In the summer of 2024, the sun has shone on the UK – at least from a stock picker’s perspective.

A decisive outcome for July’s general election is expected to have provided a degree of political stability, in contrast to other European countries. The Bank of England has begun the slow process of unwinding its 5%+ interest rates. This followed CPI inflation gliding back to the targeted 2% range in the Spring, with July’s slight rise the first real hiccup in the process.

In combination, this wave of good news has driven the FTSE 100 over 7% higher since the start of the year.

This moment in the sun follows a period that had some headlines asking what the FTSE 100 is actually for. And yes, the index has lagged its peers in stock price terms over multiple years. This has in turn encouraged some companies to list on other markets. However, as income investors know, there is one area where the UK’s market consistently stands out, regardless of the noise surrounding it (unless that noise is a global pandemic).

For income, the UK stock market is striking, in terms of longevity and consistency. Since 2002, the FTSE 100 has yielded between 3% and 4.5% each year. In the same period, the S&P 500 has averaged a dividend yield below 2%, save for the 2008-9 period when the yield climbed above 3% on the back of a collapse in share prices. The gap has only widened since the financial crisis.For income, the UK stock market is striking, in terms of longevity and consistency.

Investors in The City of London Investment Trust have benefitted from similar consistency. The trust has yielded above 3% since 2002 and over the last five years (to 19 August 2024) has yielded above 4%.

To achieve a consistent yield, with a compound annual growth rate of 3.4% over the last ten years, the trust has made sensible use of the investment trust structure. This includes using revenue reserves to ‘top up’ investors’ dividends in 2020 when dividends in the UK fell by 38% amid the uncertainty of the pandemic – happily, these have now recovered.

Another tool available to the trust is gearing. Simply put, this means borrowing money to fund additional investments when needed. This borrowing can attract lower rates than retail loans as the trust negotiates long-term financing options ahead of time. At times when market valuations are particularly attractive, this has proven a prudent choice in the past – although it does increase risk. Currently, the trust’s gearing sits at around 7%.

A final aspect of CTY’s consistent dividend yield has been its active management. Simply put, the trust has yielded more than the index in the majority of the last 10 years – which can be attributed to actively investing in only a select group of the FTSE 100 and in stocks listed outside it.

To find out more about The City of London Investment Trust click here.

There is no guarantee that past trends will continue, or forecasts will be realised.

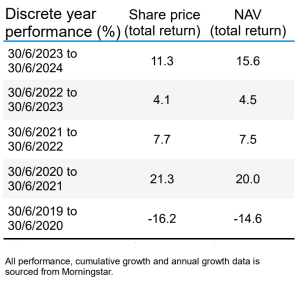

Source: Morningstar as at 30/06/2024. Past performance does not predict future returns.

Disclaimer

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority), Tabula Investment Management Limited (reg. no. 11286661 at 6th Floor, 55 Strand London WC2N 5LR and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 78, Avenue de la Liberté, L-1930 Luxembourg, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc