It may sound like finding a Crufts winner in an animal shelter, but I think the odds are better. Some of the best returns you can make in investing can be in spotting an underdog about to make a recovery.

In the past 18 months or so Marks & Spencer and Rolls-Royce have been great examples of that in the UK. M&S shares are up 290% on where they were at the start of 2023, while Rolls is up over 400%.[1]

When this happens you can find a stock taking too big a share of your portfolio and you need to take some profits. There may come a point when you deem – as we have with Rolls – that it is time to sell.

But that means you have to find the next wave of recovery winners. Recently, it has been frustrating to see companies we think fit into that category being snatched from us by market competitors and private equity investors before they have fulfilled their promise.

Lowland has benefited – the takeovers have often been at handsome premiums to where the open market was pricing them at the time. But we are still left with thoughts of what might have been had we been able to hold on.

The beauty of the stock market is that there are always opportunities. When you are looking for great recovery stocks it is usually among companies that make people groan in horror. This is because the best time to buy can be when the potential is hidden by a myriad of problems. Here are some examples currently in the portfolio which illustrate this.

BT – BT has seen its share price dragged down recently by Sky’s agreement with another network infrastructure provider, undermining BT Openreach’s market share. There are also concerns about its pension deficit, but these may be overblown.

BT’s new CEO, Allison Kirkby, seems to recognise the importance of free cash generation. Openreach remains the clear market leader[2] and may one day be sold to ‘prove’ the value of the asset. Overseas investors are sniffing around BT, so it would not surprise me to find this is one of those recovery stories where the happy ending comes long after we have been tucked up in bed asleep. But for now we are enjoying a dividend of over 5% while we wait to see what happens.

STV/ITV – Free-to-air TV is dead, surely? The market seems to think so, which is why it is ignoring ITV and its Scottish equivalent. But both have sizeable production businesses, making programmes for Netflix and others. If the market paid more attention to these it might value them differently. Meanwhile, free-to-air TV still attracts big audiences that advertisers can struggle to reach. And both companies generate attractive dividends.

Dowlais – Given that it is an automative industry supplier, we should perhaps describe the red flags on Dowlais as red lights. There are plenty of them. The global automotive industry is struggling with the cost of transitioning to electric vehicles and cheap Chinese competition. Dowlais was a spin-out from engineering giant Melrose and is still building its own followers in the market. But it has been closing unprofitable sites and trimming costs. It has a very low starting valuation but, like M&S and Rolls, a high starting market share in what it produces. And, again, it delivers a handsome dividend.

Signs of change?

When looking for recovery stocks you are trying to identify green shoots. You want businesses that have good competitive advantages but are failing to make the most of them. A change of management can help. You want a team willing to make tough decisions – to cut waste and sharpen the focus of a business on what makes most money.

Often you look for undervalued divisions that can give you some downside protection if sold. To our minds, BT’s Openreach and ITV’s studio businesses both seem more valuable than the market is giving credit for.

Finally, you must do the research. Analysts can have very short horizons. It is always worth testing their over-gloomy expectations. You want a combination of earnings recovering faster than the market expects and the valuation on the shares recovering at the same time as the recovery gains wider appreciation.

These potential recovery stocks may not make the grade. That is why a good portfolio is diversified. But if they fulfil the potential we see in them, they could add considerably to performance.

Click here for more information on Lowland Investment Company

[1] Stock price data as at 17 September 2024

[2] UK: Size of full fiber networks 2024 | Statista

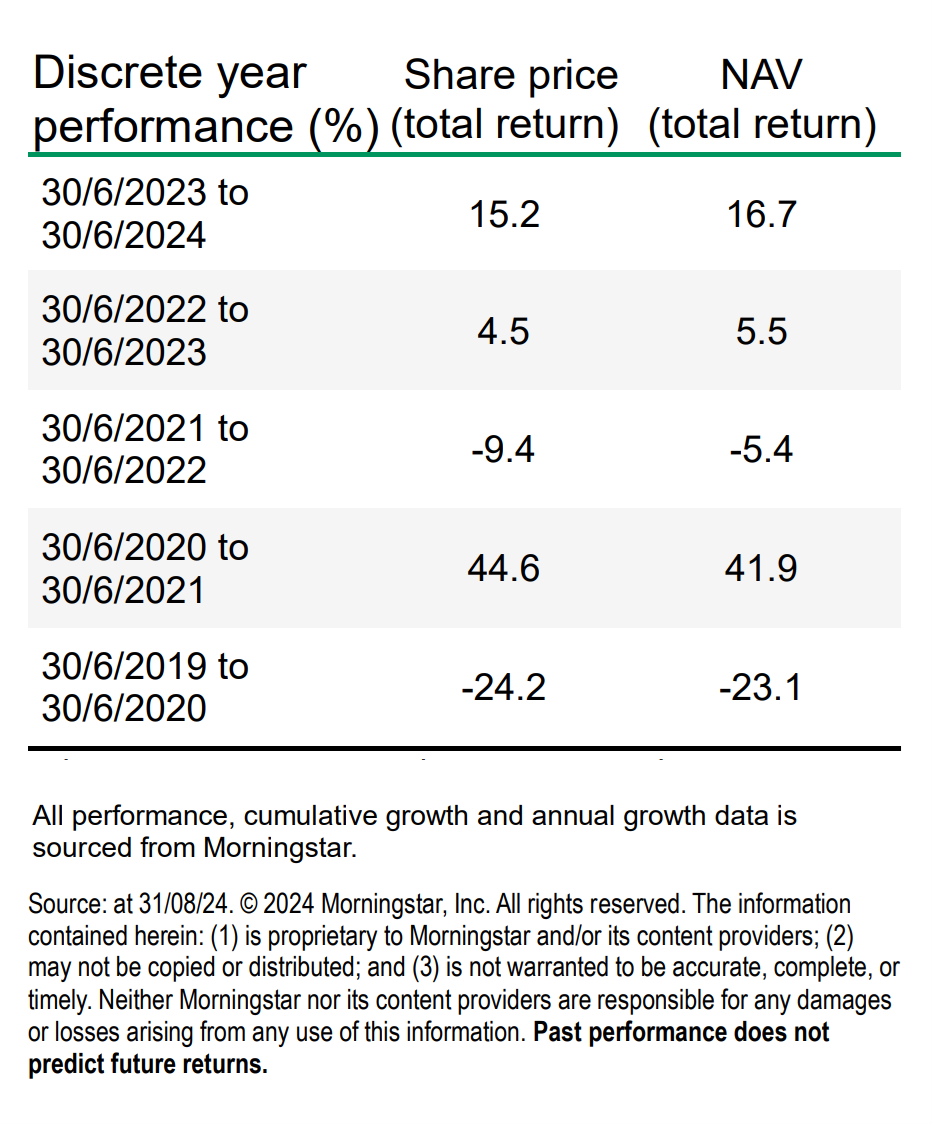

Past performance does not predict future returns.

Glossary

Diversification

A way of spreading risk by mixing different types of assets/asset classes in a portfolio, on the assumption that these assets will behave differently in any given scenario. Assets with low correlation should provide the most diversification.

Dividend

A variable discretionary payment made by a company to its shareholders.

Share price

The price to purchase (or sell) one share in a company, not including fees or taxes.

Disclaimers:

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority), Tabula Investment Management Limited (reg. no. 11286661), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 78, Avenue de la Liberté, L-1930 Luxembourg, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc