity.

1 Source: IFRS Foundation, Progress on Corporate Climate-related Disclosures—2024 Report

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.