5 reasons to add securitized assets to fixed income portfolios

Portfolio Managers John Kerschner, Nick Childs, and Jessica Shill discuss how securitized sectors might play a key role for bond investors amid a higher interest rate environment.

8 minute read

Key takeaways:

- Higher interest rates, coupled with volatility in bond markets, have pressured fixed income returns since late 2021.

- With the economy and labor market remaining resilient, the Federal Reserve (Fed) will likely need to keep interest rates higher for longer to bring inflation back to their 2% target.

- Bond investors may need to expand their investment toolkit to navigate the new interest rate regime. An allocation to securitized sectors could be a solution, as they offer the potential for attractive yields, lower interest-rate sensitivity, and greater risk-factor diversification.

Following 525 basis points in rate hikes over a period of 16 months, fixed income investors find themselves in a very different world than the zero-percent regime that ensued after the Global Financial Crisis (GFC). Now that it appears the Federal Reserve (Fed) is done raising rates, the question on investors’ minds will be: Where do we go from here?

While gains have been made on the inflation front, we are still a fair way off the Fed’s 2% target. The challenge the central bank faces is that the economy and the labor market have held up fairly well, despite the rate hikes. Until we see some meaningful softening in these areas, it is unlikely the Fed will make any significant cuts to interest rates.

Therefore, we think rates are likely to stay elevated for a longer period, and investors would do well to position their portfolios accordingly. What does that look like for fixed income allocations? In our opinion, investors should aim to strengthen both the offensive and defensive characteristics of their bond portfolios, and an allocation to securitized assets may help on both fronts.

JHI

Below we highlight our top five reasons to add securitized assets to bond portfolios in the current environment.

1. Securitized sectors are under-represented in the Agg.

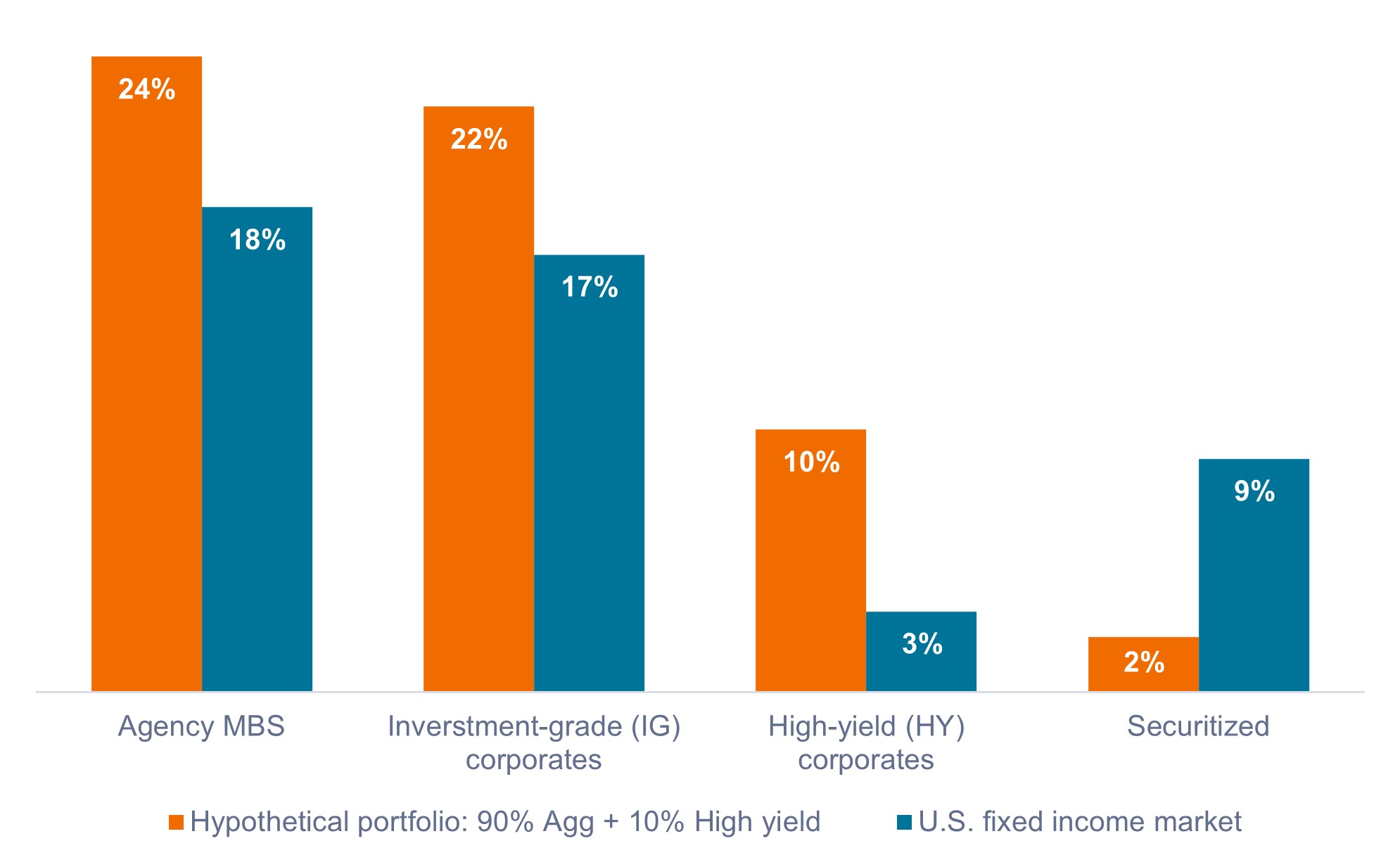

At over $5 trillion, the non-agency securitized market1 represents almost 10% of the U.S. investable fixed income universe. That said, gaining adequate exposure to securitized sectors through passive benchmarks can be challenging, as the composition of benchmark indexes often differs materially from the universe itself.

As shown in Exhibit 1, a hypothetical portfolio of 90% Bloomberg U.S. Aggregate Bond Index (Agg) and 10% high yield results in a significant overweight to corporate bonds relative to the total market. Conversely, securitized sectors are meaningfully underrepresented in the hypothetical portfolio. In our view, investors may need to actively manage these weight discrepancies to ensure they have sufficient exposure to the securitized market.

Exhibit 1: Securitized sectors are typically under-represented in Agg-based portfolios

Source: Bloomberg, SIFMA, as of 31 December 2021. Note: Securitized category includes ABS, CMBS, CLOs, and CMOs.

Source: Bloomberg, SIFMA, as of 31 December 2021. Note: Securitized category includes ABS, CMBS, CLOs, and CMOs.

2. Securitized sectors may help improve portfolio diversification.

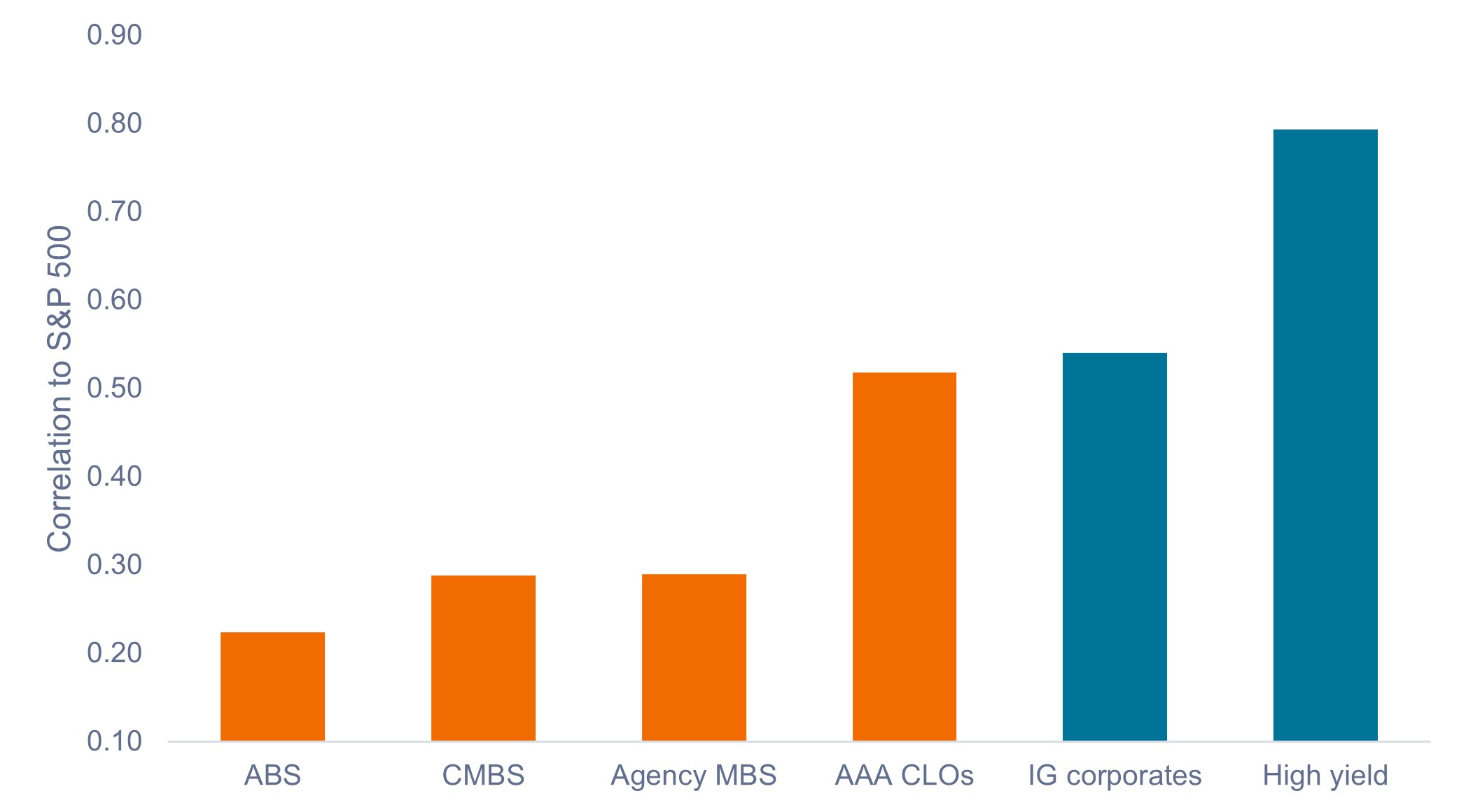

In a higher interest-rate environment, we encourage investors to think less in terms of asset class diversification and more in terms of risk-factor diversification. How much exposure does a bond portfolio have to changes in interest rates? To the corporate credit cycle? To the consumer’s creditworthiness?

To the extent that many securitized markets are backed by loans made to consumers (not corporations), they should offer some diversification from the risks that drive equities and corporate bonds, and this should be reflected in their correlations. Indeed, as shown in Exhibit 2, for the decade ended 31 October 2023, securitized sectors have exhibited lower correlations to U.S. equities than corporate bonds. All else being equal, adding assets with lower correlations should increase overall portfolio diversification, and may lead to better risk-adjusted returns in the long run.

Exhibit 2: Correlation to the S&P 500® (2013-2023)

Securitized sectors have exhibited lower correlation to U.S. equities than corporate bonds.

Source: Bloomberg, as of 31 October 2023.

Source: Bloomberg, as of 31 October 2023.

Note: Monthly correlations for the 10-year period ended 31 October 2023. Indices used to represent asset classes: ABS (Bloomberg U.S. Agg ABS Index), CMBS (Bloomberg U.S. CMBS Investment Grade Index), Agency MBS (Bloomberg Mortgage Backed Securities Index), AAA CLOs (J.P. Morgan CLO AAA Index), IG corporates (Bloomberg U.S. Corporate Investment Grade Index), High yield (Bloomberg U.S. Corporate High Yield Index).

3. Securitized sectors may be used to manage interest rate risk.

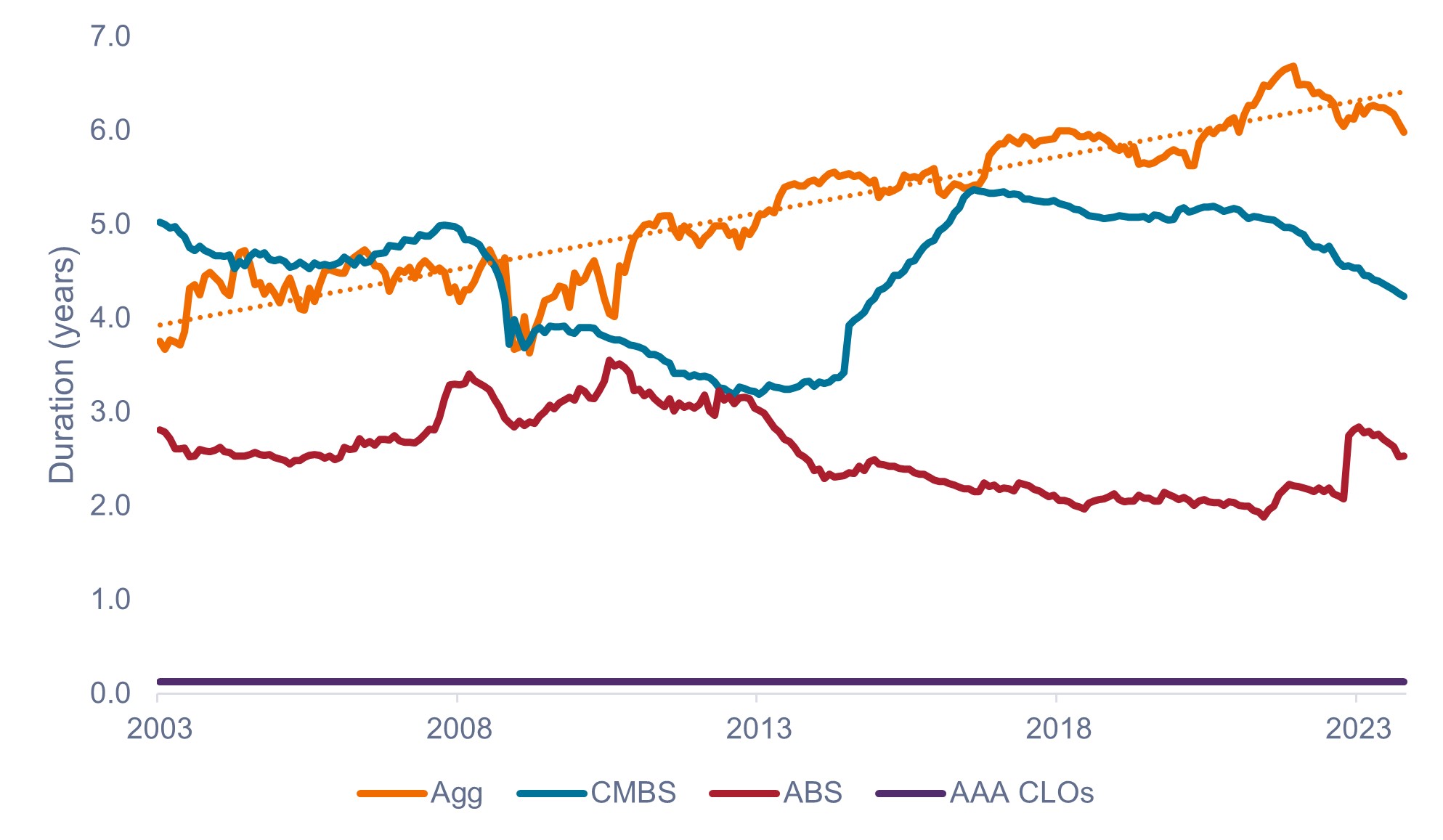

Over the past 20 years, the Agg’s duration has steadily crept up to around six years as issuers have moved to take advantage of low interest rates by issuing longer-dated debt. As a result, investors holding the Agg have effectively been taking on ever-increasing interest-rate risk as the duration of the index has ticked up. This duration extension proved to be a tailwind for returns while rates were falling but has become a headwind since rates started to move higher. Additionally, higher duration leads to increased portfolio volatility when rates fluctuate.

In our view, investors should consider managing duration risk and interest rate volatility by “rebalancing” their portfolio duration through incorporating lower-duration assets into their core bond holdings. Most securitized sectors exhibit inherently lower duration than the Agg due to the shorter-term nature of their underlying loans. As such, adding securitized assets to a portfolio may help to manage interest rate risk, as shown in Exhibit 3.

Exhibit 3: The Agg has steadily become more interest-rate sensitive since 2003

Securitized assets may be added to portfolios to dampen overall duration.  Source: Bloomberg, as of 31 October 2023.

Source: Bloomberg, as of 31 October 2023.

4. Securitized sectors may be used to improve overall credit quality.

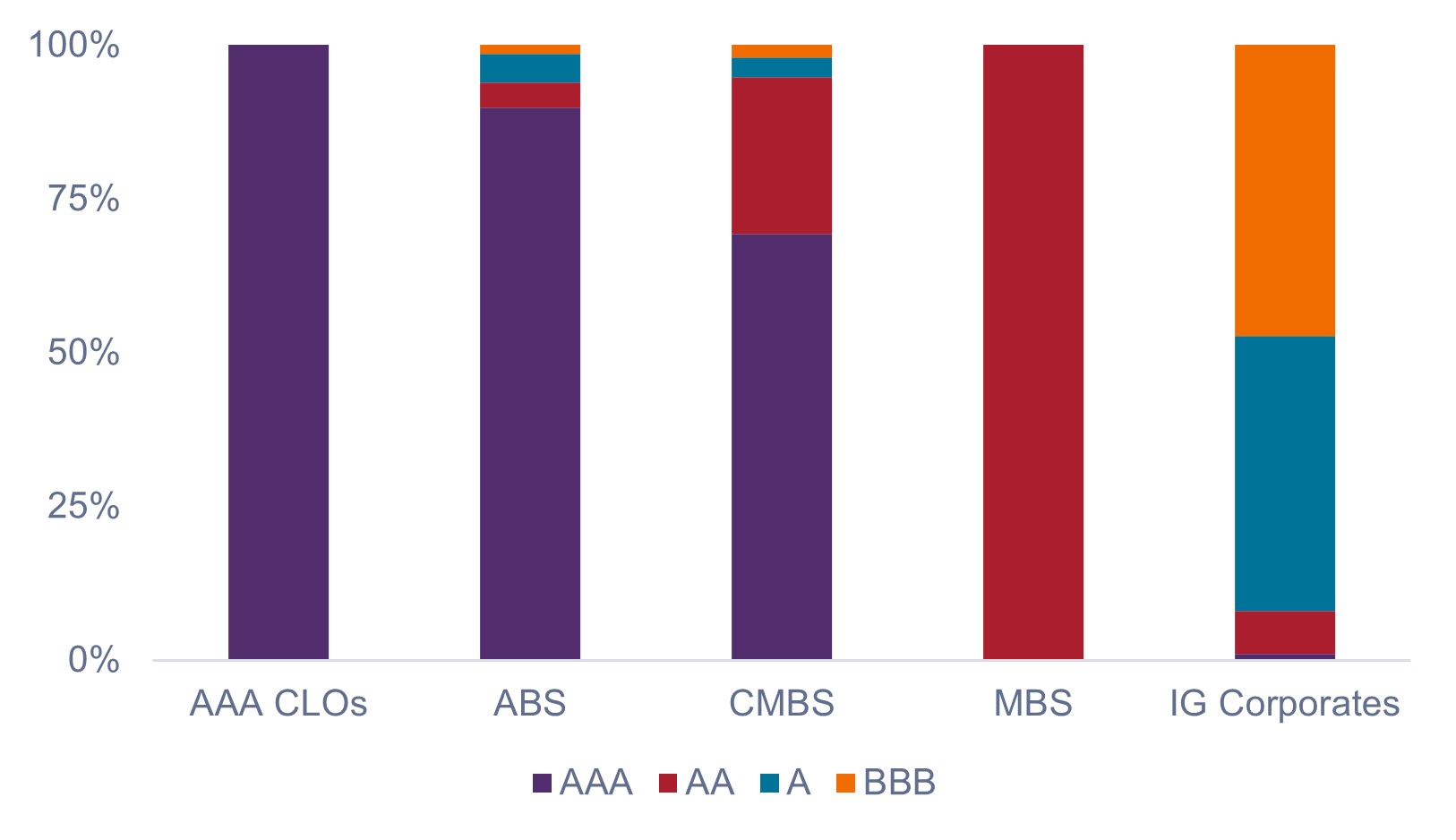

With the Fed staying committed to keeping rates high until inflation comes back down to 2%, a softening in labor markets and economic growth seems inevitable. As investors prepare for a slowdown – and the uptick in defaults and delinquencies that tends to follow – we think there is value in bolstering the credit quality of portfolios through the addition of securitized assets.

As shown in Exhibit 4, securitized indices have significantly stronger credit ratings than the corporate universe. Additionally, most MBS, ABS, and CMBS assets amortize over time, as each monthly payment includes both an interest and a principal component. This monthly paydown of principal incrementally de-risks these bonds as time passes.

Exhibit 4: Fixed income sectors broken down by credit rating

Securitized indices generally exhibit stronger credit quality than IG corporates.

Source: Bloomberg, as of 31 October 2023. Indices used to represent asset classes as per Exhibit 2.

Source: Bloomberg, as of 31 October 2023. Indices used to represent asset classes as per Exhibit 2.

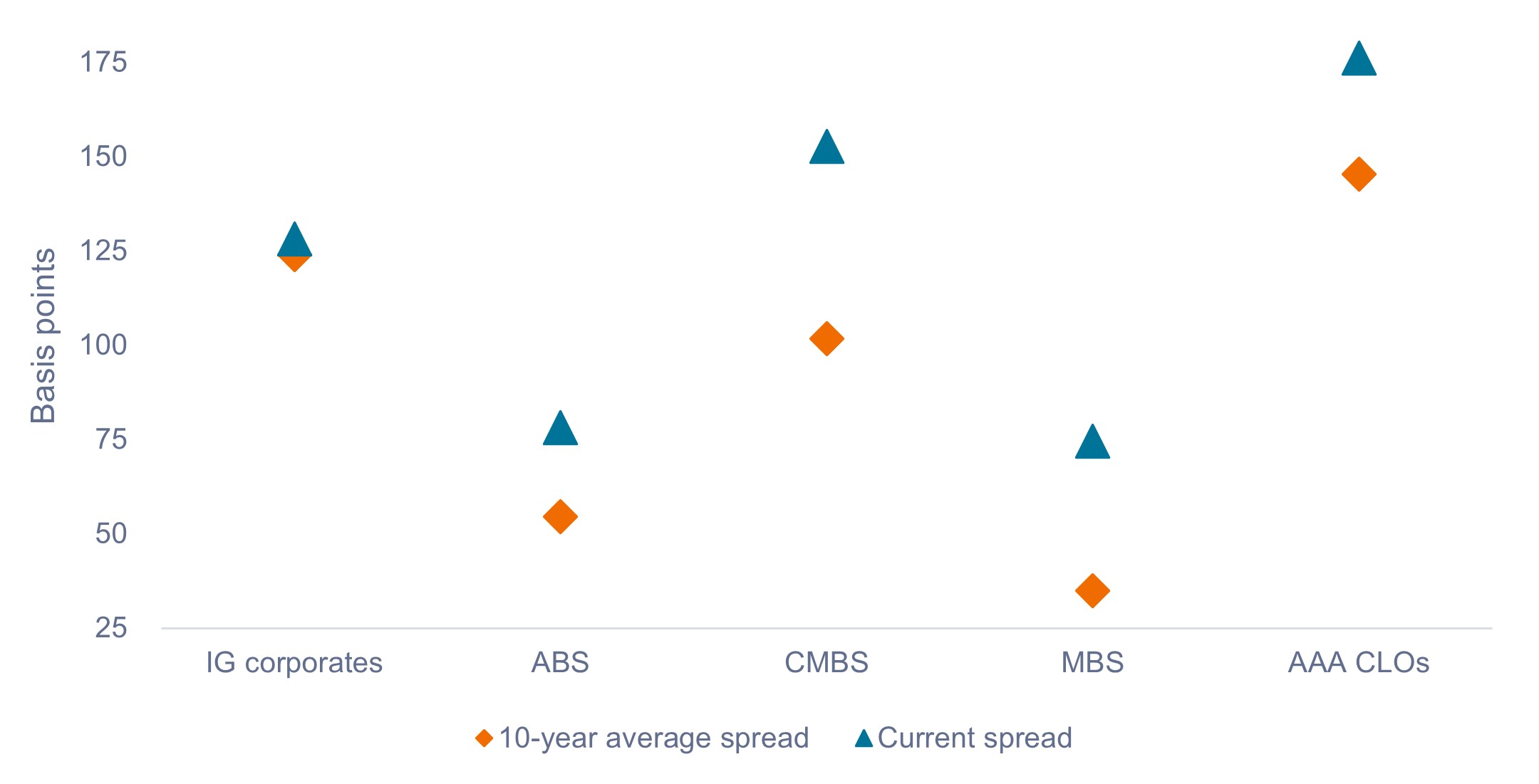

5. Securitized assets may provide opportunities for better relative valuations.

As shown in Exhibit 5, securitized spreads (the additional yield above the risk-free Treasury rate) are trading much wider than their 10-year averages. The same cannot be said for IG corporates, which are trading around their 10-year averages. The wider spreads in securitized sectors imply greater compensation for their additional risk over Treasuries. Further, we think wider securitized spreads provide investors with the opportunity to outperform versus corporates, as we would expect the difference in spreads to narrow over time.

Exhibit 5: Current spread relative to 10-year average spread.

Securitized spreads are trading wider than their 10-year averages, while corporates are less attractively priced.

Source: Bloomberg, Janus Henderson Investors, as of 31 October 2023.

Source: Bloomberg, Janus Henderson Investors, as of 31 October 2023.

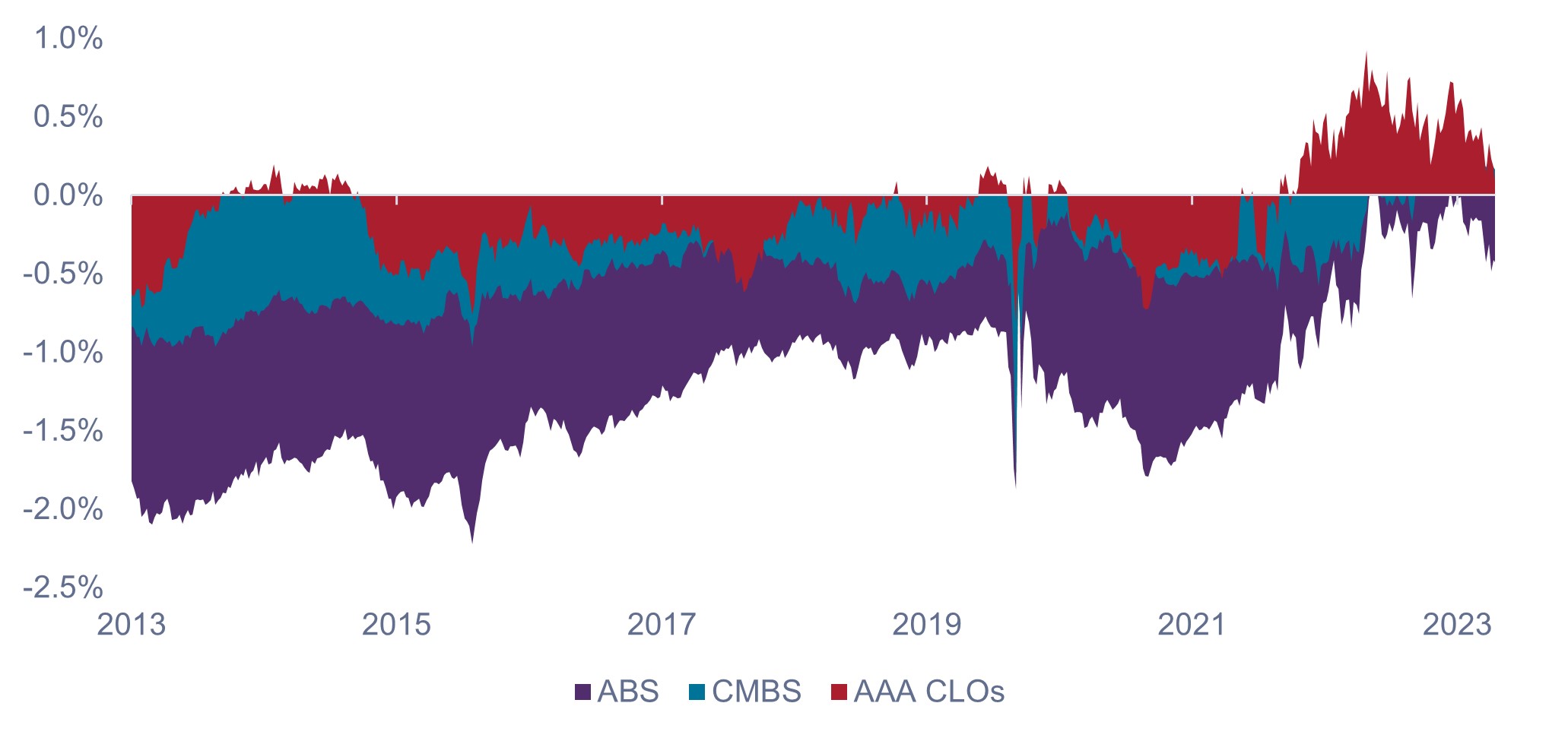

Throughout the past decade, bond investors may have shied away from higher allocations to securitized sectors due to their lower yields relative to corporates. As shown in Exhibit 6, this scenario has significantly changed in the last two years, with yields on AAA CLOs, CMBS, and ABS now generally on par with IG corporates.

Exhibit 6: Yield spread of securitized sectors over IG corporates (2013-2023)

There is now little-to-no yield penalty for holding securitized sectors in place of IG corporates.

Source: Bloomberg, Janus Henderson Investors, as of 31 October 2023.

Source: Bloomberg, Janus Henderson Investors, as of 31 October 2023.

Positioning for the future

While the tailwinds from falling interest rates after the GFC were a boon to fixed income returns, the recent reversal of that trend has put pressure on the asset class. Irrespective of where rates settle in the medium term, we believe investors will need to be more intentional when constructing portfolios by paying particular attention to duration and finding pockets of value and yield where it is available.

And as the new interest rate landscape begins to take shape, the addition of securitized assets, with their competitive yields, strong credit quality, lower duration, and diversification potential, may provide investors with the opportunity for improved risk-adjusted returns.

IMPORTANT INFORMATION

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

1 Non-agency securitized includes asset-backed securities (ABS), commercial mortgage-backed securities (CMBS), collateralized loan obligations (CLO), collateralized mortgage obligations (CMO), and excludes agency mortgage-backed securities (MBS).

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Duration can also measure the sensitivity of a bond’s or fixed income portfolio’s price to changes in interest rates.

The Fed, or Federal Reserve is the central banking system on the United States.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.