Can global small caps take big steps in 2025?

Portfolio Manager Nick Sheridan discusses the strategic value of investing in global small caps in 2025 for enhanced portfolio diversification, growth potential, and attractive valuations.

7 minute read

Key takeaways:

- Smaller caps have endured headwinds over the past few years, with a difficult interest rate cycle adding to borrowing costs, and concerns about their greater sensitivity to economic slowdowns, given their reliance on more economically sensitive sectors and less mature status.

- Smaller caps are expected to perform better in 2025 due to a combination of improving economic conditions, and a favourable interest rate environment.

- A global small cap strategy could give investors access to higher growth potential at attractive valuations, tapping into dynamic global trends, while also offering improved diversification within an equity allocation.

What themes do you expect to most influence global smaller caps in 2025?

We have seen a combination of different headwinds over the past few years for global smaller caps. Probably the most significant was higher interest rates and fears around the economic cycle as a whole. Higher interest rates hit smaller companies in two ways: the higher cost of borrowing has a potentially bigger impact due to their higher exposure to floating rate debt; and broader, heightened risk aversion, which favoured larger companies more generally perceived as defensive. Fears around economic growth hit smaller companies in particular due to their cyclicality (ie. their greater reliance on economic growth) – owing to their less mature nature and exposure to more cyclical sectors such as industrial, materials and discretionary consumer spending.

As we look ahead to 2025, we can see these two headwinds turning in our favour. We are amid a rate cutting cycle in the US, UK and Europe. The inflationary picture remains unclear (especially given current policy uncertainty) and interest rates are not going back to zero, but there is clearly still scope for further cuts in 2025. On the broader economic cycle our view is simple; if the US is accelerating due to pro -growth Trump policies and China’s policy in 2025 matches their recent fiscally expansive rhetoric, Europe, Japan and broader Asia should also benefit. Even under the threat of trade tariffs, we do not think those two economic powerhouses can meaningfully decouple from the rest of the world. If global growth accelerates and rates fall, it is hard to imagine a scenario where that does not lead to a meaningful outperformance of small caps.

What role can small caps play for asset allocators?

As small cap managers we have watched from the sidelines the build-up in momentum and extreme positioning around the artificial intelligence (AI) theme – particularly with the MAG7 (the seven huge US-listed companies that are dominating the AI development space). We do not hold a strong view on whether that positioning is a good decision. Our sense is that AI is likely to transform the growth trajectories of a few companies. But what is clear to us is that this narrow group of stocks will be prone to periods of extreme volatility and short-term profit taking, at the very least – as we saw through the summer of 2024.

This is where small caps can offer some much-needed diversification for equity allocations. They have a relatively low exposure to technology and relatively high exposure to materials and Industrials sectors. These are areas that have their own secular growth theme in the onshoring (or near-shoring) of supply chains.

So, we believe, small caps not only offer meaningful upside in 2025 but also a better diversifier in an equity allocation than they have in decades, owing to the dominance of tech in large cap allocations (Exhibit 1).

Exhibit 1: Small caps are a diversifier for investors with large cap exposure

Source: Bloomberg, Janus Henderson Investors Analysis, as at 30 September 2024.

Note: These views are subject to change without notice and should not be construed as advice. Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Where do you see the most compelling opportunities?

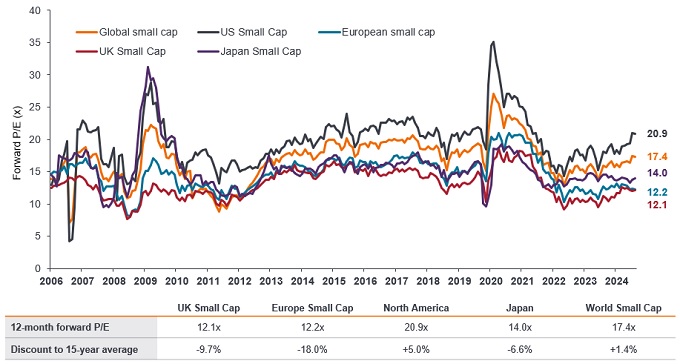

We see opportunities across the board for smaller companies (Exhibit 2). Investors have rushed to US small caps since the US election, in anticipation of expected pro-business policies under a new government. Whilst we expect earnings and returns to move higher in the US in 2025, we caution investors from ignoring the broader opportunity set in small caps.

Exhibit 2: There is opportunity for stock pickers across regions in the small caps space

Source: DataStream, MSCI regional Small Cap indices, Janus Henderson Investors Analysis, as at 4 December 2024. Past performance does not predict future returns.

Note: Forward price-to-earnings (forward P/E – x) is a version of the ratio of price-to-earnings (P/E) that uses forecasted earnings for the P/E calculation. There is no guarantee that past trends will continue, or forecasts will be realised. The views are subject to change without notice.

In Japan, the return of inflation and a new approach to governance has led to improved profitability, extending down to small caps, given their potential for higher growth. In Europe, the upcoming elections in Germany could potentially lead to a tax and pension reform agenda that we have not seen for two decades, revitalising anaemic growth. French politics brings less good news and will need to be watched closely; but it does not yet deter us from investing in Europe owing to its attractive valuations relative to history, other small cap markets, and especially compared to larger companies. Also, any ceasefire deal that ensures security for Ukraine would help to reduce investor negativity toward the region and would likely be combined with external support to help rebuild the country. We would expect either scenario to have a meaningfully positive impact on European small caps.

China’s stimulus measures have been underwhelming thus far, but we would argue that this reflects an intent to enact more forceful measures in 2025, which again would benefit European and Japanese small caps disproportionately.

There is also the ever-green argument on merger and acquisition (M&A) activity, which spans all markets. Higher interest rates put the brake on M&A activity, with a more difficult economic picture clouding general confidence in board rooms. As interest rates continue to fall, smaller companies are inevitably going to come under renewed focus for takeovers, as businesses look to expand, or acquire a particular technology or asset.

Is there a particular chart/data series that best sums up where we find ourselves approaching the turn of the year?

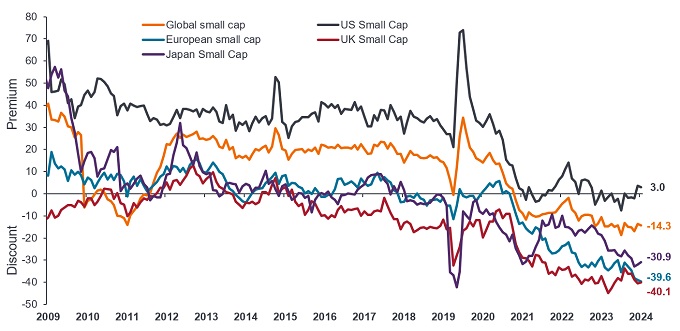

Smaller companies are generally expected to trade at a premium to their larger peers, in normal market conditions, reflecting their greater propensity for growth. That all changed in 2021, when central banks intervened to counter inflationary pressures with an aggressive cycle of interest rate hikes. This favoured the perceived relative stability and resilience of larger companies, a shift that has been distorted by the dominance of a few technology ‘mega-cap’ stocks.

Small cap indices now look heavily discounted compared to their larger peers, on both an absolute and relative basis (Exhibit 3). As interest rates continue to moderate, depending on how well central banks manage any persistent inflationary pressures, the discount on small cap markets should bring the asset class increasingly back into favour.

Exhibit 3: Small cap markets look cheap relative to their large cap peers

Source: DataStream, Janus Henderson Investors Analysis, as at 4 December 2024. The chart compares MSCI regional Small Cap indices relative to the MSCI World Large Cap Index. Past performance does not predict future returns.

Note: Forward price-to-earnings (forward P/E) is a version of the ratio of price-to-earnings (P/E) that uses forecasted earnings for the P/E calculation. There is no guarantee that past trends will continue, or forecasts will be realised. Views here are subject to change without notice.

What do you see as the most important takeaway for an investor allocating to global smaller caps in 2025?

Smaller caps tend to thrive in an environment of improving economic momentum and falling interest rates. We see opportunities across the board for region-agnostic smaller company strategies, given the prospect for earnings to improve as growth picks up, and the significant disparity in valuations relative to larger companies.

Past performance does not predict future returns.

Cyclical/cyclicality: Companies or industries that highly sensitive to changes in the economy (eg. mining), or companies that sell discretionary consumer items (such as cars).]

Discounted: Refers to a situation when a security is trading for lower than its fundamental or intrinsic value.

Economic cycle: The fluctuation of the economy between expansion (growth) and contraction (recession), commonly measured in terms of gross domestic product (GDP). It is influenced by many factors, including household, government and business spending, trade, technology and central bank policy. The economic cycle consists of four recognised stages. ‘Early cycle’ is when the economy transitions from recession to recovery; ‘mid-cycle’ is the subsequent period of positive (but more moderate) growth. In the ‘late cycle’, growth slows as the economy reaches its full potential, wages start to rise and inflation begins to pick up, leading to lower demand, falling corporate earnings and eventually the fourth stage – recession.

Fiscally expansive: Fiscal policy describes government policy relating to setting tax rates and spending levels. Fiscal austerity refers to raising taxes and/or cutting spending in an attempt to reduce government debt. Fiscal expansion (or ‘stimulus’) refers to an increase in government spending and/or a reduction in taxes.

Floating rate debt: A bond with a variable interest rate.

Forward P/E: The price/earnings ratio (P/E) is a popular ratio used to value a company’s shares, compared to other stocks, or a benchmark index. It is calculated by dividing the current share price by its earnings per share. It is calculated by dividing the current share price (P) by its earnings per share (E). The forward P/E is a version of the P/E ratio that utilises forecasted earnings in its calculation.

Inflation: The rate at which the prices of goods and services are rising in an economy. The Consumer Price Index (CPI) and Retail Price Index (RPI) are two common measures.

MAG7 (Magnificent 7): Alphabet, Amazone, Apple, Meta, Microsoft, Nvidia and Tesla.

Mega-cap: The largest designation for companies in terms of market capitalisation. Companies with a valuation (market capitalisation) above $200 billion in the US are considered mega caps. These tend to be major, highly recognisable companies with international exposure, often comprising a significant weighting in an index.

Small caps: Companies with a valuation (market capitalisation) within a certain scale, eg. $300 million to $2 billion in the US, although these measures are generally an estimate. Small cap stocks tend to offer the potential for faster growth than their larger peers, but with greater volatility.

Tariffs: A tax or duty levied on imported goods or services, commonly used as a tool to protect domestic markets or industry.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.