The surprising case for natural resources

Portfolio Manager Tal Lomnitzer discusses the strong demand for resources and the diversification merits of a long-term allocation to the asset class.

6 minute read

Key takeaways:

- The team’s analysis suggests that resources equities have shown a negative correlation with the broader equity market over the long term, yet are capable of generating similar returns with lower volatility.

- In an environment of rising inflation, certain sectors such as mining, packaging and forestry can have a good correlation with inflation expectations and are beneficiaries of decarbonisation.

- The prospects for resources companies are bright. Sustainable natural resource companies have a key role to play in supporting the transition to a more sustainable and low-carbon economy.

Think longer term to extract the best from natural resources

The global natural resources sector is generally considered to be highly cyclical, being sensitive to the economic backdrop, resulting in a strong temptation among investors to time their entry and exit with the economic cycle. We sympathise. Getting the timing wrong can be a career-limiting decision while getting it right can be extremely rewarding so it is natural to be captivated by the short cycle outlook. A myopic focus can however, miss the significant benefits of taking a longer-term perspective.

We encourage investors to consider an investment in the resources sector over the long term ‒ to think of resources as an investment rather than a trade. Unlike other segments of the market, resources equities (i.e. materials, energy and agriculture) have shown they can be negatively correlated with the broader equity market over the long term. Yet they are capable of generating similar returns.

Essential building blocks

Resources provide the essential and fundamental building blocks of economic development. While demand for some commodities like coal or oil is likely to plateau and decline, the demand for others is growing and looks set to rise. The renewable energy industry requires copper, lithium, cobalt, nickel, iron ore and silver. Digitisation requires massive server farms and enormous quantities of energy. As the world strives towards a digitised, electrified and fossil fuel-free future, resources have an integral and essential part to play. There is a fundamental growing demand for future energy sources and nutrition ‒ that can only be met by the resources sector. As the world evolves so does the need for different parts of the resources sector.

Benefiting from negative correlation over time

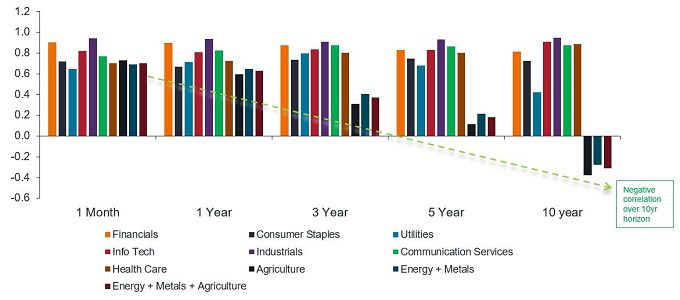

A 2016 white paper by Lucas White and Jeremy Grantham at GMO*, showed that “resource equities provide diversification relative to the broad equity market, and the diversification benefits increase over longer time horizons”. We set out to test this hypothesis on a broader data set that includes agriculture. Building on from their analysis, we disaggregated the US market into its various sectors and ran correlations between the sectors and the MSCI World Index (the market) over various rolling time periods using data from February 1995 to February 2022 (see chart 1).

We defined resources as an equally-weighted index of mining, energy and agriculture, broadly similar to the S&P Global Natural Resources Index. The analysis shows that the linkage between resources equities, other sectors and the market is high over the short term but declines dramatically over the longer term. Indeed, over a rolling ten-year period the correlation between resources and the broad market has actually been negative whereas it stays positive and rises over time for other sectors.

*GMO white paper: An investment only a mother could love: the case for natural resource equities, Lucas White and Jeremy Grantham, September 2016.

Chart 1: Resources equities have been negatively correlated with broader equities over the longer term

Source: Bloomberg, FactSet, Janus Henderson Investors. Correlation of resources (energy + mining + agriculture) to other MSCI World Index sectors, monthly observations from February 1995 to February 2022. Past performance does not predict future returns.

Potentially higher reward for less risk?

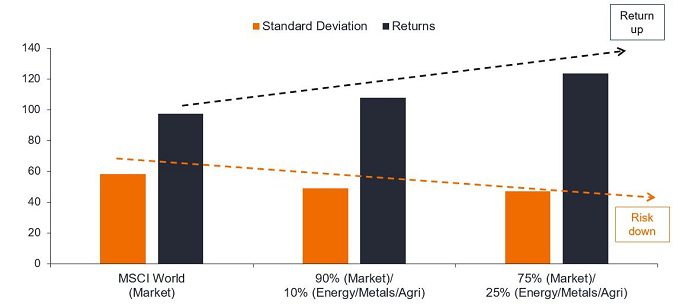

Beyond the ongoing contribution to wealth creation and quality of life, resources have the attributes of an attractive investment class in their own right. As with gravity in the domain of physics, there are certain immutable laws of investment, in particular, the relationship between risk and reward. Our analysis suggests that by adding resources to an equities portfolio it is possible to generate a similar return but with lower risk as measured by volatility (standard deviation).

Taking inspiration from GMO’s whitepaper, our analysis of more than 25 years of historical data shows that when compared against the market, the average ten-year return of a portfolio consisting of 75% MSCI World Index and 25% resources has increased while the standard deviation (the risk) has dropped. Interestingly, the results are consistent though less dramatic if a 90% MSCI World/10% resources portfolio is used (see chart 2). Unsurprisingly, combining these metrics into a Sharpe ratio shows a similar result.

Chart 2: An allocation to resources may improve risk-adjusted returns over the long term (10 years)

Source: Janus Henderson Investors and Factset. Rolling 10-year standard deviation and returns based on hypothetical portfolio allocations to the MSCI World Index and resources equities (energy + mining + agriculture). Monthly observations from February 1995 to February 2022. Hypothetical examples are for illustrative purposes only and do not represent the returns of any particular investment. Past performance does not predict future returns.

Schrödinger’s cat

Quantum physics teaches that something can exist in two states. Matter is both a particle and wave; resources equities are both cyclical and an effective portfolio diversifier. In Schrödinger’s words “this would not embody anything unclear or contradictory”. The answer lies in the timeframe. While resources are tied to the economic cycle in the near term, over longer time periods they tend to march to the beat of their own drum. Not everyone thinks in ten-year horizons, so we have re-run the risk/return analysis over rolling five-year periods using the same data and generated similar results.

To summarise, over five or ten-year horizons, adding resources including agriculture, as a core part of a portfolio is likely to engender better returns with lower risk. Instead of looking on the sidewalk for pennies it is far better to look to the horizon for nuggets of gold. Furthermore, in an environment of rising inflation an investment in the resources sector has additional attractions. Mining equities have been shown to have a good correlation (positive relationship) with inflation expectations and can be considered to be a real asset play as we move into negative real rates. The sector is not being technically disrupted, in fact, it benefits from the disruption within the energy and mobility sectors: renewables use much more copper or steel than fossil fuels, while electric vehicles require much more copper than combustion engines.

Similarly, packaging and forestry have a high correlation with inflation expectations and are benefiting from a move to ecommerce and the replacement of plastics with fibre-based packaging. There are many companies in the resources sector that appear well positioned compared to the rest of the market in terms of balance sheet strength, cashflow generation and dividends. The team believes current valuations appear attractive and a long term-investment could well be rewarding.

Resources play a key role towards sustainability

We are optimistic about the prospects for natural resources companies, which are at the nexus of sustainable development and the decarbonisation transition. While some resource sectors have potentially high environmental and social impacts associated with their extraction, production, manufacture, and distribution, we believe that sustainable natural resource companies have a key role to play in supporting the transition to a more sustainable and low-carbon economy. In our view, companies that adhere to sustainable practices are best prepared for the future and are therefore more likely to deliver attractive, risk-adjusted returns.

Volatility is the rate and extent at which the price of a portfolio, security or index, moves up and down, and is used as a measure of the riskiness of an investment.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Standard deviation is a statistic that measures the variation or dispersion of a set of values/data. A low standard deviation shows the values tend to be close to the mean while a high standard deviation indicates the values are more spread out. In terms of valuing investments, standard deviation can provide a gauge of the historical volatility of an investment.

Sharpe ratio measures a portfolio’s risk-adjusted performance. A high Sharpe ratio indicates a better risk-adjusted return. The ratio is designed to measure how far a portfolio’s return can be attributed to portfolio manager skill as opposed to excessive risk taking.

Commodities (such as oil, metals and agricultural products) and commodity-linked securities are subject to greater volatility and risk and may not be appropriate for all investors. Commodities are speculative and may be affected by factors including market movements, economic and political developments, supply and demand disruptions, weather, disease and embargoes.

Natural resources industries can be significantly affected by changes in natural resource supply and demand, energy and commodity prices, political and economic developments, environmental incidents, energy conservation and exploration projects.

Sustainable or Environmental, Social and Governance (ESG) investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than the broader market.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

S&P 500® Index reflects US large-cap equity performance and represents broad US equity market performance.

MSCI World Index℠ reflects the equity market performance of global developed markets.

S&P Global Natural Resources Index reflects the performance of large publicly-traded natural resource and commodities companies across agribusiness, energy, and metals and mining.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund follows a responsible investment approach, which may cause it to be underweight in certain sectors (due to the avoidance criteria employed) and thus perform differently than funds that have a similar financial objective but which do not apply any avoidance criteria when selecting investments.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.