Multi-sector credit: What if 2025 isn’t a Goldilocks year?

As central bankers shoot for a Goldilocks scenario for their economies, markets seem to believe the porridge is ‘just right’. Head of Secured Credit, Colin Fleury, asks what the risks are and the mixing conundrum for asset allocators.

8 minute read

Key takeaways:

- Central banks are on a quest for a Goldilocks (neither ‘too hot’ or ‘too cold’) economy, balancing growth and inflation through adjusting interest rates amid a complex backdrop of shifting political landscapes and conflicting forces.

- Diverging monetary policies and economic scenarios across regions necessitate a sophisticated global approach from asset allocators, who must navigate any rate volatility and unexpected economic outcomes.

- We believe short duration securitised debt and loans could help asset allocators build diversified portfolios that have attractive yields and defensive properties should the porridge turn out to be ‘too hot’ or ‘too cold’ in 2025.

Too hot or too cold?

For central bankers, navigating their economies to a Goldilocks scenario – where an economy is neither too hot or cold, with moderate growth and low inflation – is the coveted destination. ‘Too hot’ employment, inflation and growth could scupper this. On the flip side, cooling an economy too much could cause growth to undershoot target. The pace and magnitude of easing interest rates is their key tool.

Given the different political and macro conditions globally, central bank monetary policy is set to diverge in 2025 to target the ‘just right’ economic conditions. Turning to the UK, Europe and the US, markets expect the European Central Bank to cut most aggressively, followed by the US Federal Reserve and the Bank of England (BoE). This reflects Europe’s ‘too cold’ scenario in terms of sluggish growth, while the US is flirting with ‘too hot’, particularly if the Trump presidency results in a growth or inflation boost.

The UK growth outlook does not appear to be markedly better than continental Europe, but government policy and spending may complicate the picture for the BoE. While the expected path for short-term interest rates has remained downward across economies, recent rates volatility has been high, and the extent and pace of cuts has diverged. Changed political landscapes in the US, UK and now potentially Germany and France, add to the uncertainty in the quest for Goldilocks.

As asset allocators, we are facing our own kitchen conundrum in getting the porridge ‘just right’ in our portfolio asset mix to navigate 2025. There is the risk of ‘too hot’ rates volatility, such as a ‘higher for longer’ rate narrative materialising, which could come with a better growth outlook (or may just be the result of unexpected inflationary pressures). This may be an environment that favours high credit quality and short duration securitised or variable rate corporate loans. There is also the ‘too cold’ risk of weaker macro conditions and lower interest rates than currently expected, where even though coupon income may decline with market interest rates, the defensive properties of investment grade securitised debt could prove valuable.

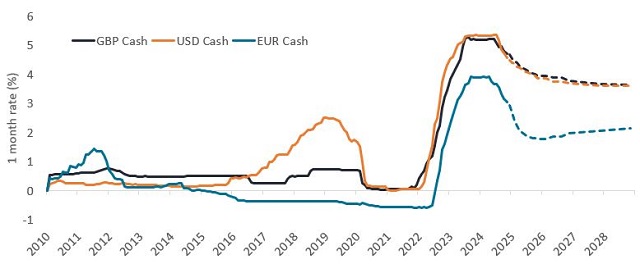

It is also important to consider when building diverse portfolios that even though market expectations are for cash rates to decline, they are forecast to remain relatively high, particularly in the US and UK. When combined with the credit spreads on offer from a diverse fixed income portfolio where securities are selected based on credit fundamentals, the overall prospective yield remains attractive.

Figure 1: Cash rates expected to stay relatively high

Source: Janus Henderson, Bloomberg, ICE, as at 26 November 2024. Forward rates based on GBP, USD and EUR OIS curves as at 26 November 2024. Notes: 1M Libor up to 31 December 2020 then SONIA, ESTR, SOFR 1M rates.

There is no guarantee that past trends will continue, or forecasts will be realised.

Consumers and corporates stay resilient

Despite this macro and political uncertainty, we enter 2025 with both corporates and consumers in decent shape and a banking sector that feels generally sound. The rapid growth of private credit funds in recent years has also reduced reliance on banks for corporate capital needs. When analysing the performance of securitised collateral pools, we have seen some weaker consumer cohorts show increasing delinquency, but generally not far beyond more normal pre-COVID levels. Overall, this cycle does not appear to have seen overly aggressive lending to either consumers or corporates. So while the economic cycle is uncertain, we are not overly concerned that 2025 could bring a material spike to corporate or consumer defaults.

Nevertheless, to prepare for potential downside risks, we are aiming to ensure multi-sector credit portfolios capture defensive properties. An example of this is sub investment grade leveraged loans, which when securitised into collateralised loan obligations (CLOs) have higher credit quality and downside protection from credit enhancement1, as well as broadening the opportunity set away from high yield for asset allocators to find the right risks.

Searching for value

Generally, credit spreads in fixed income markets are tight versus long term history and are largely fully pricing in a relatively benign economic landing. However, we see a couple of relative bright spots in loans and securitised debt. Credit spreads in these asset classes are generally more mid-range versus their long-term history, offering both somewhat better carry2 and a more positive distribution of potential market moves. They are also typically floating (variable) interest rate or relatively short duration, which currently provides extra income, while cash rates remain elevated. If rates decline as forecasted in Figure 1, this would broadly bring them in line with current longer-term interest rates (in other words it is ‘priced in’). There is also clearly the ‘too hot’ scenario where cash rates remain higher than expected and floating rate characteristics prove even more valuable.

Figure 2 compares some characteristics of AAA CLOs and B rated loans to broad investment grade and B rated corporate bond indices respectively. This shows the better credit spreads available in AAA CLOs versus investment grade, despite better credit quality and shorter spread duration (sensitivity to market price moves). Current income is also materially better due to elevated cash rates.

We also compare single B European loans to single B high yield bonds, both sources of financing for large corporate borrowers. There is some overlap between the universes, with 50 issuers accessing financing through both bonds and loans3, but loans also open up access to different issuers and therefore risks. Loans are floating rate, while high yield is mostly fixed rate. Single B rated loans offer superior risk-adjusted return potential, with higher credit spread, income and yield versus high yield (Figure 2). In terms of defensive characteristics, B rated loans are secured, while high yield can include unsecured risk (approximately 20% of the single B index is unsecured4).

Figure 2: Characteristics of European AAA CLOs versus Euro IG and B-rated loans versus B HY credit

| European AAA CLOs | Euro IG | B Loans | B High Yield | |

| Credit spread (bps)1 | 110 | 91 | 423 | 354 |

| Income (%)2 | 3.5 | 2.5 | 6.6 | 5.9 |

| Yield (%)3 | 3.3 | 3.1 | 6.4 | 5.9 |

| Average rating | AAA | A- | B | B |

| Spread duration (years)4 | 3.0 | 4.6 | 3.7 | 2.3 |

Source: Janus Henderson and ICE Indices (ER00 and HE20 subgroups), JP Morgan (Euro CLOIE AAA Index), as at 25 November 2024.

1 For CLO, used the Discount Margin (the average expected return earned in addition to the index underlying, or reference rate) of the floating rate security, for corporate credit used Swap Option-Adjusted Spread.

2 For CLO, income is calculated as credit spread plus 1-year Euro SWAP rate; for corporate credit used the running yield (coupon divided by current price).

3 For CLO, Yield is calculated as credit spread plus relevant tenor Euro SWAP; for corporate credit used Yield-to-Worst.

4 Spread duration risk measures how much a bond’s price changes in response to changes in credit spreads.

Counterbalancing forces

While central bankers are toying with balancing inflation and growth to reach Goldilocks, asset allocators are on their own Goldilocks quest to capture alpha and defensive properties in portfolios. For fixed income investors, this is concocting a ‘just right’ asset mix for portfolios. Given generally tight fixed income credit spreads, benign default expectations and a reasonable pace of easing priced into markets, a ‘soft’ landing is the most anticipated outcome.

Markets assume the porridge is ‘just right’, but there are risks it could be ‘too hot’ or ‘too cold’. On the ‘too hot’ side, rates could end up higher than expected as government spending complicates rate cuts and perhaps inflation isn’t beaten as hoped. On the ‘too cold’ side, central banks could fail to engineer the ‘soft’ landing and in a worst-case scenario, we are tipped into broad recession. The path ahead is uncertain and so balancing portfolios considering both scenarios makes sense.

Attractive carry is still available in fixed income, particularly on the short end of curves. The careful balancing act for asset allocators can also be through managing duration. For example, creating a diversified portfolio that has high credit quality, attractive front-end yield from floating rate debt alongside some diversification through longer-dated investments, such as high yield. Building diversified portfolios – mixing that ‘just right’ porridge – across fixed income markets will be key, in our view, to delivering performance in 2025.

Footnotes

1 Credit enhancement is a strategy in securitisation to improve the credit quality and ratings of asset-backed securities. It’s a key part of securitisation transactions and is used to reduce the risk of default for the issuer.

2 Carry: A typical definition is the benefit or cost of holding an asset. For a bond investor this includes the interest paid on the bond and potential gains or losses from currency changes.

3 Source: Bloomberg. As at 19 November 2024.

4 Source: Bloomberg, as at 27 November 2024.

Note: High Yield Corporate Bonds refers to ICE BofA European Currency Non-Financial High Yield 2% Constrained Index. Corporate Loans refers to CS Western European Leveraged Loan Index.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.