Back to basics with intermediate duration

The Portfolio Construction and Strategy Team reflects on the past year’s painful drawdown in fixed income markets and explains why, after investors had wisely been moving to the short end of the yield curve, intermediate-duration bonds may now be more attractive.

3 minute read

This article is part of the latest Trends and Opportunities report, which outlines key themes for the next stage of this market cycle and their nuanced implications across global asset classes.

Longer-duration assets have historically been a better ballast in true risk-off environments and can act as a diversifier to a short-duration allocation.

2022 Recap

- Duration-sensitive fixed income generated the worst drawdown in recent history on fears of runaway inflation. For the second year in a row, core bonds were a detractor to the 60/40 portfolio.

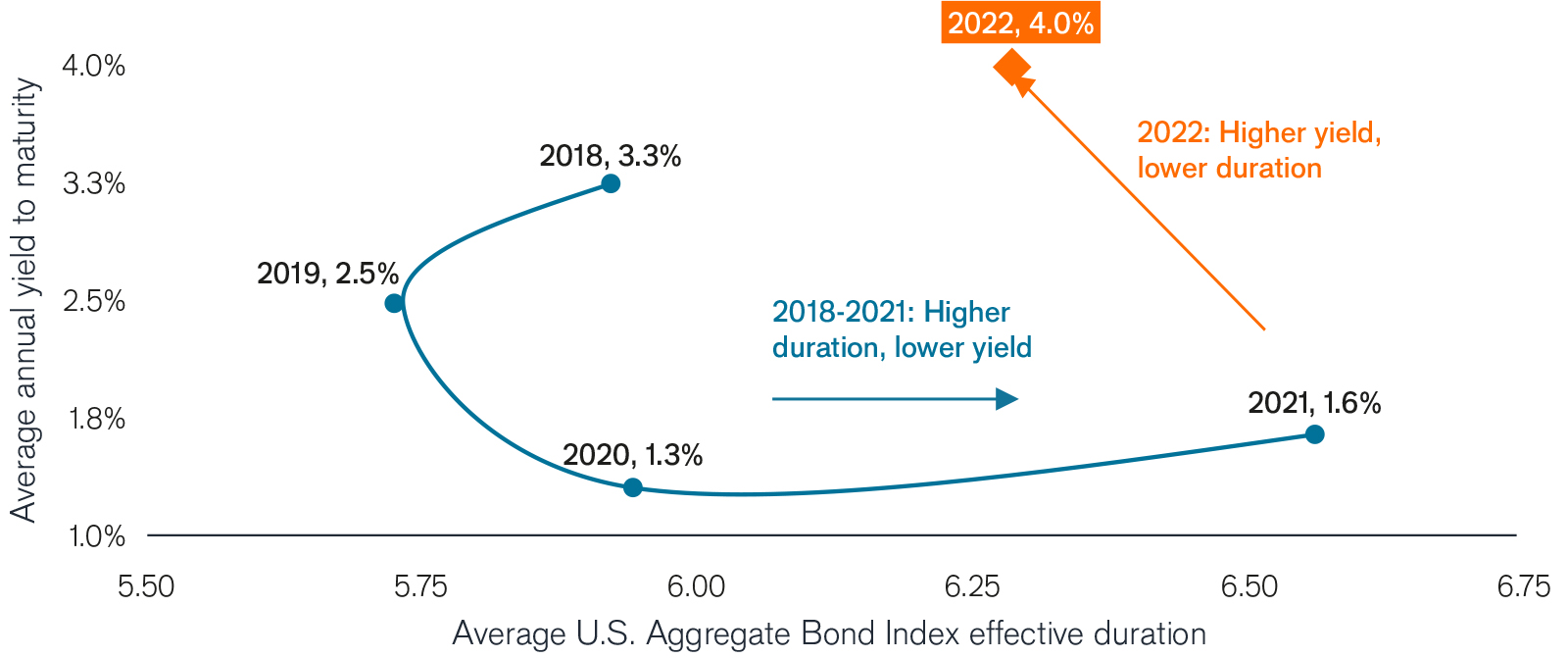

- This unprecedented repricing, while painful, has led to a much more favourable yield/duration trade-off for intermediate bonds.

- Toward the latter half of 2022, intermediate duration began to demonstrate periods of impressive return as the market pondered the impact of the Federal Reserve (Fed) pausing its rate-hiking cycle to assess the severity of a potential economic slowdown.

Yield duration trade-off more favourable

Source: Morningstar, as at 31 December 2022.

Outlook

- At the start of the new year, many investors are focused on how to source positive returns during what could be a continued market drawdown.

- Historically, duration has provided a ballast when equity earnings sell off, including during the sharp COVID drawdown in early 2020, when U.S. Treasuries returned 5.3% despite the 10-year yield starting 232 basis points (bps) lower than where it sits today.

- Persistent inflation has caused yields to stay elevated and decouple from the declining growth trajectory. Should inflation continue its downward trend, we believe rates will recover along with growth, leading to an attractive environment for core bonds.

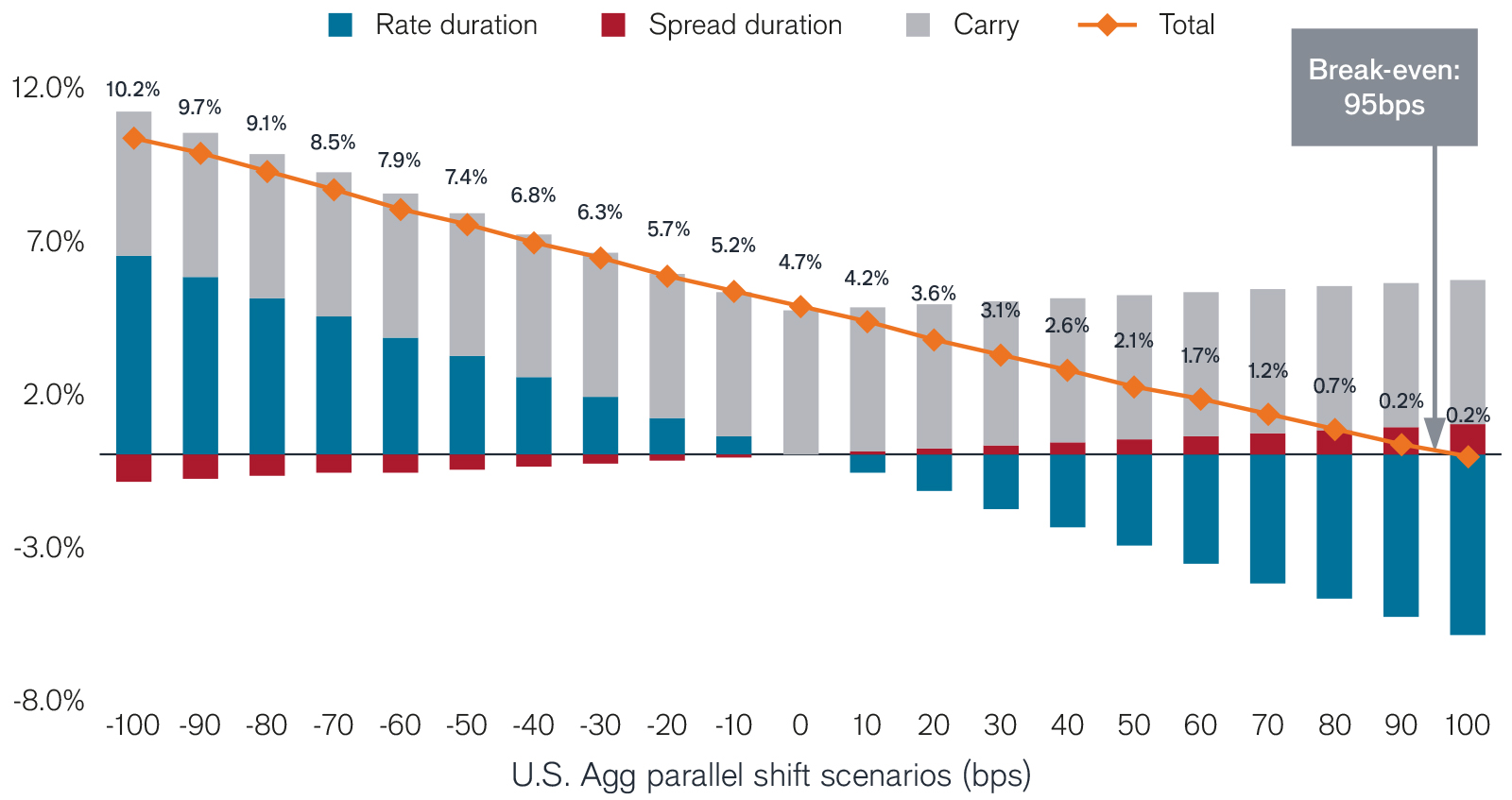

Break-even rates have reset much higher

Source: Janus Henderson, assuming a 1-year holding period, as at 31 December 2022.

PCS Perspective

- In our global proprietary database of financial professional portfolios, allocations to intermediate bonds were down 36% year over year as investors smartly moved to the shorter end of the yield curve to help insulate their portfolios from rate increases.

- This year’s historic losses in intermediate duration make for a compelling current yield profile that can help provide cushion against potential future rate volatility.

- In a slowing growth environment, duration also provides ample opportunity for capital appreciation should rates move lower.

- Longer-duration assets have historically been a better ballast in true risk-off environments and can act as a diversifier to a short-duration allocation. As a result, we think it may now make sense to get back to basics in core fixed income with intermediate duration.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Volatility measures risk using the dispersion of returns for a given investment.

Yield cushion, defined as a security’s yield divided by duration, is a common approach that looks at bond yields as a cushion protecting bond investors from the potential negative effects of duration risk. The yield cushion potentially helps mitigate losses from falling bond prices if yields were to rise.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

U.S. Treasury securities are direct debt obligations issued by the U.S. Government. With government bonds, the investor is a creditor of the government. Treasury Bills and U.S. Government Bonds are guaranteed by the full faith and credit of the United States government, are generally considered to be free of credit risk and typically carry lower yields than other securities.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.