In a previous article we highlighted the attractiveness of the yields on offer from corporate bonds from a historical perspective. Yields have since crept up and a revised version of the chart is shown below. Yields are at a level that compares favourably with yields available across the last 20 years.

Figure 1: Yield on global investment grade corporate bonds

Source: Bloomberg, ICE BofA Global Corporate Index, yield to worst, 31 December 2009 to 31 August 2023. The ICE BofA Global Corporate Index tracks investment grade corporate debt publicly issued in the major domestic and Eurobond markets. Yield to worst (YTW) is the lowest yield a bond can achieve provided the issuer does not default and accounts for any applicable call feature (i.e. the issuer can call the bond back at a date specified in advance). Yields may vary over time and are not guaranteed.

The upward pressure on yields has principally come from a rise in sovereign bond yields. Factors that have contributed to the rise include stronger-than-expected economic growth in the US; tension in the Middle East creating fresh concerns about the price of oil and the pace of disinflation; and a renewed focus on demand and supply given that elevated fiscal deficits are having to be funded by more price-sensitive buyers now that key central banks are engaging in quantitative tightening (reducing their holdings of government bonds).

Credit spreads (the additional yield over a government bond of the same maturity) have gapped marginally wider as the benefits of potentially stronger economic news are offset by higher financing costs and geopolitical fears. Taken together, the tightening of financial conditions is ultimately going to slow the economy – something that members of the US Federal Reserve (Fed) have been vocal in recognising. Commentators from investment banks reckon the recent tightening in financial conditions since the September FOMC meeting is equivalent to as much as three 25 basis point hikes by the Fed.1

Unsettled markets mean the timing and pace of interest rate cuts by the Fed and the European Central Bank have swung around but markets remain convinced that cuts will start in the middle of next year.2 Tighter financial conditions could, if anything, prompt deeper cuts if they lead to a faster-than-expected economic slowdown.

The rise in bond yields means that not only are bond yields at relatively high rates historically, they also compare favourably against equities. Equities do not typically pay out their full earnings, so the dividend yield is normally below the earnings yield. What is interesting about the current climate is that even at the higher earnings yield, equities – which are viewed as a higher risk, more volatile asset class – are offering barely any premium to investment grade corporate bond yields. This is unusual in history as Figure 2 shows.

Figure 2: Yield on global equities and investment grade (IG) corporate bonds

Source: Bloomberg, Earnings yield and dividend yield on MSCI World Index (equities). The MSCI World Index is an equity index that tracks the performance of large and medium-sized companies across 23 developed market countries. ICE BofA Global Corporate Index, ICE BofA 1-5 year Global Corporate Index, yield to worst, definition as for Figure 1. The ICE BofA 1-5 year Global Corporate Index is a subset of ICE BofA Global Corporate Index including all securities with a remaining term to final maturity less than 5 years. 30 September 2003 to 19 October 2023. Yields may vary over time and are not guaranteed.

Figure 2 also demonstrates that investors do not have to stretch their maturity horizon to achieve a high yield – nearly all the yield available from the global investment grade corporate bond market can be achieved by investing in shorter-dated (sub 5-year) bonds. Again, this is a rare opportunity and one that may not be around for long.

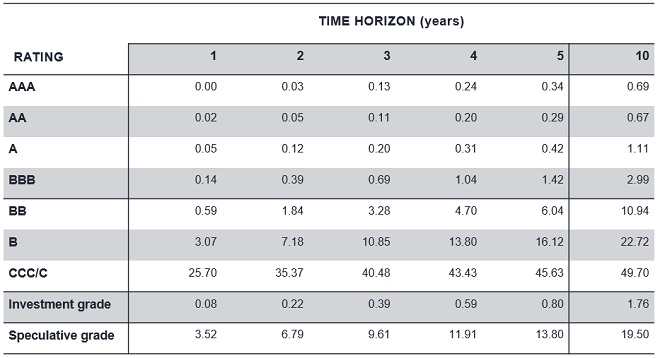

Provided a corporate bond does not default, an investor can be fairly confident of the return they will receive if a bond is held to maturity. There is always a risk, however, that a borrower could get into trouble and default and this could occur at any time. The following table demonstrates that the combination of a higher credit rating (investment grade BBB or higher) with a sub-5-year horizon has historically represented a low default incidence. Investing in lower rated bonds can bring rewards but the greater risk of default means more careful assessment of a borrower’s credit fundamentals is required, together with a more selective approach.

Figure 3: Global corporate average cumulative default rates (1981-2022) %

Source: S&P Global Ratings Credit Research & Insights and S&P Global Market Intelligence Credit Pro. Default, Transition and Recovery: 2022 Annual Global Corporate Default and Rating Transition Study, April 2023. AAA to BBB represent investment grade credit ratings, while BB to CCC represent speculative grade credit ratings. Past performance does not predict future returns.

Investors could seek to lock in today’s yield by buying an individual bond, but we think that a fixed maturity bond fund would be a less risky route. Just like an individual bond it has a regular coupon and fixed maturity date but comes with the added benefit of diversification across a portfolio of bonds. Furthermore, credit selection is undertaken by a team of experts, who will monitor the portfolio throughout its fixed term, helping to avoid default risk and maximise the yield.

We believe that with the peak in the interest rate cycle near at hand, today represents an opportunity to lock in attractive yields and a fixed maturity bond fund offers a straightforward vehicle to achieve this.

1Source: Morgan Stanley, Morgan Stanley Financial Conditions Index, 20 October 2023.

2Source: Bloomberg, World Interest Rate Projections, as at 23 October 2023.

Credit ratings: A score given by a credit rating agency such as S&P Global Ratings, Moody’s and Fitch on the creditworthiness of a borrower.

Credit risk: The risk that a borrower will default on its contractual obligations, by failing to meet the required debt payments.

Corporate bonds: A debt security issued by a company. Bonds offer a return to investors in the form of periodic payments and the eventual return of the original money invested at issue on the maturity date.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

Diversification: A way of spreading risk by mixing different types of assets/asset classes in a portfolio. It is based on the assumption that the prices of the different assets will behave differently in a given scenario. Assets with low correlation should provide the most diversification.

Duration: The sensitivity of a bond or fixed income portfolio to changes in interest rates. The larger the figure the more sensitive it is to movements in interest rates.

Financial conditions: A mix of conditions that have the potential to affect the economy, covering aspects such as cost of borrowing, the direction of asset prices, and currency strength. Tighter conditions are said to exist when borrowing costs rise, equity prices fall and the US dollar strengthens, which are seen as headwinds to growth.

Fiscal policy: Connected with government taxes, debts and spending. Government policy relating to setting tax rates and spending levels. It is separate from monetary policy, which is typically set by a central bank. Fiscal austerity refers to raising taxes and/or cutting spending in an attempt to reduce government debt. Fiscal expansion (or ‘stimulus’) refers to an increase in government spending and/or a reduction in taxes.

Inflation: The annual rate of change in prices, typically expressed as a percentage rate. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Disinflation is a decline in the rate of inflation.

Interest rate cycle: Interest rates typically rise and fall over time and a full cycle reflects the change from trough to peak and back again. The movement in rates is typically affected by how central banks respond to growth and inflation in the economy.

Investment grade: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings.

Maturity: This refers to the date when a bond’s principal (original value) is repaid to the bondholder. The term to maturity is the period in which a bondholder receives interest payments.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Easing refers to a central bank increasing the supply of money and lowering borrowing costs. Tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money. Restrictive policy is where policy is being tightened.

Recession: A significant decline in economic activity lasting longer than a few months. A soft landing is a slowdown in economic growth that avoids a recession. A hard landing is a deep recession.

Speculative grade: A bond with a lower credit rating than an investment grade bond, also known as a sub-investment grade bond, or high yield bond. These bonds usually carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher interest rate (coupon) to help compensate for the additional risk.

Treasury: a debt security issued by the US government. A Treasury Bill is for 12 months or less, while a Treasury Bond is for longer.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down.

Yield: The level of income on a security, typically expressed as a percentage rate. The 10-year Treasury yield is the interest rate on US Treasury bonds that will mature 10 years from the date of purchase.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- Emerging markets expose the Fund to higher volatility and greater risk of loss than developed markets; they are susceptible to adverse political and economic events, and may be less well regulated with less robust custody and settlement procedures.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.