Absolute return: Add a little bit of stock dispersion… and stir

With stock dispersion once again at the fore, offering greater potential for uncorrelated returns, Portfolio Manager Luke Newman asks if this is the ingredient that absolute return investors have been waiting for.

5 minute read

Key takeaways:

- With attention turning to the pace and timing of any potential interest rate cuts in 2024, we have seen a major shift in market structure, characterised by greater dispersion in stock performance.

- Valuations and borrowing costs are returning to more rational behaviour – a much more supportive environment for bottom-up fundamental stock picking strategies.

- We see opportunities on both the long and short side, across industries (particularly with regards to the future impact of AI) and geographies, remaining conscious of ongoing geopolitical risks.

As we move further into 2024, we believe investors will face a complicated series of chain reactions, with the convergence of forces including inflation, a higher cost of capital, failing consumer strength and geopolitics.

JHI

JHI

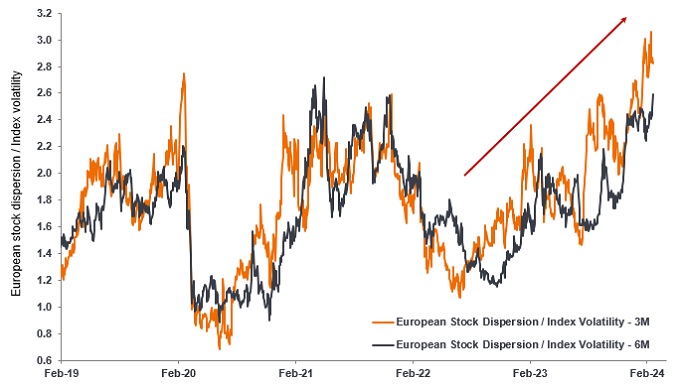

2024 has been called the year of the ‘pivot’, where central banks have gained the upper hand, in terms of managing inflation. The question has now firmly turned to the pace and timing of any rate cuts. Alongside this shift in direction for monetary policy, we have also seen a major shift in market structure that transforms the picture within equities, characterised by greater dispersion in performance (you can see the very clear trend in Europe, for example – Exhibit 1).

Exhibit 1: Stock dispersion trending higher

Source: Morgan Stanley, Factset, Bloomberg, 19 February 2019 to at 19 February 2024. Compares stock dispersion in the MSCI Europe Index with expected market volatility, as indicated by the Euro Stoxx 50 Volatility Index (VSTOXX), over three- and six-month rolling periods. Past performance does not predict future returns.

We are seeing valuations re-establish themselves to more rational levels, where companies are not able to take on huge volumes of debt as easily as they have. The higher cost of capital from borrowing is an important theme, and one that is very different to what we have seen in recent years.

In our view, this environment allows bottom-up fundamental stock picking strategies to differentiate themselves. If we are correct, market dispersion is going to be an important characteristic to consider on both the long and the short side. Investors will need to think very hard about how and where they deploy their capital, at a regional, sector and stock level.

What is the opportunity?

Whenever we talk about opportunity, AI has to be part of the conversation. It is hard to identify a company almost anywhere in the world where there won’t be some kind of first- or a second-order implication. There are so many areas that could potentially be disintermediated by AI at a lower cost, although this is not just a revenue issue.

There are clear social implications as well, in terms of how AI can enhance the productivity of human workers – but also how many of them it can replace. Related to that, we think those businesses that lack the flexibility to be able to shift away from employing large labour forces, or which have underinvested in their operating model, are more likely to face issues. This could provide an opportunity on the short side.

It might seem less counterintuitive, but we also believe that some types of businesses that are hoping to monetise an AI proposition may end up struggling, potentially in areas such as music, or education. If we consider what assumptions have been made for revenue, pricing and profit margins, some perceived AI winners could arguably end up as potential short positions if we see their views as overoptimistic.

Elsewhere, one of the areas that we are paying most attention to for potential shorts is industrials. Cost management and efficient investment will be key given their direct impact on profits. We are paying close attention to situations where a company’s capital expenditure is coming under pressure as a knock-on from higher discount rates.

At a regional level, we do not believe that domestic UK and Europe is as bad as prices would seem to indicate. We suspect that with investors paying more attention to valuation, Europe might seem to offer more opportunity than the US on a relative basis. The environment remains challenging, but a lot of bad news seems already priced in. That does not mean you can just blindly run around buying perceptually ‘cheap’ stocks, or short expensive ones. But if you can find a strong catalyst, it looks like a supportive environment for stock picking.

Where to avoid?

From an absolute return perspective, we are still seeing a lot of excesses unravelling, particularly in the US, where companies have been more eager to take advantage of ultra-low rates and loose monetary policy. While potentially advantageous for those companies looking to grow, the unwind can be painful.

This is an environment where there is no substitute for hard work. Industries and individual companies will come under increased scrutiny to address the timing, scale and cost of potential refinancing. Investors need to identify potential pressure points that could end up as more expensive debt or lead to share dilution from new equity issuance.

We recognise the potential impact of tighter financing in areas like electric vehicles – more broadly, any high-ticket item that requires financing is under a lot more pressure. The hurdles are also getting bigger for any new competitor looking to take market share in an industry, a potentially favourable situation for incumbent businesses with strong balance sheets that are able to self-finance.

Geopolitics – ever present, ever problematic

When it comes to absolute return (or any form of liquid alternatives, for that matter), it is important to always marry long-term investment views with a realisation that bouts of unexpected volatility are never far away. While we can talk about the broader improved environment for equity stock picking, it should be placed in context against more current concerns, from uncertainties over the pace or timing of any potential interest rate cuts, through the ongoing conflicts in Ukraine and Gaza, to industry-focused concerns about the impact of AI and obesity drugs. All of these factors have injected volatility and uncertainty into the market. These are not irrational concerns – there are risks for supply chains, the cost and availability of particular resources, borrowing costs, etc.

A lot has been going on, and it has been fast and furious. But at least the market volatility we have seen has been more rational and understandable. As an active investor, it is possible to harness these factors, if you judge them correctly, either in terms of seeking to mitigate risks, or to try and capitalise. When you have rational markets, valuation matters. That is a potentially huge advantage for active managers.

Balance sheet: A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. Monetary policy tools include setting interest rates and controlling the supply of money.

MSCI Europe Index: An index that shows the performance of large and mid-sized companies across 15 developed countries in Europe.

Euro Stoxx 50 Volatility Index (VSTOXX): An index that measures the near-term expected volatility in the European stock market.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.