Over the last decade or so, fluxes in the world’s markets have been driven by a select group of themes. These themes describe the changes taking place in societies and economies, from ageing populations through to the adoption of new technologies. Most focus has been placed on the developers of AI, to the direct benefit of the US market. However, disruptors and innovators can be found in other markets too.

The UK market is famous for its dividend payments. Often sourced from legacy industries, such as oil & gas and banks, this can give the market a reputation as having a foot firmly in the past. Yet, the mere survival of the FTSE – and the attraction of some of its members for overseas buyers – betrays another side.

Investing for income through innovation

The City of London Investment Trust personifies this reputation for income. It has raised its dividends for 58 years – longer than any other investment trust. Yet, maintaining dividend growth requires the companies the trust invests in to keep growing too. As such, the trust’s investments include some of the trailblazers available in the UK.

One of the challenges facing the world in the 21st century is a rapidly ageing population. This has widespread consequences, not least for healthcare. One of the stalwarts of the UK stock market is GSK, a leading biopharma business and part of the CTY portfolio. Its vaccines are used to treat common respiratory conditions, which are risky for older populations.

Demand for insurance services has also seen a sustained rise over the last few years as an older population seeks comfort in later life. CTY investment Aviva is addressing this trend, modifying products like health insurance for the needs of these customers.

Technology means more than Chat GPT

When we discuss technology, our minds tend to head straight to Silicon Valley. However, innovation is not limited to tech pioneers. A clear innovator in the UK is BAE Systems. Its defence products are in high demand, due in part to their integration of new technologies – and this demand seems unlikely to diminish as three decades of relative peace sadly fade away.

A less well-known, but transformed, FTSE member is RELX. What was once a relatively staid publisher now provides a wide range of services to businesses. Notably, some of these use AI to real advantage. As such, it has been one of CTY’s highest growth investments over the last three years.

What innovation means for investors

CTY’s stated investment objective is to provide its investors with long-term growth in income and capital. While its dividend track record is commendable, its commitment to capital growth is less well-known. By uncovering future growth opportunities in the UK market, the trust’s manager, Job Curtis, aims to ensure he is capturing future dividend potential alongside current high yielders.

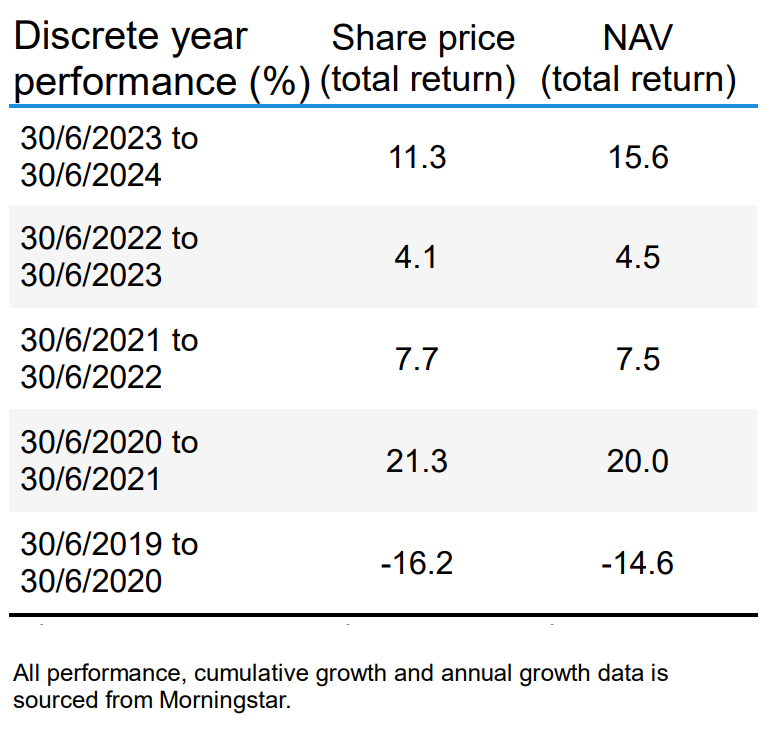

With this in mind, stock selection added 2.64% to the trust’s return relative to its benchmark in the trust’s full year to 30 June 2024. More impressive is the trust’s long-term track record of outperforming inflation. Over the five years to 30 June 2024, the trust achieved an NAV return of 43.42%, while inflation over that period was c. 25%. As such, investors over this period saw a real return drawn principally from UK stocks.

To find out more about The City of London Investment Trust click here.

Source: Morningstar as at 31/08/2024

Past performance does not predict future returns.

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Disclaimer

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority), Tabula Investment Management Limited (reg. no. 11286661), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 78, Avenue de la Liberté, L-1930 Luxembourg, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc