Balanced Fund

High-conviction equities and actively managed bonds: emphasising balance between asset growth and reduced volatility

A2 USD share class, Morningstar ratings are based on the representative share class of this fund and are dated to the last month-end upon availability from Morningstar.

Past performance does not predict future returns.

- The Fund's investments in equities are subject to equity market risk due to fluctuation of securities values.

- The Fund invests in debt securities and asset/ mortgage-backed securities/ commercial papers; and is subject to greater interest rate, credit/ counterparty, volatility, liquidity, downgrading, valuation, credit rating risks. It may be more volatile.

- Investments in the Fund involve general investment, RMB currency and conversion, currency, hedging, economic, political, policy, foreign exchange, liquidity, tax, legal, regulatory and securities financing transactions related risks. In extreme market conditions, you may lose your entire investment.

Read more

- The Fund may invest in financial derivatives instruments for investment and efficient portfolio management purposes. This may involve counterparty, liquidity, leverage, volatility, valuation, over-the-counter transaction, credit, currency, index, settlement default and interest risks; and the Fund may suffer total or substantial losses.

- The Fund's investments are concentrated in US companies/ debt securities and may be more volatile.

- The Fund may at its discretion pay dividends (i) pay dividends out of the capital of the Fund, and/ or (ii) pay dividends out of gross income while charging all or part of the fees and expenses to the capital of the Fund, resulting in an increase in distributable income available for the payment of dividends by the Fund and therefore, the Fund may effectively pay dividends out of capital. This may result in an immediate reduction of the Fund’s net asset value per share, and it amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment.

- Investors should not only base on this document alone to make investment decisions and should read the offering documents including the risk factors for further details.

Less

Dynamic 60:40 portfolio in US equity and fixed income capturing the long term US market growth.

Why it’s still time to take a balanced approach

A balanced approach remains vital for mitigating risks and achieving long-term gains despite recent market volatilities.

Simple, cost-effective diversification

Simple, cost-effective diversification

With one single investment, investors can gain exposure to different asset classes, styles, and markets.

An efficient portfolio solution

An efficient portfolio solution

A core allocation to a balanced fund aims to ensure diversified, risk-managed exposure for steady growth and resilience.

Consistency

Consistency

Investors can be left feeling more confident in their core asset allocation, knowing that it is designed to adjust and navigate through various market conditions.

Janus Henderson Balanced Fund: actively managed, one-stop core solution

Flexible, defensive, dynamic

Beyond traditional investing: For over 30 years, Janus Henderson has offered clients a simple asset allocation solution focused on up-market capture and down-market defence.

What makes Janus Henderson Balanced Fund successful?

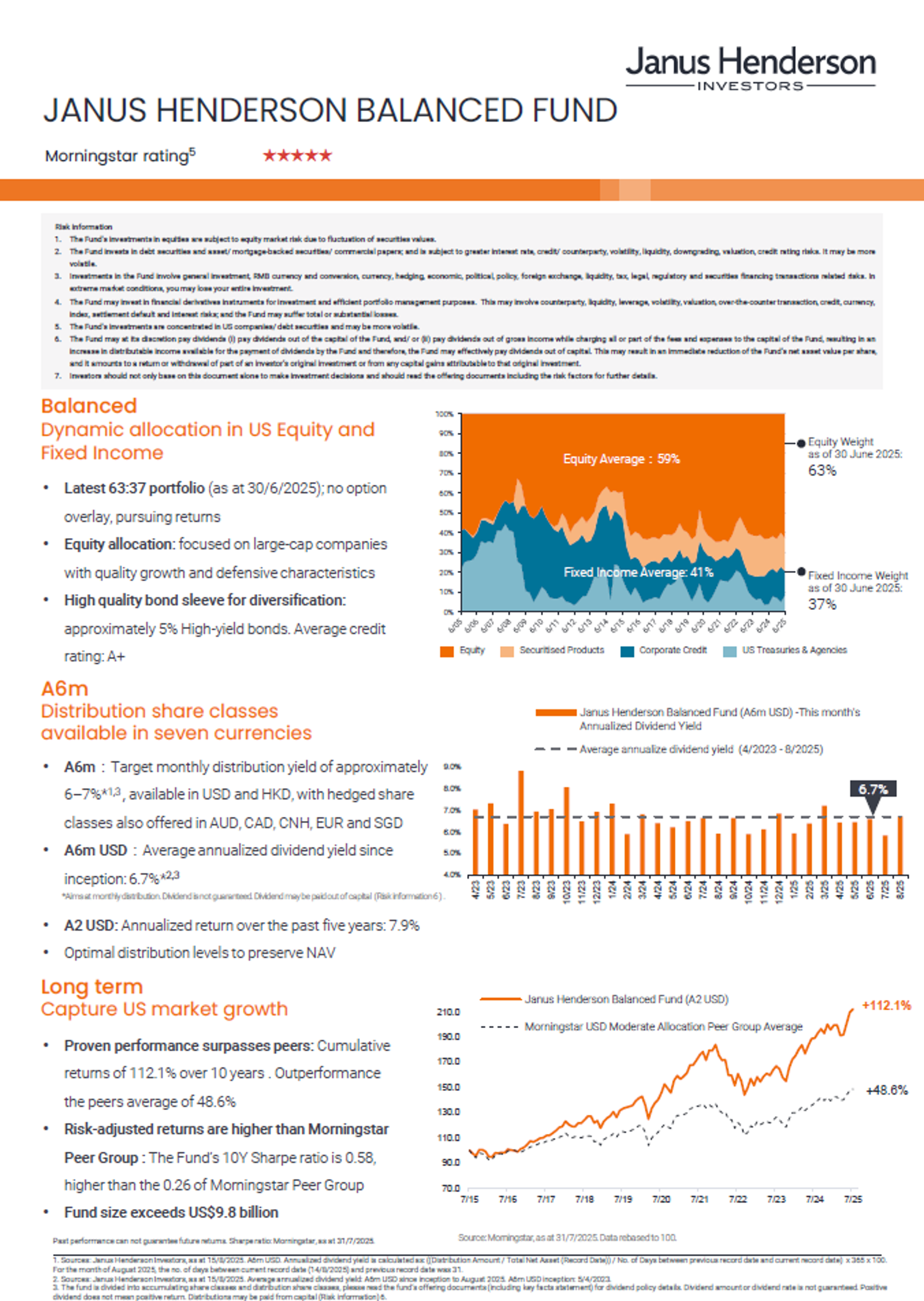

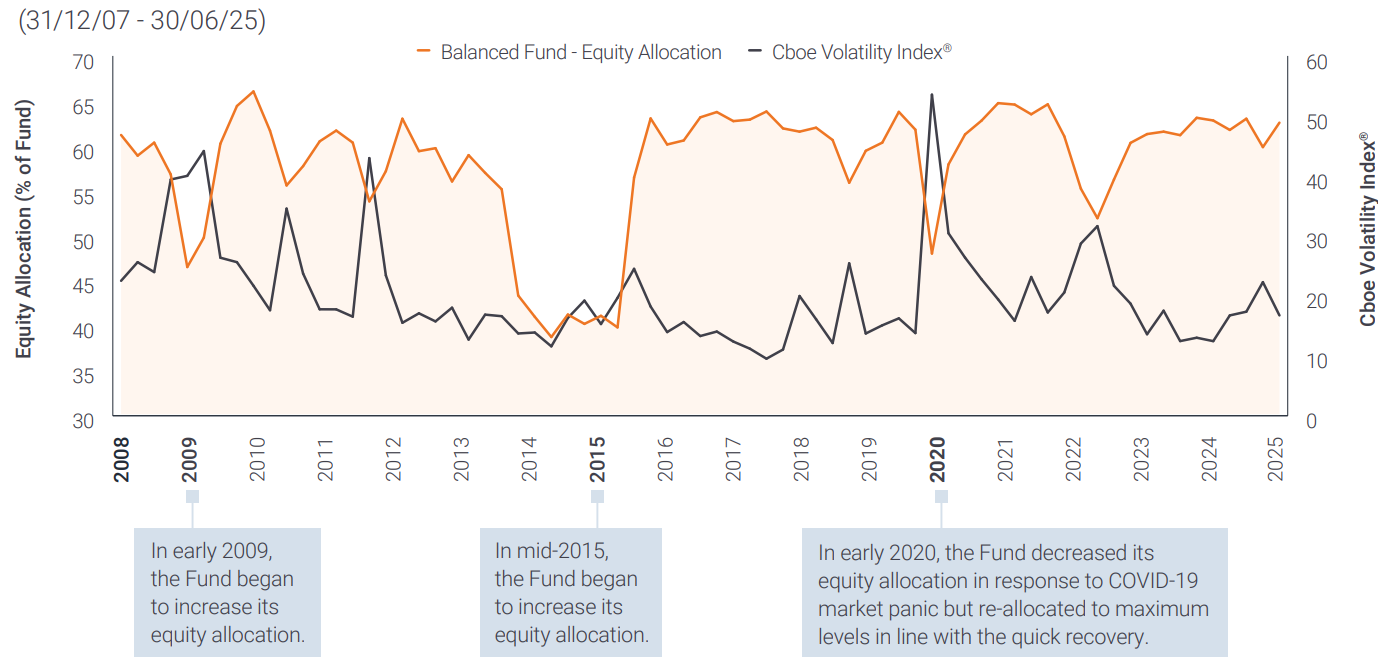

The Balanced Fund’s dynamic asset allocation strategy has the flexibility to defensively position in anticipation of market volatility while seeking strong risk-adjusted returns. Unlike many competitors, our allocation is NOT constrained by static targets, the Balanced Fund can actively pivot between an equity weighting of 35% to 70% depending on market conditions

View fundHigh-conviction US equities

We focus on US large-cap equities with growth potential. Historically, US equities have offered higher returns than other developed markets.

Actively managed bonds

The Fund has historically delivered when it has counted – on the downside, thanks to our bottom-up, actively managed intermediate-term bond allocation. Past performance does not predict future returns.

A balanced outcome

Our experts adjust asset allocation between stocks and bonds, helping to mitigate some of the emotional decision making that can be led by market volatility.

What does this approach mean for drawdowns?

The teams' dynamic approach provides the flexibility to defensively position ahead of market volatility while seeking strong, risk-adjusted returns.

The Balanced Fund has historically delivered when it has counted—on the downside. Whether it was market downturns, like the tech bubble collapse of the early 2000s, or the global financial crisis of 2008, the Fund captured less of the downside.

Past performance does not predict future returns.

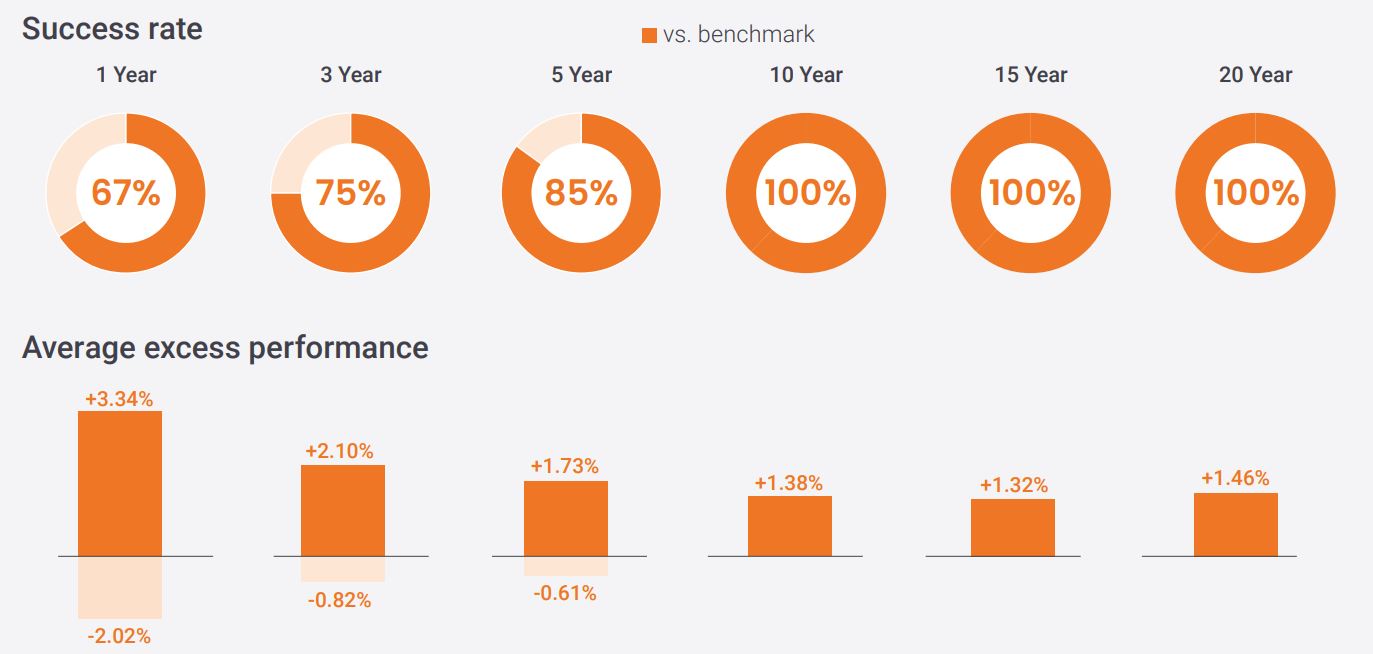

A steady success

The teams' dynamic approach provides the flexibility to defensively position ahead of market volatility while seeking strong, risk-adjusted returns.

Janus Henderson Balanced Fund outperformed the benchmark* on a monthly rolling-period basis 100% of the time over the 10, 15, and 20- year periods.

Source: Morningstar, Janus Henderson Investors, as of 30 June 2025.

Note: Success Rate is based on the rolling monthly returns since Fund inception (24/12/98), the chart depicts the percentage of time the Balanced Fund (A2 USD gross) outperformed the Balanced Index. Average excess performance represents, on average, how much the fund outperformed during periods of outperformance, or underperformed during periods of underperformance. *Balanced Index (60% S&P 500 / 40% BB US Agg Bond)

Past performance does not predict future returns.

A look at dynamic allocation and market volatilty

The Fund’s dynamic approach provides the flexibility to defensively position ahead of market volatility while seeking strong risk-adjusted returns. This process, coupled with diverse of return , can help mitigate downside risk.

Source: Janus Henderson Investors, as of 30 June 2025.

There is no assurance that the investment process will consistently lead to successful investing. The equity allocation changes over time subject to strategic investment decisions. Cboe Volatility Index® or VIX® Index® shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500® Index options and is a widely used measure of market risk. The VIX Index methodology is the property of Chicago Board of Options Exchange, which is not affiliated with Janus Henderson.

Capital at risk. Past performance does not predict future returns.

Meet the team

Let our team make the asset allocation decision between stocks and bonds for you and help remove some of the emotional decision making that can be led by market volatility.

Portfolio Manager

Head of US Fixed Income/Head of Core Plus | Portfolio Manager

Portfolio Manager