Economic divergence and monetary policy: A look at Canada and the UK

Portfolio Manager Daniel Siluk explains how varying degrees of progress in reining in inflation and supporting growth are resulting in differing policy prescriptions that investors may be able to capitalize on by fine-tuning their interest rate exposure across multiple geographies.

4 minute read

Key takeaways:

- Facing a likely midyear slowdown in economic growth, the Bank of Canada could follow peers in Sweden and Switzerland that have already cut interest rates.

- In contrast, upside surprises in services inflation will likely keep the Bank of England on pause.

- By taking a global approach to generating returns, bond investors have the opportunity to increase interest rate exposure – or duration – in countries poised to loosen policy while being more cautious in jurisdictions where victory against inflation has yet to be declared.

Earlier this year, we noted that varying economic growth rates and progress in reining in inflation would likely lead to diverging monetary policies among global central banks. Furthermore, we made the case that in several instances, forward-looking markets were not effectively reflecting the potential for policy divergence. Fast forward a few months, and disparate economic and policy paths are indeed becoming more evident.

At present, the economic paths of Canada and the United Kingdom showcase a notable divergence, which is leading these countries’ respective central banks to chart decidedly different courses. Recent data releases provide insight into this phenomenon, highlighting how each country’s unique economic conditions are influencing monetary policy.

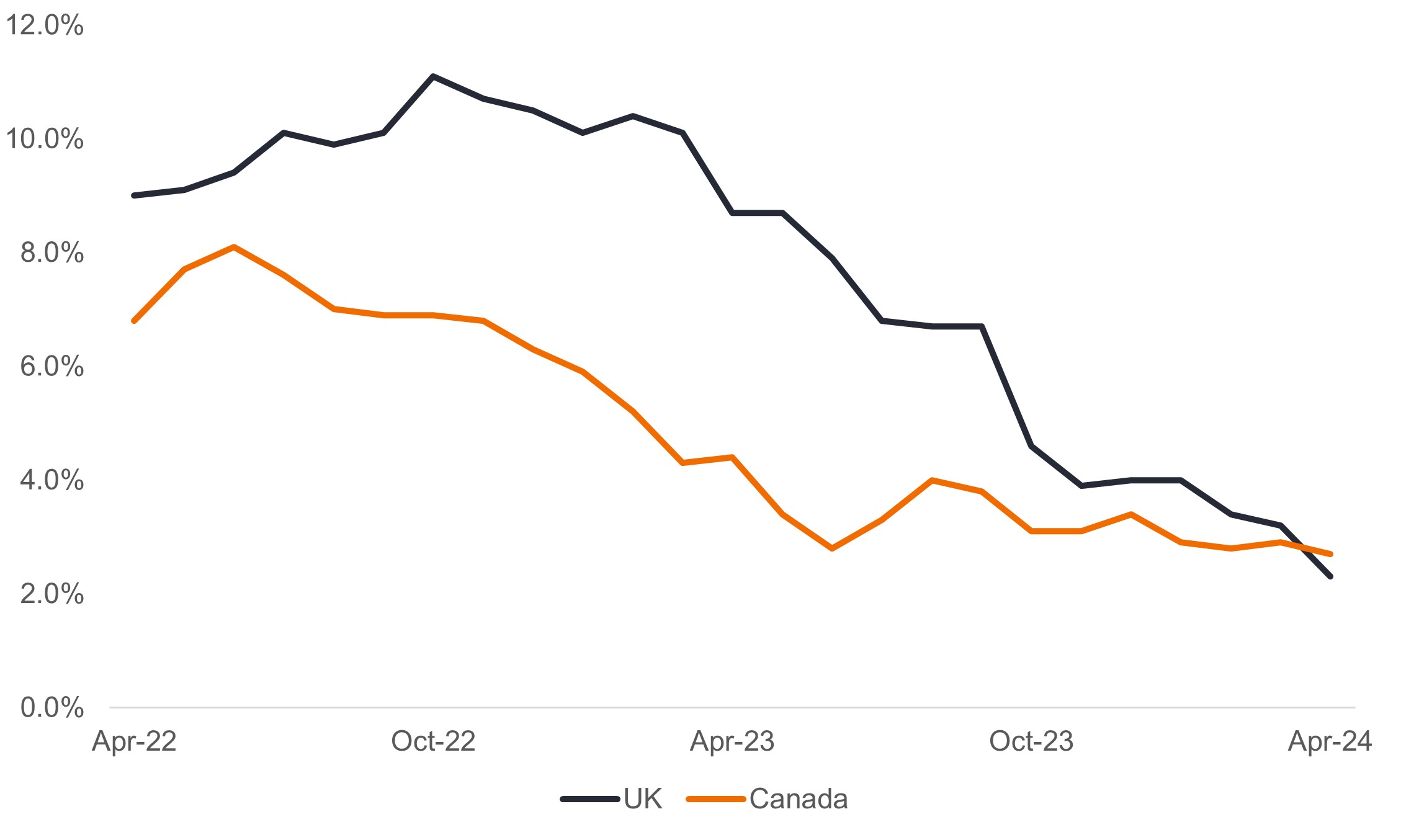

Canada’s path to rate cuts

In Canada, the latest data indicate a cooling inflation environment. The headline consumer price index (CPI) for April rose by 0.5% on a non-seasonally adjusted basis, aligning with market expectations and contributing to the annual pace of inflation slowing to 2.7% from 2.9% in March. This slowdown is significant, considering inflation in Canada peaked at 8.1% in June 2022. The data suggest that the Bank of Canada’s (BoC) restrictive monetary policy is effectively beginning to impact the economy.

Given these conditions, the market’s anticipation for a rate cut by the BoC has increased, moving from a 40% chance to 60%. The expectation is that – barring any significant surprises in growth and employment data – the BoC may initiate a rate cut over the summer, with the most likely move being in July.

Year-over-year change in consumer price index

Halting progress in the UK’s battle against inflation has likely put it behind Canada with respect to imminent rate cuts.

Source: Janus Henderson Investors, as of 28 May 2024.

Source: Janus Henderson Investors, as of 28 May 2024.

United Kingdom’s delayed easing cycle

In contrast to Canada, the UK’s higher-than-anticipated headline and services inflation for April have dampened the prospects of an early rate cut from the Bank of England (BoE). CPI decreased less than anticipated – to 2.3% from 3.2% – with services inflation dropping only marginally, to 5.9% from 6%, against forecasts of 5.5%. This has led to a recalibration of expectations, with the likelihood of a June rate cut drastically reduced.

The BoE’s Monetary Policy Committee (MPC) has historically shown tolerance for volatility, but the April data’s deviation from expectations, especially in services inflation, cannot be overlooked. Despite anticipating further declines in inflation, the consensus is now to delay rate cuts until later in the summer or even into the fall. This cautious approach, in our view, is reflective of the BoE’s strategy to sustainably achieve its inflation objective while supporting a tentative economic recovery, as evidenced by gross domestic product growth in the first quarter of this year registering the strongest gain since late 2021.

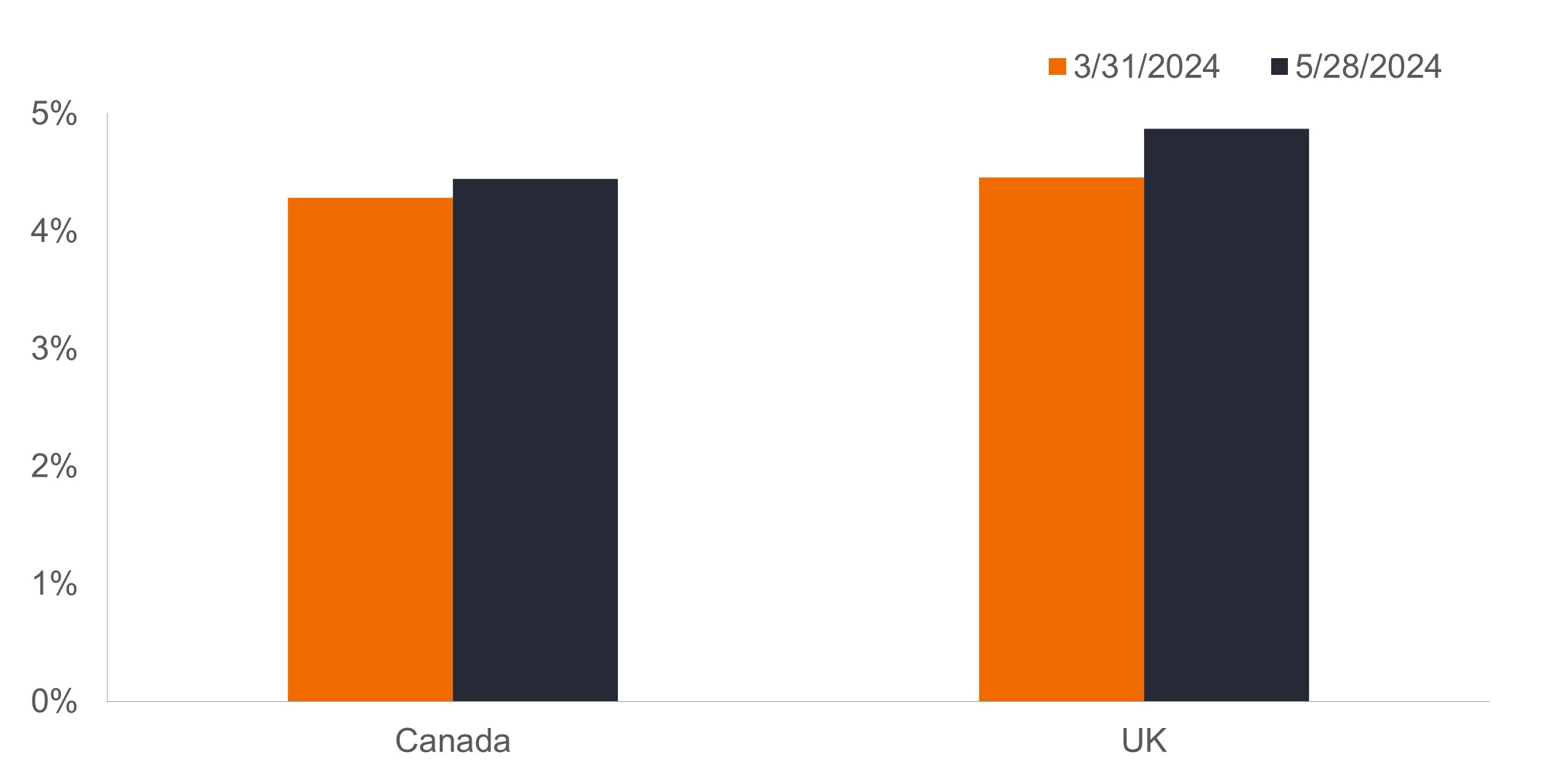

2024 end-of-year expectations for benchmark policy rates

While market-based forecasts for Canada’s benchmark rate remain relatively stable – with odds modestly increasing for a summer reduction – futures investors have dialed back their expectations for mid-to late-year cut in the UK.

Source: Bloomberg, as of 28 May 2024.

Source: Bloomberg, as of 28 May 2024.

Opportunities in divergence

The diverging economic activities and subsequent monetary policy responses in Canada and the UK highlight the potential for varied investment strategies in developed markets. Canada’s cooling inflation and the anticipated easing of monetary policy present an opportunity to gain exposure to Canadian duration. Conversely, the uncertainty and delayed easing cycle in the UK suggest a more cautious approach may be warranted, and we would caution against owning UK duration at this juncture.

This divergence not only highlights the nuanced nature of global economic recovery but also emphasizes the importance of closely monitoring economic indicators to inform investment decisions. As central banks navigate this complex economic landscape, the opportunities and risks within different jurisdictions will continue to evolve, offering strategic avenues for astute investors.

Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Department of Labor Statistics.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Quantitative Easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.