Words matter. Since the Chairman of the US Federal Reserve (the Fed) intimated that the central bank might be done hiking rates in June last year, investors were treated to an early Christmas present, which saw markets rally hard, with listed property equities amongst the biggest winners.1

As listed real estate investment trust (REIT) specialists, sometimes we forget that the wider investing public may not always recognise or be following the nuances of commercial real estate (CRE), let alone the role of listed REITs within the asset class. So, after the stellar run since early November last year, three key questions for investors are: What is priced into real estate equities today? What should they expect going forward? And does the public versus private market opportunity still exist?

Party pooper!

Over the past couple of years, we have witnessed changes in capital markets, most notably in government bond yields, that are unprecedented in terms of magnitude and rapidity. Specifically, the US 10-year Treasury yield advanced from less than 1% to 5% over the course of about 36 months, and then fell back down to about 4% in the last two months of 2023.2 This kind of seismic volatility should typically drive a corresponding response in the price of any asset, like fixed income or real estate, that is directly or indirectly priced relative to the risk-free rate.

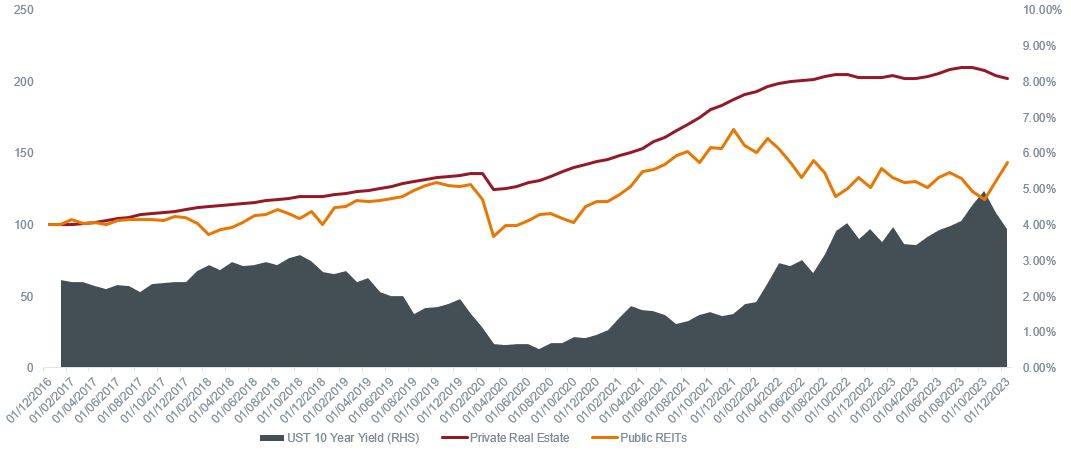

We often speak to clients who are worried about the downside risk to real estate valuations. These concerns are valid, but are far more relevant to valuations reported by privately-owned commercial real estate (which represent the vast majority of all CRE). Using the world’s largest non-traded REIT – Blackstone Real Estate Income Trust as a gauge, private real estate valuations remain frozen in an interest rate regime that no longer exists. In contrast, public REIT share prices have reacted to changing interest rates in real time given they are valued by the market daily.

Public versus private real estate pricing reconverging?

Source: breit.com, Bloomberg, Janus Henderson Investors analysis as at 31 December 2023. BREIT (Blackstone Real Estate Income Trust) used as a proxy for private real estate and FTSE Nareit Equity REITs as a proxy for public REITs. Indexed to 100 from BREIT inception in 2017. Past performance does not predict future returns.

The recent and rapid move down in interest rates is a result of markets taking on the view that the Fed’s aggressive hiking cycle has ended. Although past performance is not a guide to future returns, listed REITs have historically been among the best performing equities following a cycle’s final Fed hike.3 Whilst it remains early days since the “pivot party” began, we are encouraged by the fact that since 1 November, real estate was the best performing sector within the S&P 500 to the end of December 2023.4 Here it’s important to remember that stock prices are inherently forward looking, and that because the market helped public REITs discard stale valuations, they were in a position to rebound in response to a favourable move in rates. While the ride may be bumpy, there is reason to believe falling rates will be a tailwind for REIT share prices similar to how rising rates were a headwind over the past few years.

Pass the (debt) parcel

Another concern we hear from clients relates to leverage (debt levels) within commercial real estate, delinquent loans, difficulty in refinancing low coupon debt and potential defaults. Again, these concerns are valid and again they pertain mainly to privately-owned CRE. Bank lending and commercial mortgage-backed securities (CMBS) are two primary debt sources for private commercial real estate in the US. Debt issuance volumes from each of these were down 67% and 40% respectively over the first nine months of 2023 (most recent data available).5

Conversely, public REITs are predominantly investment-grade borrowers in the unsecured bond market, and have had continued access to debt capital. US REIT bond issuance was up 65% year-on-year in 2023 and is already off to a strong start in January 2024 with some deals oversubscribed multiple times.6

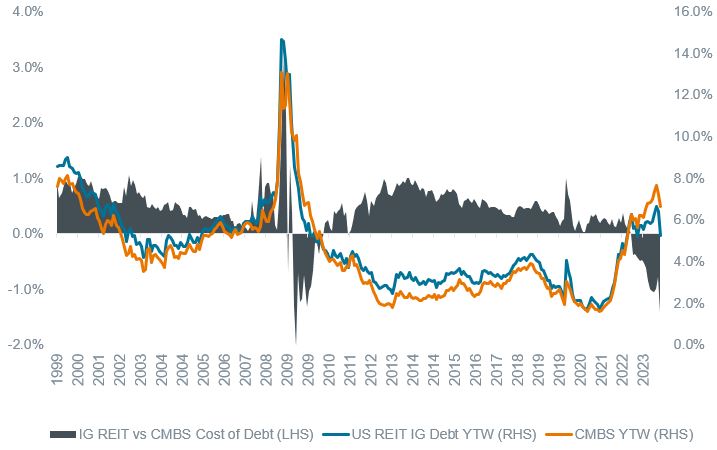

In addition, the cost of debt for investment grade REITs is as favourable relative to the CMBS market (a proxy for private real estate cost of debt) as it has been since the Global Financial Crisis. It’s noteworthy that public REITs typically operate with far less leverage (about 35%) than private real estate (about 60%+).7 This allows for opportunistic equity issuance, which should also be an important source of growth capital for public REITs. As their share prices recover, public REITs can benefit from more favourable cost of debt and equity capital than they have in years.

Investment grade public REITs benefit from relatively lower debt costs

Source: Bloomberg, Janus Henderson Investors analysis, as at 30 November 2023. ICE BofA Fixed Rate CMBS Index, Bloomberg Investment Grade (IG): REITs Statistics Index. Area chart shows IG REIT YTW (yield-to-worst) minus CMBS YTW.

We do believe many owners of CRE will face debt service coverage problems related to the now higher cost of refinancing existing debt in an environment where real estate values have declined, and traditional lenders are tight-fisted. However, this really only applies to highly levered private owners of CRE. While we don’t believe there will be widespread distress in private CRE, we do expect lenders will require additional capital injections to refinance debt, which is likely to come from asset sales.

As for public REITs, we expect their cost and access to capital advantages will be put to good use to acquire “good buildings with bad balance sheets” from private owners, and they look well placed to continue expanding market share as they have over the past three decades.

Party planner

As we head into a new capital markets environment, we acknowledge that broader commercial real estate does face challenges – some US$600bn of CRE debt will need to be refinanced in 2024 with most of this belonging to private real estate.8

Public REITs, on the other hand, have already felt the chill of capital markets and with the change in sentiment brought about by a potential change in Fed policy taking the worst-case scenarios for real estate off the table, we believe investors stand to gain as public REITs have a clear advantage versus the more challenged private CRE and as capital markets normalise.

1 Nareit.com, as at 31 December 2023.

2 Trading Economics as at 31 December 2023.

3 UBS, Datastream, Janus Henderson analysis, as at 31 December 2022.

4 Bloomberg, S&P 500 Economic Sectors Index. Real estate = S&P 500 Real Estate Index. Past performance does not predict future returns.

5 Mortgage Bankers Association (MBA) Commercial/Multifamily Databook Q3 2023.

6 S&P Capital IQ Transactions Statistics 2023.

7 Green Street, Morgan Stanley, Janus Henderson Investors analysis, as at 31 December 2022.

8 Moody’s Analytics, Mortgage Bankers Association, Raymond James Research.

Balance sheet: a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time, used to gauge the financial health of a company.

Bond yield: level of income on a security, typically expressed as a percentage rate. For a bond, this is calculated as the coupon payment divided by the current bond price. Lower bond yields means higher bond prices.

Capital market: part of the financial system that deals with raising capital through investments or trading investments with other investors. The stock, bond, currency and derivatives markets are examples of this.

CMBS: commercial mortgage-backed securities are a type of fixed-income security created by banks by bundling a group of commercial real estate loans, which are rated according to risk then sold to investors.

FTSE EPRA Nareit Developed Index tracks the performance of real estate companies and real estate investment trusts (REITs) from developed market countries.

Leverage: the amount of debt that a REIT carries. The leverage ratio is measured as the ratio of debt to total assets.

Risk-free rate: the rate of return of an investment with, theoretically, zero risk. The benchmark for the risk-free rate varies between countries. In the US, for example, the yield on a US 10-year Treasury note is often used.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Volatility: the rate and extent at which the price of a portfolio, security or index, moves up and down.

Yield-to-worst: the lowest yield a bond with a special feature (such as a call option) can achieve provided the issuer does not default. When used to describe a portfolio, this statistic represents the weighted average across all the underlying bonds held.

IMPORTANT INFORMATION

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs) may be subject to additional risks, including interest rate, management, tax, economic, environmental and concentration risks.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.