The tug of war in high yield bonds in 2024

Tom Ross, Fixed Income Portfolio Manager, considers the outlook for global high yield corporate bonds in 2024 and the potential tug of war between rates and spreads.

6 minute read

Key takeaways:

- 2024 is likely to be a slow year for the global economy with some regions flirting with recession as the lagged impact of earlier monetary policy tightening takes effect.

- We expect a tug of war as policymakers cut rates but growth scares cause volatility in credit spreads.

- This tug of war is likely to cause price swings in high yield bonds, offering tactical investment opportunities. Meanwhile, elevated yields should provide patient investors with a buffer to ride out the volatility.

It is no revelation to say that economic growth in 2024 is set to be slow. The consensus view among contributors to Bloomberg’s economic forecasts is that the global economy will grow by less than it did in 2023 – about 2.7% is pencilled in for 2024, compared with around 2.9% in 2023.1 At first glance, that might seem immaterial, but bear in mind that these are real (inflation-adjusted figures), so with the decline in inflation, nominal growth will be weaker. The second point to make is that emerging markets are expected to do a lot of the heavy lifting: the US and the Eurozone in aggregate are expected to grow around 1% in real terms.1

Subdued growth

For high yield corporate bonds, slow economic growth is a world away from no economic growth. It should be sufficient to allow most high yield rated companies to carry on meeting their debt obligations. Corporate fundamentals appear reasonably robust this late in an economic cycle and a well-flagged downturn means companies have had more time to prepare. In fact, expectations for the European economy are already low, which could offer room to surprise on the upside, whereas we still think the market has capacity to be shocked by any weak data emanating from the US.

We are mindful that the lagged impact of monetary tightening could be felt in 2024. Even though we expect central banks in the US and Europe to cut interest rates in the next 12 months, companies that need to undertake refinancing are still facing a jump in financing costs given how low rates were in preceding years.

The cumulative impact of this is likely to curtail profits and encourage companies to cut costs. Given that high yield borrowers tend to be more heavily represented by small and medium sized companies as well as the more cyclical sectors, slower growth will typically be more keenly felt than among investment grade borrowers.

Spread movement

When discussing the high yield asset class, commentators often talk about defaults and while a company failing to meet its obligations is clearly unwelcome, a broader consideration is the movements in spreads (the additional yield that a high yield bond pays over a government bond of similar maturity).

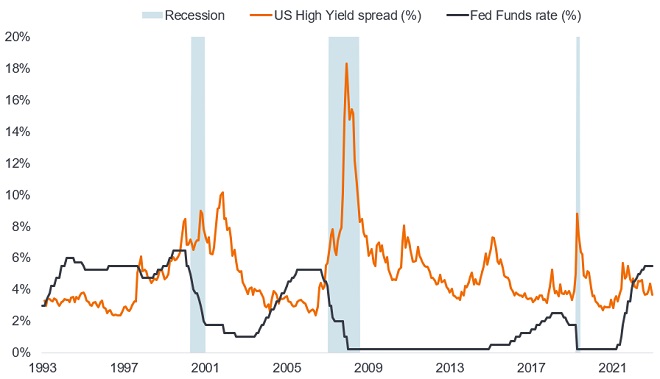

Alongside individual corporate factors, spreads on high yield bonds are heavily driven by sentiment. Towards the end of 2023, expectations of a soft-landing scenario took hold. For spreads to tighten (decline) further requires inflation to be behaved and economies to grow moderately. This did happen in the mid-1990s after the US Federal Reserve (Fed) eased rates, so we do not rule it out. Any evidence of recession in the US, however, and spreads could move wider (higher), potentially undoing any positive effect from central banks cutting rates.

Figure 1: Recession worries need to ease for spreads to tighten further

Source: Bloomberg, Bloomberg US Corporate High Yield OAS (option-adjusted spread over government), US Federal Reserve Fed Fund Target Rate (upper bound), recession periods as per National Bureau of Economic Research, 31 December 1993 to 30 November 2023. Past performance does not predict future returns.

Decompression (spread widening as you move down the credit spectrum in response to negative news) has principally been among lower rated CCC rated bonds (primarily in Europe), with spreads on BB and B rated bonds actively tightening in 2023. There is logic to this – CCC rated bonds are more vulnerable to default while BB and B are better placed to cope with a sluggish economy – but we think the market may be a little complacent given the potential risks on the horizon. The maturity wall (companies needing to refinance in the next couple of years) has been growing so there is the potential for volatility as the window to delay refinancing shrinks.

Our expectations for defaults in 2024 are that, outside of a sharp recession, they will be higher but more of a plateau than a spike. This more prolonged default cycle pushes the onus onto security selection for longer. In Europe, the lower proportion of CCC rated bonds in that region means the default rate should remain below that in the US.

Finding a firm footing

A potentially bumpy growth outlook next year, in our view, argues for a nimble investment approach. The risk of spread widening poses a greater problem for more cyclical sectors, so our preference is for sectors with more predictable cash flows such as healthcare. We are selective in terms of consumer-facing sectors but see opportunities in food retailers, given their more reliable revenues and nascent easing in cost inflation. We believe certain areas of leisure continue to offer attractive prospects provided the jobs market remains resilient. In our view, the telecom sector faces some structural challenges as this mature industry carries high levels of debt yet needs to meet some significant capital expenditure requirements.

The directional pull

Yields on bonds adjusted higher in response to inflation and higher interest rates but that adjustment is, in our view, done. Central banks have been successful in their war on inflation, so rate cuts should be a given, although the timing of cuts will be another source of volatility. We are mindful that average yields on high yield bonds of 7.1% in Europe and 8.5% in the US provide an attractive income and a potential cushion against mishaps.2 In fact, a 1% decline in yield on a bond yielding 8.5% has the potential to deliver low double-digit total returns over a 12-month period, provided the bond does not default.3 So, there is much to play for if a soft landing comes to fruition.

For much of 2022 and 2023, fund flow data for the high yield asset class was dominated by outflows.4 November 2023 saw an improvement in sentiment as investors chased yield and the soft-landing scenario gained credence. With markets having been negative towards the asset class over the last two years, a drip-drip of positive flows could be supportive in the near term.

In summary, therefore, the prospects for high yield bonds remain dependent on the unfolding economic data. We believe that security selection will be increasingly important in a period where defaults are likely to creep higher and the lagged effect of policy tightening may be most acute. A tug of war could take place between spreads and rates. Contained inflation and sluggish economies should allow central banks to cut rates and for government bond yields to fall. While this could help pull down yields on high yield bonds, we anticipate the lagged impact of monetary tightening to cause the occasional growth scare. Throughout 2023 we experienced several reversals in sentiment and we anticipate more of the same in 2024 as bouts of optimism and pessimism around economic growth causes volatility in spreads. It will be a year for vigilance, but volatility should present opportunities.

1Source: Bloomberg, Economic Forecasts. The forecasts are based on a composite of economists’ figures, as at 1 December 2023. There is no guarantee that past trends will continue, or forecasts will be realised.

2Source: Bloomberg, ICE BofA Euro High Yield Index, ICE BofA US High Yield Index, yield to worst. The yield to worst is the lowest yield a bond (index) can achieve provided the issuer(s) does not default; it takes into account special features such as call options (that give issuers the right to call back a bond at a specified date). Yields as at 30 November 2023. Yields may vary over time and are not guaranteed.

3Total return potential assumes a 100 basis points (1%) decline in yield on a bond with four years to maturity and no default. Basis point (bp) equals 1/100th of a percentage point, 1bp = 0.01%. Yields may vary over time and are not guaranteed. There is no guarantee that past trends will continue, or forecasts will be realised.

4Source: Bloomberg Intelligence, Corporate Credit Dashboard, Europe and North America high yield fund flows, as at 1 December 2023. There is no guarantee that past trends will continue, or forecasts will be realised.

The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed rate corporate bond market.

The ICE BofA Euro High Yield Index tracks the performance of EUR denominated below investment grade corporate debt publicly issued in the euro domestic or Eurobond markets.

The ICE BofA US High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

Cash flow: The net amount of cash and cash equivalents transferred in and out of a company.

Capital expenditure: Money invested to acquire or upgrade fixed assets such as buildings, machinery, technology and equipment in order to maintain or improve operations and foster future growth.

Corporate fundamentals are the underlying factors that contribute to the price of an investment. For a company, this can include the level of debt (leverage) in the company, its ability to generate cash and its ability to service that debt.

Credit rating: A score given by a credit rating agency such as S&P Global Ratings, Moody’s and Fitch on the creditworthiness of a borrower. For example, S&P ranks investment grade bonds from the highest AAA down to BBB and high yields bonds from BB through B down to CCC in terms of declining quality and greater risk, i.e. CCC rated borrowers carry a greater risk of default.

Credit spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Cyclical: Companies or industries that are highly sensitive to changes in the economy, such that revenues are generally higher in periods of economic prosperity and expansion and lower in periods of economic downturn and contraction.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

High yield bond: Also known as a sub-investment grade bond, or ‘junk’ bond. These bonds usually carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher interest rate (coupon) to compensate for the additional risk.

Inflation: The rate at which prices of goods and services are rising in the economy.

Investment-grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies.

Late cycle: Economic activity often reaches its peak, implying that growth remains positive but slowing.

Leverage: This is a measure of the level of debt in a company. Net leverage is debt (minus cash and cash equivalents) as a ratio of earnings (typically before interest, tax, depreciation and amortisation).

Maturity: The maturity date of a bond is the date when the principal investment (and any final coupon) is paid to investors. Shorter-dated bonds generally mature within 5 years, medium-term bonds within 5 to 10 years, and longer-dated bonds after 10+ years.

Monetary policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Nominal data reflects economic data quoted in current prices so it incorporates inflation. Nominal economic growth is usually higher than real growth (inflation-adjusted) but this difference subsides when inflation falls.

The real interest rate is the rate of interest an investor, saver or lender receives after allowing for inflation.

Recession: A significant decline in economic activity lasting longer than a few months. A soft landing is a slowdown in economic growth that avoids a recession. A hard landing is a deep recession.

Refinancing: The process of revising and replacing the terms of an existing borrowing agreement, including replacing debt with new borrowing before or at the time of the debt maturity.

Total return: This is the return on an asset or investment that takes into account both income and any capital gain/loss.

Tug of war: a test of strength in which two teams pull against each other at opposite ends of a rope.

U.S. Treasury securities are direct debt obligations issued by the U.S. Government. The investor is a creditor of the government. Treasury Bills and U.S. Government Bonds are guaranteed by the full faith and credit of the U.S. government, are generally considered to be free of credit risk and typically carry lower yields than other securities.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, at its most simple, this is calculated as the coupon payment divided by the current bond price.

Volatility measures risk using the dispersion of returns for a given investment. The rate and extent at which the price of a portfolio, security or index moves up and down.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- Emerging markets expose the Fund to higher volatility and greater risk of loss than developed markets; they are susceptible to adverse political and economic events, and may be less well regulated with less robust custody and settlement procedures.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.