Dividends

HFEL

Henderson Far East Income Limited

Dividends

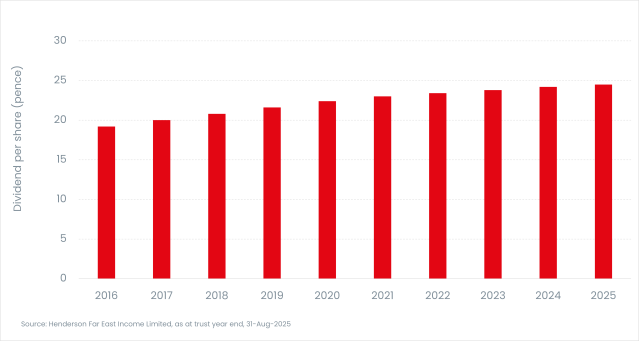

Henderson Far East Income seeks to provide shareholders with a growing total annual dividend per share.

One of the main advantages of investment trusts is the ability to retain surplus income to create revenue reserves. Henderson Far East Income can add to these reserves in years of strong dividend growth and pay them out in the leaner years, thereby smoothing the level of dividend payments when appropriate.

Henderson Far East Income’s dividend policy is to pay four quarterly interim dividends in November, February, May and August.

Past performance does not predict future returns. The value of an investment and the income from it may go down as well as up and you may lose the amount originally invested.

Dividend history

Dividend history

| Ex Dividend Date | Pay Date | Amount div p/ps |

|---|---|---|

| 29-Jan-26 | 27-Feb-26 | 6.25 |

| 30-Oct-25 | 28-Nov-25 | 6.25 |

| 24-Jul-25 | 29-Aug-25 | 6.25 |

| 01-May-25 | 30-May-25 | 6.20 |

| 30-Jan-25 | 28-Feb-25 | 6.20 |

| 24-Oct-24 | 29-Nov-24 | 6.20 |

| 25-Jul-24 | 30-Aug-24 | 6.20 |

| 25-Apr-24 | 31-May-24 | 6.10 |

| 25-Jan-24 | 23-Feb-24 | 6.10 |

| 26-Oct-23 | 24-Nov-23 | 6.10 |

| 27-Jul-23 | 25-Aug-23 | 6.10 |

| 27-Apr-23 | 26-May-23 | 6.00 |

Discrete performance (%)

|

Quarter End As of 31/12/2025 |

2024/2025 | 2023/2024 | 2022/2023 | 2021/2022 | 2020/2021 |

|---|---|---|---|---|---|

| Share price | 16.26 | 19.15 | -13.12 | 0.84 | -2.78 |

| Net asset value per share | 17.14 | 9.50 | -5.37 | -1.82 | -0.49 |

Source: © 2026 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not predict future returns.