Equity markets in Japan have been stuck in a low growth, deflationary macro environment for decades since the economic bubble burst in the early 1990s – but all this could be about to change, with potential for the property sector to be a key beneficiary.

What is supporting our positive view? A confluence of favourable factors is at play. An accommodative central bank, that still has one eye on the rear-view deflationary mirror, and an eagerness by corporates to unlock the considerable value on balance sheets, which has been hidden for years and is now being realised through corporate reforms. This provides the almost perfect backdrop for a possible continuation of the strong performance that we have already seen from Japanese equities year-to-date in 2024.

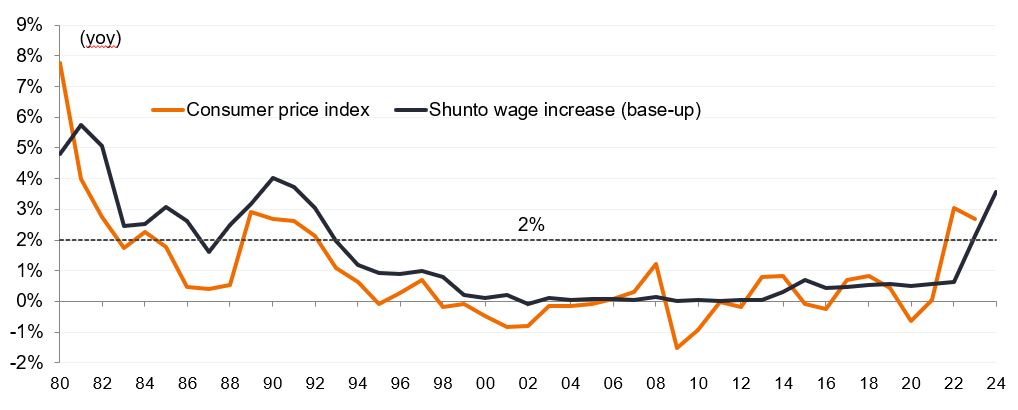

A sustainable virtuous price-wage inflation cycle is key

For almost two years we have seen inflation in Japan hover around the 2% target level. Wage growth has returned and is running at the highest rate in decades. The crucial point in determining the sustainability of this turnaround and answering the “is it different this time?” question, is whether the virtuous cycle between price and wage inflation will continue. The government and corporate Japan are certainly keen to keep the party going. This requires companies to shift their focus away from cost cutting and hoarding cash, to driving revenue growth and increase domestic investments.

Chart 1: Price and wage inflation

Source: Rengo, MHLW, UBS Japan economics team.

Corporate reforms are driving real change

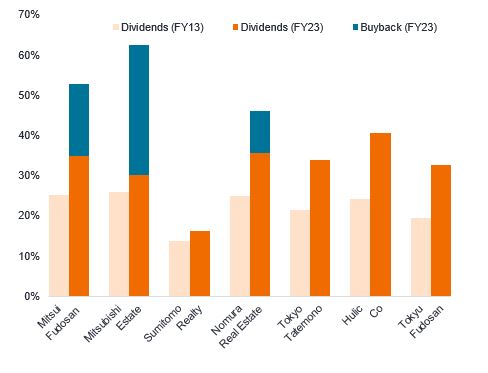

Another area of excitement stems from corporate reform that began with ‘Abenomics’ more than a decade ago. We can see a continuation of this support in a wide range of measures and efforts. Among these are the Tokyo Stock Exchange, which is putting pressure on companies to be better stewards of shareholder capital and improve disclosures, and regulatory changes in areas like mergers and acquisitions (M&A) to facilitate consolidation. Meanwhile, the role of activist investors is increasing. On the corporate front, businesses are beginning to refocus on the cost of capital and shareholder returns by setting return-on-equity (ROE) targets, selling non-core holdings and cross shareholdings, as well as increasing dividends and buybacks. Such companies have typically seen a positive impact on their share price performance, while those that have not adopted these measures are being left behind.

Chart 2: Japanese equities – dividends and buybacks enhancing total shareholder returns

Source: UBS Quantitative Research as at 22 May 2024, FactSet, fiscal year-end 2011 to fiscal year-end 2024 year-to-date. Past performance does not predict future returns.

Through our interactions with Japanese real estate companies over the past decades, we sense a positive change in attitude and believe this will continue to improve over time. Indeed, we have begun to see some of these changes already with the recent release of companies’ medium-term (three to five years) management plans, including forecasts and guidance.

Chart 3: Japanese developers’ total shareholder returns are improving

Source: UBS, Janus Henderson Investors analysis, as at 31 May 2024. There is no guarantee that past trends will continue, or forecasts will be realised.

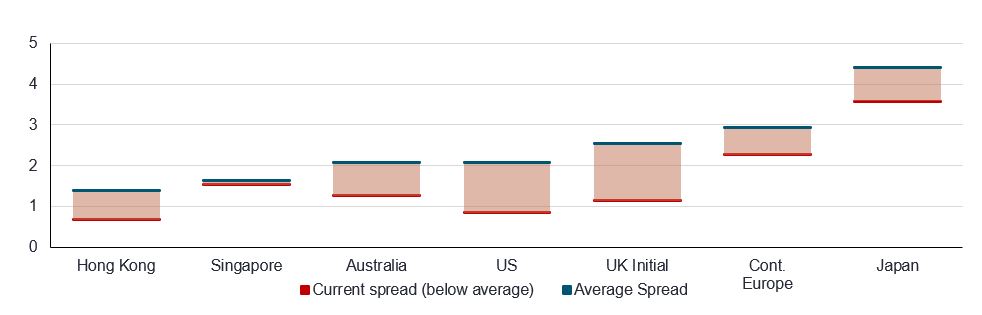

Potential for a strong turnaround story with supportive valuations

Japanese real estate is likely to be one of the key beneficiaries of the positive wage-price inflation cycle. Rising rates are well-anticipated by the market, with the 10-year JGB (Japanese Government Bond) yield recently hitting a 13-year high. Most investors expect that the Bank of Japan will increase rates gradually to ensure inflation is sustainable at these levels and that there remains a positive property yield spread (difference between property yield and bond yield); certainly much wider than other real estate markets globally to be able to absorb the higher rates.

Chart 4: Japan well positioned to absorb gradual rate rises

Property yield spreads vs 10-year bond yields (%)

Source: Datastream, CBRE, Jones Lang LaSalle, IPD, NCREIF, UBS estimates. The overall region cap rates are based on weighted average of sub sectors. Cap rates as of last available data points and 10-year bond yields as of 9-May-2024. Note: Current cap rate spreads calculated based on 10-year bond yields as of 9-May-2024.

In the listed space, valuations of real estate companies currently remain attractive and supportive of further re-rating over time, particularly for companies that have been focused on corporate reforms to deliver better shareholder returns.

Chart 5: Japanese developers’ historical price to net asset value

Source: UBS, Janus Henderson Investors Analysis, as at 31 May 2024. Price-to-NAV (P/NAV) ratio shows the company’s share price to the net asset (or book) value per share and is used as an indicator of how much investors are prepared to pay per $1 of net assets. There is no guarantee that past trends will continue, or forecasts will be realised.

Imperative to be selective

In our view, Japan is the most exciting region in Asian property right now.

This matters as Japan makes up almost half of the listed real estate investment universe in Asia. However, we believe it is crucial to remain selective as it will not likely be a case of a “rising tide lifts all boats”.

This is because not all sectors have the pricing power to increase rents due to different property dynamics and lease structures. Property fundamentals will continue to drive returns; those sectors with the strongest growth, like hotel, high street retail and residential, look well placed to benefit from strong inbound tourist demand and positive wage growth.

Perhaps somewhat surprisingly, not all companies are embracing corporate reforms and as a result, are missing out on the potential for multiple (valuation) re-rating. Investors should look to avoid these companies. Instead, they should look to companies with management teams who after many years of cajoling, are finally starting to embrace corporate reforms. This will allow them to unlock the treasure trove of hidden value that has up until recently, remained beyond the reach of shareholders.

Abenomics: a series of economic policies introduced by former prime minister Shinzo Abe in late 2012 included more liberal use of fiscal and monetary policy, as well as structural reforms to improve Japan’s competitiveness in global markets aiming to turnaround Japan’s sluggish economy.

Bond yield: the level of income on a security, typically expressed as a percentage rate. For a bond, this is calculated as the coupon payment divided by the current bond price. Lower bond yields equate to higher bond prices.

Capitalisation (cap) rate: is calculated by dividing a property’s net operating income by its asset value. It is an assessment of the yield of a property over one year. Generally, the higher the cap rate, the greater the risk and return.

Net Asset Value (NAV): the total value of an asset minus outstanding debt and fixed capital expenses.

Property yield: the annual return on the capital investment usually expressed as a percentage of the capital value.

Re-rating: occurs when investors are willing to pay a higher price for shares, usually in anticipation of higher future earnings.

Return on equity (ROE): a company’s net income (income minus expenses and taxes) over a specified period, divided by the amount of money its shareholders have invested. It is used as a measurement of a company’s profitability, compared to its peers.

Share buybacks: where a company buys back their own shares from the market, thereby reducing the number of shares in circulation, with a consequent increase in the value of each remaining share. It increases the stake that existing shareholders have in the company, including the amount due from any future dividend payments. It typically signals the company’s optimism about the future and a possible undervaluation of the company’s equity.

IMPORTANT INFORMATION

REITs or Real Estate Investment Trusts: invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally, REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.