The other 493: Finding opportunities outside the Mag 7

Portfolio Manager Nick Schommer explains that, while investors have gravitated toward the growth of the “Magnificent Seven” technology platforms, there is a strengthening case for a broadening of market returns.

5 minute read

Key takeaways:

- Mega-cap tech and communication services stocks continue to dominate market returns as investors have flocked to these safe havens during a period of restrictive monetary policy.

- As monetary policy eases, we think we are likely to see an environment where out-of-favor areas of the market start to perform again.

- As such, we believe investors should consider diversifying into market segments that could benefit as rates come down and overlooked recovery plays where investors had priced in a recession.

In 2023, a narrow group of tech giants and communication services stocks, the so-called “Magnificent Seven” (Mag 7), dominated stock market gains, while the rest of the S&P 500® Index lagged well behind.

During a period of more restrictive monetary policy and greater economic uncertainty, it’s not surprising that investors have gravitated toward the Mag 7, with their durable earnings and strong fundamentals.

But while these stocks have served as a popular flight-to-quality trade, now may be the right time to find opportunity in areas that were left behind in a rising rate environment.

Narrow leadership

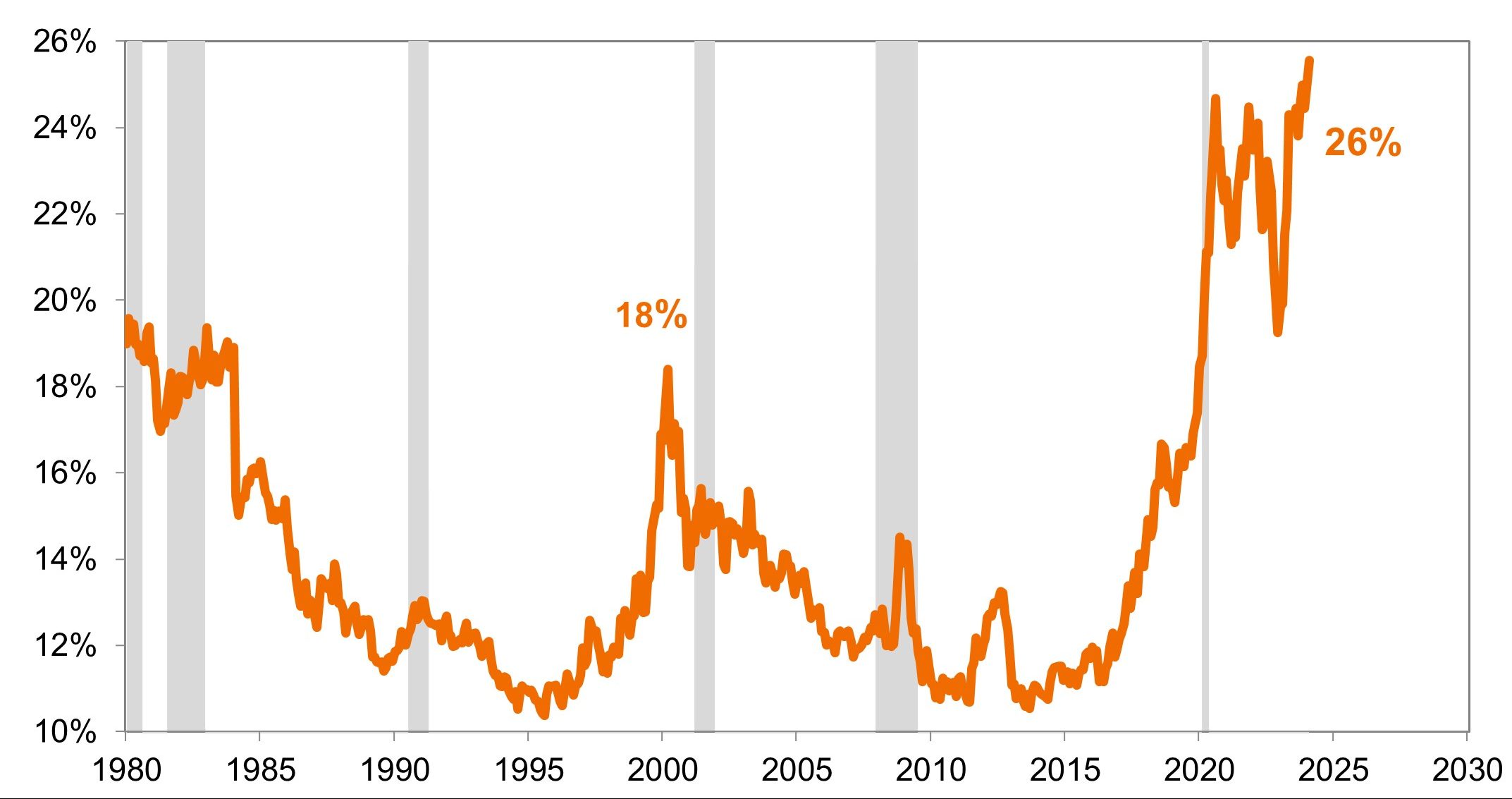

On the heels of exceptional 2023 performance from the largest market capitalization stocks of the S&P 500, the degree of index concentration is at levels we’ve only seen a couple of other times – one being the late-’90s dot-com bubble and the other the 1972 “Nifty 50” era. Given the similarities in the tech-centric business models of companies in the top 5, this level of index concentration diminishes the impact of return drivers from other market segments. In our view, investors should be aware of such top-heavy and narrow performance.

Figure 1: Large-cap index concentration has been on the rise

Five largest companies as share of S&P 500 total market cap.

Source: Goldman Sachs Investment Research Division, as of 12 February 2024. Gray bars indicate recession periods.

Source: Goldman Sachs Investment Research Division, as of 12 February 2024. Gray bars indicate recession periods.

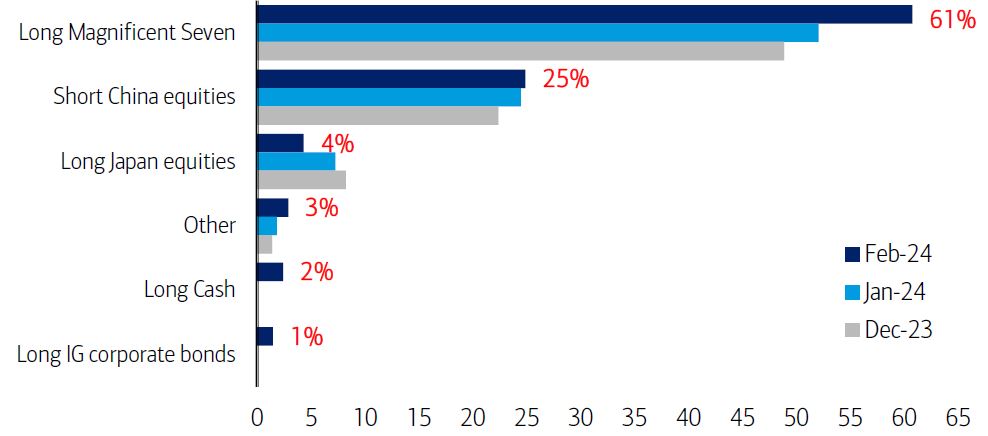

Investors also need to consider the risks of crowded positioning in this market segment. According to a Bank of America survey in January, the “most crowded” trades deemed by global managers was “Long Magnificent Seven” (61% of those polled), which has climbed steadily higher in the polling over the preceding three months. A large number of investors trading in a particular market segment can lead to increased volatility and the risk of a drawdown event.

Figure 2: Crowded trades

Percentage response of fund managers to the survey question: “What do you think is currently the most crowded trade?”

Source: Bank of American (BofA) Global Research Fund Manager Survey, 13 February 2024.1

Fed policy shift opens door for broader market leadership

There are several economic and market factors that can contribute to a broadening of stock market returns, one of which is more accommodative monetary policy. Lower interest rates can boost market liquidity and encourage investors to participate across a wider range of stocks.

In December, the Federal Reserve (Fed) signaled its intent to transition from a 24-month tightening campaign to an easing cycle. This dovish pivot from combating inflation to steering a soft landing triggered a rally and market rotation. After a host of industries traded down in 2023 due to higher interest rates and the prospect of a recession, we began to see a more normalized market where out-of-favor areas were performing again. With the market gaining confidence in an economic soft landing and expectations for a more accommodative monetary policy taking hold, we expect to see this broadening of returns continue.

Where to look for opportunities

Defensive areas of the market lagged throughout 2023 as the Fed aggressively raised rates, but we believe certain sectors are poised to perform relatively well. For example, we expect healthcare and utilities to have a strong 2024 because they offer resilient earnings regardless of the economic backdrop, and their cost of capital is declining as monetary policy eases. For utilities, we are also positive on the generational transformation in power consumption that is currently underway, along with its associated capital expenditure.

Small- and mid-caps, as well as companies with financial leverage, also stand to benefit from cheaper funding costs. These companies are more reliant upon capital markets, and their funding costs are now less expensive than it would have been two months ago.

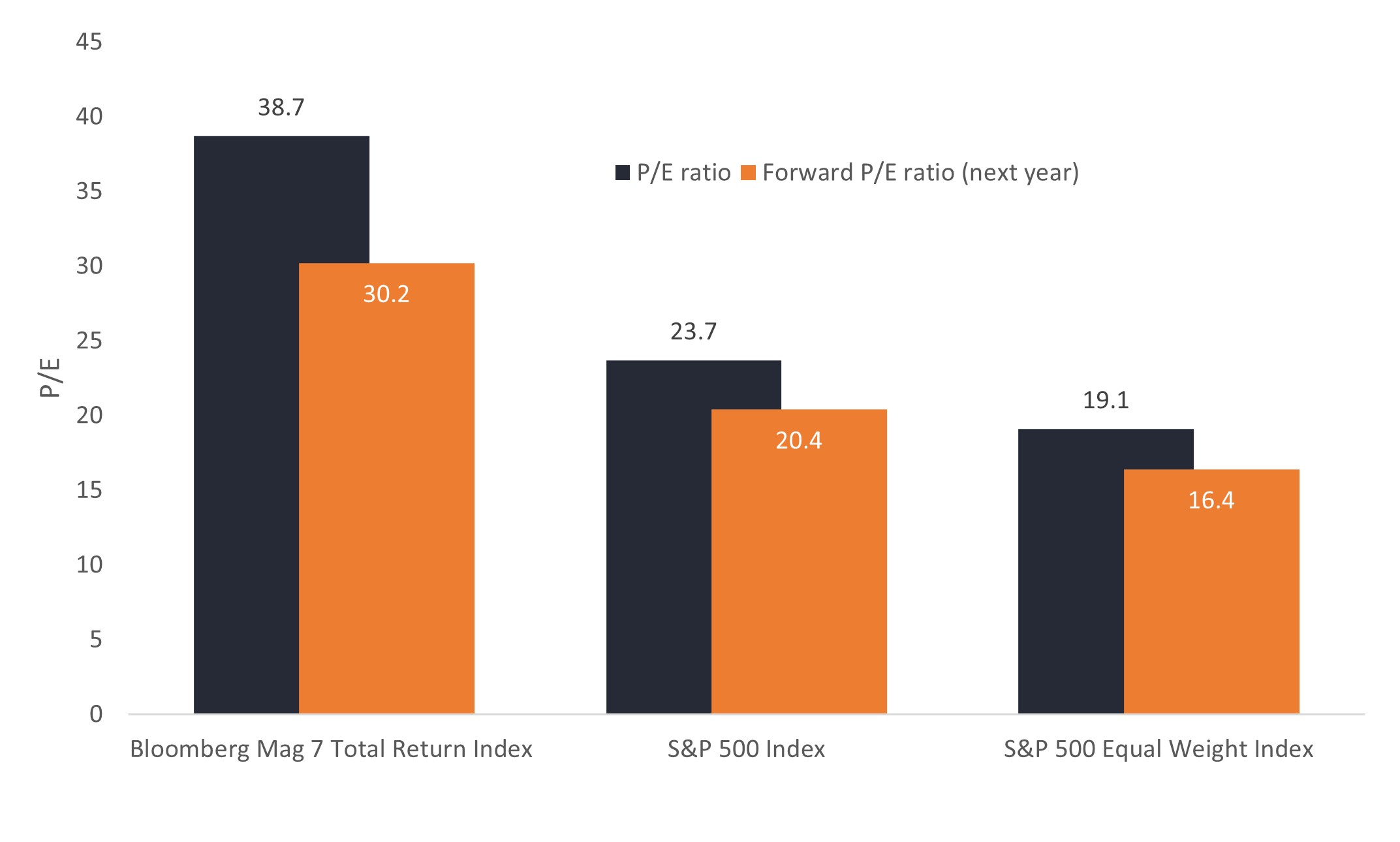

From a valuation perspective, we believe opportunities exist in overlooked areas of the market. The S&P 500® Equal Weight Index, which offers a more balanced representation of market valuation across all stocks in the Index, trades at nearly half the valuation of the Bloomberg Mag 7 Total Return Index on the forward price-to-earnings ratio.

Figure 3: Reasonable broader market valuations

Source: As of 30 January 2023.

Source: As of 30 January 2023.

Seeking diverse returns

With the reversal in the direction of Fed policy, we think investors should look for diverse return drivers across different market segments, sizes, and styles. The rally at the end of the 2023 showed renewed strength in areas that priced in a recession, such as financials, casino operators, and consumer discretionary stocks. This rotation reflected market confidence in a soft landing. We expect this broadening of returns to continue in 2024.

There are still risks to monitor – namely a reacceleration of inflation or a hard-landing recession scenario – but the outlook is improving for a normalized market, in our view. By seeking value in overlooked areas outside the largest tech companies, we believe investors can position portfolios for more diverse market leadership.

IMPORTANT INFORMATION

Smaller capitalization securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalization securities.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

1 The Bank of American (BofA) Global Research Fund Manager Survey is a monthly report that canvasses the views of approximately 300 institutional, mutual and hedge fund managers around the world. In February, an overall total of 249 panelists, with $656 billion in assets under management, participated in the survey, taken February 2 to February 8, 2024.

Reprinted by permission. Copyright © 2024 Bank of America Corporation (“BAC”). The use of the above in no way implies that BAC or any of its affiliates endorses the views or interpretation or the use of such information or acts as any endorsement of the use of such information. The information is provided “as is” and none of BAC or any of its affiliates warrants the accuracy or completeness of the information.

Under no circumstances shall BofA Securities or affiliates be liable to you or any third party for any damages (including but not limited to direct, indirect, special and consequential damages), losses, expenses, fees, or other liabilities that directly or indirectly arise from this license, the Report or the Content or your use of the materials. You hereby waive and release BofA Securities and affiliates from any claims for damages, losses, expenses, fees, liabilities, causes of action, judgments and claims arising out of or related to your use of the Report or the Content, whether now existing or arising in the future.

You recognize that information contained in the Content or Report may become outdated and that BofA Securities and affiliates are under no obligation to update the Content or Report or notify you of any changes to the Content or Report. The Report and Content are provided “AS IS,” and none of BofA Securities and affiliates make any warranty (express or implied) with respect to the Report or any content including the Content, including, without limitation, any warranty of ownership, validity, enforceability or non-infringement, the accuracy, timeliness, completeness, adequacy, merchantability, fitness for a particular purpose, or suitability of the material for any intended audience.

The Bloomberg Magnificent 7 Total Return Index is an equal-dollar weighted equity benchmark consisting of a fixed basket of 7 widely-traded companies classified in the United States and representing the Communications, Consumer Discretionary and Technology sectors as defined by Bloomberg Industry Classification System (BICS).

Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

The S&P 500® Equal Weight Index (EWI) is the equal-weight version of the widely-used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight – or 0.2% of the index total at each quarterly rebalance.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.