Multi-Asset Quarterly Outlook: Fortunes diverge as the cycle extends

Global Head of Multi-Asset Adam Hetts and Portfolio Manager Oliver Blackbourn discuss how an extended cycle may bode well for riskier assets over the short term but introduces the risk that policy rates stay elevated, creating a headwind for bonds.

9 minute read

Key takeaways:

- Economic prospects are diverging, with resilience in the U.S. potentially delaying rate cuts while the eurozone and China are likely already in need of supportive policy.

- After initially rallying in anticipation of a dovish turn, bond yields now better reflect a higher-for-longer rates scenario than do equities.

- The dominance of a few richly priced mega-cap stocks obscures more attractive valuations across a range of equity market segments.

Earlier this year, we stated that investors were not yet out of the woods with respect to economic or financial market risk. A few months on, the likelihood of a soft landing in most jurisdictions has increased. Central banks like the Federal Reserve (Fed) now face a dilemma: Should they cut too soon, inflation could stabilize at a higher-than-desired level; overly restrictive policy, on the other hand, could further weigh on economic activity, increasing the probability of a hard landing.

In light of a steady U.S. economy, the futures markets imply three 25 basis-point (bps) reductions this year compared to prior expectations of up to seven cuts. The bond market has been quicker to price this in than have equities, with yields across the curve markedly higher than they were at the onset of 2024. In contrast, stocks have moved from strength to strength. However, when excluding the handful of mega-cap U.S. names that have dominated markets, valuations appear closer to fair value. The same holds true for European equities, which could benefit from both imminent rate cuts and a bottoming of the cycle.

In a new twist, the likely policy path following a soft-landing scenario could increase the odds of a fiercer, rates-driven contraction down the road. And as evidenced by this year’s divergence between global sovereigns and equities, what’s already priced in should be an essential consideration when seeking to capture excess returns over the near- to mid-term.

The Economy: Delay does not mean never

With economic – and thus policy – trajectories diverging, it’s important to ask not only which asset classes to prioritize, but also where? In continuing the 2023 trend, the U.S., in our view, is still best in class in terms of economic growth. Consumption has remained strong as real wage growth – thanks to declining inflation – has taken the baton from pandemic-era excess savings. Furthermore, after a period of goods hording followed by revenge tourism, consumption has become more balanced, with both goods and services returning to trend. Strength in the latter category, however, is a contributor to wage-driven inflation, especially as the labor market remains relatively tight.

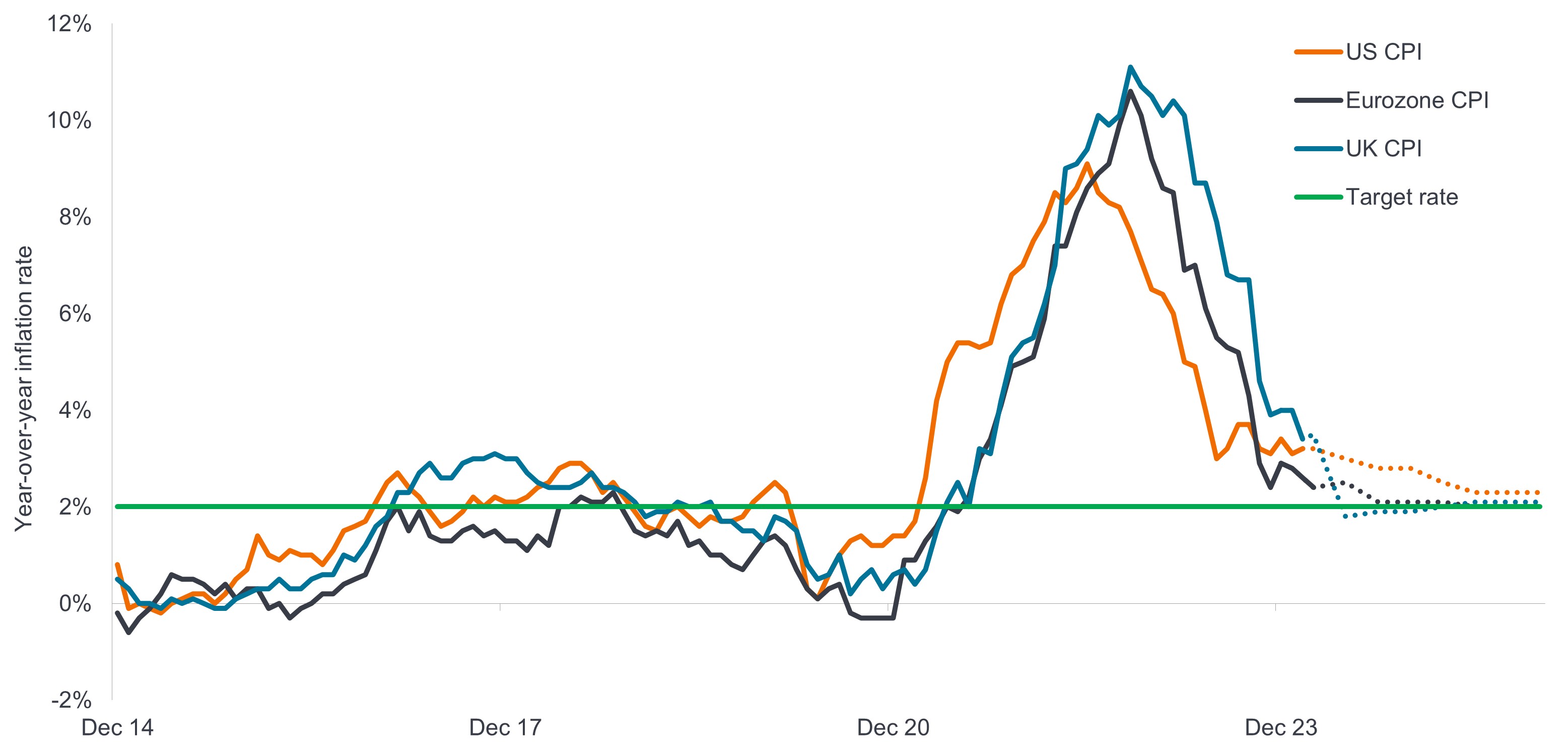

Headline inflation returning to target

Behind the expectation of policy rates receding from restrictive levels is inflation falling considerably across many jurisdictions.

Source: Bloomberg, Janus Henderson Investors, as of 5 March 2024. Note: Dotted lines represent Bloomberg consensus forecasts.

In Europe, signs are emerging that a period of pronounced economic weakness may be turning. New orders in key regions are outpacing inventories, and German exports have picked up. The eurozone’s economy may soon get an assist in the form of rate cuts by the European Central Bank (ECB). This is made possible by a considerable decline in inflation, although that is partly due to weak consumption.

In Asia, as evidenced by the Bank of Japan recently stepping away from some of its policy accommodation, there is the possibility that the country is finally emerging from its multi-decade deflationary funk. While it’s not facing broad-based price declines, China appears to be moving in the opposite direction. Importantly, the lifeline of policy support that many expected from the central government has yet to arrive. The debt overhang concentrated in the country’s property sector and in municipal and provincial governments could mean that the favored stimulus channel of construction spending has run its course.

Inflation is on the retreat across nearly all major jurisdictions, meaning that we’ve almost certainly reached peak interest rates in this policy cycle. Despite the progress, many countries will find it more challenging to go from current levels to their inflation targets than it was to come off cycle peaks.

Sovereign Bonds: It all begins with rates

In any cycle, interest rates serve as both a barometer of and instrument for calibrating economic health. With the onset of rate cuts delayed, the consensus view that sovereign yields would inevitably decline has been upended. This is primarily due to U.S. resilience. Consequently, we have a neutral view toward global sovereigns and a negative tilt toward U.S. Treasuries.

The eurozone and UK are navigating the conflicting prospects of keeping rates at restrictive levels due to wage-driven inflation versus lowering them to offset sluggish growth. Should inflation continue to drift lower and the anticipated cyclical recovery prove slow, the eurozone will likely be in pole position for a rate cut among advanced economies. With that, we hold a neutral tilt toward the regions’ sovereign markets.

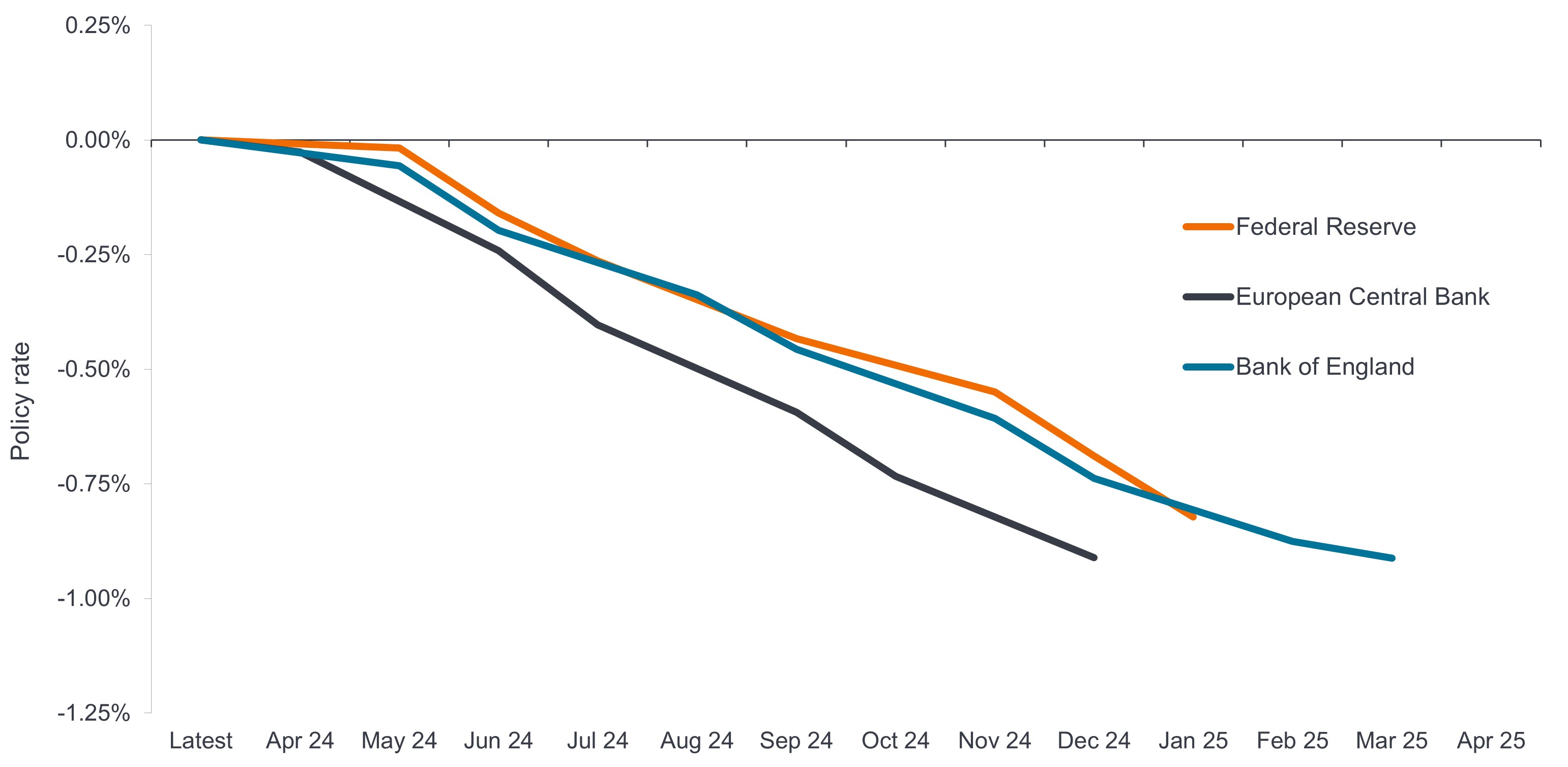

Market-based interest rate expectations

A shallower trajectory for interest rate reductions is indicative of a resilient economy, which may help cyclically exposed assets while creating additional headwinds for sovereign bonds.

Source: Bloomberg, Janus Henderson Investors, as of 2 April 2024.

Credit: Narrow spreads but better than the alternative?

The delay in rate cuts that doused the rally in sovereigns did little to quell enthusiasm for corporate credits. We have less enthusiasm on U.S. investment-grade and high-yield issuance, but that’s premised on limited upside – due to full valuations – rather than any impending disaster. In fact, corporate balance sheets, in aggregate, are healthy, with interest costs as a percentage of operating profits at very low levels. The reason for this is astute management teams locking in low rates well into the future. As a result, default rates have yet to flash caution. It remains to be seen how companies navigate rolling over debt once they reach their maturity wall in what will likely be a period of higher financing costs.

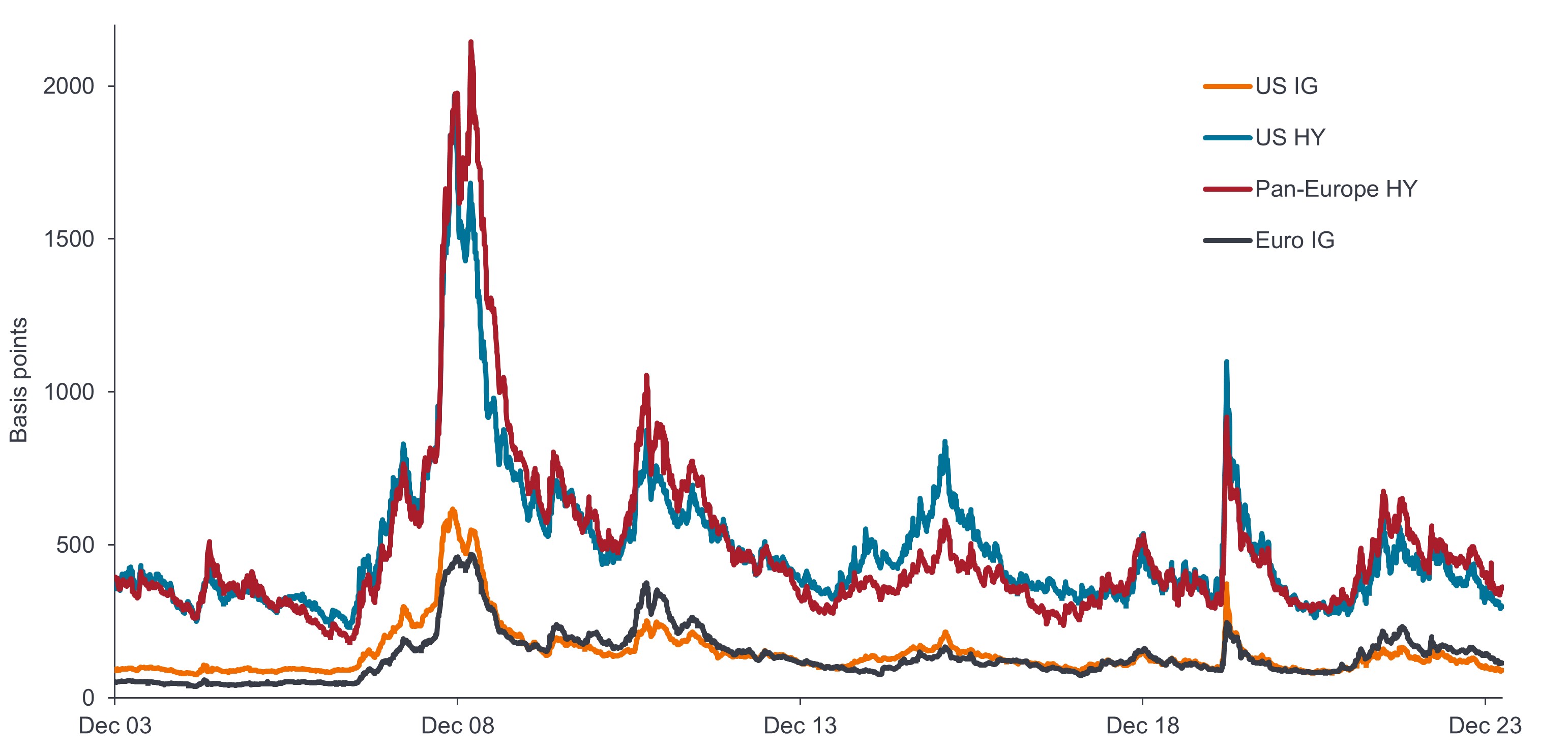

U.S. and European credit spreads

Narrow credit spreads are not only a reflection of economic resilience – namely in the U.S. – but also of corporations having locked in low rates, a tactic that has kept defaults at comfortable levels.

Source: Bloomberg, as of 1 April 2024.

Internationally, we have a more favorable view of European investment grade given the likelihood they will benefit from near inevitable cuts by the ECB. Despite nascent signs of hope that the European economy is finding its footing, flagging consumption can only cause us to justify a neutral tilt toward the region’s high-yield issuance.

Emerging market (EM) hard currency sovereigns are more difficult to judge. Investment-grade spreads are notably narrow while high-yield valuations appear more attractive. We do, however, maintain a cautious tilt toward local currency EM debt as the higher-for-longer rate scenario in the U.S. not only provides a safer alternative to these issuers, but also pressures EM currencies, diluting returns in U.S.-dollar and other hard currency terms.

Equities: Dispersed outcomes

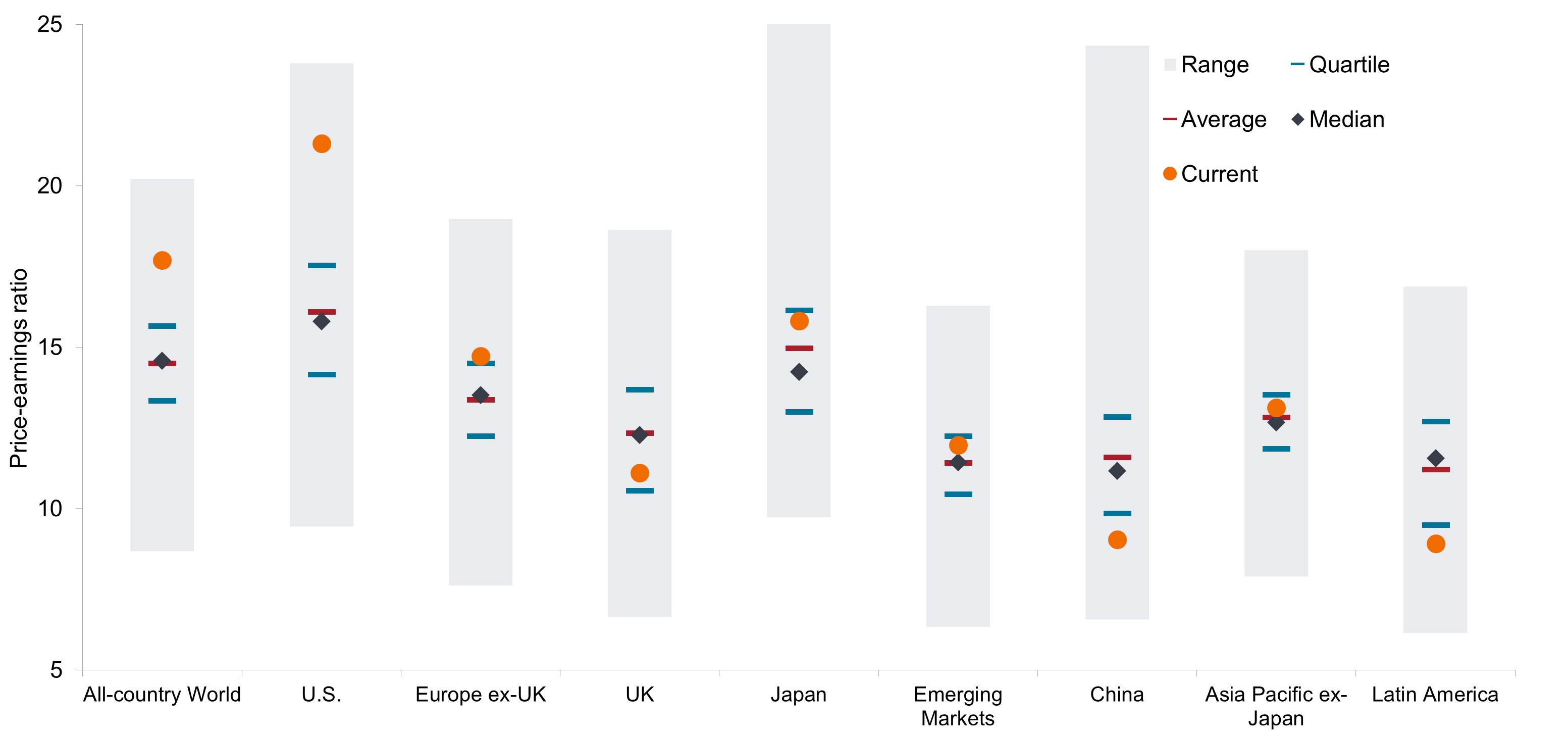

It’s impossible to discuss equities without acknowledging the market’s narrowness thanks to the dominance of a handful of U.S.-domiciled mega-cap stocks. Looking exclusively through a valuation-based lens at market-cap weighted indices, a neutral tilt is all that global equities can presently muster. Peeling back the layers, however, we see pockets of opportunity but also areas where even more caution is merited.

We have little doubt that many large-cap U.S. stocks leveraged to secular themes like artificial intelligence (AI) are capable of compounding earnings over an extended period. However, in aggregate, corporate earnings in the U.S. may have already reached their cycle peak. With that tailwind removed and the additional one of falling rates – especially beneficial to growth stock valuations – delayed, the prospects for additional upside appear limited. An extended cycle, on the other hand, should benefit more cyclically oriented value stocks as their earnings runway is prolonged.

Global equity valuations

Beneath the headline valuations that are skewed by a small number of mega caps with high earnings multiples, many segments of the equities market appear closer to fair value.

Source: Datastream, Janus Henderson Investors, as of 29 March 2024. Note: P/E ratio ranges and averages based on past 20 years.

The recent affirmations that major central banks intend to cut rates over the rest of the year, despite above-target inflation and still-solid growth forecasts, bodes well for smaller companies. This segment of the equities market tends to be more leveraged than larger-cap peers, and the rise in interest rates has been painful, exacerbated by smaller companies’ higher exposure to floating-rate loans and shorter maturities.

However, a decrease in borrowing costs amid a resilient economy could lead to improving earnings. Furthermore, small-cap valuations look less demanding than those of large caps. There is meaningful implementation risk in this space, given the share of unprofitable companies in the small-cap benchmark has reached a higher-than-usual 40%, making security selection paramount. Midcaps show similar promise and provide generally better fundamentals due to their lower debt loads.

While it’s a big ask for U.S. stocks to beat earnings expectations at their cyclical peak, Europe has a better chance of exceeding its low bar of 2% growth for 2024. The cyclical nature of Europe, along with many other ex-U.S. economies, means that their companies’ earnings should benefit from an extended cycle, and in the case of the former, eventual rate cuts.

The (near) end of Japan’s decades-long experiment with accommodative policy should lead to a strengthening of the yen. That may seem incongruent with the Japanese currency reaching a 34-year low against the U.S. dollar, but on the other hand, the combination of such a low starting point and less policy rigidity could lead to currency appreciation. As a strengthening yen can act as a headwind for Japan’s export-oriented economy, we believe a neutral tilt toward Japanese stocks is merited.

Without a positive policy catalyst, our preferred tilt toward Chinese equities is negative. Elsewhere in emerging markets, an extended economic cycle may help earnings, but the longer the dollar is buttressed by 5.50% policy rates, the harder it will be for investors to justify a more than neutral tilt toward EM ex-China equities.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Bond prices generally move in the opposite direction of interest rates, thus bond prices may decline as interest rates rise, and vice versa.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Excess Return indicates the extent to which an investment out- or underperformed an index.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Smaller capitalization securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalization securities.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.