US large-cap equities: Peering through the earnings lens

Portfolio Manager Jeremiah Buckley examines key factors contributing to earnings growth expectations for U.S. large-cap equities. In his outlook for 2024, he highlights improving margins, secular growth tailwinds, declining long-cycle spending, and consumer expenditures as areas to watch.

5 minute read

Key takeaways:

- With a moderate earnings growth forecast for 2024, our outlook for U.S. large-cap equities is cautiously optimistic.

- Improving corporate margins and secular growth tailwinds are positive drivers, while consumer spending will support some sectors but not others, and declining long-cycle expenditures may be an overlooked risk.

- Economic transitions call for careful stock selection and an emphasis on quality. In our view, investors should focus on companies with financial flexibility and secular growth tailwinds that are less reliant on macroeconomic conditions to drive growth.

After modest declines in 2023, and despite lingering macroeconomic uncertainties, we anticipate earnings growth to resume in 2024, but to remain below the long-term historical average.

There are positive factors supporting our moderate growth forecast, as well as risks to monitor. From a base case perspective, we expect to see modest real gross domestic product (GDP) growth, resilient yet decelerating consumer spending, steady labor force conditions, profit margin improvement, and growth from key secular trends.

Can consumer strength persist?

Consumer spending has powered the economy post-pandemic, but it will likely face conflicting forces in 2024. Diminished household savings and higher interest rates will likely curb spending on big-ticket and debt-financed purchases, such as in homes and autos. However, categories supporting cash-flush consumers may prove to be more resilient in a higher rate environment due to interest earned on savings.

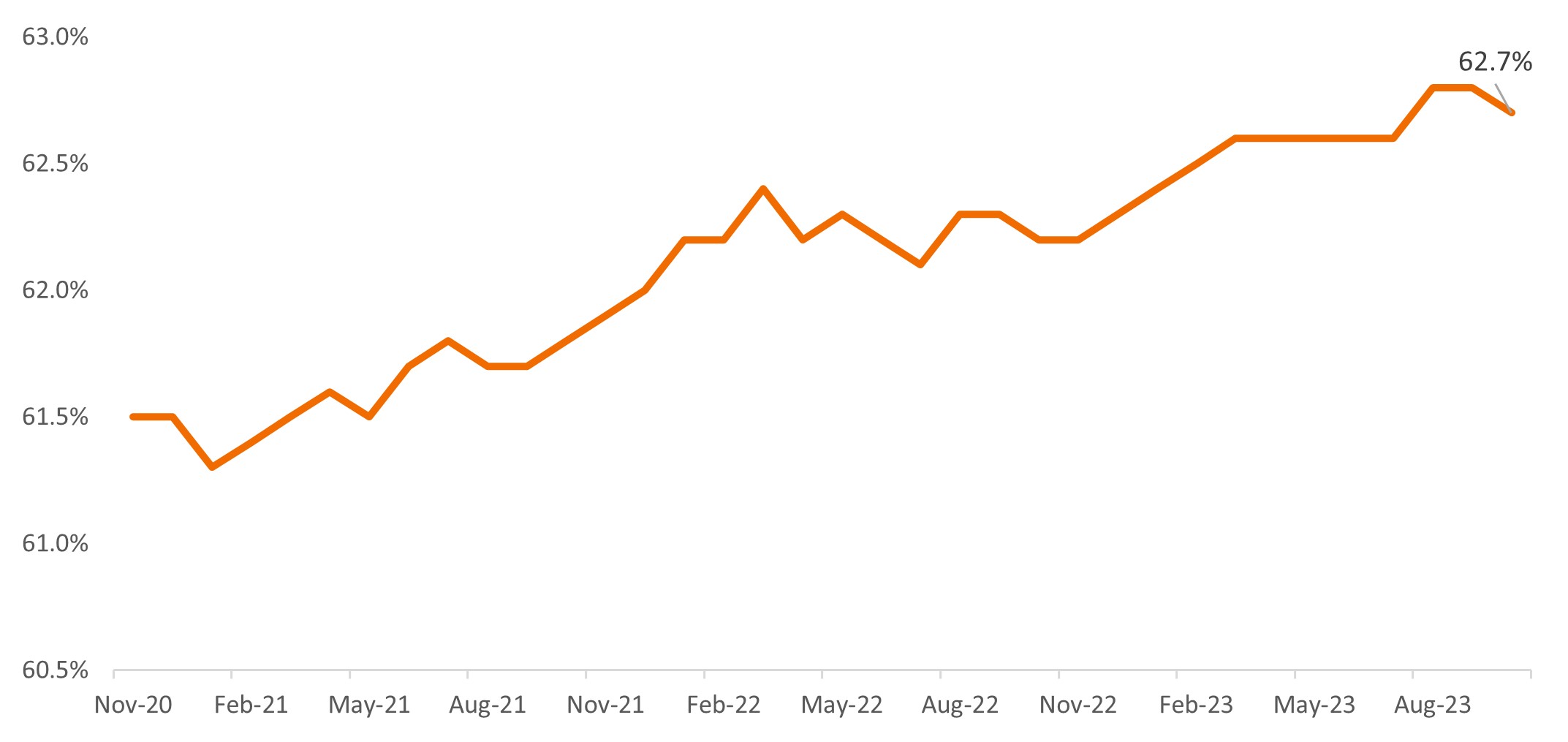

Robust consumer spending has been strongly supported by the labor market, which we believe will remain relatively steady in 2024. Notably, labor force participation continues to tick incrementally higher, which is a positive sign. And consumer discretionary spending should benefit from recent real wage gains.

U.S. labor force participation rate

Source: U.S. Labor Department, Bloomberg; seasonally adjusted data for trailing 3 years ending 31 October 2023.

Source: U.S. Labor Department, Bloomberg; seasonally adjusted data for trailing 3 years ending 31 October 2023.

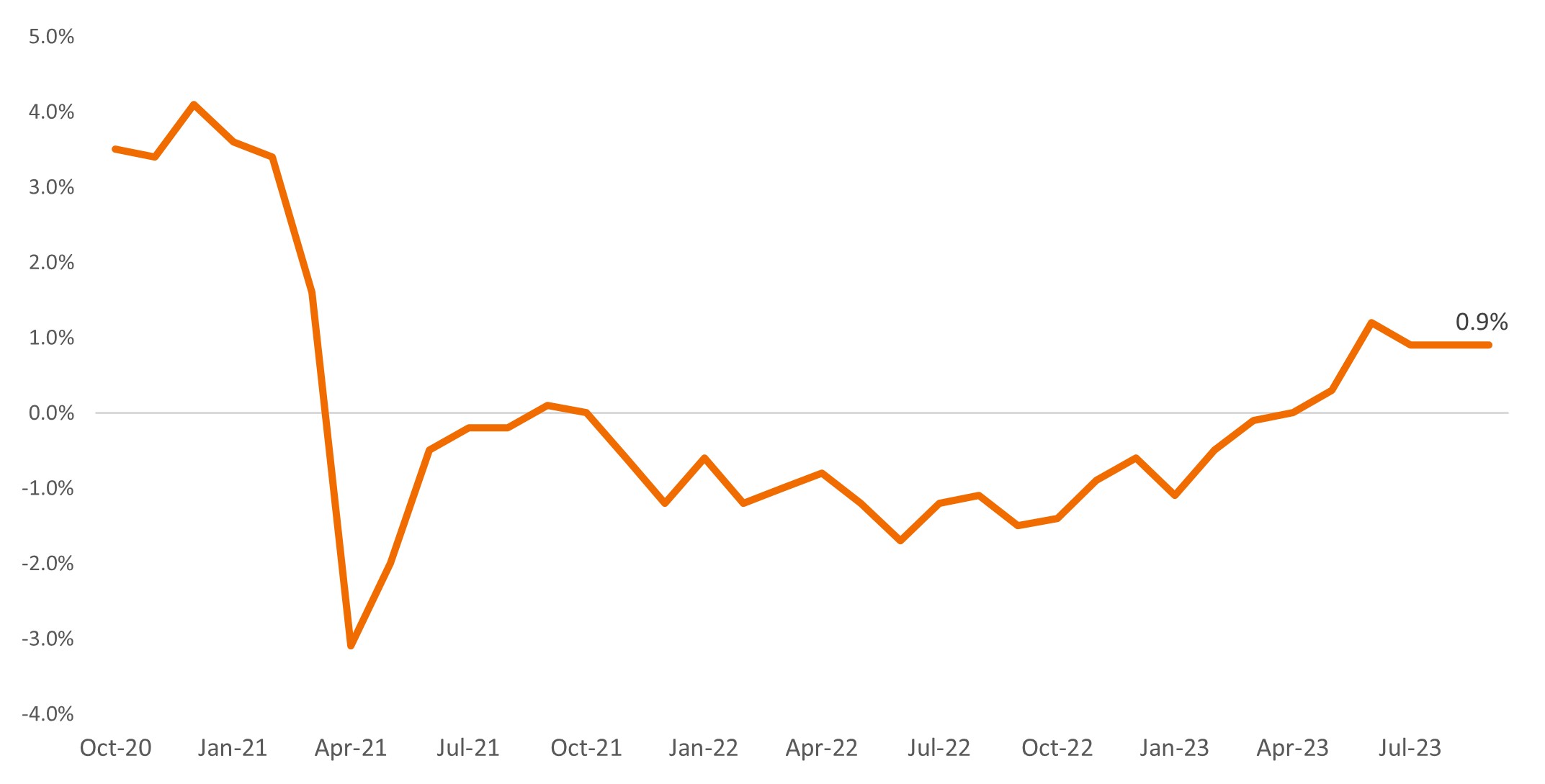

Average hourly earnings adjusted for inflation

Source: U.S. Labor Department. Average hourly earnings year-over-year, seasonally adjusted. Inflation represented by the Core Personal Consumption Expenditures (PCE) Price Index. Source: Bureau of Economic Analysis (BEA).

Margin pressures easing

From the corporate perspective, wage inflation appears to be easing – a boon for margins – and we expect continued moderation back toward historical ranges in the coming months. Service companies, in particular, have already experienced this tailwind as hiring and retention recently normalized compared to 6-12 months ago.

Additionally, third-quarter earnings failed to reveal any major margin pressures in manufacturing or other economic sectors that would signal hiring reductions. Declining raw material and transportation costs are finally flowing through to lower cost of goods sold, while new inventories are replacing pricier items built on 2022’s high input costs – a benefit that emerged late in 2023 and should persist into 2024.

Secular growth drivers

Earnings growth potential is further supported by powerful secular trends. Two we are paying particularly close attention to are artificial intelligence (AI), specifically generative AI (GenAI), and weight loss therapies like incretins.

AI is a powerful technology with the potential to create lasting productivity and efficiency gains. Companies that are enabling the buildout of AI infrastructure and platforms are the early beneficiaries, profiting from current technology spending, but we anticipate the scope of investment opportunities will broaden. With the fast-rising enterprise adoption of GenAI and in-house training of large language models (LLMs), the question for investors becomes, what value can be unlocked? We are focused on identifying the potential winners and losers related to this long-term theme.

As for incretins and GLP-1 appetite suppression weight-loss drugs, this breakthrough innovation also has the potential to drive both growth and disruption. We are bullish on the outlook but monitoring potential secondary impacts. These weight loss therapies help curb appetite, and the growth in their adoption rate has sparked volatility in consumer staples, retail, and restaurants as users increasingly focus on reduced calorie intake. Ripple effects could also impact healthcare utilization, should obesity rates decline.

Cycle risks loom

While our outlook is cautiously optimistic, we believe the lagged impact of higher rates on long-cycle capital spending, or multi-year project expenditures, is an overlooked potential risk. Long-cycle strength helped propel 2023 growth as many projects in capital goods, defense, and aerospace were brought to fruition after pandemic delays due to supply chain and labor issues. In addition, construction spend resilience in 2023 owes partly to government spending and projects that span years, like multi-family housing.

These tailwinds should fade, particularly in a higher rate environment. New orders are declining and there will likely be a gap in replacement spending on new projects, creating a drag on overall economic expansion in the year ahead.

On a positive note, short-cycle industries like PCs, semiconductors, and life-sciences equipment – all of which endured recession in 2023 amid inventory digestion – have the potential to recover to normal levels in 2024. We are keeping a close eye on this potential transition of economic growth and earnings drivers from long-cycle capital goods to short-cycle industries.

Quality is key

We are closely monitoring both consumer and capital spending as they heavily inform our base case assumptions for moderate earnings growth and a cautiously optimistic view on large-cap growth equities.

Expectations that interest rates will stay elevated translate, in our view, to highly leveraged companies coming under pressure while those “quality” companies with conservative balance sheets and consistent cash flows will have opportunities to grow market share. This can be accomplished by increasing organic growth investments, making acquisitions at more attractive prices, or accelerating share repurchases should uncertainty around an economic soft-landing lead to market volatility.

During this economic transition, we think higher-quality companies with financial flexibility and secular growth tailwinds look best positioned, as they are less reliant on overall macroeconomic growth to drive earnings growth.

Core Personal Consumption Expenditure Price Index is a measure of prices that people living in the U.S. pay for goods and services, excluding food and energy.

Margins refers to profit and operating margins, which are expressed as a percentage and measure the degree to which a company makes money. Profit margin represents the portion of a company’s sales revenue that it gets to keep as a profit, after subtracting all of its costs. Operating margin is how much profit a company makes on a dollar of sales after paying for variable costs of production, such as wages and raw materials, but before paying interest or tax.

Secular growth refers to market activities that lead to significant growth and unfold over long-time horizons. The market activities aren’t influenced by short-term factors and are likely to continue moving in the same general direction for the foreseeable future.

Volatility measures risk using the dispersion of returns for a given investment.

IMPORTANT INFORMATION

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.