Multiple tailwinds place residential real estate in a favourable position

Alongside a growing economy, US apartment landlords are benefiting from demographic tailwinds, as the largest age cohort today also happens to be in the prime rental age of 25-34 (see chart 1). With home ownership unattainable for many given mortgage rates over 6%,1 homeownership rates have continued to decline. Alongside this we have seen an (overdue?) pickup in the ‘unbundling’ of younger adults from their parental homes. Together, these factors have amplified rental demand, reflected in occupancy levels exceeding 95% in recent quarters,2 a level typically associated with market rental growth.

Chart 1: Continuing apartment demand supported by demographics – prime rental age is the largest US age cohort

Source: US Census Bureau, national population by characteristics, latest data at 2023.

Locations such as Seattle and San Francisco, which had languished post-pandemic, are also now witnessing a recovery, supported by newly-elected politicians focusing on re-establishing the vibrancy of central business districts, and return to work mandates by major tech employers such as Amazon, Microsoft, and Salesforce.

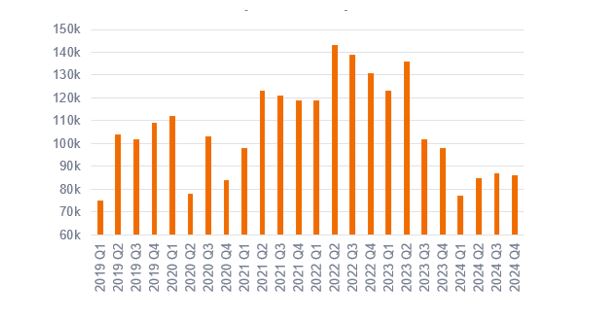

The headwind for landlords in recent years has been the high levels of new inventory hitting markets. This is a consequence of the record construction spree triggered by low borrowing costs and buoyant demand in 2021 and 2022, notably in Sunbelt cities like Nashville, Austin, and Charlotte. Rent growth here is weak, and at times has been negative. However, with construction starts trending down (chart 2), expectations are for an inflection point in these markets next year, setting the stage for a resumption of broad-based growth across the apartments sector.

Chart 2: Supply for multifamily units is trending downwards

Quarterly multifamily development starts (units)

Source: US Census Bureau and US. Department of Housing and Urban Development, Survey of Construction. New privately-owned housing units started, data to Q4 2024.

Senior housing: boomers leading the pack

Senior housing landlords have been amongst the best performers in the real estate investment trust (REIT) market in recent years. Market leader Welltower has seen an almost 150% shareholder return since the start of 2023,3 far outperforming even the en-vogue data centre landlords!

Demand is experiencing remarkable growth, driven by the anticipated 5% annual increase in the 80+ demographic through 2030.4 With occupancy rates and rental growth on the rise, senior housing REITs have leveraged operational efficiencies and data insights to offer superior services to residents and improved margins to shareholders. The pandemic spurred a retreat of private capital from this asset class, which has allowed listed REITs like Welltower and Ventas to acquire, at scale, properties at attractive yields in the 7-8% range,5 enabling a powerful blend of internal and external growth.

Student accommodation – supply constrained with resilient demand

At the other end of the demographic spectrum, student housing continues to see demand for purpose-built accommodation far outstripping available supply, which has enabled some landlords to consistently see rental growth rates ahead of inflation. In the current academic year, UK-focused REIT Unite reported rental growth of more than 8% from the prior year.6 With a shrinking supply of private rental housing, constraints on new development and recession resilient demand, we expect the sector to continue to deliver.

Living sector offers defensive growth at a discount today

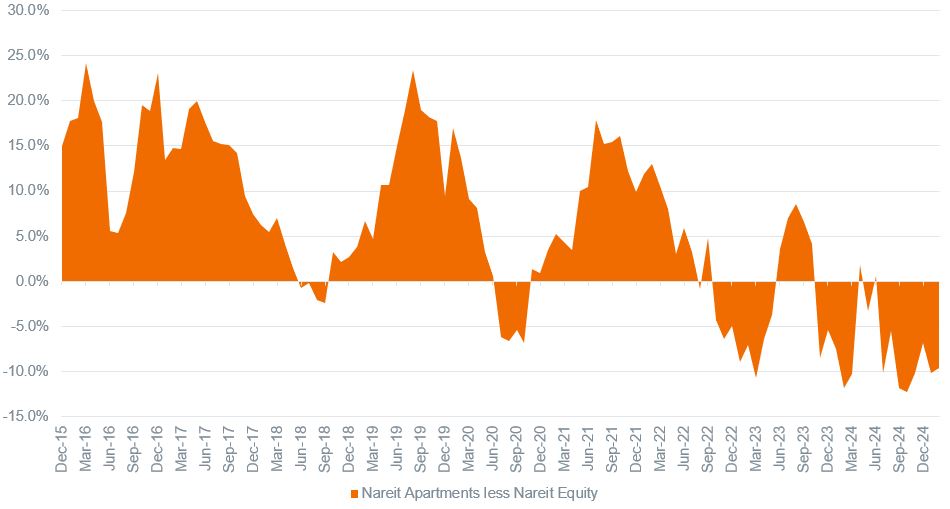

As we look ahead, the residential sector, supported by traditional apartment landlords alongside alternative sub-sectors, presents a compelling investment case as supply pressures ease and could be set for another period of outperformance.

Chart 3: Apartment REITs have outperformed broader REITs more than 70% of the time over the past ten years

Rolling 3-year annualised Apartment REITs outperformance versus Equity REITs

Source: Bloomberg, Janus Henderson Investors analysis, 3-year total returns (monthly) Nareit Equity Apartments Index less Nareit Equity Index 10 years to 28 February 2025. Past performance does not predict future returns.

We also take comfort from the fact that US residential REITs are currently trading at a double-digit discount to net asset value (NAV) and multiples have de-rated from their historical premiums.7 This is despite the fact that balance sheets are stronger than ever, and operating platforms are driving strong efficiencies and growth potential. As a result, we believe residential REITs look well positioned for a multi-year run of earnings and dividend per share growth and the potential for a re-rating, as evidence of the next cycle surfaces through accelerating rent growth.

1 MortgageNewsDaily.com; typical 30-year mortgage term, as at 28 March 2025.

2 As reported by various residential REITs, Q4 2024 occupancy levels.

3 Financecharts.com, Welltower REIT, 30 December 2022 to 28 February 2025. Past performance does not predict future returns.

4 Organisation for Economic Co-operation and Development, 2025-2030 estimates.

5 Welltower Q4 2024 earnings report.

6 Unite Group.com as at 25 February 2025; financial results 2024.

7 SNL Real Estate as at 31 January 2025. Past performance does not predict future returns.

Featured image at beginning of the article: Welltower’s senior housing asset on 56th Street, Manhattan. Image credit: Welltower Inc., published and reproduced with permission.

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally, REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.

FTSE Nareit All Equity REITs Index tracks the performance of the U.S. real estate investment trust (REIT) market.

Balance sheet: an indicator of a company’s financial strength. The balance sheet is a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time.

De-rating: occurs when investors are willing to pay a lower price for (REIT) shares, usually in anticipation of lower future earnings.

Discount to NAV: net asset value (NAV) measures the underlying value of the REIT’s holdings by taking the market value and subtracting any debts, such as mortgage liabilities. When a REIT’s market price is lower than its NAV, it is said to be trading at a discount.

Dividend per share: the total dividend a company/REIT pays out over a 12-month period, divided by the total number of outstanding shares.

Multifamily: residential real estate that allows for more than one households to live in a single property, and are often rented out rather than being owner-occupied, with some sharing communal spaces and utilities.

Multiples: are used to compare the value of similar assets. In real estate a common multiple is the cap rate, used for income-producing properties such as apartments, offices, or retail, which reflects the return on investment and the risk of the property.

NAV: Net Asset Value measures the underlying value of the REIT’s holdings by taking the market value and subtracting any debts, such as mortgage liabilities.

Property multiples de-rated from historical premium: refers to valuations that are now cheaper compared to the higher prices that investors were willing to pay in the past.

Property yield: the annual return on the capital investment usually expressed as a percentage of the capital value.

Re-rating: occurs when investors are willing to pay a higher price for (REIT) shares, usually in anticipation of higher future earnings.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.