Japan introduced its Corporate Governance Code in 2015, as a way to establish principles for good corporate governance, including transparency, risk management, and the responsibility of companies to take appropriate measures to address sustainability issues. The eight years leading up to 2023 are widely considered to be the first phase of the country’s governance reform efforts. During this period, many companies implemented improvements to board roles and responsibilities, capital allocation, and enhanced shareholder value through the provision of more proactive disclosures and dialogues.

This reflects a significant change compared to the regime of old corporate Japan. Previously, very few companies had independent ‘outside’ directors (neither employed by the company, its subsidiary, or parent company) but now there is impressive progress, with over 90% of companies with outside directors comprising more than 30% of the board. These enhancements have taken time to achieve; companies and shareholders today are reaping the results, including higher dividends and share buybacks exceeding profit growth. These factors are providing a significant boost to Japanese equities, following years of deflation and economic stagnation that impacted the attractiveness of the asset class.

Board structures have improved

Source: Japan Exchange Group (JPX), Janus Henderson Investors as at 29 March 2024.

Phase 2 of governance reforms is underway

In March 2023, the Tokyo Stock Exchange (TSE) implemented reform measures to address companies’ low price-to-book (P/B) ratio. This marked the beginning of the second phase of beefing up corporate governance. The measures aim to boost investment in equities by both domestic and foreign investors, as well as support the growth potential of companies. The TSE urged company management to be conscious of the cost of capital and stock price, and improve dialogues with shareholders as well as related disclosures.

The TSE’s master-stroke is to now link capital efficiency with social responsibility as Japan’s population ages. This linkage was missing in the past, but now provides management teams with a sense of purpose and social licence to pursue more efficient capital structures.

Growing acceptance that reforms need to be broad-based

Governance reform is not something that only top tier companies should promote; all listed companies should increase their efforts. Widespread changes are occurring. Japan is a consensus-driven society that does not desire – or is used to – ‘strong’ leaders. While it often takes a long time to reach a consensus, once it is formed, actions are taken quickly. We now see broad recognition of the importance of efforts to enhance shareholder value in listed companies, and as a result these initiatives are progressing rapidly.

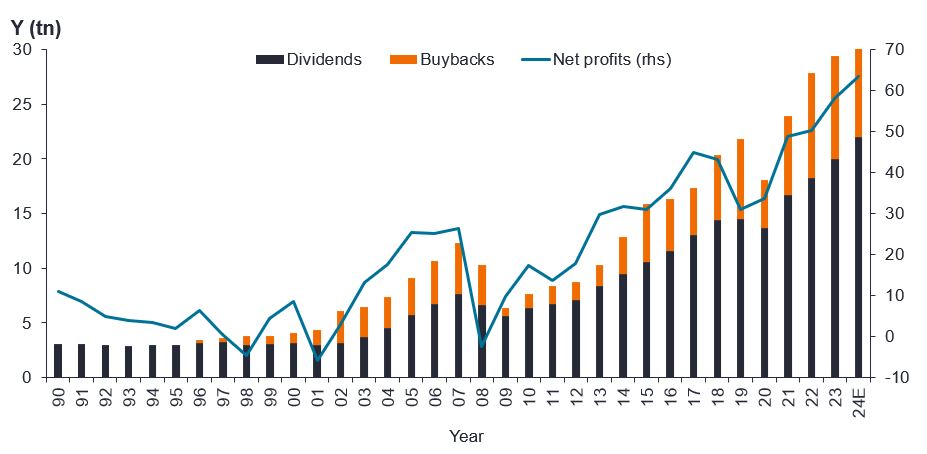

Buybacks and dividends are enhancing total returns

This is evidenced by Japanese companies’ rising shareholder returns. Share buybacks and dividends are forming a larger component of total returns. Buybacks, which were virtually non-existent 30 years ago, reached more than JPY 10 trillion in the fiscal year ending March 20241. Dividends expanded from JPY 2 trillion to JPY16 trillion in the same period. In fact, buybacks already reached JPY6 trillion in the two months since the start of FY2025 (April and May), surpassing the amount announced in the same period last year by 50%.

The power of buybacks is improving, as managements are now increasingly cancelling the repurchased shares, not just continuing to hold onto them as treasury stock, which is increasing shareholder value.

Buybacks and dividends are rising

Growth of shareholder total returns has exceeded EPS growth

Source: Nomura Research, Janus Henderson Investors analysis, as at 31 May 2024. Based on top-down analysis, March financial year-end. *FY21-22 are GS estimates. There is no guarantee that past trends will continue, or forecasts will be realised. The views are subject to change without notice. Past performance does not predict future returns.

Ending the practice of cross-shareholdings

Rising buybacks are being funded by surplus capital and cash holdings from successful efforts to improve return-on-equity (ROE) to address low valuations. This includes replacements for aged or non-strategic assets, unwinding cross-shareholdings, and reviewing cash holding levels.

The long-held practice of cross-shareholdings involves holding other listed company’s shares for strategic purposes like maintaining business relationships with business partners or gaining from information flow. This has been criticised as it contributes to poor corporate governance, including low company transparency by protecting management.

A clear benefit of progress in the unwinding of cross-shareholdings is that the proceeds are increasingly allocated to fund share buybacks. This typically boosts a company’s share price in the short term, increases confidence in its prospects, as well as provides a support level for the share price, which is beneficial during periods of market weakness.

The accelerated pace in phase two of governance reforms is reflected by major casualty insurers like MS&AD, Sompo Japan and Tokio Marine announcing that they will end cross-shareholdings. The trigger was the regulator, Japan’s Financial Services Agency, breaking up a pricing cartel in the property & casualty insurance sector. This improved both corporate governance and capital efficiency as the proceeds from unwinding the crossholdings would be used to fund share buybacks. The attention led to reforms, and later, an announcement that these insurance companies would sell all their cross-held shares within six years – in our view, this could be considered the biggest surprise of the year.

Corporate governance reforms are increasing the long-term attractiveness of Japanese equities

The funds obtained from the dissolution of cross-shareholdings, which account for more than 30% of the insurers’ capital, are planned to be used for dividends, share buybacks, and mergers & acquisitions. With the expectation that this will significantly improve the ROE of insurance companies, which had been inferior to global peers, the share prices of insurance companies rose significantly.2 The very solid keiretsu structure of the auto industry has also announced similar measures, and it is hoped that this will spread to other sectors with high cross-shareholding ratios, such as banks.

In the long term, the dissolution of cross-shareholdings is expected to drive a chain of positive reactions. The shift of major shareholders from financial institutions and companies to individuals and institutional investors will clarify the evaluation criteria for management. Management teams should become more conscious of their company’s stock price in order to gain voting support at their annual general meetings (AGMs).

Active management needed to navigate the changing governance landscape

Japan’s stock market has been trading at low valuations relative to profit growth for many years, due to its opaque decision-making and corporate actions that sometimes undermine shareholder rights. Since 2023, a gradual stock market revaluation has been underway. We believe this is only the beginning as investors start to acknowledge the essential changes that corporate Japan is prioritising to create shareholder value and attract inflows.

Transformational change often leads to market inefficiencies, presenting active investors with unique opportunities to generate meaningful returns. The focus on top-tier companies has left some often undervalued laggards with strong growth prospects underexplored. Corporate governance improvements, and the impact on stock prices, will vary greatly among individual companies. This emphasises the importance of market knowledge and expertise when it comes to stock selection – which active management can deliver to investors.

1 Source: Nikkei as at 24 April 2024.

2 Bloomberg, Insurer shares hit record in Japan on talks to unwind holdings, 13 February 2024.

There is no guarantee that past trends will continue, or forecasts will be realised.

Corporate governance: a set of rules, practices, and processes used to run and control a company. This includes key areas such as environmental awareness, ethical behaviour, corporate strategy, compensation, and risk management.

Cost of capital: the minimum rate of return or profit a company must earn before generating value, typically used to determine financial risk and whether an investment is justified.

Earnings per share (EPS): is the bottom-line measure of a company’s profitability, defined as net income (profit after tax) divided by the number of outstanding shares.

Keiretsu: an intricate business network with a long-term transactional relationship. The business network is largely composed of banks, manufacturers, supply chain partners, and distributors who work closely together for the success of the whole group.

Price-to-book (P/B) ratio: a financial ratio used to value a company’s shares, calculated by dividing a company’s market value (share price) by its book value (the value of all a company’s assets minus its liabilities). A P/B value below one indicates a firm is valued at less than the sum of its assets, either because it is undervalued, or because the market has doubts about its future profitability.

Return-on-equity (ROE): a company’s net income (income minus expenses and taxes) over a specified period, divided by the amount of money its shareholders have invested. It is used as a measurement of a company’s profitability, compared to its peers. A higher ROE generally indicates that a management team is more efficient at generating a return from investment.

Share buybacks: when a company buys back its own shares from the market, it leads to a reduction in the number of shares in circulation, and as a consequence increases the value of each remaining share. Buybacks typically signal the company’s optimism about the future and a possible undervaluation of the company’s equity.

TOPIX (Tokyo SE First Section Index): a market benchmark covering an extensive proportion of the Japanese stock market and is a free-float adjusted market capitalization-weighted index.

Treasury stock: refers to previous outstanding stock that has been repurchased and is held by the issuing company. As the shares are repurchased from the open market, shareholders’ equity is reduced by the amount paid for the stock. Treasury stock do not issue dividends, have no voting rights and are and not included in earnings per share (EPS) calculations.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Emerging markets expose the Fund to higher volatility and greater risk of loss than developed markets; they are susceptible to adverse political and economic events, and may be less well regulated with less robust custody and settlement procedures.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.