Rough seas abound

Volatility in markets has been widespread since US President Trump’s tariffs were announced, with fixed income markets not escaping unscathed. Spread widening has occurred across fixed income with lower credit quality markets, such as high yield, particularly feeling the pain. Taking a sub-set of the securitised markets, European AAA CLOs are generally trading 20-30bps wider from a week ago, moving to a spread of c.140 bps[1]. While volatility can of course be disconcerting, the entry point for AAA CLOs looks even more attractive now, with spreads sitting around the 70th percentile range over a 10-year history. If we compare this to a week ago, AAA CLO spreads were sitting around the 40th percentile range[1]. Given the velocity of moves, it is worth considering the context of how securitised investments have performed – both in a liquidity and price context – in prior market drawdowns.

Shallow and short choppy waters

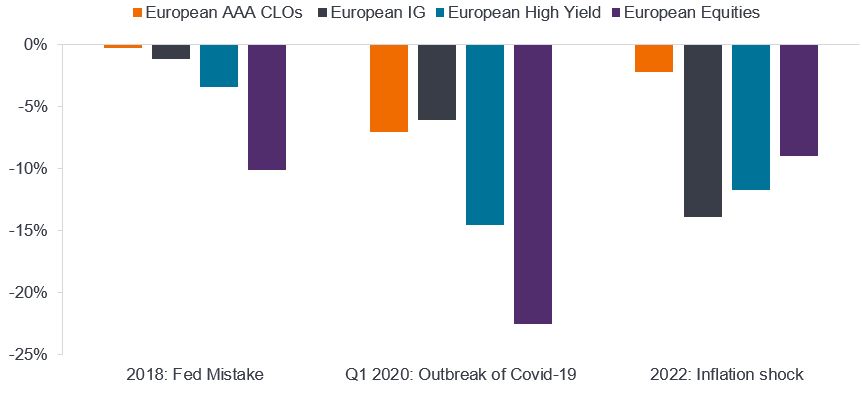

Securitised investments such as CLOs are a credit product and as such during periods of volatility, spreads often widen. It is worth noting though that AAA-rated CLOs (or even A or AA-rated) have never experienced a default, even during the Global Financial Crisis. Such dislocations are often relatively short-term and shallow, compared to other credit products and equities. In Figure 1, we consider the recent drawdowns seen in European markets across equities and fixed income markets. Notwithstanding the spread percentile shift noted above, month-to-date European AAA CLO returns have been down only 0.46%, which is only just behind the declines from European investment grade (IG) corporate bonds, despite the latter benefitting from interest rate declines (as longer duration fixed rate investments).

Figure 1: Drawdown versus other asset classes during volatile markets

Source: Janus Henderson Investors, JP Morgan, Bloomberg. EUR returns. European AAA CLOs: JP Morgan European AAA CLO Index. European IG: ICE BofA Euro Corporate Bond Index. European High Yield: ICE BofA European Currency Non-Financial High Yield 2% Constrained Ind. European Equities: MSCI Europe.

Note: 2018 and 2022 periods correspond to calendar year returns. For illustrative purposes only. Past performance does not predict future returns.

The worst drawdown for CLOs was a fall of 7.6% during COVID. During volatile periods, CLOs have typically retraced the downside within six to 12 months. This rapid recovery can be attributed to the high quality of the asset class, with investors encouraged to purchase on attractive relative valuations.

Figure 2: Historically drawdowns have been shallow and brief

Source: Janus Henderson Investors, Bloomberg, JP Morgan as at 31 March 2025.

Note: Chart showing cumulative drawdowns. JPM AAA CLO Index: JP Morgan European AAA CLOIE index. European IG Index: ICE BofA Euro Corporate Bond Index.

Drawdown returns from 31 December 2017 to 31 March 2025. Past performance does not predict future returns.

Depth of liquidity is key

Liquidity has also held up well in the European securitised sector during times of market stress, such as during the COVID pandemic or the UK liability-driven investment (LDI) related turmoil in 2022. Around €13 billion of European securitisations were sold over four weeks from the end of September that year, and volumes were absorbed well[2]. While many investors hold AAA CLOs for the longer term, some use the asset class as a shorter-term allocation, deploying capital to other areas of the market, such as equities, when we see market dislocations. CLO markets have remained extremely liquid and orderly during bouts of historic market turbulence. Over the recent volatility, the European CLO market has remained open, liquid and functioning, with rational pricing. While we have seen average liquidity cost – the difference between the bid and offer price on a specific bond (or the bid-ask spread) – approximately more than double from the 20bps[3] we saw pre-tariffs, this move is in line with what we would expect during periods of stress, and entirely rational.

How can the rough seas be navigated?

For investors the challenge is to navigate such volatility while considering the robustness of portfolios, not just in the context of what we know, but also in consideration of the “known unknowns” in terms of any further escalation. We believe that investors should:

- Keep market drawdowns in perspective. Fixed income assets are performing as expected in this environment, with dispersion seen across markets.

Figure 3: Fixed income sector returns (euro hedged)

|

MTD (%) |

YTD (%) |

|

| Euro AAA CLOs | -0.46 | 0.47 |

| Euro ABS (Investment Grade) | -0.08 | 0.88 |

| Global Investment Grade | -1.20 | 0.19 |

| Euro Investment Grade | -0.23 | -0.08 |

| Global High Yield | -2.54 | -1.71 |

| Euro High Yield | -1.78 | -1.15 |

| Euro Loans | -1.28 | -0.50 |

| Euro Equities | -8.99 | -2.02 |

Figure 4: Fixed income sector returns (sterling hedged)

| Name | MTD (%) | YTD (%) |

| Euro AAA CLOs | -0.40 | 1.00 |

| Euro ABS (Investment Grade) | -0.03 | 1.37 |

| Global Investment Grade | -1.19 | 0.62 |

| Euro Investment Grade | -0.20 | 0.38 |

| Global High Yield | -2.56 | -1.30 |

| Euro High Yield | -1.79 | -0.73 |

| Euro Loans | -1.27 | 0.15 |

| Euro Equities | -7.03 | 1.42 |

Source: Janus Henderson Investors, Bloomberg, JP Morgan, Credit Suisse, as at 8 April 2025. ICE BofA Global Corporate Index; ICE BofA Global High Yield Index; JP Morgan European AAA CLOIE Index; ICE BofA Euro Corporate Index; Credit Suisse Western European Leverage Loan Index; ICE BofA European Currency Non-Financial High Yield 2% Constrained Index; Euro Stoxx 50 Index. Bloomberg Pan European Floating rate ABS Index. Past performance does not predict future returns. For illustrative purposes only.

- Remember that securitised assets often lag movements in the corporate credit market: While the asset class has shown resiliency, further spread volatility would not be surprising, given the magnitude of the market sell off. However, history has shown that in past periods of volatility, high grade securitised can bring resilience to portfolios.

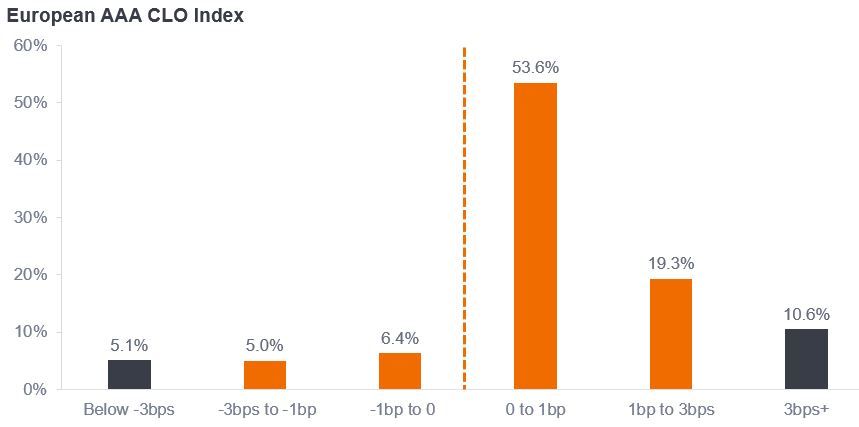

- Price volatility does not automatically mean defaults: Investors can be assured that securitised investments are performing as expected. When highly rated securitised sectors, such as AAA-rated CLOs, experience any volatility, this is just mark-to-market volatility, not realised losses or defaults. To put returns in a wider context, 84% of daily returns of the CLO Index are between -3bps and +3bps, but there are brief periods of extremes, which tend to be short-lived. During severe market instability, price dispersion between AAA CLOs emerges, where an active approach can help to manage both risk and capture opportunity.

Figure 5: CLO daily return histogram

Source: Janus Henderson Investors, JP Morgan, Citi, Bloomberg. Showing daily returns from 1 March 2013 to 31 March 2025.

Note: Daily returns from 29 December 2017 to 31 March 2025 are for JP Morgan European AAA CLO Index. Prior to this, daily returns are estimated using AAA CLO spread moves, assumed carry and cash returns. Daily cash returns are estimated using 1m Euribor. For illustrative purposes only. Past performance does not predict future returns.

Securitisation offers a breakwater

There is clearly a lot of uncertainty that does not show signs of abating yet. We believe it is important for investors, including ourselves, to take the time to sift through the noise to identify the major themes that will come from this. Another area of renewed uncertainty is rates. Floating rate investments like securitised are beneficial in environments of interest rate volatility, as we have seen with market expectations for rates changing frequently in response to sentiment towards factors such as growth or inflation.

Recent fixed income price dispersion serves as a reminder of the benefit of diversification within a multi-sector credit portfolio. We believe that our fundamental style and broad asset class flexibility in such portfolios positions us well to navigate through and take advantage of volatility as relative value emerges. For example, high credit quality securitised debt, such as AAA CLOs, has held up better through the volatility, unlike high credit beta assets such as high yield.

Having a breakwater when sailing through rough tides can also help, which is what income offers as a cushion for returns. An attractive income stream, coupled with lower spread duration of securitised investments, means that the asset class represents an attractive defensive income opportunity amid high market volatility.

Footnotes

[1] Source: Bloomberg, Janus Henderson Investors, as at 8 April 2025.

[2] Source: Janus Henderson Investors estimates and BWIC volumes between 30 September 2022 and 21 October 2022.

[3] According to JHI observations using our proprietary systems that monitor CLO trading.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.