Entering the era of Trump 2.0, the President and his administration have introduced measures that significantly impact the investment landscape, with tariffs being a notable example. The administration’s approach, framed within the context of national security and aiming to recalibrate trade relationships with both allies such as Mexico and Canada, as well as competitors like China, reflects a strategic shift in economic policy. This move has sparked discussions on its implications for global trade and how emerging market assets may fare in such an environment.

Although trade concerns were the stated primary focus, it’s becoming clear that tariffs are being utilized more as a negotiation tool to further Trump’s wider goals. This was demonstrated by the recent tariff threats to Colombia, which maintains a trade deficit with the US, to address immigration issues.

The ripple effects of tariffs are complex and far-reaching, impacting individual countries and the global economy at large.

When a country faces tariffs, its local markets come under pressure and the main adjustment valve is typically a weakening of its currency. Tighter financial conditions put downward pressure on economic activity beyond the tradable sector. Of particular relevance in the near term given elevated and rigid inflation, this adds inflationary pressures and prompts central banks to tighten monetary policy, which could further hinder growth prospects.

Moreover, tariffs impair the efficiency of global trade, inevitably driving up costs and fostering inflation over the long term. An additional channel that can affect the overall asset class more broadly is how the Fed responds to increased policy uncertainty and potential higher prices on imported goods. Clearly the Fed has already turned more cautious and while we see a high bar for the Fed to actually start hiking, an environment of interest rates being higher for longer looks increasingly likely. The fiscal outlook of the US is also likely to influence the thinking of the Fed, adding an additional layer of uncertainty.

What does this mean for EMD HC investment?

The imposition or threat of tariffs on countries with which the US has significant trade deficits, such as China, Mexico, and Canada, highlights Trump’s strategy of exploiting the limited retaliatory capabilities of some nations to enhance his position in future trade negotiations.

However, Trump’s sensitivity to domestic stock market fluctuations and inflationary pressures – particularly given the role the recent exit from an inflationary period played in his election victory – suggests that tariff policies are likely to be country-specific or more narrowly focused on certain sectors.

From the lessons of Trump 1.0, we’ve observed a shift towards ‘friendshoring’, with Mexico surpassing China in export volume to the US in 2023, and other nations like South Korea, Thailand, and Taiwan benefiting from the US-China trade realignment. This suggests that while tariffs on one country may pose challenges, they can also create opportunities for others.

This highlights the strength of the EMD HC asset class as it has a diverse range of countries, making it less vulnerable due to its smaller individual country exposure while offering diversification opportunities across more than 72 countries.

Potential vulnerable countries under Trump 2.0 may include those that gained from exporting rerouted from China, many of which are concentrated in the ASEAN region. These countries, initially benefiting from the shift in trade dynamics, now face the risk of becoming targets themselves or suffering from broader geopolitical tensions and trade disruptions.

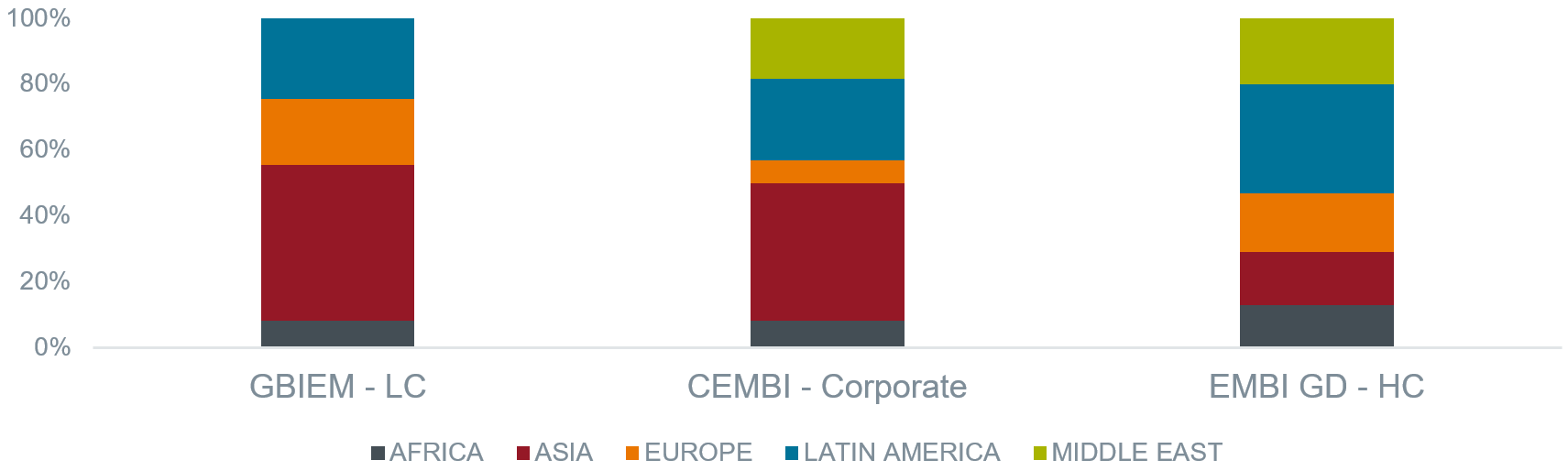

The geographical breakdown of different JP Morgan emerging market debt indices shows considerable variation; the hard currency sovereign index has lower exposure to countries in Asia and elsewhere that are at risk from tariffs. This is shown on the following two charts below where we compare country exposures for Local Currency (LC) Sovereign (left), Hard Currency Corporates (middle) and Hard Currency (HC) Sovereigns (right).

Chart 1: Regional exposure

Source: JP Morgan Research, 31 December 2024

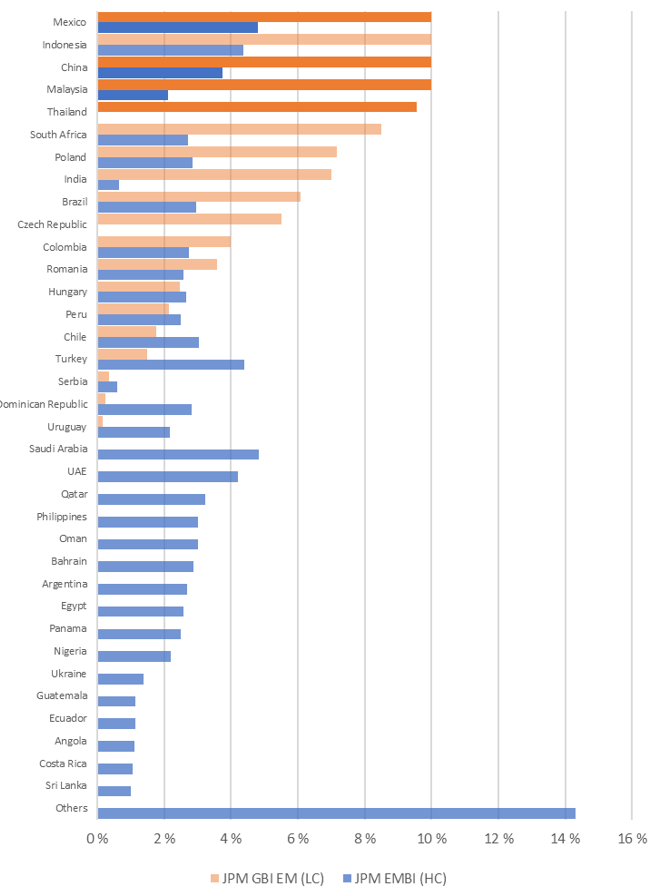

Chart 2: Key country exposures

Source: JP Morgan Research, 31 December 2024

Chart 3: Country exposure of EMD HC vs LC

Source: JP Morgan Research, 31 December 2024

Note: Darker bars indicate higher potential impacted countries; from left to right (HC%, LC%): Mexico (4.81%,10%), China (3.7%,10%), Malaysia (2.11%, 10%), Thailand (0%, 9.55%). Others include 39 JP EMBI countries with less than 1% weight as at 31 December 2024

Global macro-backdrop

Given Trump’s focus on inflation and financial market performance, these will likely serve as policy constraints. While the Federal Reserve has adopted a more cautious stance, we see the threshold for resuming a rate-hiking cycle remains high.

Meanwhile, improvements in the credit fundamentals of EMD HC have enhanced its resilience to an uncertain and challenging external environment. Despite policy uncertainties in the US, we do not anticipate the US policies will significantly alter the expected slowing of the US economy and a resilient EM growth outlook. However, current US policies do introduce increased downside risks for the global economy, especially for countries outside the US.

Looking ahead

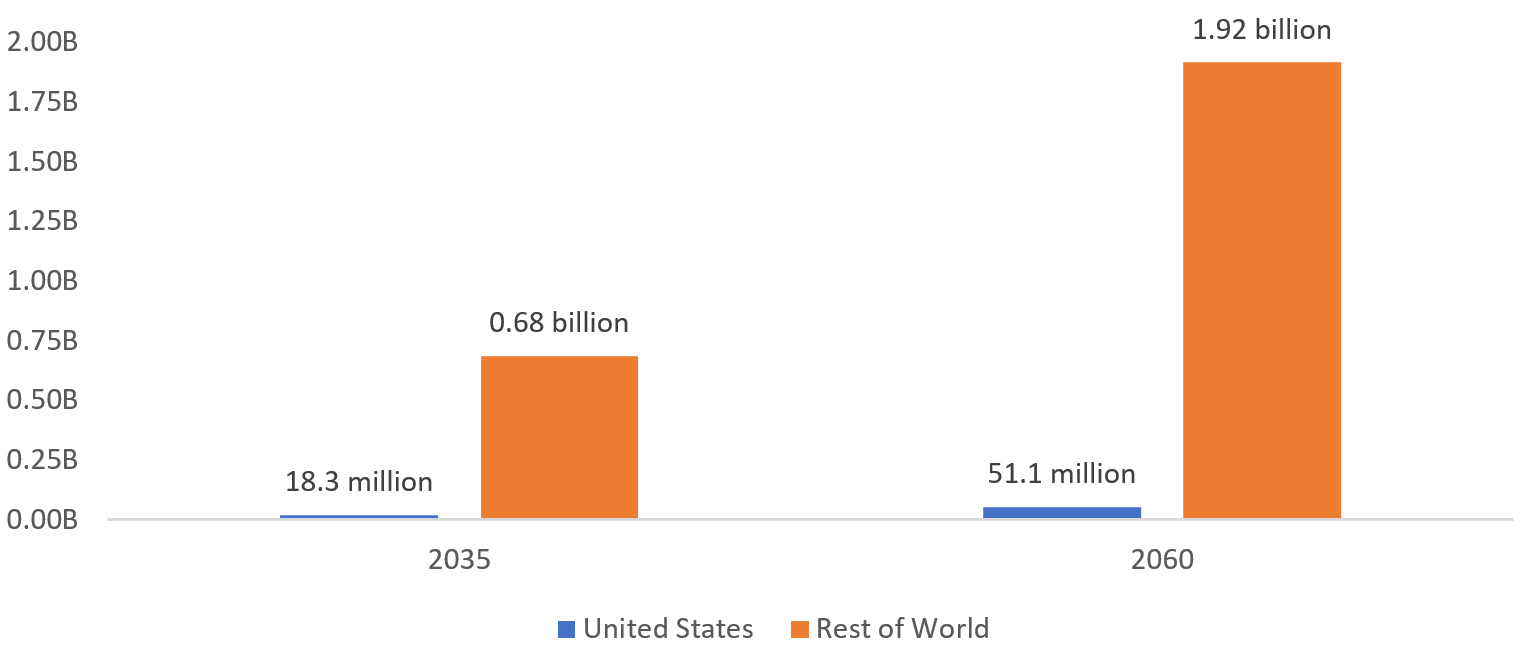

In the long term, the US’s current treatment of its allies and adversaries could risk destabilizing many relationships, potentially leading to increased regionalization. This shift away from efficient globalization towards a more regionalized approach could compel countries to reassess their relationships with the US in favour of closer, more amicable nations. Such a scenario may not bode well for the US economy, particularly at a time when it faces a diminishing birthrate and a shrinking workforce.

Chart 4: Projected population change from 2025

Source: Janus Henderson Investors, Macrobond, 31 December 2024

In summary

In conclusion, as we navigate the complexities of international trade under Trump’s administration, it’s evident that tariffs will likely continue to serve as Trump’s primary tool in negotiations with various countries. This strategy, while effective from a negotiation standpoint, introduces a layer of uncertainty that affects all trading partners and is poised to have a global impact that leans towards the negative.

The potential resilience of EMD HC to these new challenges is somewhat underappreciated thanks to its broad country composition and the significant improvements in fundamentals observed in recent years. The higher level of underlying treasury yields today provides some advantage by providing an offset to wider credit sovereign spreads, should the outlook deteriorate from here.

Diversification: A way of spreading risk by mixing different types of assets/asset classes in a portfolio, on the assumption that these assets will behave differently in any given scenario. Assets with low correlation should provide the most diversification.

Emerging market: The economy of a developing country that is transitioning to become more integrated with the global economy. This can include making progress in areas such as depth and access to bond and equity markets and development of modern financial and regulatory institutions.

Inflation: The rate at which the prices of goods and services are rising in an economy. The Consumer Price Index (CPI) and Retail Price Index (RPI) are two common measures. The opposite of deflation.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. Monetary policy tools include setting interest rates and controlling the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money. See also fiscal policy.

Protectionism: The practice of restraining trade between countries, usually with the intent of protecting local businesses and jobs from foreign competition. Measures taken typically include quotas (limits on the volume or value of goods and services imported) or tariffs (tax or duty imposed on imported goods and services).

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall. High yielding (non-investment grade) bonds are more speculative and more sensitive to adverse changes in market conditions.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- Emerging markets expose the Fund to higher volatility and greater risk of loss than developed markets; they are susceptible to adverse political and economic events, and may be less well regulated with less robust custody and settlement procedures.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.