US equities can play an important role in investor portfolios for several reasons ‒ particularly now, with inflation lingering and the economic outlook so clouded.

US equities’ position in the global market

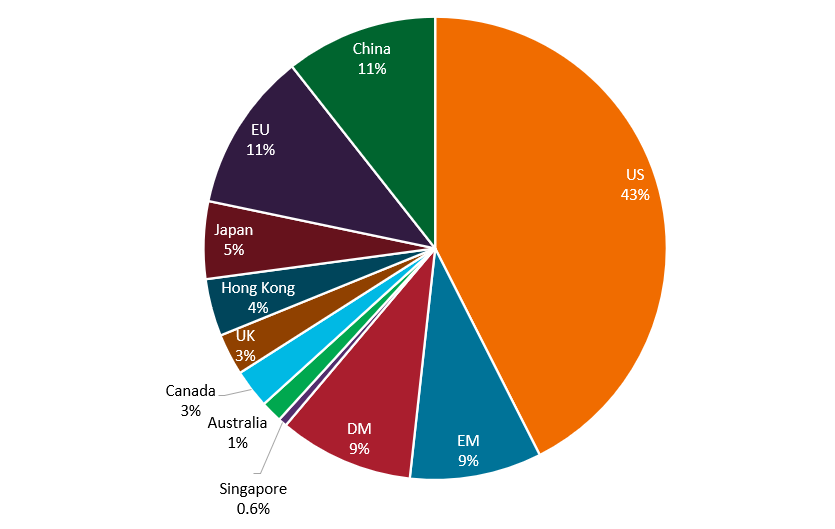

The US equity market is the largest in the world, with its companies accounting for over 40% of global market capitalisation (Figure 1). The US is among the most accessible, transparent and liquid markets, and its economic environment has fostered a culture of growth and innovation. Thus, many of the world’s most successful companies are based in the US. Based on these supportive dynamics, many investors choose to allocate a portion of their equity exposure to the US market.

Figure 1. Global equity market capitalization (% of total)

Source: World Federation of Exchanges, Securities Industry and Financial Markets Association (SIFMA) estimates. EU= countries of the European Union, EM = Emerging Markets, DM = Developed Markets, at 30 June 2023.

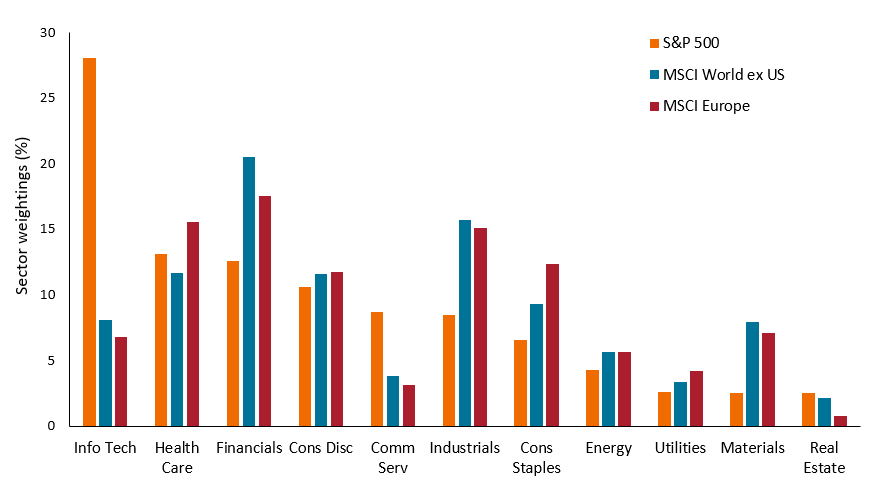

The US differs significantly from other global markets regarding the types of companies that make up its economy. For example, the US market is heavily tilted to growth-oriented, technology-centric sectors such as information technology and communication services. The S&P 500® Index has more than triple the MSCI World ex. US Index’s exposure to information technology companies (28.1% versus 8.1%). At the same time, the S&P 500 has significantly less than the MSCI World ex. US Index’s allocation to sectors that comprise a substantial portion of other countries’ economies, such as financials and industrials (Figure 2). These differences in economic composition and industry exposure may offer diversification for portfolios that invest in both the US and other global markets.

Figure 2. US and global index sector weightings

Source: S&P Dow Jones Indices, MSCI, at 31 July 2023.

Growth and technology as a hedge against inflation

In addition to these broad-level considerations, US equities may also offer advantages specific to the current environment of lingering/high inflation and economic uncertainty. Equities ‒ and growth equities in particular ‒ may generally provide a hedge during inflationary periods, as they have the potential to grow at a rate faster than inflation. As labour costs continue to rise, companies less dependent on labour ‒ like some in the information technology sector ‒ may also be less exposed to wage pressures. At the same time, one of the main drivers of disinflation over the past decade has been the proliferation of technology. Recent wage inflation may incentivise further investment in efficiency and substitution solutions to moderate labour costs, to the benefit of select companies.

We continue to believe that all companies must decide how to harness and leverage technology to survive and grow in the long term, and that technology-based themes can continue to provide tailwinds in coming years. For instance, businesses helping to enhance productivity, digital transition, and connectivity across all areas of the economy may stand to benefit. We think that demand for semiconductors will continue to increase, driven in part by tailwinds such as the transition to greener energy production, increased adoption of electric vehicles (EVs), as well as AI applications. We also continue to believe that all companies aspire to be more productive and more agile, and this requires continued investment in software.

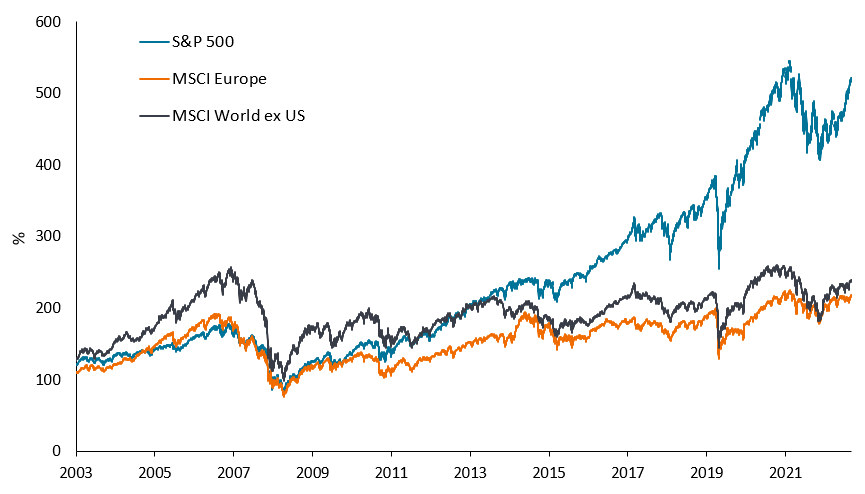

The previously mentioned bias towards growth and technology companies has proven to be a long-term boon for US markets relative to other areas of the global market (Figure 3). As we enter a period where it appears growth may become scarcer and corporate borrowing more expensive, an allocation to US equities may prove beneficial.

Figure 3. US and global index performance

Source: Bloomberg, 31 December 2002 to 31 July 2023, rebased to 100 at start date. Past performance does not predict future returns.

Earnings will be key to market growth

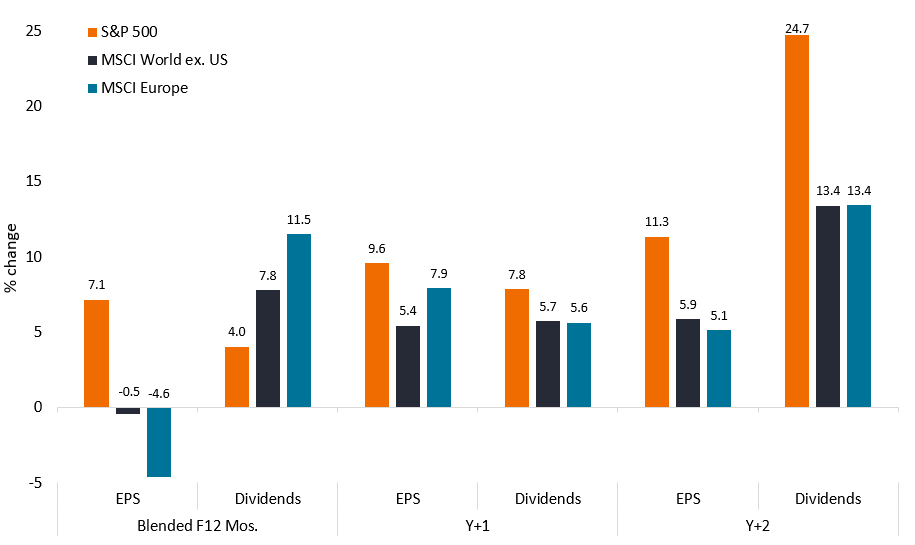

Following a difficult 2022, the US market has proven to be resilient, and we believe it can remain buoyant in the face of economic uncertainty. As companies adapt to higher interest rates, and as inflation moderates, we believe earnings strength will now be key to market growth. Although we expect a volatile and bumpy ride, we are bullish on earnings growth prospects for the rest of 2023 and into 2024, even assuming a scenario of slow-to-flat growth in the economy. Earnings estimates have moderated; however, consensus S&P 500 earnings forecasts still assume growth over the next 12 months. Further, the S&P 500 is expected to grow earnings per share (EPS) and dividends at a higher rate than the MSCI World ex. US and MSCI Europe Indices in coming years (Figure 4).

Figure 4. US, Europe, and global index earnings per share and dividend growth estimates

Source: Bloomberg, at 18 August 2023. F12= Forward 12 months (current and next years) Estimates, Y+1= Next Year Estimates, Y+2= 2 Year Forward Estimates. Index weighted average. Past performance does not predict future returns.

Focus on the long-term

Given these factors, we believe that US equities can play a multi-faceted role in investor portfolios, especially now, as the global economy faces persistent inflation and an uncertain growth outlook. We think that markets are ultimately driven by long-term sustainable earnings growth, and that companies able to increase earnings over time will benefit. We see many of these opportunities today in the US market.

Disinflation: A fall in the rate of inflation (rather than negative inflation/deflation).

Diversification: A way of spreading risk by mixing different types of assets/asset classes in a portfolio, on the assumption that these assets will behave differently in any given scenario. Assets with low correlation should provide the most diversification.

Dividends: A variable discretionary payment made by a company to its shareholders.

Earnings per share (EPS): A company’s profit (after tax) divided by the number of outstanding shares. It is one of the most popular ways for investors to assess a company’s value.

Growth companies/growth equities: Growth investors search for companies they believe have strong growth potential. Their earnings are expected to grow at an above-average rate compared to the rest of the market, and therefore there is an expectation that their share prices will increase in value.

Hedge: A trading strategy that involves taking an offsetting position to another investment that will lose value as the primary investment gains, and vice versa. These positions are used to reduce or manage various risk factors and limit the probability of overall loss in a portfolio.

Inflation: The rate at which the prices of goods and services are rising in an economy. The Consumer Price Index (CPI) and Retail Price Index (RPI) are two common measures.

Market capitalization: The total market value of a company’s issued shares. It is calculated by multiplying the number of shares in issue by the current price of the shares. The figure is used to determine a company’s size and is often abbreviated to ‘market cap’.

Market liquidity: Market liquidity is a measure of how easily assets can be traded or converted into cash. Assets that can be easily traded in the market in high volumes (without causing a major price move) are referred to as ‘liquid’.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.