Key trends driving U.S. securitized fixed income in 2025

In his 2025 investment outlook, Head of U.S. Securitized Products John Kerschner shares his U.S. securitized outlook, identifying the key trends he believes will drive investment returns in the year ahead.

6 minute read

Key takeaways:

- Securitized sectors registered broadly strong returns in 2024, as their cheaper relative valuations and a strong economy attracted more buyers into the asset class.

- Looking ahead to 2025, we believe securitized sectors have more runway for outperformance, with specific catalysts driving potential returns in commercial mortgage-backed securities, collateralized loan obligations, and asset-backed securities.

- We believe the diverse nature of the securitized market necessitates an investment approach based on deep fundamental research and active security selection. In our view, it is important to be intentional about the types and quality of securitized assets our clients are exposed to, seeking to avoid concerning parts of the market while taking advantage of more attractive opportunities.

Following a year of strong returns for U.S. securitized fixed income, we believe the following key trends are likely to shape the opportunity set for investors in 2025:

1. CMBS: The office comeback

In 2022 and 2023, the office real estate market took a hit from rising interest rates, coupled with high vacancies as more employees worked from home. Some commentators were calling for catastrophic outcomes for the office sector, while those in the industry simply kept their heads down and tried to “survive to 2025”.

Now that 2025 is upon us, the office market appears to be healing, and the catastrophic predictions have come and gone. Year to date through mid-November, non-agency commercial mortgage-backed securities (CMBS) have posted their highest excess returns in the past decade, while issuance for 2024 is set to hit levels not seen since 2021.

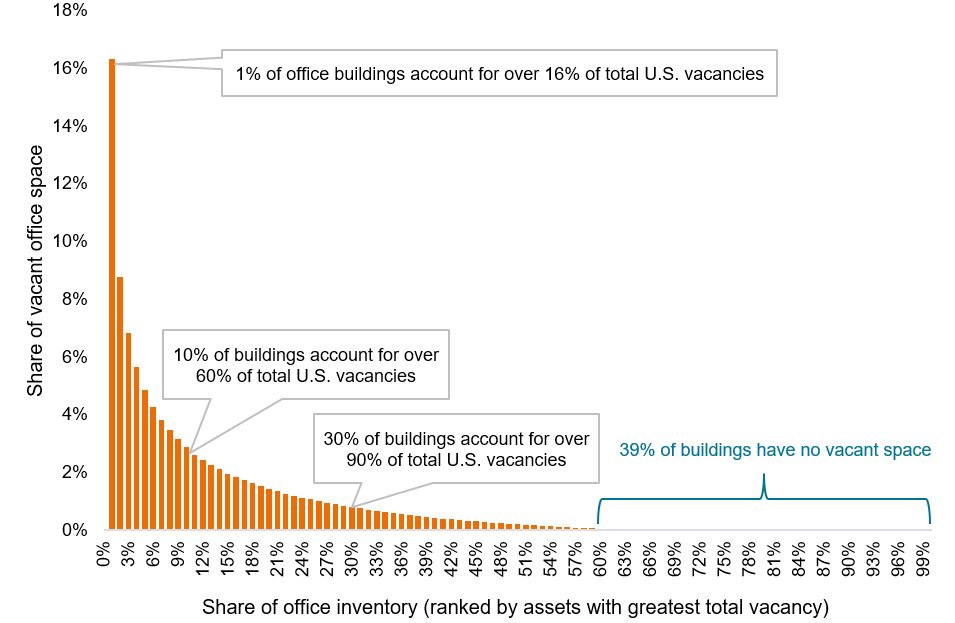

Recent outperformance is being driven by the catch-up effect – after two consecutive years of under-performance, investors are moving back into commercial real estate on the more favorable outlook. Further, as shown in Exhibit 1, investors are recognizing that vacancies are not uniform across the industry, but rather are very much building specific.

Exhibit 1: Office vacancy concentration by share of total U.S. office inventory

Vacancies are concentrated in a small segment of the overall market

Source: JLL Research, as of 15 November 2024.

In our view, the bifurcated market sets up well for an active approach whereby an experienced manager can perform deep research and seek out opportunities in individual buildings that exhibit industry-leading leasing metrics.

Even after the strong excess returns in 2024, we believe the CMBS sector has more runway for outperformance, as credit spreads in the sector are still well wide of their 10-year tightest levels. This compares favorably to corporate bonds, which are trading at much richer valuations.

| Bloomberg U.S. CMBS Investment Grade Index | Bloomberg AA Corporate Index | |

| Average credit quality | AAA/AA+ | AA/AA- |

| Current credit spread | 95 bps | 40 bps |

| 10-year tightest spread | 62 bps | 36 bps |

| Current yield to worst | 5.3% | 4.9% |

| Duration | 4.1 years | 7.9 years |

Source: Bloomberg, as of 15 November 2024.

2. CLOs: Higher for longer back on the table under Trump 2.0

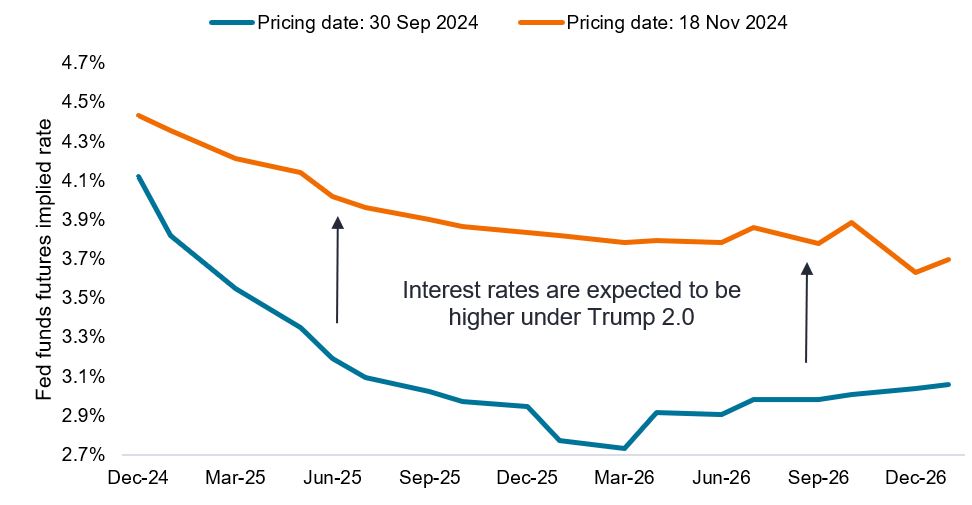

Before the 2024 U.S. presidential election, rates markets had been pricing in 200 basis points (bps) of cuts through the end of 2025 on the back of downward-trending inflation and the Federal Reserve’s (Fed) bumper 50 bps September rate cut. All that changed following Donald Trump’s election victory and the Republican Party’s Congressional sweep

Now it appears the way is open for Trump to implement the policies he proposed on the campaign trail – lower taxes, sweeping tariffs on imported goods, and large-scale deportations of immigrants living in the country illegally. If enacted, some of these polices could lead to higher growth – but also higher inflation, which would hamstring the Fed from cutting rates as much as previously projected.

As shown in Exhibit 2, rates markets have since adjusted to a higher-for-longer future, anticipating the federal funds rate will fall only about 100 bps over the next two years.

Exhibit 2: Fed funds futures implied rate through January 2027

Interest rates are expected to be higher under the new administration

Source: Bloomberg, as of 18 November 2024.

In our view, the repricing of rates markets bodes well for floating-rate bonds such as collateralized loan obligations (CLOs), as higher rates translate into higher income for investors, all else equal.

Take AAA CLOs for example, which currently yield 5.6%.1 If CLO credit spreads remain constant at existing levels and rates unfold as markets expect, AAA CLOs could experience only a modest reduction in yield over the next 24 months.

3. ABS: The U.S. consumer endures

U.S. consumer loan balances, which include credit cards and other revolving plans, recently surpassed $1 trillion for the first time in history, but the rise in debt tells only half the story. Households remain well capitalized, with ample ability to service consumer debt.

While some lower-income households are beginning to show some financial strain, middle- and upper-income households – which account for more than 85% of total spending – have benefited from stock portfolios and home values rising to all-time highs, low levels of unemployment, and wages that continue to grow well ahead of their pre-COVID rates.

As a result, rising debt levels have not led to an alarming deterioration in households’ ability to service their debt. As shown in Exhibit 3, the debt service ratio has simply returned to, and stabilized around, its pre-COVID range and remains well below the concerning levels seen leading up to the Global Financial Crisis. We believe the outlook for asset-backed securities (ABS) and consumer credit remains upbeat amid the enduring strength of U.S. households.

Exhibit 3: Consumer debt service ratio vs. outstanding debt (2000 – 2024)

Households have more debt, but also more income and assets

Source: Board of Governors of the U.S. Federal Reserve System, as of Q2 2024. Consumer debt service ratio = Consumer debt service payments as a percentage of disposable personal income.

In summary

In our view, U.S. consumers and corporates remain in good shape. We consider the risk of recession to be low and believe investors can lean into the attractive yields in securitized fixed income. Moreover, as active managers, we can be selective about the types and quality of securitized assets our clients are exposed to, seeking to avoid concerning parts of the market while taking advantage of more attractive opportunities.

1 As of 15 November 2024. Calculated using 3-month SOFR plus the J.P. Morgan CLO AAA Index Discount Margin.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

The Bloomberg Aa Corporate Index measures the Aa-rated, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

The Bloomberg US CMBS Investment Grade Index measures the investment-grade market of US Agency and US Non-Agency conduit and fusion CMBS deals with a minimum current deal size of $300mn. The index includes both US Aggregate eligible (ERISA eligible) and non-US Aggregate eligible (non-ERISA eligible) securities.

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Commercial mortgage-backed securities (CMBS): fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Investment-grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies.

Risk assets: Financial securities that may be subject to significant price movements (ie. carrying a greater degree of risk). Examples include equities, commodities, property lower-quality bonds or some currencies.

Volatility measures risk using the dispersion of returns for a given investment.

Yield to worst (YTW) is the lowest yield a bond can achieve provided the issuer does not default and accounts for any applicable call feature (ie, the issuer can call the bond back at a date specified in advance). At a portfolio level, this statistic represents the weighted average YTW for all the underlying issues.

IMPORTANT INFORMATION

Actively managed investment portfolios are subject to the risk that the investment strategies and research process employed may fail to produce the intended results. Accordingly, a portfolio may underperform its benchmark index or other investment products with similar investment objectives.

Derivatives can be more volatile and sensitive to economic or market changes than other investments, which could result in losses exceeding the original investment and magnified by leverage.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Mortgage-backed security (MBS): A security which is secured (or ‘backed’) by a collection of mortgages. Investors receive periodic payments derived from the underlying mortgages, similar to the coupon on bonds. Mortgage-backed securities may be more sensitive to interest rate changes. They are subject to ‘extension risk’, where borrowers extend the duration of their mortgages as interest rates rise, and ‘prepayment risk’, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.