Despite political headwinds, healthcare stocks stay anchored to innovation

The surprise nomination of Robert F. Kennedy Jr. to head healthcare policy in the U.S. caused substantial volatility in November. But despite heightened uncertainty, the sector’s long-term outlook appears intact, say Portfolio Managers Andy Acker and Dan Lyons – giving investors a potential opportunity to invest at attractive valuations.

8 minute read

Key takeaways:

- Healthcare investors face questions around potential policy changes heading into 2025 and should prepare for volatility over the near term, in our view.

- Historically, markets have tended to overcorrect during such periods, given the legal and legislative limitations of modifying healthcare policy in the U.S.

- We believe investors should stay focused on the sector’s biggest drivers of long-term performance – innovation and demand – which now appear deeply discounted.

In a surprise twist late in the U.S. election cycle, healthcare stocks – which for much of 2024 avoided the political spotlight – have been hit by growing worries over the potential for significant changes to healthcare policy under the incoming Trump administration.

The turning point was when president-elect Donald Trump nominated Robert F. Kennedy Jr. to head the Department of Health and Human Services, which oversees the Food and Drug Administration (FDA), the National Institutes of Health (NIH), the Centers for Medicare & Medicaid Services (CMS), and other related departments. Kennedy is known for radical views – including skepticism of vaccines and the biopharmaceutical industry – and news of the nomination caused healthcare stocks to sell off.

Kennedy’s appointment is not guaranteed and could take through the first quarter of 2025 to be confirmed, with potential policy changes only occurring thereafter. In the meantime, market participants will be left to weigh the range of possible outcomes from the nomination, which is likely to create a period of elevated uncertainty for the sector.

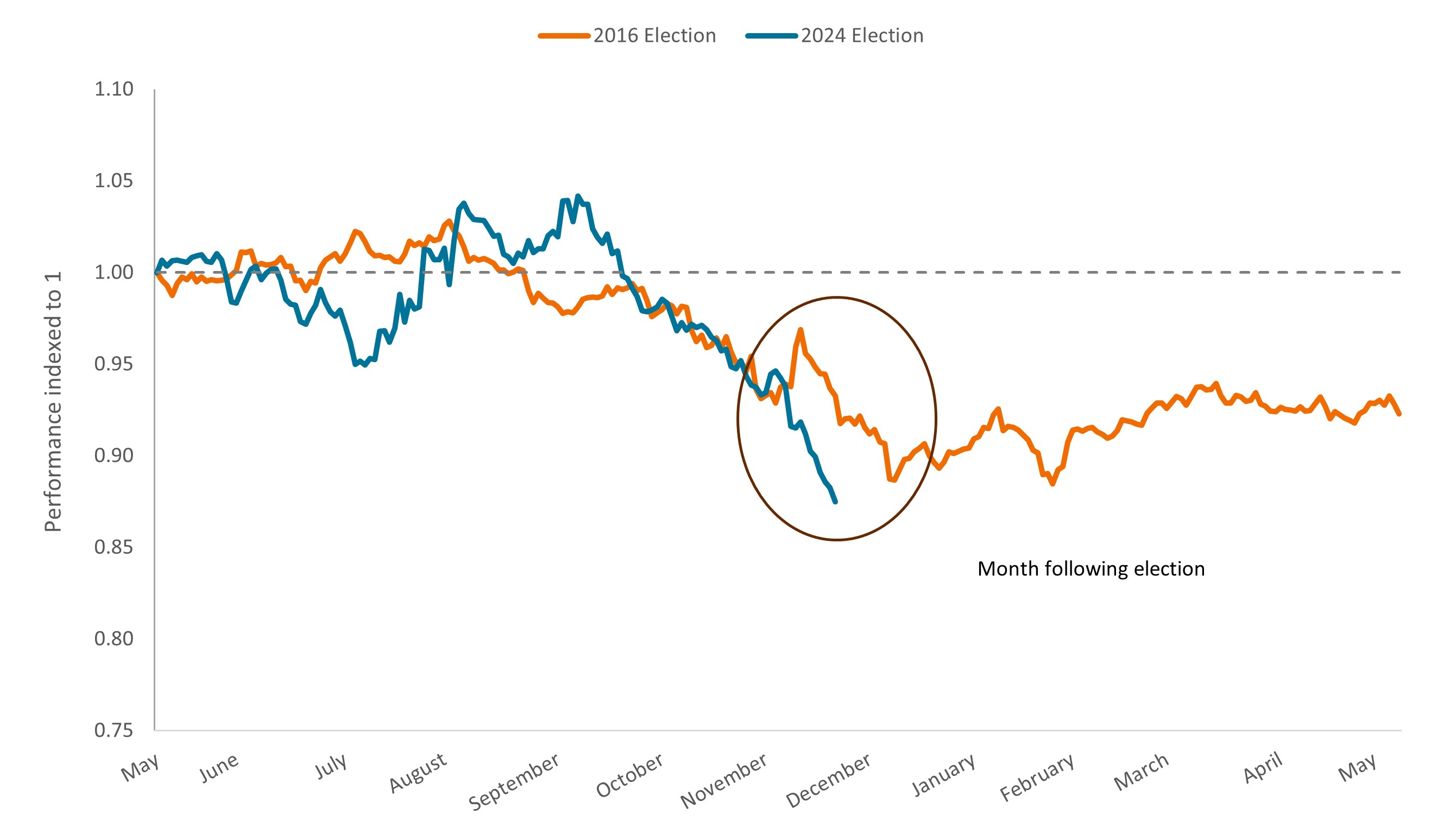

Fear vs. reality of policy change

In short, this has not been an ideal start to the new presidential cycle – but it’s also not something we haven’t seen before. In 2016, when Trump was first elected, healthcare stocks sold off in the weeks following the vote as the president-elect criticized high drug prices and vowed to replace the Affordable Care Act (ACA), the landmark legislation that created the public insurance market (Figure 1). The comments then, like now, led to heightened uncertainty over the short term but eventually subsided as the reality of what the new administration could accomplish came into view.

Figure 1: Total return of S&P 500® Healthcare Sector relative to S&P 500® Index

Performance six months before and after U.S. election

Source: Bloomberg. Data for 2016 election are as of 8 May 2017, and for 2024 election, as of 19 November 2024. The S&P 500 Healthcare Sector comprises those companies included in the S&P 500 that are classified as members of the GICS® health care sector.

We expect something similar could happen this time. To be sure, some of Kennedy’s positions are unorthodox, if not concerning. A well-known vaccine skeptic, he has linked childhood vaccinations to autism and claimed that vaccines are inadequately tested. He has also been critical of the biopharmaceutical industry, calling for an end to the so-called user fees the industry pays the FDA to help fund drug reviews. In addition, Kennedy has flagged the disparity in drug prices paid in the U.S. versus other countries and has threatened to remove FDA staff he deems as acting in the interest of the food and pharma industries, not public health.

The sum of these and other Kennedy agenda items has alarmed investors. But when taken point by point, it becomes clear that, in practice, many ideas would face obstacles or lack bite. To take a few examples:

- Reducing FDA resources would require Congressional backing. Federal law limits the ability to fire significant numbers of employees, so eliminating staffing at the FDA would be difficult to carry out without Congressional intervention. Similarly, the user fees paid by biopharma are protected by the Prescription Drug User Fee Act (PDUFA), which has been reauthorized regularly by Congress since its passing in 1992 and is not up for renewal until the end of 2027. Furthermore, it is widely agreed that PDUFA has been instrumental in accelerating new drug launches, and we believe the Trump administration would be reluctant to be seen as hindering innovation, as greater access to new therapies for cancer and other severe diseases has long received bipartisan support. Indeed, Vivek Ramaswamy, a former biotech executive who was named co-chair of the newly formed government efficiency advisory panel, has said he’d like to speed the delivery of new drugs to market by removing bureaucratic hurdles at the FDA.

- Vaccines are highly unlikely to be removed from market. The medical community has been outspoken about the value of vaccines after two centuries’ worth of use and has raised alarms about what happens when public opinion turns against vaccinations. Such backlash could explain a recent shift in Kennedy’s rhetoric, in which he has clarified he is more concerned with helping citizens make informed decisions about vaccines, not blocking access. In addition, a lengthy legal process based on strong scientific evidence would be needed to remove vaccines from market and, undoubtedly, would be met with many challenges in court.

- Drug pricing policy is likely to continue under existing Inflation Reduction Act (IRA) rules, which allow Medicare to negotiate pricing for select drugs (and which investors have already adapted to). Like Trump during his first administration, Kennedy wants to level the playing field for drug prices, writing in a recent op-ed that “legislators should cap drug prices so that companies can’t charge Americans substantially more than Europeans pay.” As such, there is some chance that the “most favored nation” policy (introduced during Trump’s first term) could be revived during Medicare drug price negotiations, which would cap U.S. drug prices to the lowest prices charged in developed market economies. However, we see this as unlikely given the negative impacts it would have on the biopharma industry and Republicans’ long-held stance that drug price controls hurt innovation. Legislation would also be required to enact such a change and may not be prioritized given other agenda items, such as tax policy.

Staying focused on innovation, value

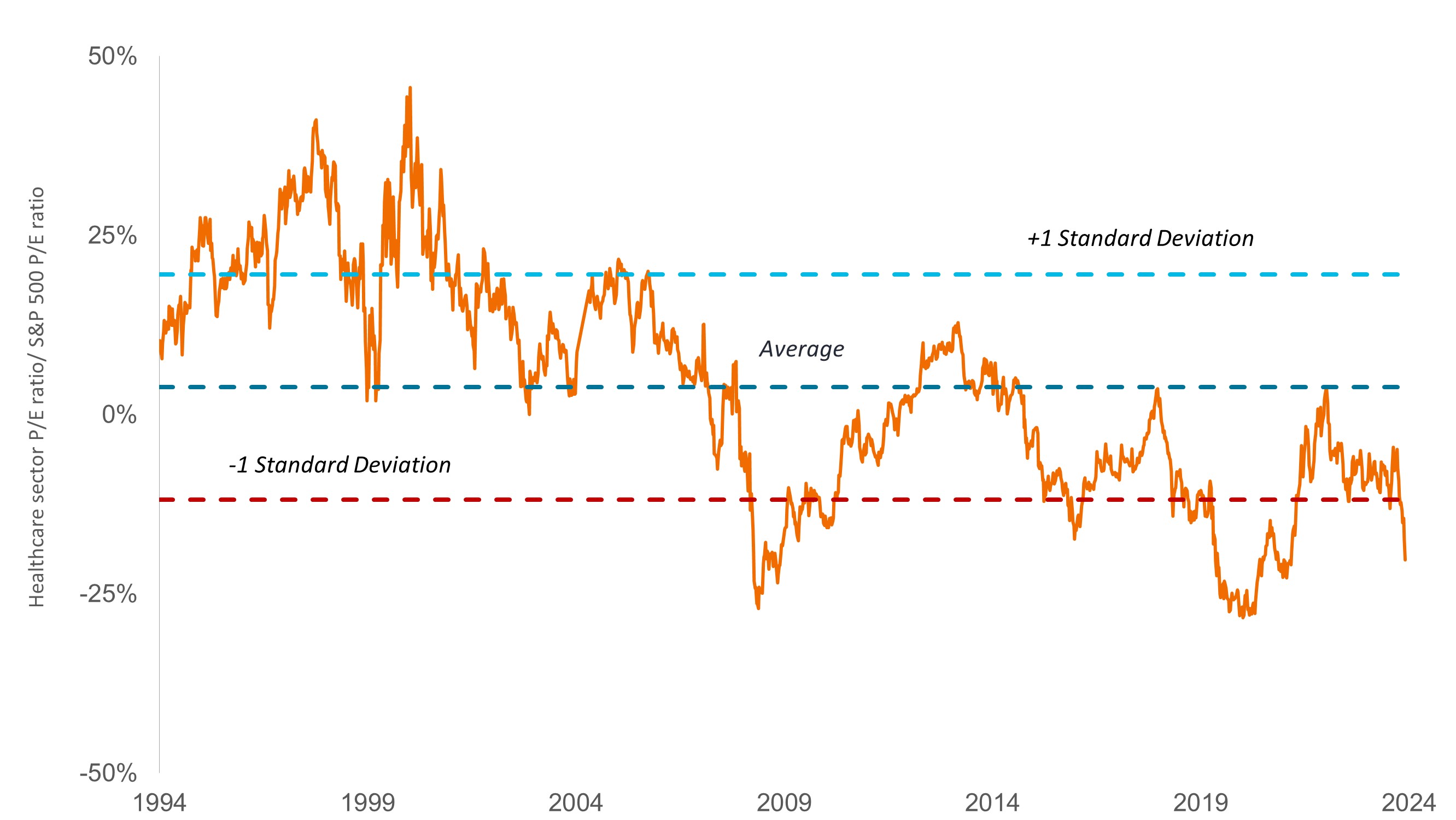

For now, investors will have to wait and see. The market’s initial reaction to Kennedy’s nomination has left the S&P 500 Healthcare Sector trading at a deep discount to the broader index (Figure 2).

In our view, valuations are no longer giving sufficient credit to long-term secular growth drivers – namely, accelerating medical breakthroughs and rising global demand – as well as some potential positives of a Trump presidency. These include an expectation that the Trump administration will usher in deregulation and corporate tax cuts, which could ease the way for more mergers and acquisitions and boost healthcare earnings. Deregulation could also benefit insurers in Medicare Advantage, which over the past year came under pressure with respect to quality ratings and reimbursement.

Figure 2: The S&P 500 Healthcare Sector has grown deeply discounted relative to the broader equity market

Source: Bloomberg, data are weekly from 23 December 1994 to 15 November 2024. P/E=price-to-earnings ratio. P/Es based on estimated earnings for the next 12 months.

While we believe investors should brace for continued volatility as we head into 2025, we also think now is an opportune time to focus on companies advancing the standard of care for patients or improving outcomes and efficiencies for the healthcare system. To that end, the sector has been delivering in spades, with more than 110 FDA drug approvals over the past two years1 and no shortage of clinical data readouts expected in the coming year.

Innovation is occurring not just in drug development but also in medical devices, an area of the sector that so far has escaped unwanted attention and could offer some refuge amid the White House transition. In November, for example, two companies independently delivered positive data for implants that seal off the heart’s left atrial appendage, a pocket within the cardiac muscle wall that can increase the risk of stroke in people with atrial fibrillation (irregular heartbeats). The studies showed that both implants reduced the chance of stroke without the need for blood thinners, which can cause excessive bleeding and other negative side effects.

Managed healthcare could also be more positive. Last year, rising costs weighed on insurers’ earnings. Now, heading into 2025, companies have adjusted benefits and/or premiums to mitigate the impact on earnings, while medical utilization may begin to subside after a post-pandemic surge. Drug distributors could also be a source of resilience: The industry – which purchases, stores, and distributes medicines – is highly consolidated and today benefits from soaring demand for GLP-1 obesity and diabetes injections, new drug launches, and investment in specialty services that help keep customers loyal.

We also think investors should take comfort in the fact that, in the weeks following the election, biopharma companies continued to raise capital via secondary equity offerings, which contributed to some of these stocks’ outperformance relative to their peer group over that period.2 More deals could be in the offing before the end of the year/early 2025 in light of continued innovation across biopharma pipelines. In fact, it’s likely that 2024 could set a record for annual follow-on issuance by biotechnology companies – a sign that specialist investors still have confidence in the sector.

We remain confident in the sector, too, and believe investors who stay focused on fundamentals could weather this period of uncertainty to their potential long-term benefit.

1 Food and Drug Administration, from 31 December 2022 to 22 November 2024.

2 Leerink, as of 22 November 2024.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Standard Deviation measures historical volatility. Higher standard deviation implies greater volatility.

Volatility measures risk using the dispersion of returns for a given investment.

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.