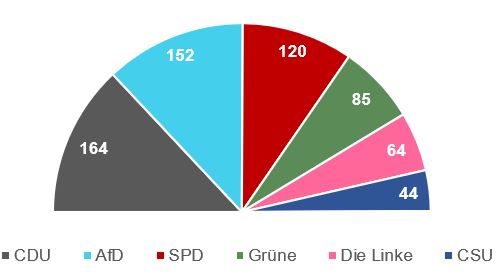

Diverging political hues

The result of the German election carried a somewhat positive note with the potential for forming a centre-right CDU/CSU coalition led by a new Chancellor, Friedrich Merz and avoiding the need for a three-way coalition with the Grüne (Green) party. Yet the lack of a two-thirds majority among parties supportive of higher defence spending suggests that significant fiscal reforms – without support from the Left – may not be forthcoming in the near term, or at least not without several rounds of negotiations and concessions.

Against a backdrop of weakening economic growth in Germany, another divisive issue is the debt brake, which was put into place in 2009 to limit government borrowing. Specifically, it allows the federal government to run a structural deficit of no more than 0.35% of the gross domestic product (GDP) under normal circumstances. The far-right AfD, which is now the main opposition party, and the Left Party hold widely divergent views on the debt brake. The AfD, with its fiscal conservatism, has made statements indicating that the ideal level of government debt should be 0% of GDP, arguing that any positive amount is unfair to future generations. On the other hand, the Left Party advocates for the complete removal of the debt brake and proposes reducing military expenditure.

Therefore, there might be an opportunity for the new government who appear open to reform on the debt brake to negotiate with the Left Party to gain its support, a process that would need a two-thirds majority in the Bundestag, the federal parliament.

The potential pathways to amend the debt brake include:

- Declaring a state of emergency, which requires a simple majority but is subject to strict legal constraints.

- Creating an off-budget ‘special-purpose vehicle’, which needs approval by a two-thirds majority in the Bundestag.

- Undertaking a constitutional reform of the debt brake itself, necessitating a two-thirds majority in both the Bundestag and Bundesrat (Federal Council) for approval.

In response to the election results, Chancellor Merz has called for swift coalition talks, setting an ambitious deadline to form a new government by Easter. This timeline indicates a desire for quick resolution and a speedy return to the business of governance, amid waning economic growth and Germany’s recognition that it can no longer depend on the US for defence and Russia for energy.

Figure 1: German (Bundestagswahl) 2025 election results

Source: Die Bundeswahlleiterin February 2025.

What does this mean for the credit landscape?

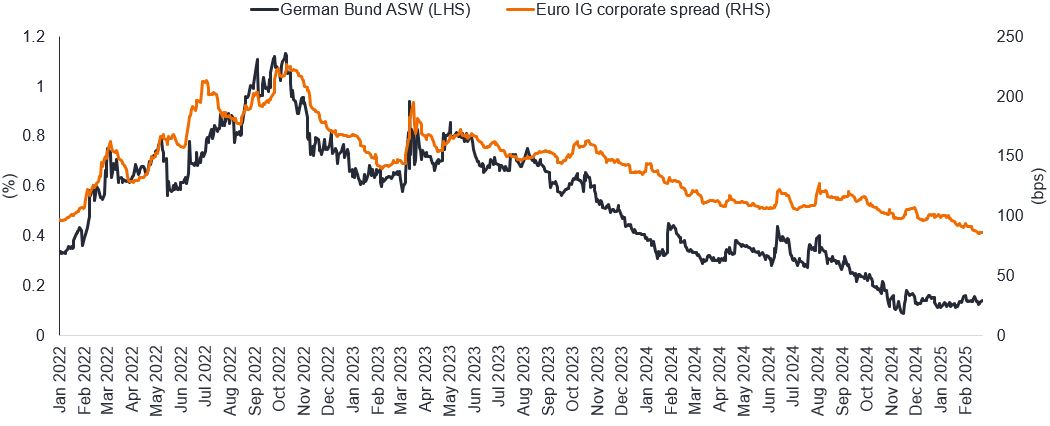

The structural economic challenges facing Germany are expected to significantly pressure the new government to increase borrowing. While we don’t expect the impact to be particularly large, given that concessions are likely during coalition negotiations, it may lead to higher yields on German debt. This, in turn, could lead to a tightening of the asset swap spread (ASW) for the Bund (German government bond). The asset swap spread is the premium (or spread) over the reference floating rate (often a cash rate such as Libor or Euribor) that an investor demands to be compensated for the credit risk and other risks associated with holding the bond instead of a risk-free asset, typically a government bond.

Figure 2: German 2-year Bund ASW spread versus Euro investment grade credit spread

Source: Bloomberg, as at 24 February 2025. Euro IG corporate spread= ICE BofA Euro Corporate Index option-adjusted spread. German Bund ASW= German 2-year Bund asset swap spread.

The tightening observed in ASW thus far, as shown in Figure 2, coupled with the potential for additional tightening could have a positive impact on corporate credit spreads, from a demand and rating compression perspective. This is where the ratings between higher-rated and lower-rated companies narrows. Most retail investors scrutinise credit valuations based on their spread over government bond yields. Although ‘all-in-yield’ – the total yield or return that an investor can expect to receive from an investment – has become a crucial demand consideration. For institutional investors, the landscape of credit valuations takes on a different hue. These clients tend to view credit valuations against swaps (derivatives), a practice that inherently makes credit valuations relatively more appealing when the Bund ASW tightens.

The outcome of coalition negotiations that either maintains or further tightens Bund ASWs is likely to be positive for Euro investment grade (IG) – the highest quality credit, as its relative value becomes attractive.

Adjusting to changing shades

Forming a new government will stoke a period of volatility, with political negotiations likely to cause market reactions. Additionally, shifts in fiscal policy will not immediately impact the economy, as the effects of such changes typically unfold over time, making the long-term outcomes more consequential than they might seem at first.

We therefore view the election outcome as generally positive, albeit with this expectation of near-term volatility. Such instability is anticipated not just from forming a new government but also from escalating trade tensions — an issue highlighted in the CDU’s victory speech with a call for greater independence from the US— and developments in the Ukraine-Russia conflict.

Therefore, our asset mix strategy is tilted towards high quality Euro IG credit, which we believe could help mitigate volatility. At the same time, we are focusing on those sectors and select names that we believe are well-equipped to traverse a changing landscape, while also capturing any relative value opportunities that may arise.

Debt brake can be understood as a function of the output gap and is defined as the ratio of trend gross domestic product (trend GDP) to current GDP.

Gross domestic product: a broad measure of the size and health of a country’s economy, it is the value of all finished goods and services produced by a country, within a specific time period (usually quarterly or annually).

Special purpose vehicle: A Special Purpose Vehicle (SPV) is a separate legal entity created by an organization. The SPV is a distinct company with its own assets and liabilities, as well as its own legal status. Usually, they are created for a specific objective, often to isolate financial risk. As it is a separate legal entity, if the parent company goes bankrupt, the special purpose vehicle can carry on.

Bundesrat: (German: “Federal Council”), one of the two legislative chambers of the Federal Republic of Germany. It is the Upper House and acts mainly in an advisory capacity, since political power resides in the popularly elected Bundestag, but its consent is required for a large number of laws and regulations as well as for constitutional amendments.

All in yield: The total yield or return that an investor can expect to receive from a bond or other fixed-income investment, taking into account all aspects of the investment. This includes not only the interest payments (coupon yield) but also any capital gains or losses upon maturity or sale, and adjustments for any premium or discount at which the bond was purchased relative to its face value.

Derivative (or swaps): A financial instrument for which the price is derived from one or more underlying assets such as shares, bonds, commodities or currencies. It is a contract between two or more parties which allows investors to take advantage of price movements in the asset(s). Futures, options and swaps are all examples of derivatives.

Bond yield: The level of income on a security expressed as a percentage rate. For a bond, this is calculated as the coupon payment divided by the current bond price. There is an inverse relationship between bond yields and bond prices. Lower bond yields mean higher bond prices, and vice versa.

Credit spread: The difference in yield between securities with similar maturity but different credit quality, often used to describe the difference in yield between corporate bonds and government bonds. Widening spreads generally indicate a deteriorating creditworthiness of corporate borrowers, while narrowing indicate improving.

Credit rating: An independent assessment of the creditworthiness of a borrower by a recognised agency such as Standard & Poors, Moody’s or Fitch. Standardised scores such as ‘AAA’ (a high credit rating) or ‘B’ (a low credit rating) are used, although other agencies may present their ratings in different formats.

Credit: Credit is typically defined as an agreement between a lender and a borrower. It is often narrowly used to describe corporate borrowings, which can take the form of corporate bonds, loans or other fixed interest asset classes.

Risk-free rate: The rate of return of an investment with, theoretically, zero risk. The benchmark for the risk-free rate varies between countries. In the US, for example, the yield on a three-month US Treasury bill (a short-term money market instrument) is often used.

Investment grade: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies.

Structural deficit is a type of budget deficit that reflects the underlying fiscal position of a government, independent of the effects of the economic cycle. A budget deficit occurs when a country spends more money than it receives.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.