Technology stocks: AI giving the tech ‘vampire’ superpowers

Portfolio Manager Alison Porter discusses the team’s positive view on the technology sector in 2025. As the tailwind from AI begins to mature, investors are reminded that disruptive tech waves are typically lengthy and accompanied by higher volatility.

7 minute read

Key takeaways:

- It is important for investors to recognise that compute waves like AI are typically lengthy, given the potential to disrupt multiple sectors and magnitude of investment required. As with previous tech waves, volatility is to be expected.

- As the AI wave matures into 2025, it gives the ‘vampire’ (technology) superpowers to use its FAANGs to suck more share from the wider economy. Hence, the role of active management and stock selection is increasingly essential in the fast-evolving tech landscape, particularly as narrow thematic approaches show limitations.

- We believe a focus on the fundamental strengths and potential of companies driving disruption, rather than those at its receiving end, is key to a rewarding investment in the tech sector.

How long will the AI wave last?

Following two years of back-to-back double-digit returns,1 investors continue to ask whether investment in generative artificial intelligence (gen AI) is now over; and if we are at the top of the AI hype cycle. While we are no longer in the early stages of the gen AI ‘fourth wave’ of technology, we believe that investors are still underestimating both the length and magnitude of investment required, as well as the long-term disruption and benefits it will bring.

Compute waves are lengthy

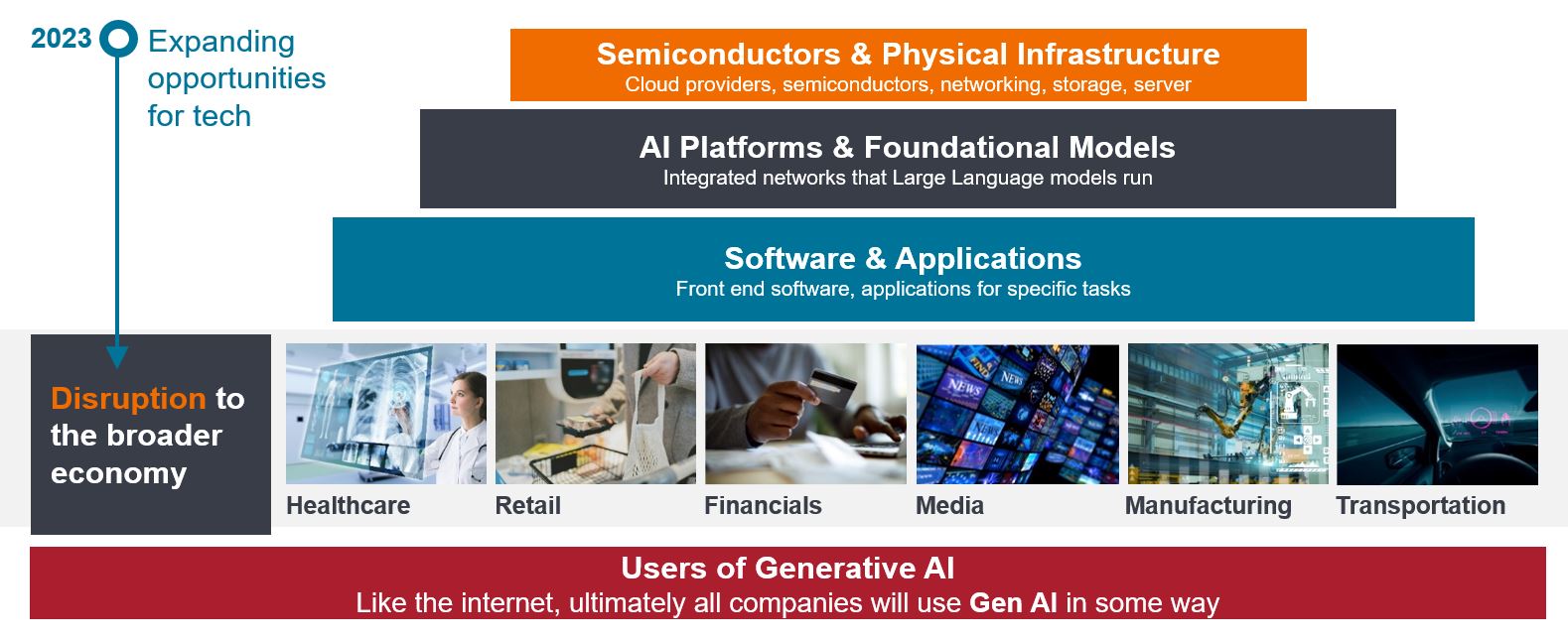

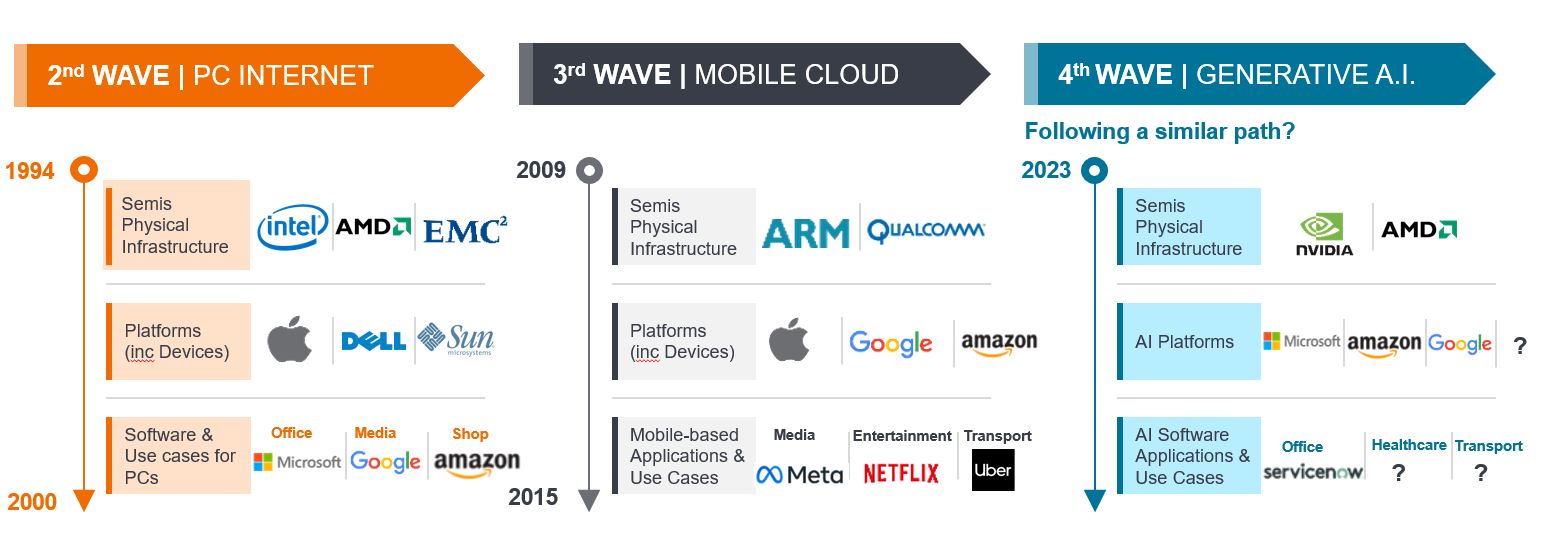

Firstly, it’s important to clarify the difference between a compute wave and a theme (like cybersecurity, electric vehicles, or clean technology). A compute wave requires broad investment across the full stack of technology – from silicon building blocks, to user interface and applications. The PC internet era required an initial shift from the analogue world to digital, driving prices of compute down, which democratised access and connected homes. The mobile cloud wave that internet infrastructure was built upon, was catalysed by the launch of the iPhone in 2007. It’s notable that a key mobile application like Uber did not have its initial public offering (IPO) until 2019.

The parallel here is that infrastructure has to be built and scale achieved before the most exciting and useful new applications are fully developed and adopted. The pace of capital expenditure investment in AI data centres has been unprecedented and the demand for accelerated compute from the likes of NVIDIA have grown at an unparalleled pace. However, this generative AI wave has yet to witness an interface shift or new edge device requirements. Our experience shows this to be consistent with the pattern of previous tech waves. It spans resource and productivity optimisation; shifts in payments and financial systems; transportation being reimagined by autonomous capabilities; healthcare diagnostics, surgery and drug discovery; humanoid robots, and the more familiar upgraded PC and mobile devices. We know there is much yet to come as AI copilots and autonomous agents become commonplace across the economy. For investors, patience is required to benefit from this pervasive and transformative wave.

Figure 1: Why AI is a wave, not a theme

Requires investment in all tech layers, leading to broad disruption and innovation

Volatility is to be expected, not feared

And as previous tech waves have also demonstrated, investors should not expect the pace of development and adoption of generative AI to be linear. There are bottlenecks in infrastructure development and the availability of silicon (microchips), such as NVIDIA’s latest Blackwell chip. Indeed, past waves have typically run for more than six years and delivered outsized returns – but all have also involved elevated volatility and frequent drawdowns.2

A changing political regime in the US will bring additional volatility as taxes, tariffs and regulations are reconsidered. Technology and artificial intelligence are a national priority for many countries and central to a broader deglobalisation and reindustrialisation strategy being undertaken. While this is expected to increase volatility, it will also serve as a tailwind to demand in infrastructure and areas like autonomous driving, where we are likely to see accelerated development as new federal laws emerge.

An active stock-picking approach offers more versus narrow thematics

As this AI wave matures into 2025, we believe that active management will be more important than ever. The cost of capital is likely to fluctuate further but interest rates are unlikely to be returning to zero. Hence in our view, valuation discipline will be an important feature of determining returns again. Typically, periods of technology inflection are notable for changes in market leadership, therefore relying on indices heavily weighted to the winners of the last wave may prove challenging.

Going back ten years, seven of the largest 10 technology companies outperformed the broader MSCI All World Index, while only four outperformed the tech index itself. Technology remains a ‘winners take most’ market; higher growth is not guaranteed by shifting down the market cap curve. Companies with a large user base and large platforms are able to more quickly scale new products, with significant resources to do so. Company size preference alone has not been a reliable strategy for stock selection in the technology sector – nor has narrow thematic bias.

Artificial intelligence as a wave underlies a wide variety of long-term investment themes such as Next Generation Infrastructure (including Cybersecurity), Fintech, Electrification (including power, electric vehicles and Clean Tech) and Internet 3.0, which help guide idea generation. A focus on competitive advantage, responsible management, scalable profitability and new product innovation – at a rational price, and irrespective of market capitalisation or geography, is essential. We believe marrying the bottom-up identification of tech leaders and thematic idea generation with underappreciated earnings power can help us to navigate the ongoing challenge of valuation in this dynamic and innovative sector.

Figure 2: AI opportunities in 2025 and beyond

Source: Janus Henderson Investors, as at 30 September 2024. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned. Use of third-party names, marks or logos is purely for illustrative purposes and does not imply any association between any third party and Janus Henderson Investors, nor any endorsement or recommendation by or of any third party. Unless stated otherwise, trademarks are the exclusive property of their respective owners. Past performance does not predict future returns. There is no guarantee that past trends will continue nor that forecasts will be realised.

Gen AI is giving the tech ‘vampire’ superpowers

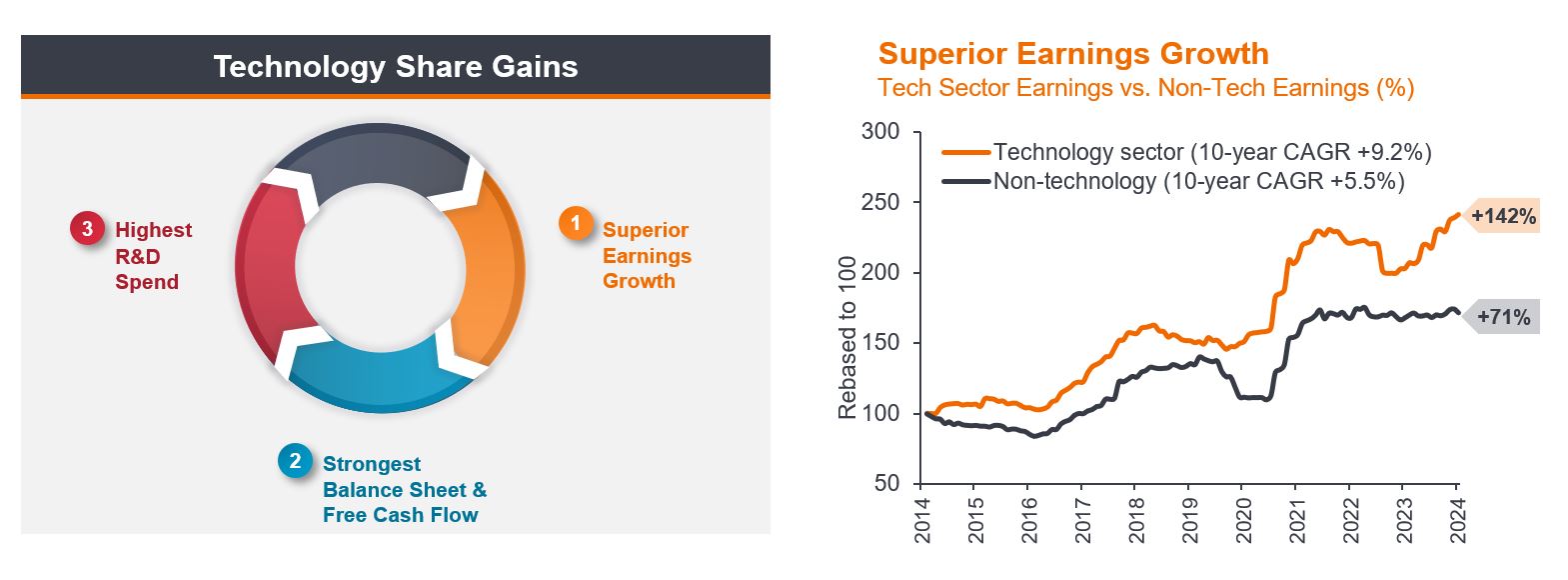

The build-out of infrastructure and applications for generative AI is expected to take years to play out. It is important to note that with each wave of technology not only has more investment been required to realise its potential, but more disruption in more sectors across the broader economy has ensued. As the gen AI wave matures, disruption across many other sectors will accelerate – just as it has in the past. The technology sector continues to leverage its balance sheet strength advantage to invest heavily in future research and development, supporting its capability to generate attractive returns for investors.

Figure 3: AI is enabling accelerated technology share gains

Source: Janus Henderson Investors, Bernstein, as at 31 October 2024. Rebased to 100 at 31 October 2014. Tech sector earnings chart compares earnings in Technology defined as MSCI ACWI Information Technology + Communication Services (ex Telecoms) Index and Non-technology defined as MSCI ACWI ex (Information Technology + Communication Services ex Telecoms) Index. Based on trailing earnings. Prior to December 2018, the custom index of MSCI ACWI IT & Communication Services includes companies that were originally in the Technology sector and companies that are currently in the Communication Services sector. Past performance does not predict future returns.

We continue to be excited by the outlook for technology equities. Our focus remains on finding the leaders across the sector by navigating the hype cycle, and we believe that a focus on stock fundamentals can help to drive consistent returns. As gen AI matures, it essentially gives the ‘vampire’ (technology) superpowers to use its FAANGs to suck more share from the wider economy. We believe that investors will be well served to remain focused on the companies and sectors that are driving, rather than experiencing, disruption.

Past performance does not predict future returns.

1 Source: Janus Henderson Investors, Bloomberg. Tech sector = S&P 500 Information Technology Index, total returns in USD terms for 2023 and year-to-date 25 November 2024.

2 Source: Janus Henderson Investors, Bloomberg, as at 31 December 2023. Tech sector = S&P 500 Information Technology Index, total returns in USD terms. PC wave 1994-2000; mobile internet wave 2009 to 2015.

AI copilot: an intelligent virtual assistant that leverages large language models (LLMs) to facilitate natural, human-like conversational interactions, supporting users in a wide variety of tasks.

Balance sheet strength: refers to a company being in a strong financial position. The balance sheet is a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time.

Bottom-up investing: focuses on the analysis of individual securities, considering factors impacting company valuation, such as earnings, management team quality, margins, as well as wider economic factors, to identify the best opportunities in a sector or region.

Edge device: computing devices near the network’s edge, usually near data sources or consumers, which are key in real-time applications and Internet of Things (IoT) deployments.

FAANG: was an acronym coined in 2013 for Facebook, Amazon, Apple, Netflix, and Google as these major tech stocks’ performance had a substantial effect on the overall global equities market.

Market cap: market capitalisation is the total market value of a company’s issued shares and is typically used to determine a company’s size.

Hype cycle: represents the different stages in the development of a technology from conception to widespread adoption. Typically, markets overestimate the short-term potential of a new technology or innovation and underestimate its long-term potential, creating volatile movements both up and down for underlying stocks exposed to these technologies.

Volatility: the rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. It is used as a measure of the riskiness of an investment.

Key investment risks:

- The Fund's investments in equities are subject to equity securities risk due to fluctuation of securities values.

- Investments in the Fund involve general investment, currency, RMB currency and conversion, liquidity, hedging, market, economic, political, regulatory, taxation, securities lending related, reverse repurchase transactions related, financial and interest rate risks. In extreme market conditions, you may lose your entire investment.

- The Fund may invest in financial derivatives instruments to reduce risk and to manage the Fund more efficiently. This may involve counterparty, liquidity, leverage, volatility, valuation and over-the-counter transaction risks and the Fund may suffer significant losses.

- The Fund's investments are concentrated in technology sector and may be more volatile and subject to technology related companies risk.

- The Fund may invest in Eurozone and may suffer from Eurozone risk.

- The Fund may charge performance fees. An investor may be subject to such fee even if there is a loss in investment capital.

- Investors should not only base on this document alone to make investment decisions and should read the offering documents including the risk factors for further details.