Tariffs have been synonymous with President Trump’s approach since his first term, marking a significant aspect of his policy toolkit. In 2018, he implemented various tariffs, primarily focusing on China and Mexico, but the European Union was also affected. These measures targeted specific imports, including steel and aluminium on a global scale, as well as specific products from the EU, such as aircraft, wine, cheese and olives.

However, this sequel is unfolding differently, especially regarding actions taken against Canada. The prospect of tariffs could act as a catalyst for negotiations on topics distinct from goods targets, which is ultimately the administration’s goal. We expect this could extend to other countries or regions, including Colombia, Panama, Greenland, as well as Mexico and Canada. Trump has already threatened, but not enforced, tariffs on goods coming from the EU, and he could turn his attention other countries within the Asia-Pacific region to highlight or address perceived trade imbalances. The President has, so far, been moot on the prospects of UK tariffs.

Evaluating the likelihood of tariffs becoming permanent versus adopting various other measures presents a significant challenge. The Trump administration employs a unique strategy in negotiations through tariffs, making it crucial to grasp the actual objectives of the President and his team.

The sector implications

Autos

The automotive sector is directly impacted, particularly the US big three Original Equipment Manufacturers (OEMs), General Motors, Ford and Stellantis, as they operate production facilities in Mexico and Canada to supply the US. Component suppliers are also caught in the crosshairs as they have factories shipping components across border or components are used in vehicles that are then shipped to the US.

One initial consideration is whether this situation represents an ‘opening gambit’ from Trump, aimed at negotiation. Notably, it was announced on the morning of 3rd February that the imposition of tariffs on Mexican goods would be postponed for a month, alongside news that the Mexican president agreed to deploy 10,000 National Guard troops to the US-Mexico border. Another question is whether auto manufacturers will attempt to pass the burden of tariffs onto consumers, potentially impacting demand, or choose to absorb part of the cost, affecting their profit margins.

We believe that OEMs will probably, at least in the short term, take on the additional costs, leading to reduced margins before they adjust pricing strategies for both their customers and suppliers. Moving manufacturing back to the US is not a swift process, especially given the difficulty in sourcing appropriately skilled workers. Although there is spare capacity in several US-based factories, those that produce higher-margin trucks and SUVs (Sport Utility Vehicles) are operating at near full capacity, complicating any plans to relocate production. Repurposing existing facilities for new production lines would also necessitate a significant investment.

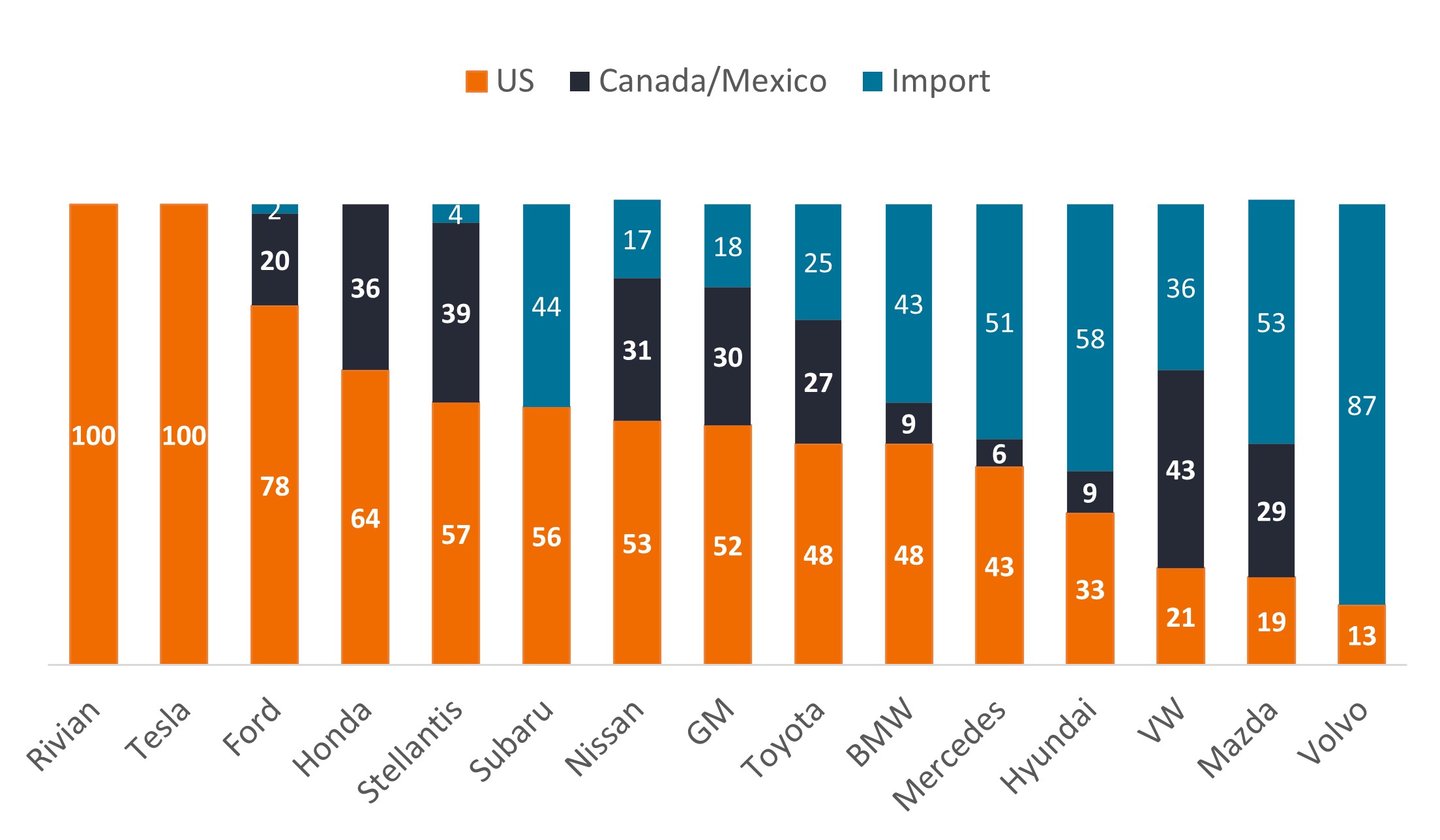

Figure 1: OEMs’ percentage of US sales by country of assembly in 2024

Source: Barclays, 3 February 2025. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

For European OEMs, it is mainly the German premium car manufacturers that would be impacted, as shown in Figure 1. However, the effect on companies like BMW and Mercedes might be mitigated by their significant manufacturing presence in the US, which aligns with their strategy of producing locally for the domestic market. The situation for Volkswagen (VW) is somewhat more complicated due to its large manufacturing facility in Mexico where it manufactures VW branded vehicles, although the US represents a relatively small market for the VW brands. Its subsidiaries Porsche and Audi both import from Europe to the US and so would be affected. Should tariffs extend to the UK, the greatest impact would likely be felt by Jaguar Land Rover and Aston Martin, given the US is a key market for each. Given these brands’ premium or luxury pricing, they should have more flexibility to offset tariffs with price increases, helped by the depreciation of sterling against the US dollar.

Regardless of currency fluctuations, the larger OEMs could still struggle to pass the full extent of these costs onto pressured consumers. Vehicle price inflation in the US has significantly exceeded the general Consumer Price Index (CPI), with prices on average nearly 30%1 higher compared to pre-pandemic levels. The estimated effect of tariffs is projected to exceed US$3,000 per vehicle on average, which would result in an approximate 7% increase in pricing.2 With most new vehicles bought with finance, affordability has been further impacted by interest rates.

Tech

Turning to the technology sector, software is likely to be minimally affected by tariffs due to its non-reliance on physical asset production and the geographical distribution of its workforce. On the other hand, hardware, which is often manufactured abroad, relies on components such as semiconductor chips and wafers. These are predominantly produced in the Asia-Pacific region, excluding China (for example, in Thailand and Malaysia), before being shipped to Mexico for assembly, taking advantage of lower labour costs. The impact of the recently announced tariffs would therefore be most pronounced in the assembly phase. Large end-market manufacturers like Dell and HP would likely feel the effects more acutely than their suppliers.

Energy and commodities

The Trump administration likely factored in the effects of tariffs on energy and commodities for the US economy, as evidenced by the reduction of energy resources tariffs to 10% versus the 25% applied more broadly on Canada. The situation with steel is key as imports from Canada and Mexico (mainly Canada) make up about 35% of the total (Figure 2), yet 90% of US steel exports are destined for these two countries3, presenting a different perspective on the trade imbalance. The critical issue moving forward is how potential retaliatory tariffs might affect the flow of this commodity. Tariffs on aluminium could pose a greater challenge to the US economy, given the country’s status as a significant net importer of aluminium.

Figure 2: 2023 US imports by commodity

| Copper (kt) | Aluminium (kt) | Zinc (kt) | Steel (kt) | PGMs (t) | Crude oil (kb/d) | |

| US 2023 Imports | 1128 | 6140 | 753 | 25100 | 145 | 6500 |

| US 2023 Net Imports | 565 | 4532 | 677 | 15700 | 45 | 2400 |

| US imports as % of demand | 71% | 114% | 80% | 27% | NA | 39% |

| US net imports as % of demand | 36% | 82% | 67% | 17% | NA | 15% |

| Share of imports from Canada | 28% | 56% | 47% | 32% | 6% (Palladium) | 60% |

| Share of imports from Mexico | 8% | 2% | 15% | 15% | NA | 11% |

| Share of imports from China | 0.50% | 4% | 2% | 1% | 0% | 0% |

Source: TradeMap, EIA, Woodmac, Morgan Stanley Research. Share from Mexico and Canada shown on a share of volume basis. PGMs= Platinum Group Metals.

Navigating uncertainty

In conclusion, “Tariff Wars II” marks a complex chapter in global trade dynamics, with far-reaching impact across various sectors. The Trump administration’s strategy continues to unfold in unexpected ways. The responses from affected countries and industries, as well as the potential for retaliatory measures, will play a critical role in shaping trade and global growth dynamics.

For markets, it is evident that pricing dislocations present both relative value opportunities and risks, especially for companies unable to adapt to this challenging landscape. It is crucial for investors to engage in strategies that actively address these challenges, with a dynamic approach to allocate across regions and sectors. For example, automotive companies represent a material proportion of both investment grade and high yield indices. We have maintained a defensive stance towards the sector, recognising not only the rising threat of global trade wars, but also the subdued outlook for production volumes this year and the challenges arising from the uneven roll-out and adoption of electric vehicles around the world.

We believe that a robust credit research process to select issuers who are well-placed to overcome these challenges is key to effectively steer through these uncertain waters. Currently, our emphasis is on actively investing in companies that boast strong balance sheets, solid liquidity, and operations characterised by consistent cash flow stability and/or the potential for growth.

1 Source: US Bureau of Labor Statistics for CPI, JP Morgan Average Transaction Prices for vehicles, as at 31 December 2024.

2 Source: Janus Henderson, JP Morgan, Wolfe research estimates, February 2025.

3 Source: US Department of Commerce, Enforcement and Compliance. Public trade data from S&P Global Inc, last updated on January 22 2025, using November 2024 data.

Balance sheet: A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Balance sheet strength: A company’s financial position. See also: balance sheet.

Consumer Price Index (CPI): A measure that examines the price change of a basket of consumer goods and services over time. It is used to estimate inflation. ‘Headline’ CPI inflation is a calculation of total inflation in an economy, and includes items such as food and energy, where prices tend to be more volatile. ‘Core’ CPI inflation is a measure of inflation that excludes transitory/volatile items such as food and energy.

Original equipment manufacturers: An original equipment manufacturer (OEM) is a company that makes parts or equipment for other companies to sell under their own brand.

Trade imbalance: This occurs when a country imports more than it exports, or vice versa.

IMPORTANT INFORMATION

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.